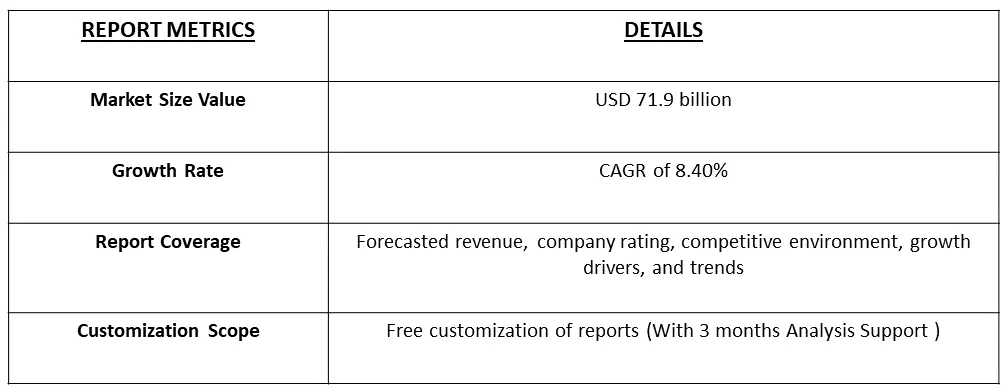

The global cytokine market size was valued at USD 71.9 billion in 2022 and is expected to register a CAGR of 8.40% during forecast period, 2023-2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

Cytokines are small proteins or glycoproteins that act as signaling molecules in the body, playing a crucial role in cell signaling and communication within the immune system. They are produced by various cells, particularly immune cells, and are involved in regulating the body's response to inflammation, infection, and trauma. Cytokines help orchestrate complex cellular processes, including the activation, proliferation, and differentiation of immune cells. These proteins are key mediators in both the innate and adaptive immune responses, influencing the behavior of cells such as lymphocytes, macrophages, and other immune cells. Cytokines can have diverse functions, including promoting inflammation to eliminate pathogens, regulating the immune response to prevent excessive damage to the body's tissues, and participating in the resolution of immune reactions.

The Advances in biotechnology and genetic engineering have enabled the production of recombinant cytokines, facilitating their use in research and therapeutic applications. Improved technologies contribute to the development of cytokine-based therapies. In the face of emerging infectious diseases and global health challenges, the study of cytokines is critical for understanding host responses and developing strategies to combat infections.

The rising prevalence of autoimmune diseases and cancer has driven the demand for cytokines as potential therapeutic agents. Cytokines are being explored for their ability to modulate the immune system and regulate inflammatory responses, making them promising candidates for treating these diseases. The trend towards personalized medicine has impacted the cytokine market, with a growing emphasis on tailoring treatments based on individual patient characteristics. This includes the identification of specific cytokine profiles that can inform personalized therapeutic approaches.

Market Segmentation: The Cytokine Market is segmented by Cytokine Type (Tumor Necrosis Factor-TNF, Interleukins-Il, Interferons-IFN, Epidermal Growth Factor-EGF, Other Cytokine Types), Therapeutic Application (Cancer, Asthma and Airway Inflammation, Arthritis, and Other Therapeutic Applications), and Geography (North America, Europe, Asia-Pacific, Middle East, and Africa, and South America). The report offers the value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Advances In Biotechnology and Genetic Engineering

The advances in biotechnology and genetic engineering have revolutionized the production of cytokines, making it possible to generate recombinant cytokines in large quantities. This development has significantly impacted both research and therapeutic applications, offering several advantages over traditional methods of cytokine production. The genetic engineering allows the insertion of cytokine genes into host organisms, such as bacteria, yeast, or mammalian cells, to produce recombinant cytokines. This enables the mass production of cytokines with high purity and consistency. Additionally, cytokines have gained acceptance as valuable biomarkers for disease diagnosis, contributing to the growth of the market. For instance, a 2022 article titled 'Cytokine response as a biomarker for early diagnosis and outcome prediction of stem cell transplant recipients and acute leukemia patients with invasive aspergillosis' reported that serum levels of IL6 and IL10 cytokines were significantly elevated on day zero in patients with invasive aspergillosis (IA) compared to controls, even in those who were neutropenic. Furthermore, a study published in 2022, 'Impact of serum interleukin-22 as a biomarker for the differential use of molecular targeted drugs in psoriatic arthritis: a retrospective study,' suggested that the cytokine IL-22 could serve as a biomarker indicating treatment response to TNF-i and IL-17-i in patients with psoriatic arthritis (PsA).

