The report on the Commercial Aircraft Landing Gear Market provides a comprehensive analysis of the key factors driving and restraining market growth, segmental analysis, and recent developments in the aerospace industry. With the aim of offering valuable insights to stakeholders and decision-makers, this report delves into the market dynamics that are shaping the commercial aircraft landing gear sector.

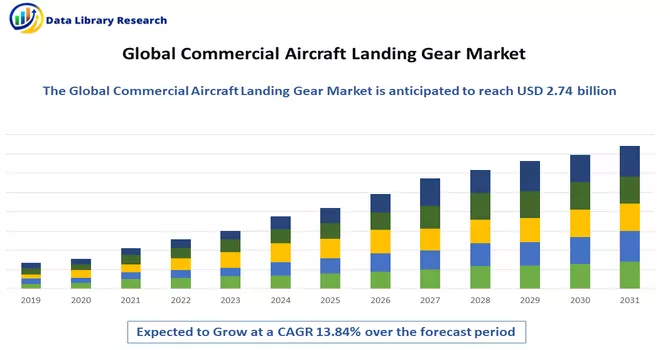

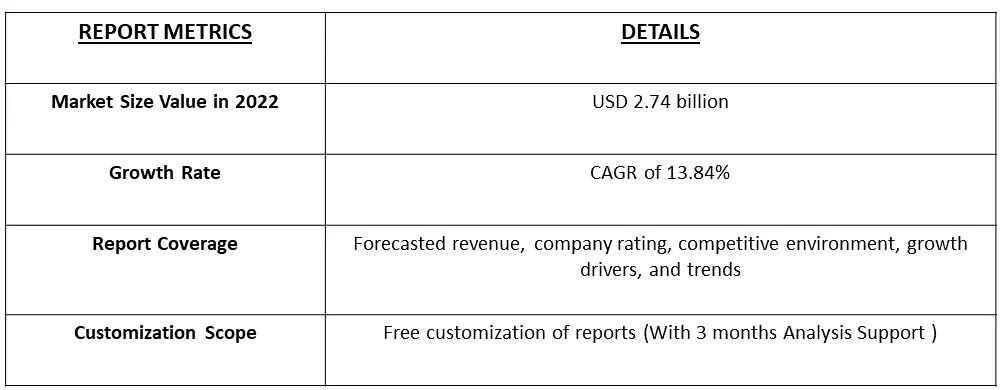

The commercial aircraft landing gear market is anticipated to grow from USD 2.74 billion in 2022, registering a CAGR of 13.84% during the forecast period 2022-2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

The expansion of major airlines' fleet sizes and the rapid growth of the commercial aviation sector are expected to drive demand for new airliners and, as a result, landing gear. Due to the increased production of next-generation aircraft, the civil aviation sector is expected to grow significantly. Improvements in global economic conditions have increased global air passenger traffic. To meet rising air travel demand, the number of commercial airplanes has increased dramatically. This increase in the number of commercial aircraft is expected to drive demand for commercial aircraft landing gear systems.

Drivers :

Rising Demand for Air Travel

The global aviation industry has witnessed an exponential increase in passenger air travel, driving the demand for commercial aircraft. As airlines expand their fleets to meet this demand, there is a parallel need for modern, efficient landing gear systems to ensure passenger safety and operational efficiency. The growth of urban centers and tourism hubs is driving demand for shorter-haul flights, regional jets, and smaller aircraft. These trends necessitate the development of specialized landing gear systems suitable for various aircraft sizes and configurations.

Technological Advancements

Innovations in landing gear technology, such as lightweight materials, advanced shock absorbers, and digital monitoring systems, are improving the performance, durability, and reliability of landing gear components. These innovations are reducing maintenance costs and enhancing the overall lifecycle of landing gear systems. For instance, in April 2022, Liebherr Aerospace and Airbus signed a contract for their long-term collaboration to jointly design key features of the landing gear for Airbus’ future requirements.

For Detailed Market Segmentation - Download Free Sample PDF

The COVID-19 pandemic has had a significant impact on the aviation industry, with the imposition of travel restrictions and the suspension of flights in a global effort to contain the spread of the virus. The industry is in survival mode, crippled by traffic and revenue losses. According to the International Air Transport Association (IATA), the International Civil Aviation Organization (ICAO), the Airports Council International (ACI), and the United Nations World Tourism Organization (UNWTO), international air passenger traffic in 2022 climbed 152.7% versus 2021 and reached 62.2% of 2019 levels. For instance, in December 2022 international traffic climbed 80.2% over December 2021, reaching 75.1% of the level in December 2019.

