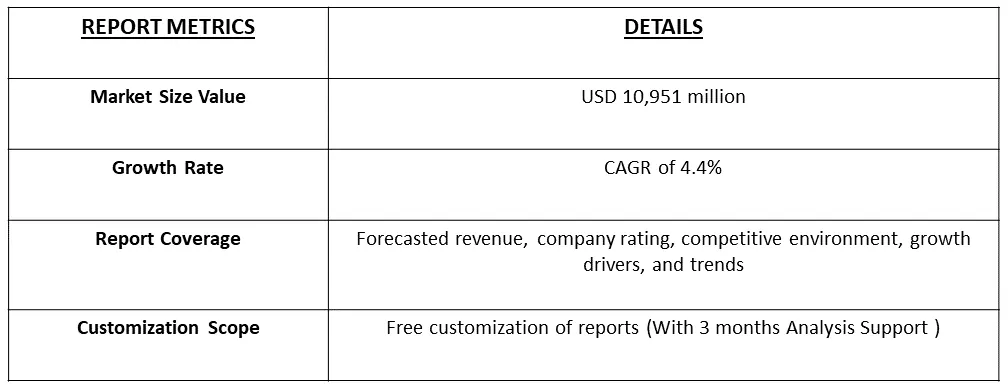

The Global Coal Trading Market is poised to achieve a volume of 10,951 million tonnes by the year 2023, reflecting a Compound Annual Growth Rate (CAGR) of 4.4% during the forecast period spanning from 2023 to 2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

The coal trading market involves the dynamic exchange of coal as a commodity, encompassing both its purchase and sale. As a fundamental fossil fuel, coal plays a pivotal role in the global energy landscape, finding applications in diverse sectors such as electricity generation, industrial processes, and heating. The coal trading market revolves around the intricate processes of trading, pricing, and transporting coal across various stakeholders, including producers, traders, and end-users like power plants and industrial facilities. A fundamental catalyst driving the dynamics of the coal trading market is the global demand for energy. Given its historical significance as a major energy source, especially in regions where it is abundant and cost-effective, coal continues to be a vital contributor to the world's energy mix. Factors such as burgeoning populations, rapid industrialization, and ongoing economic development collectively propel the escalation of energy needs. This surge in demand, in turn, fuels the necessity for coal in power generation and various industrial applications.

Numerous countries and industries have increasingly prioritized the shift towards cleaner and more sustainable energy sources, propelled by heightened environmental awareness and commitments to curbing carbon emissions. This overarching trend has translated into a discernible reduction in coal consumption in certain regions, exerting an influence on the dynamics of the global coal trading market. The ascendancy of renewable energy sources, notably wind and solar power, has emerged as a pivotal factor reshaping the landscape of the coal trading market. Substantial investments in renewable energy projects, coupled with the declining costs associated with renewable technologies, have positioned them as competitive alternatives to coal. This transformative shift is not only impacting the demand for coal but is also actively recalibrating the energy mix in diverse regions.

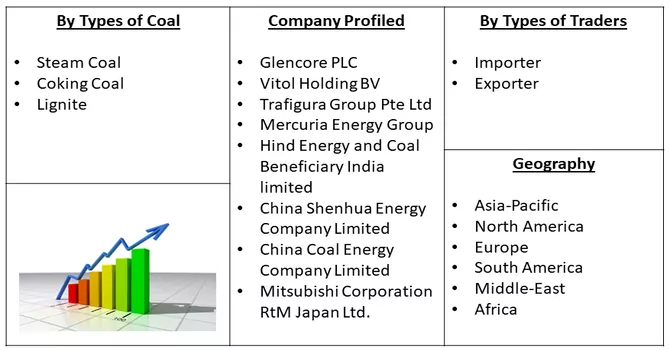

Market Segmentation: The Coal Trading Market is segmented by Types of Coal (Steam Coal, Coking Coal, and Lignite), Types of Traders (Importer and Exporter), and Geography (North America, Asia-Pacific, Europe, Middle East & Africa, and South America).

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Increased Energy Demand

The demand for coal is intricately linked to patterns of energy consumption, particularly in regions where coal plays a substantial role in power generation. Dynamic factors such as industrial expansion, population growth, and economic development collectively contribute to heightened energy requirements, consequently fostering an increased demand for coal. Notably, in developing economies, coal retains its pivotal status as a fundamental energy source. Fluctuations in energy demand within these economies can significantly influence and shape the patterns observed in coal trading. This interplay underscores the close connection between evolving energy needs and the dynamics of coal trading markets.

Government Policies and Regulations

Government policies and regulations wield substantial influence over the dynamics of the coal trading market. The formulation and implementation of environmental policies, emission standards, and commitments aimed at reducing carbon emissions play a pivotal role in shaping the demand for coal and influencing the broader energy mix. When governments enact stringent regulations pertaining to air quality and actively promote the transition towards cleaner energy sources, it often translates into a diminished demand for coal. The impetus to curb environmental impact and enhance sustainability can lead to a discernible reduction in coal consumption within these regulatory frameworks.

These governmental interventions play a crucial role in determining the trajectory of the coal trading market. They reflect a broader commitment to balancing energy needs with environmental considerations and often contribute to the ongoing transformation of the energy sector. As countries navigate the delicate equilibrium between energy security, environmental sustainability, and economic imperatives, the regulatory landscape becomes a key driver shaping the intricate interplay within the coal trading market.

