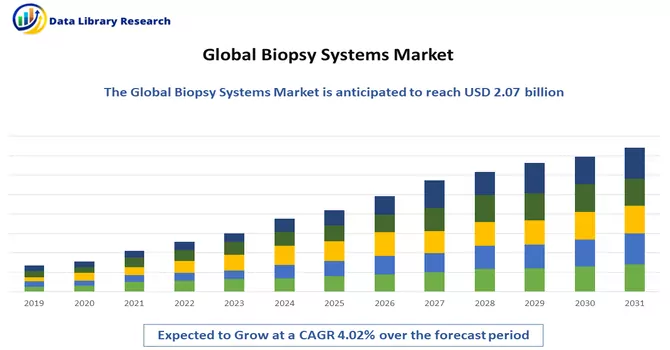

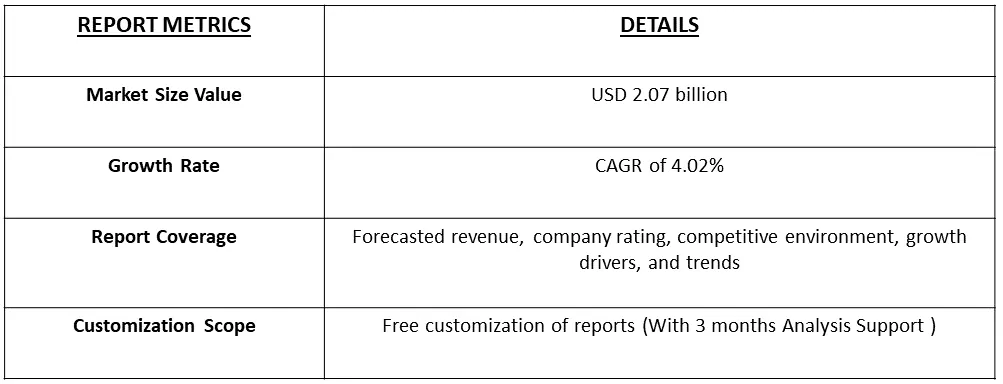

The Biopsy Devices Market size is expected to grow from USD 2.07 billion in 2022 and is expected to register a CAGR of 4.02% during the forecast period (2023-2030).

Get Complete Analysis Of The Report - Download Free Sample PDF

Biopsy devices are medical instruments designed for the collection of tissue samples from the body for diagnostic purposes. These devices play a crucial role in the field of medicine, allowing healthcare professionals to obtain small specimens of tissues or cells from suspicious or abnormal areas within the body. Biopsy procedures are commonly performed to investigate and diagnose various medical conditions, such as cancers, infections, inflammatory disorders, and other abnormalities.

The growth of the biopsy devices market is fueled by several propelling factors that collectively contribute to the increasing adoption of these devices worldwide. These factors not only enhance diagnostic capabilities but also align with the broader trends in healthcare, emphasizing minimally invasive procedures, addressing the rising incidence of cancer cases, and encouraging government initiatives for improved diagnosis. The increasing preference for minimally invasive procedures in healthcare has significantly contributed to the growth of biopsy devices. Patients and healthcare providers favor these procedures due to their advantages, such as shorter recovery times, reduced pain, and lower risk of complications compared to traditional surgical approaches.

The biopsy device market is witnessing dynamic trends that reflect advancements in technology, changing healthcare paradigms, and an increased focus on precision medicine. These trends shape the landscape of diagnostic procedures, especially in the field of oncology. The integration of telepathology allows for remote consultations, enabling pathologists to analyze biopsy samples from various locations. This trend supports collaborative decision-making and facilitates access to specialized expertise, particularly in areas with limited resources.

