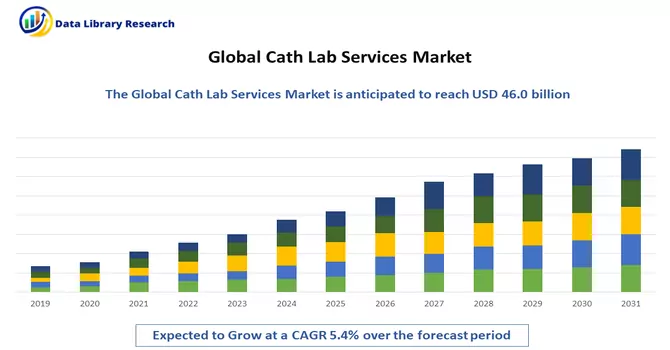

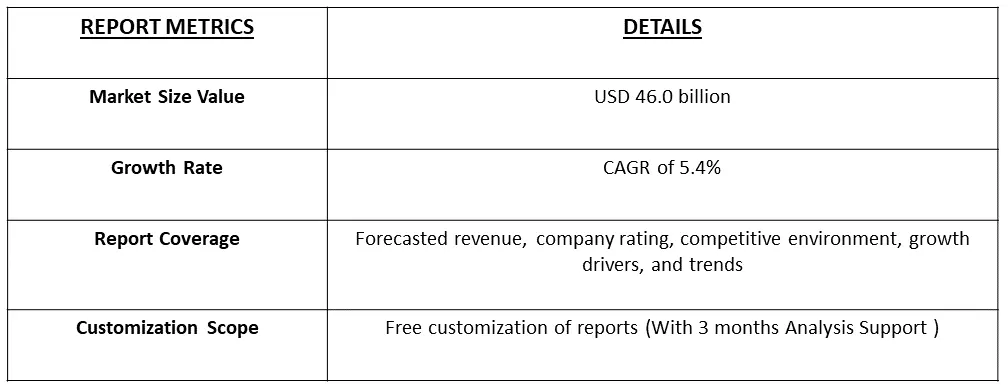

The global cath lab services market was valued at USD 46.0 billion in 2023, and is projected to register a CAGR of 5.4% from 2023 to 2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

The Cath Lab Services market involves the provision of medical services within a Cardiac Catheterization Laboratory. These services include a range of diagnostic and interventional procedures aimed at treating cardiovascular diseases. Cath lab services are crucial for the assessment and management of conditions such as coronary artery disease, heart valve disorders, and structural heart issues.

The high prevalence of cardiovascular diseases globally, including coronary artery disease, heart attacks, and heart failure, drives the demand for cath lab services. As the incidence of cardiovascular conditions continues to rise, there is an increased need for diagnostic and interventional procedures offered by cath lab services Ongoing advancements in medical technology, including imaging systems, catheters, and interventional devices, enhance the capabilities of cath lab service. Technological innovations contribute to improved diagnostic accuracy, safety, and the expansion of treatment options within cath labs.

The global surge in cardiovascular diseases, encompassing conditions such as coronary artery disease, heart attacks, and heart failure, is a key driver for the growing demand in cath lab services. With the ongoing rise in the prevalence of cardiovascular conditions, there is an escalating requirement for the diagnostic and interventional procedures provided by cath lab services. Continuous progress in medical technology, spanning imaging systems, catheters, and interventional devices, elevates the capabilities of cath lab services. Technological advancements play a crucial role in enhancing diagnostic precision, safety, and broadening the array of treatment options available within cath labs.

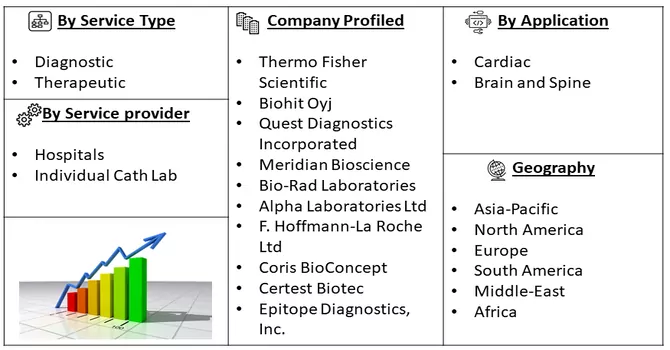

Market Segmentation: The Cath Lab Services Market is segmented by Type of Service (Therapeutics and Diagnostics) and Geography (North America, Europe, Asia-Pacific, Middle-East and Africa, and South America). The report offers the value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Prevalence of Cardiovascular Diseases