Use of Cytokine as a Potential Biomarker for Neonatal Sepsis and Potential Contribution in Stem Cell Therapy

Cytokines play a crucial role in the immune response, and their levels can be indicative of an inflammatory or infectious state. In the context of neonatal sepsis, timely and accurate diagnosis is paramount for effective intervention. Research has explored the utility of cytokines, such as interleukins (e.g., IL-6, IL-8) and tumor necrosis factor-alpha (TNF-α), as biomarkers for neonatal sepsis. Elevated levels of these cytokines in the bloodstream may signal an inflammatory response associated with sepsis. Early detection of neonatal sepsis using cytokine biomarkers allows for prompt initiation of appropriate treatments, potentially improving outcomes and reducing the risk of complications. The specificity and sensitivity of cytokine biomarkers contribute to their potential as valuable tools in neonatal healthcare. Cytokines also play a pivotal role in stem cell therapy, a field gaining momentum in neonatal medicine. Stem cells, with their regenerative potential, offer a promising avenue for treating various neonatal conditions, including those associated with sepsis. Cytokines act as signaling molecules in the stem cell microenvironment, influencing the behavior and differentiation of stem cells. They contribute to the regulation of immune responses, tissue repair, and overall homeostasis. In stem cell therapy for neonatal sepsis, the controlled modulation of cytokines can enhance the therapeutic effects of administered stem cells. Additionally, cytokines may serve as indicators of the therapeutic response in stem cell treatments. Monitoring changes in cytokine profiles post-treatment can provide insights into the immunomodulatory effects and overall efficacy of stem cell therapy in neonatal patients. Thus, the above-mentioned factors are expected to contribute towards the growth of the studied market over the forecast period.

Market Restraints:

High Costs for Therapy Using Cytokine and Use of Lacks of Specificity

The therapeutic use of cytokines faces challenges related to high costs and a lack of specificity, which impact their broader adoption and effectiveness in medical treatments. The production and purification of cytokines for therapeutic purposes involve complex biotechnological processes. These processes often require advanced technologies, specialized equipment, and stringent quality control measures, contributing to elevated production costs. Moreover, meeting regulatory standards for the production of therapeutic cytokines involves additional expenses to ensure product safety, efficacy, and consistency. Complying with regulatory requirements adds to the overall costs of bringing cytokine-based therapies to market. Thus, such factors are expected to slow down the growth of the studied market over the forecast period.

The COVID-19 pandemic intensified research and development efforts in immunotherapy, including the exploration of cytokines, to understand their potential in managing the immune response to the virus. This increased focus on immunotherapy may have influenced the cytokine market. The pandemic prompted the initiation of numerous clinical trials to assess the efficacy of various therapeutic agents, including cytokines, in managing COVID-19 symptoms. The outcomes of these trials could have significant implications for the future use of cytokines in treating viral infections.

Moreover, according to a 2021 article titled 'COVID-19 infection: an overview on cytokine storm and related interventions,' the predominant consequences of COVID-19 include acute respiratory distress syndrome (ARDS) and pneumonia. These conditions, particularly ARDS, are frequently fatal among COVID-19 patients, and the onset of ARDS is often attributed to a cytokine storm—an excessive release of pro-inflammatory cytokines. Notably, interleukins such as interleukin-6 (IL-6), interleukin-1 (IL-1), interleukin-17 (IL-17), and tumor necrosis factor-alpha (TNF-α) play a pivotal role in causing lung injury in individuals with ARDS, primarily due to compromised respiratory epithelium.The cumulative impact of these factors underscores the profound influence of COVID-19 on the cytokine market. The heightened awareness of cytokine storm's role in severe COVID-19 cases has spurred increased research and development efforts, directing attention toward cytokines as potential therapeutic targets. As a result, the dynamics of the cytokine market have experienced shifts, reflecting the urgency to develop interventions that modulate the cytokine response to mitigate the severity of respiratory complications in COVID-19 patients.

Segmental Analysis :

Cancer Segment is Expected to Witness Significant growth Over the Forecast Period

The intricate mix of cytokines produced within the cancer microenvironment plays a pivotal role in cancer pathogenesis. While certain cytokines released in response to infection, inflammation, and immunity can impede cancer development, cancer cells, in turn, respond to host-derived cytokines that foster growth, inhibit apoptosis, and facilitate invasion and metastasis. Overcoming these challenges has led to clinical investigations involving engineered cytokine mutants (superkines), chimeric antibody-cytokine fusion proteins (immunokines), anticancer vaccines, checkpoint inhibitors, and cancer-directed monoclonal antibodies. These approaches aim to enhance antibody-dependent cellular cytotoxicity, sustain cellular responses, and improve anticancer efficacy.

The growth of the market is propelled by factors such as the escalating prevalence of cancer, heightened research efforts, and increased funding in the field of cancer therapy. For instance, according to Globocan 2020, the reported number of new cancer cases was 19,292,789, projected to increase to 28,887,940 by 2040. Furthermore, market expansion is fueled by competitive dynamics, ongoing product launches, strategic collaborations, and advancements in pipeline assets and research. An illustrative example is Sonnet BioTherapeutics Holdings, Inc., which, in April 2022, presented data from preclinical studies of their proprietary Fully-Human Albumin Binding candidates at the American Association for Cancer Research (AACR) Annual Meeting 2022.Given these influential factors, the cancer application segment is anticipated to steer growth within the industry over the forecast period.