Market Segmentation: The biopsy devices market has been segmented by Product (Needle-based Biopsy Instruments (Core Biopsy Devices, Aspiration Biopsy Needles, Vacuum-assisted Biopsy Devices), Procedure Trays, Localization Wires, and Other Products), Application (Breast Biopsy, Lung Biopsy, Colorectal Biopsy, Prostate Biopsy and Other Applications), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, and South America). The report offers the value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers :

Increasing Preference for Minimally Invasive Procedures

The increasing preference for minimally invasive procedures represents a transformative trend in healthcare, with profound implications for diagnostic practices, particularly in the field of biopsy devices. This shift in approach is driven by the desire to enhance patient outcomes, reduce procedural risks, and improve overall healthcare experiences. Minimally invasive procedures, including those involving biopsy devices, prioritize patient comfort by minimizing trauma to surrounding tissues. This approach translates to reduced postoperative pain and faster recovery times, allowing individuals to resume their normal activities more swiftly compared to traditional, more invasive techniques. Needle biopsy techniques, such as fine-needle aspiration and core needle biopsy, have witnessed continuous technological innovations. These advancements include finer needle designs, real-time imaging guidance, and improved sampling mechanisms, contributing to the efficacy and safety of minimally invasive biopsy procedures. Thus, such factors are expected to drive the growth of the studied market.

Initiatives Undertaken by Governments for Diagnosis

Governments around the world are playing a crucial role in advancing healthcare systems, particularly in the domain of diagnosis, by implementing strategic initiatives that promote accessibility, affordability, and innovation. These initiatives are pivotal in shaping the landscape of diagnostic technologies, including the development and utilization of biopsy devices. Governments allocate substantial funding for research and development in the healthcare sector, specifically targeting advancements in diagnostic technologies. This funding supports the exploration of innovative biopsy devices, aiming to enhance accuracy, reduce invasiveness, and expand the range of diagnostic applications. Governments provide incentives, such as tax credits and grants, to stimulate innovation in healthcare technologies, including diagnostic devices. These incentives encourage private-sector investments in research and development, fostering a conducive environment for the advancement of biopsy technologies.

Restraints:

Availability of Alternative Techniques

The advances in non-invasive imaging technologies, such as magnetic resonance imaging (MRI), computed tomography (CT) scans, and positron emission tomography (PET) scans, provide detailed images of internal structures without the need for invasive tissue sampling. These imaging modalities offer valuable insights into the nature and location of abnormalities, reducing reliance on invasive biopsy procedures for certain cases. The cost associated with biopsy procedures, including the need for specialized equipment and skilled personnel, may influence healthcare providers and patients to explore alternative diagnostic avenues. The cost-effectiveness and accessibility of alternative techniques can impact decision-making in favour of these options.

The COVID-19 pandemic has had a significant impact on the healthcare industry, including the biopsy devices market. The repercussions of the pandemic have influenced various aspects of the market, from disruptions in supply chains to shifts in healthcare priorities. The pandemic led to the postponement or cancellation of non-urgent medical procedures, including certain biopsy procedures. Hospitals and healthcare facilities diverted resources to address the immediate challenges posed by the pandemic, impacting the scheduling of elective and non-emergency diagnostic interventions. The pandemic prompted a revaluation of healthcare delivery models, with an increased emphasis on resilience and adaptability. This may lead to the integration of digital health solutions and the optimization of diagnostic pathways, potentially influencing the utilization of biopsy devices in the long term. Thus, the COVID-19 pandemic has introduced challenges and changes to the biopsy devices market, impacting the demand, supply chain dynamics, and the overall landscape of diagnostic procedures. The extent of the impact will likely be influenced by the ongoing management of the pandemic, vaccination efforts, and the ability of healthcare systems to adapt to evolving circumstances.