The prevalent and escalating global incidence of cardiovascular diseases stands as a significant catalyst for the Cath Lab Services market. Cardiovascular ailments, ranging from coronary artery disease to valvular and structural heart issues, continue to be leading causes of morbidity and mortality on a worldwide scale. This surge in cardiovascular diseases contributes to a heightened demand for the diagnostic and interventional procedures provided by cath lab services. As the global population ages and persistent risk factors like hypertension and diabetes prevail, the necessity for cath lab services for both diagnosis and treatment experiences a continuous upswing.

Recent data from the World Health Organization (WHO) as of June 2021 indicates that approximately 33.5 million individuals worldwide are grappling with atrial fibrillation (AFib), a prevalent and serious arrhythmia. Additionally, a July 2021 report from the British Heart Foundation titled 'UK Factsheet' reveals that 7.6 million people in the United Kingdom are living with heart and circulatory diseases. Moreover, the 2022 American Heart Association (AHA) report highlights that globally, around 244.1 million people were dealing with ischemic heart disease (IHD) in 2020, with the highest prevalence rates in North Africa, the Middle East, Central and South Asia, and Eastern Europe. As the aging demographic expands globally, the incidence of heart rhythm disorders is anticipated to rise, posing a noteworthy concern. This projected increase is expected to drive the adoption of cath lab services, consequently fueling the growth of the market under consideration.

Technological Advancements in Cath Lab Equipment

The ongoing advancements in medical technology, particularly in cath lab equipment and imaging systems, drive the market. Innovations include improved imaging modalities, advanced catheters, and interventional devices, as well as the integration of artificial intelligence (AI) and robotics. Technological advancements enhance the capabilities of cath labs, allowing for more precise diagnostics, minimally invasive interventions, and improved patient outcomes. The adoption of state-of-the-art equipment contributes to the overall growth and competitiveness of Cath Lab Services.

Furthermore, various market participants are actively involved in expanding their business footprint, thereby playing a role in the growth of the region. As an illustration, in May 2022, Mary Lanning Healthcare enhanced its Cardiac Catheterization Lab. The introduction of the Intrasight platform marked a significant upgrade, integrating iFR (instantaneous wave-free ratio) with high-definition intravascular ultrasound (IVUS). Notably, this upgrade represents the first implementation of intravascular ultrasound in the form of the new high-definition IVUS, providing a clearer and more informative depiction of the arteries within the heart.

Market Restraints:

High Cost of Equipment and Procedures

The expenses associated with establishing and maintaining a catheterization laboratory, encompassing the acquisition of advanced imaging equipment and interventional devices, can be substantial. Moreover, costs related to skilled personnel, ongoing training, and equipment maintenance significantly contribute to the overall high expenditure of cath lab services. The considerable financial hurdle for entering and sustaining operations in this field can restrict the accessibility of cath lab services, especially in healthcare settings with limited resources. This financial barrier may also influence reimbursement considerations and the allocation of healthcare budgets. Moreover, cath lab services tend to be concentrated in urban or well-established healthcare centers, creating a scenario where access is limited in rural or underserved areas. Disparities in geographic access to cath lab facilities can lead to delayed or insufficient care for individuals residing in remote regions. The restricted access exacerbates healthcare outcome disparities, as patients in underserved areas encounter challenges in obtaining timely cardiovascular assessments and interventions. It is imperative to address infrastructure and access gaps to ensure the equitable delivery of care. Consequently, these factors are anticipated to impede the growth of the studied market. Thus, these factors are expected to slow down over the forecast period.

In numerous regions, there was a temporary halt or significant reduction in elective procedures, including those conducted in cath labs. Hospitals and healthcare facilities redirected their resources to cope with the surge in COVID-19 cases, leading to the postponement of non-urgent cardiovascular interventions. The disruption in elective procedures resulted in a backlog of cases and delayed access to cath lab services for patients with non-emergent cardiovascular conditions. Healthcare systems grappled with the challenge of reassessing priorities based on the urgency and severity of cardiovascular conditions. Emergent cases, such as acute myocardial infarctions, continued to receive prompt attention, while elective and non-emergent cases were often deferred. This shift in prioritization had a direct impact on the types of cases being addressed in cath labs, with a heightened focus on urgent and critical interventions.