Market Restraints:

The imposition of rigorous environmental regulations targeting the reduction of carbon emissions and the mitigation of climate change has emerged as a notable constraint in the coal trading market. Nations and geographic areas that enforce stringent emissions standards and implement carbon pricing mechanisms often experience a reduction in the demand for coal, particularly within the power generation sector. The prevailing global trend towards adopting renewable energy sources, such as wind and solar power, has further acted as a constraining factor on the coal trading market. The escalating investments in renewable energy projects and the increasing competitiveness of renewable technologies have contributed to a notable decline in coal consumption. This trend is particularly pronounced in regions where there is a prioritization of clean energy transitions, emphasizing the transformative impact of environmental regulations on the coal trading landscape.

The advent of lockdowns, travel restrictions, and economic deceleration during the pandemic precipitated a notable reduction in energy demand. This downturn manifested as industries and businesses curtailed operations, directly impacting the necessity for electricity and, consequently, leading to a decline in coal consumption. The brunt of the reduction in energy demand was particularly acute within the industrial and commercial sectors. The pandemic acted as an accelerant for certain transformative trends within the energy sector, notably propelling the momentum towards cleaner and more sustainable energy sources. In various regions, the diminishing appetite for coal found its counterpoint in an augmented reliance on renewable energy and natural gas. Governments and utility entities underwent a revaluation of their energy strategies, prompting some to expedite plans for the phased decommissioning of coal-fired power plants. This recalibration reflects a broader recognition of the evolving energy landscape, influenced by both the immediate impacts of the pandemic and an overarching commitment to fostering sustainability in the energy sector.

Segmental Analysis:

Steam Coal Segment is Expected to Witness Significant Growth

Steam coal, also known as thermal coal, is a type of coal used primarily for the generation of steam and heat. It is the most abundant type of coal and is widely used in power plants for electricity generation. The term "steam coal" refers to its suitability for firing steam boilers to produce steam, which is then used to drive turbines connected to generators. The primary use of steam coal is in power generation. It is burned in power plants to produce steam, which drives turbines and generates electricity. Steam coal is particularly valued for its energy content and efficiency in producing high temperatures necessary for electricity production.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North America has undergone a notable transformation in its energy landscape, marked by a diminishing dependence on coal for electricity generation. The region has observed a discernible shift towards increased utilization of natural gas, a growing emphasis on renewable energy sources, and a concerted focus on enhancing energy efficiency. This evolving energy mix carries significant implications for the demand dynamics of coal within the power sector. Over the years, there has been a noticeable contraction in the coal-fired power capacity across North America. This trend is underscored by the retirement or conversion of several coal-fired power plants, with alternative fuels gaining traction. Various factors contribute to this shift, including stringent environmental regulations, mounting public pressure for cleaner energy solutions, and the growing economic competitiveness of natural gas and renewables.

The influence of environmental regulations cannot be overstated, as they play a pivotal role in steering the region towards cleaner energy alternatives. Public sentiment, increasingly attuned to ecological concerns, has spurred a collective push for sustainable energy practices, exerting pressure on the energy industry to adopt cleaner and greener solutions. Moreover, the economic viability of natural gas and renewables has emerged as a driving force behind the transition away from coal. Advances in technology, coupled with favorable market conditions, have positioned natural gas and renewables as more cost-effective alternatives for electricity generation. This economic competitiveness, in conjunction with the environmental benefits, has propelled the shift away from coal-fired power in North America.

Thus, the evolving energy landscape in North America reflects a multifaceted interplay of regulatory, economic, and societal factors. This transition underscores a broader commitment to fostering sustainable and environmentally conscious energy practices, with implications that extend beyond the immediate region and contribute to the global discourse on the future of energy.

Get Complete Analysis Of The Report - Download Free Sample PDF

The coal trading market is partially consolidated. Some of the key players in the coal trading market include:

Recent Development:

1) In 2023: Gov. Jim Justice reported that West Virginia's export market grew for the third consecutive year in 2022 to a value of USD 7.6 billion, according to the U.S. Census Bureau's recent trade statistics. This marks a 20% increase over 2021, with an additional USD 1.4 billion in exports.

2) In 2023, The Rockefeller Foundation and Global Energy Alliance for People and Planet (GEAPP) announced the Coal to Clean Credit Initiative (CCCI) have set a new comprehensive standard for the use of carbon finance to incentivize a just transition away from coal-fired power plants to renewable energy in emerging economies. This initiative, which is supported by Climate Policy Initiative (CPI), RMI, and South Pole, will begin running a consultative process to develop the methodology this month, setting a global benchmark for carbon-financed coal transition projects. The Rockefeller Foundation and GEAPP plan to present CCCI’s methodology during the United Nations Climate Change Conference (COP28) in Dubai with the endorsement of a leading carbon standard.

Q1. What was the Coal Trading Market size in 2023?

As per Data Library Research the Coal Trading Market is poised to achieve a volume of 10,951 million by 2023.

Q2. At what CAGR is the Coal Trading market projected to grow within the forecast period?

Coal Trading Market is expected to grow at aCompound Annual Growth Rate (CAGR) of 4.4% during the forecast period.

Q3. What are the factors driving the Coal Trading Market?

Key factors that are driving the growth include the Increased Energy Demand and Government Policies and Regulations.

Q4. Which Region is expected to hold the highest Market share?

North America region is expected to hold the highest Market share.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model