Segment Analysis :

Vacuum-assisted Biopsy Devices Segment is Expected to Witness Growth Over the Forecast Period

Vacuum-assisted biopsy (VAB) devices represent a significant advancement in breast biopsy techniques, providing an efficient and minimally invasive method for obtaining tissue samples from breast abnormalities. These devices have revolutionized the diagnostic landscape by offering enhanced precision, improved sampling capabilities, and a more patient-friendly experience. A vacuum-assisted biopsy involves the use of a specialized handheld device equipped with a vacuum system. A hollow needle is inserted into the breast lesion, and the vacuum assists in the controlled collection of multiple tissue samples. This method allows for more comprehensive sampling compared to traditional core needle biopsy. Thus, Vacuum-assisted biopsy involves the use of a specialized handheld device equipped with a vacuum system. A hollow needle is inserted into the breast lesion, and the vacuum assists in the controlled collection of multiple tissue samples. This method allows for more comprehensive sampling compared to traditional core needle biopsy.

Breast Biopsy Segment is Expected to Witness Growth Over the Forecast Period

Breast biopsy plays a critical role in the diagnosis of breast abnormalities, providing essential information for treatment planning and patient management. The field has seen significant advancements in biopsy techniques and devices, contributing to improved accuracy, efficiency, and patient outcomes. Historically, open surgical biopsy was the standard for breast tissue sampling. However, this invasive approach was associated with greater discomfort, longer recovery times, and increased risk. As a result, less invasive methods gained prominence. Thus, breast biopsy devices have evolved significantly, moving from traditional, more invasive approaches to less invasive and more precise techniques. These advancements not only enhance diagnostic accuracy but also contribute to more personalized treatment strategies for breast abnormalities. As technology continues to evolve, breast biopsy procedures are likely to further benefit from innovative devices and imaging technologies, ultimately improving outcomes for individuals undergoing breast biopsies.

North America is Expected to Witness Growth Over the Forecast Period

North America stands as the predominant contributor to market revenue, with well-established industry players expected to maintain a significant market share throughout the forecast period. The United States, in particular, leads in the number of performed biopsies, playing a pivotal role in the overall market expansion. According to the American Cancer Society's 2020 report, an estimated 60,530 new cases of leukaemia and approximately 23,100 leukaemia-related deaths were anticipated in the United States for the year 2020. The region's sophisticated healthcare infrastructure and the increasing prevalence of infections are anticipated to exert a positive influence on the growth trajectory of biopsy devices over the projected timeframe.

Get Complete Analysis Of The Report - Download Free Sample PDF

The biopsy devices market exhibits fragmentation owing to the presence of numerous market players, and the continuous introduction of new products by these entities contributes to this diversification. These companies are strategically employing tactics such as launching products with technological innovations and forming partnerships to enhance their profitability in the industry. Consequently, the primary strategy of choice is the introduction of new products, closely followed by collaborative initiatives and geographical expansion, all aimed at achieving market capitalization. Some of the key market players working in this market players are:

Recent Development

1) In March 2021, The Quick-Core Auto Biopsy System ("Quick-Core Auto") for soft tissue biopsy was launched by IZI Medical Products LLC ("IZI"), a prominent developer of medical devices used in interventional radiology and interventional oncology treatments. The Quick-Core Auto is a lightweight, completely automatic biopsy equipment that adds to the reliability, precision, and quality of IZI's Quick-Core semi-automatic biopsy system.

2) In November 2020, NeoDynamics AB, a MedTech business dedicated to improving breast cancer diagnosis and treatment, entered a partnership with the Buckinghamshire Healthcare NHS Trust in London for its NeoNavia pulse biopsy technology.

Q1. What was the Biopsy Systems Market size in 2022?

As per Data Library Research the Biopsy Devices Market size is expected to grow from USD 2.07 billion in 2022.

Q2. At what CAGR is the Biopsy Systems market projected to grow within the forecast period?

Biopsy Systems Market is expected to register a CAGR of 4.02% during the forecast period.

Q3. What segments are covered in the Biopsy Systems Market Report?

By Product Type, By Type, By Application and Geography are the segments covered in the Biopsy Systems Market Report.

Q4. Which region has the largest share of the Biopsy Systems Market? What are the largest region's market size and growth rate?

North America has the largest share of the market . For detailed insights on the largest region's market size and growth rate request a sample here.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model