Segmental Analysis:

Therapeutics and Diagnostics Segment is Expected to Witness Significant Growth Over the Forecast Period

Angioplasty is a medical procedure that utilizes a catheter with a balloon tip to open narrowed or blocked blood vessels, particularly coronary arteries, often accompanied by the concurrent placement of a stent to maintain vessel patency. This therapeutic approach is commonly employed for patients with coronary artery disease, aiming to restore blood flow to the heart muscle. Another procedure, balloon valvuloplasty, involves the use of a balloon catheter to open a narrowed heart valve, frequently performed in cases of aortic stenosis. The objective is to alleviate valve stenosis and enhance blood flow through the affected valve.

The escalating global burden of cardiovascular diseases, particularly coronary heart disease, the diagnostic segment is poised for significant growth. According to the Centers for Disease Control and Prevention (CDC) data from February 2022, 4.6% of adults in the United States were diagnosed with coronary heart disease in 2020. Additionally, an estimated 1.5 million heart attacks and strokes occur annually in the U.S. Furthermore, the Pan American Health Organization (PAHO) reported in 2021 that cardiovascular diseases contribute to 40.8 million disability-adjusted life years (DALYs) in the America.

Furthermore, the growing the prevalence of coronary heart disease, data from the National Center for Chronic Disease Prevention and Health Promotion updated in July 2022 reveals it as the most common type of heart disease, with approximately 805,000 people in the U.S. experiencing a heart attack each year. This alarming scenario underscores the growing awareness of disease management and the significance of diagnostics among the general population. Thus, these factors are expected to drive the growth of the segment.

North America Region is Expected to Witness Significant growth over the Forecast Period

North America boasts advanced healthcare infrastructure, with well-equipped hospitals and medical facilities. The region has a substantial number of catheterization laboratories, particularly in urban and metropolitan areas. The presence of advanced infrastructure supports the provision of high-quality Cath Lab Services, including state-of-the-art diagnostic procedures and interventional treatments. Cardiovascular diseases, including coronary artery disease, heart attacks, and heart failure, are prevalent in North America. The high incidence of these conditions contributes to the demand for Cath Lab Services.

The prevalence of cardiovascular diseases drives the need for both diagnostic and therapeutic interventions provided by catheterization laboratories. As per the 2020 Update on Heart & Stroke Statistics from the American Heart Association, there are over 356,000 instances of out-of-hospital cardiac arrests (OHCA) annually in the United States, and unfortunately, more than 90% of these cases result in fatalities. The yearly occurrence of non-traumatic OHCA is approximated to be 356,461, equating to approximately 1,000 incidents every day. This heightened prevalence is anticipated to contribute to a rise in the adoption of cath lab services in the region, thereby fostering the growth of this market. Thus, the market is expected to witness significant growth in the region over the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

The market exhibits fragmentation, characterized by the presence of numerous small and large players. Faced with the challenges posed by the COVID-19 pandemic and the escalating demand for cath lab services, prominent market participants are strategically employing measures such as the introduction of new equipment, engaging in mergers and acquisitions, forming joint ventures, and establishing partnerships and collaborations. These proactive initiatives serve as effective means for companies to attain and sustain their market positions in the United States. Furthermore, a number of players are intensifying their efforts to diversify and broaden their product portfolios.

Key Players :

Recent Developments:

1. In May 2022, Ruhunu Hospital (Pvt.) Ltd launched the first private sector Cath Lab in the South. The hospital has invested INR 250 million in a Philips Cath Lab machine.

2. In March 2022, Kumaran Hospitals and Rela Institute launched an artificial intelligence-based Cath lab. The Innova IGS 5 with auto right with advanced visualization and multipurpose applications will provide fine image details simultaneously on cross-sections and volume-rendered to help you visualize vessels, small devices, and soft tissues.

Q1. What was the Cath Lab Services Market size in 2023?

As per Data Library Research the global cath lab services market was valued at USD 46.0 billion in 2023.

Q2. At what CAGR is the Cath Lab Services market projected to grow within the forecast period?

Cath Lab Services Market is projected to register a CAGR of 5.4% over the forecast period.

Q3. What are the factors driving the Cath Lab Services Market?

Key factors that are driving the growth include the Prevalence of Cardiovascular Diseases and Technological Advancements in Cath Lab Equipment.

Q4. Which Region is expected to hold the highest Market share?

North America region is expected to hold the highest Market share.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model