Tumour Necrosis Factor Segment is Expected to Witness Significant growth over the Forecast Period

Tumor Necrosis Factor (TNF) is a crucial cytokine that plays a central role in orchestrating immune responses and regulating inflammation. As a member of the cytokine superfamily, TNF exerts multifaceted effects on various cellular processes, influencing both the immune system and broader physiological functions. TNF is primarily recognized for its proinflammatory actions. It is produced by immune cells, including macrophages and T cells, in response to infection, injury, or other immune challenges.Proinflammatory cytokines, such as TNF, trigger a cascade of events leading to the activation of immune cells, inflammation, and the recruitment of additional immune mediators to the site of action. Thus, understanding the intricate interplay between TNF and other cytokines provides insights into the mechanisms underlying immune responses and the pathogenesis of diseases. Ongoing research continues to unveil the complexities of TNF signaling, paving the way for novel therapeutic strategies and targeted interventions in immune-mediated disorders and cancer.

North America Region is Expected to Witness Significant growth over the Forecast Period

North America is poised to assert its dominance in the cytokine market, fueled by a surge in cancer prevalence, notable product launches, and robust research and development initiatives in the region. For instance, according to the Globocan 2020 report, the United States alone witnessed 2,556,022 cancer cases, a figure projected to escalate to 3,316,283 by 2035, accentuating the anticipated growth of the market over the forecast period.

The competitive landscape, marked by the presence of industry contenders, strategic mergers, acquisitions, and substantial research funding, further propels market expansion. An illustrative example is Amgen, a California-based company, announcing in June 2022 that the U.S. Food and Drug Administration (FDA) approved RIABNI (rituximab-arrx), a biosimilar to Rituxan. This approval extends to the treatment of adults with moderate to severely active rheumatoid arthritis (RA) who have had insufficient responses to one or more tumor necrosis factor (TNF) antagonist therapies. RIABNI's existing approvals encompass the treatment of adult patients with Non-Hodgkin's Lymphoma (NHL), Chronic Lymphocytic Leukemia (CLL), Granulomatosis with Polyangiitis (GPA), also known as Wegener's Granulomatosis, and Microscopic Polyangiitis (MPA).

Furthermore, in March 2022, Xenco, a clinical-stage biopharmaceutical company specializing in engineered antibodies and cytokines for cancer and autoimmune disease treatment, presented preclinical data from XmAb Cytokine Programs at the American Association for Cancer Research (AACR) Annual Meeting 2022. This underscores the heightened focus on studies and research related to cytokines, augmenting market growth in the region.

Thus, these factors, North America is poised to experience substantial growth throughout the forecast period, solidifying its position as a key player in the cytokine market.

Get Complete Analysis Of The Report - Download Free Sample PDF

The cytokine market is characterized by the presence of numerous key players, each actively engaging in strategic initiatives to fortify their market positions. These companies are strategically pursuing mergers, launching new products, acquiring businesses, and entering into partnerships. These concerted efforts are aimed at enhancing their competitiveness and establishing a robust foothold in the dynamic cytokine market. Through these strategic moves, companies seek to capitalize on emerging opportunities, broaden their product portfolios, and strengthen their capabilities in research, development, and production. Mergers and acquisitions enable them to consolidate resources and expertise, facilitating a more comprehensive approach to addressing market demands. Simultaneously, new product launches contribute to innovation and responsiveness to evolving customer needs, ensuring a competitive edge in the rapidly advancing cytokine market. Some of the key market players working in this market segment are:

Recent Development

1) In May 2022, Sanofi revealed that the U.S. Food and Drug Administration (FDA) had given priority review status to the supplemental Biologics License Application (sBLA) for Dupixent (dupilumab). This application aimed to secure approval for treating adults with prurigo nodularis, a persistent inflammatory skin condition characterized by severe itching and skin lesions. The FDA is set to make a decision by September 30, 2022. Dupixent stands out as a fully human monoclonal antibody, effectively inhibiting signaling in the interleukin-4 (IL-4) and interleukin-13 (IL-13) pathways without exhibiting immunosuppressant properties.

2) In July 2022, Sandoz, a prominent player in generic and biosimilar medicines globally, announced that the U.S. Food and Drug Administration (FDA) accepted its Supplemental Biologics License Application (sBLA) for a high concentration formulation of 100 mg/mL (HCF) of its biosimilar Hyrimoz (adalimumab-adaz). This application covers indications not protected by orphan exclusivity for the reference medicine Humira (adalimumab). These indications include rheumatoid arthritis, juvenile idiopathic arthritis, psoriatic arthritis, ankylosing spondylitis, Crohn's disease, ulcerative colitis, and plaque psoriasis.

Q1. What was the Cytokine Market size in 2022?

TAs per Data Library Research the global cytokine market size was valued at USD 71.9 billion in 2022.

Q2. At what CAGR is the cytokine market projected to grow within the forecast period?

Cytokine Market is expected to register a CAGR of 8.40% during forecast period.

Q3. Which Region is expected to hold the highest Market share?

North America region is expected to hold the highest Market share.

Q4. Which are the major companies in the Cytokine Market?

GlaxoSmithkline PLC, Novartis AG, Amgen and Pfizer Inc. are some of the major companies in the Cytokine Market.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model