Segmental Analysis:

The Main Landing Gear Segment to Dominate the Market During the Forecasted Period

The main landing gear is an essential component of an aircraft’s undercarriage system, which is used for takeoff and landing. The landing gear supports the aircraft when it is not flying, allowing it to take off, land, and taxi without damage. The most common type of landing gear consists of wheels, but airplanes can also be equipped with floats for water operations or skis for landing on snow. For instance, in the A380, the world’s largest commercial aircraft, the main landing gear consists of 20 wheels in total. In September 2022, Revima Asia Pacific announced that it had signed a 2-year agreement with Luxair for the provision of a B737 NG landing gear overhaul. Also, in 2020, there was a decline in commercial aircraft deliveries due to the COVID-19 pandemic. With the increase in air passenger traffic, airlines have started operating on all major routes and have also added new routes thus in turn creating a new demand for the commercial landing gear market.

Narrowbody Aircraft Segment is Expected to Witness Significant Growth During the Forecasted Period

A narrow-body aircraft, also known as a single-aisle aircraft, is an airliner arranged along a single aisle, permitting up to 6-abreast seating in a cabin less than 4 meters (13 ft) in width. In contrast, a wide-body aircraft is a larger airliner usually configured with multiple aisles and a fuselage diameter of more than 5 meters (16 ft), allowing at least seven-abreast seating and often more travel classes.

Asia-Pacific Region is Expected to Witness Significant Growth Over the Forecast Period.

According to the International Air Transport Association (IATA), Asia-Pacific Airlines witnessed a 363.3% rise in full-year international traffic in 2022 compared to 2021, maintaining the strongest year-over-year rate among all regions. The region is expected to register the highest growth rate during the forecast period, mainly due to the increasing investments from India and China in the aviation sector and the rising demand for commercial aircraft due to increased air traffic. In November 2022, China Aviation Supplies (CASC) signed a bulk purchasing agreement for 140 Airbus jets worth USD 17 billion. The deal comprised CASC’s pre-existing orders. Additionally, Airbus confirmed the signature of multiple aircraft orders with Air China, China Eastern, China Southern, and Shenzhen Airlines for a total of 292 A320 family aircraft in July 2022, demonstrating an extremely positive recovery momentum for the Chinese aviation market. Such an immense order for aircraft is expected to drive high demand for landing gears to be installed on these aircraft, leading to an exponential rise in market growth opportunities during the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

The market for commercial aircraft landing gear is consolidated due to the presence of few players in the market. The market includes landing gear system suppliers, component providers, landing gear integrators, and MRO providers. Some of the key market players working in this market segment are:

Key Players :

Recent Development:

1) In May 2023, Emirates, the world’s largest operator of Airbus A380 long-range aircraft, has recently signed two major contracts with Lufthansa Technik AG for comprehensive Maintenance, Repair, and Overhaul (MRO) services. As per the agreement, Lufthansa Technik will provide Emirates with highly flexible extra capacity for A380 base maintenance such as C-checks and overhaul of the airline’s double-deck flagships’ main landing gears.

2) In July 2022, Ethiopian Airlines announced that the airline has signed a contract with Boeing Global Services that includes a landing gear exchange program for 19 Boeing V787 models and a 5-year contract for airplane health management services.

Q1. What is the current Commercial Aircraft Landing Gear Market size?

The commercial aircraft landing gear market is anticipated to grow from USD 2.74 billion.

Q2. What is the Growth Rate of the Commercial Aircraft Landing Gear Market?

Commercial Aircraft Landing Gear Market is registering a CAGR of 13.84% during the forecast period.

Q3. What are the Growth Drivers of the Commercial Aircraft Landing Gear Market?

Rising Demand for Air Travel and Technological Advancements are the Growth Drivers of the Commercial Aircraft Landing Gear Market.

Q4. Which region has the largest share of the Commercial Aircraft Landing Gear Market? What are the largest region's market size and growth rate??

Asia-Pacific Region has the largest share of the market . For detailed insights on the largest region's market size and growth rate request a sample here.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model