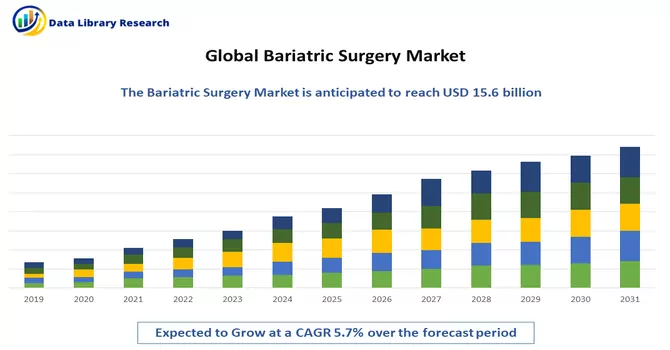

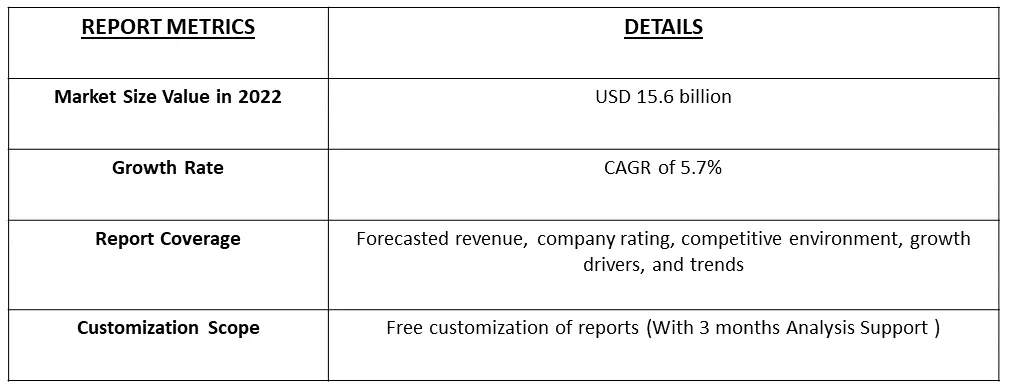

The Bariatric Surgery Market is currently valued at USD 15.6 billion USD in the year 2022 and is expected to register a CAGR of 5.7% during the forecast period, 2023-2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

Bariatric surgery, often referred to as weight loss surgery or obesity surgery, is a medical procedure performed on individuals who are severely overweight or obese and have not achieved significant weight loss through non-surgical methods such as diet and exercise. The primary goal of bariatric surgery is to aid in weight reduction, improve overall health, and potentially alleviate or reduce obesity-related health conditions.

The major factors attributing to the growth of the bariatric surgery market are an increase in obesity among people and a rising prevalence rate of Type 2 diabetes and heart diseases. People with more fat in their bodies are highly likely to be affected by diabetes. Hence, patients are taking certain measures to prevent obesity with bariatric surgeries.

Minimally invasive bariatric surgery techniques, such as laparoscopic surgery, have become more common. These procedures result in smaller incisions, shorter hospital stays, quicker recovery times, and reduced post-operative pain. Moreover, an increasing number of insurance companies are providing coverage for bariatric surgery, making it more accessible to patients who qualify.

Market Segmentation:

The Bariatric Surgery Market is segmented by Device (Assisting Devices, Implantable Devices, and Other Devices) and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report offers the value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Drivers :

Increase in Obesity

People with more fat in their bodies are highly likely to be affected by diabetes. Hence, patients are taking certain measures to prevent obesity with bariatric surgeries. For instance, according to the World Health Organization (WHO) May 2022 report on the European region, in the WHO European Region, over 60% of adults and 29% of boys and 27% of girls who are children are overweight or obese and also, as per the same report, overweight and obesity rank fourth among the risk factors for non-communicable diseases in the region, after high blood pressure, unhealthy eating, and cigarette use. Further, according to the December 2021 report of the International Diabetes Federation, it is estimated that about 537 million adults in the age group of 20-79 years were living with diabetes in 2021 across the world and this number is projected to increase to 643 million by 2030. Hence, owing to the high burden of obesity and the increasing prevalence of risk factors for obesity are expected to fuel growth in the bariatric surgery market over the forecast period.

Technological Development

The market expansion is supported by a variety of strategies employed by the major market players, such as funding for research and development to broaden the scope of bariatric surgery. For Instance, In June 2021, Cincinnati-based Standard Bariatrics, Inc., developed the Titan SGS, a first-of-its-kind design that allows surgeons to perform sleeve gastrectomy, the top bariatric surgical procedure for obesity disease. Additionally in June 2021, to expedite the development and commercialization of their first bariatric surgical platform for sleeve gastroplasty, Standard Bariatrics has secured USD 35 million in Series B funding.

Restraints. :

High Cost of Bariatric Surgery The high cost of bariatric surgery may make it difficult for the patients living in developing countries which may slow down the growth of the studied market over the forecast period. For instance, the latest update published by Baptised Health in July 2022, reported that bariatric surgery can cost between USD 15,000 and USD 23,000. Thus, such high costs may make it difficult for the patients living in developing countries, thereby impeding the studied market growth. Moreover, long-term complications may include ulcers, scarring, and narrowing of the anastomosis (where the intestine is connected to the gastric pouch), known as a stricture.

The COVID-19 pandemic has had a profound and lasting impact on various industries, including diagnostics and surgical procedures, and has disrupted global healthcare systems due to lockdown measures and reduced public mobility. According to the American Society for Metabolic & Bariatric Surgery (ASMBS), bariatric surgeries were categorized as non-emergent procedures, resulting in the postponement of these surgeries and a decrease in their success rates. A study conducted in September 2020, titled 'Bariatric Surgery During the COVID-19 Pandemic: The Perspective of Physicians and Patients,' found that virtual consultations and telemedicine became viable options for continuing weight loss programs during the pandemic. This was due to the elevated risks and complications associated with morbid obesity and surgical interventions amid the COVID-19 crisis. The pandemic exacerbated the vulnerabilities of the obese population, both psychologically and physiologically, making it more challenging to manage obesity effectively.

Also, an article published in The Lancet, 'Bariatric and Metabolic Surgery During and After the COVID-19 Pandemic' in 2020, highlighted the significant impact of the pandemic on obesity treatment. This impact exposed millions of children, adolescents, and adults to an increased risk of worsening comorbidities, limited their access to care, and raised their chances of experiencing severe COVID-19 outcomes. Consequently, the substantial number of COVID-19-positive patients and the consequential strain on healthcare systems worldwide resulted in a decline in various bariatric procedures. This decline negatively affected the market in 2020 and, to a lesser extent, in 2021.

Segmental Analysis:

Gastric Balloon Segment is Expected to Witness Significant Growth over the Forecast Period

Gastric balloons, also known as intragastric balloons (IGBs) or stomach balloons, have gained prominence as temporary medical devices designed to aid in weight loss efforts. They are placed in the stomach for a limited duration to curb food intake and facilitate weight loss. Several factors are propelling the demand for gastric balloons, including innovative product introductions, heightened patient awareness, partnerships with bariatric surgery centers, and streamlining manufacturing processes for operational efficiency.

A study titled "Endoscopic Intragastric Balloon: A Gimmick or a Viable Option for Obesity?" published in the Annals of Transitional Medicine in March 2020 highlighted the effectiveness of the Orbera gastric balloon. It demonstrated a notable pooled total body weight loss (TBWL) of 13.16% after six months, and a remarkable 26.9% excess weight loss in comparison to control groups. These findings underscore the efficacy of gastric balloons as a treatment for obesity and weight reduction, contributing significantly to the growth of this market segment.

Furthermore, technological advancements are expected to drive the studied market growth over the forecast period. For instance, Spatz Medical introduced the Spatz3 balloon in May 2019, which outperformed non-adjustable balloons in the market, based on clinical trials approved by the United States FDA. This innovation has provided consumers with a more effective option for weight loss. Thus, the segment is expected to witness significant growth over the forecast period.

North America Region is Expected to Witness Significant growth Over the Forecast Period

North America is positioned to be the dominant force in the overall market throughout the projected period. This is primarily due to the escalating rates of obesity across the region, among other factors. Additionally, the availability of advanced healthcare infrastructure and the increasing awareness regarding bariatric surgery are key drivers of this market's prominence.

According to data from the Centers for Disease Control and Prevention (CDC) as of May 2022, there was a substantial increase in the prevalence of obesity in the United States. From March 2017 to March 2020, 41.9% of Americans were classified as obese, marking a significant rise from 30.5%. Notably, the prevalence of severe obesity also climbed from 4.7% to 9.2% during the same period. The CDC has identified obesity as a major cause of preventable deaths in the United States and a leading contributor to chronic diseases both domestically and globally. Obesity-related comorbidities encompass cardiovascular diseases, diabetes, musculoskeletal disorders, and some forms of cancer.

Data from the United States National Health Statistics Reports published in June 2021 revealed that among adults aged 20 and over, the prevalence of obesity stood at 41.9%, severe obesity at 9.2%, and diabetes at 14.8%. The increasing prevalence of obesity within the population is anticipated to be a significant driver of the bariatric surgery market in the United States.

Furthermore, the presence of a well-established healthcare infrastructure and a substantial number of market players in the country is expected to bolster market growth over the forecast period. For example, in September 2020, Ethicon, a part of the Johnson & Johnson Medical Devices Companies, introduced the ECHELON ENDOPATH Staple Line Reinforcement (SLR), a buttressing device aimed at reducing potential complications during bariatric procedures. Therefore, the high prevalence of obesity, the increasing adoption of bariatric surgeries in the United States, and the expansion of insurance coverage are expected to propel the bariatric surgery market during the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

The bariatric surgery market is moderately competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. With the rising patient awareness levels and increasing obese population, a few other smaller players are also expected to enter into the market in the coming years. Some of the major players in the market are:

Recent Developments:

1. In January 2022, Standard Bariatrics, Inc.'s Titan SGS completed 1,000 clinical case uses. The anatomy-based approach of Titan SGS surgical stapler technology in bariatric surgery is benefiting patients.

2. In July 2021, The Food and Drug Administration granted de novo authorization for Apollo Endosurgery to market its Apollo ESG and Apollo REVISE endoscopic systems for the treatment of patients with obesity.

Q1. What is the current Bariatric Surgery Market size?

The Bariatric Surgery Market is currently valued at USD 15.6 billion USD.

Q2. At what CAGR is the Bariatric Surgery Market projected to grow within the forecast period?

Bariatric Surgery Market is expected to register a CAGR of 5.7% during the forecast period.

Q3. What are the factors driving the Bariatric Surgery Market?

Key factors that are driving the growth include the Increase in Obesity and Technological Development

Q4. Which are the major companies in the Bariatric Surgery Market?

Medtronic PLC, Ethicon Inc., Apollo Endosurgery Inc. and Intuitive Surgical Inc. are some of the major companies in the Bariatric Surgery Market

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model