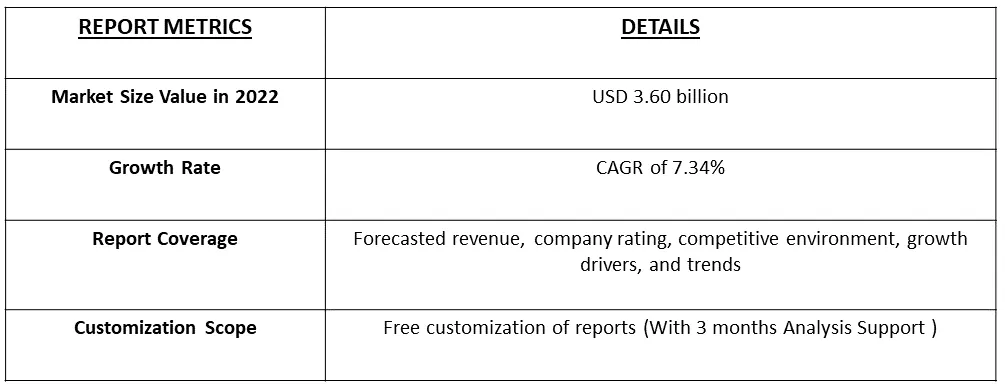

The Dental X-ray Systems Market size is estimated at USD 3.60 billion in 2022, registering a CAGR of 7.34% during the forecast period (2023-2030).

Get Complete Analysis Of The Report - Download Free Sample PDF

The dental X-ray system market serves a wide range of healthcare providers, including general dentists, orthodontists, oral surgeons, and other dental specialists. It plays a vital role in maintaining and improving oral health by aiding in the early detection of dental issues and contributing to effective treatment planning.

The major growth drivers of the dental imaging market are the rising burden of dental diseases, technological advancements in dental imaging, and increasing demand for cosmetic dentistry.

The dental X-ray market has been expanding into emerging regions where there is a growing awareness of oral health and a rising demand for dental services. Manufacturers have been targeting these regions for market growth. Dental X-ray systems have been designed with a focus on customization to cater to various dental specialties. Additionally, workflow efficiency has been a key consideration, with features that enable faster and more streamlined imaging processes. Thus, the market is expected to witness significant growth over the forecast period

Segmentation:

The Dental X-ray Systems Market is segmented

By Technology :

Procedure Type :

Geography

The report offers the value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Drivers:

Growing Burden of Dental Diseases

The research study, titled "Prevalence of Untreated Caries in the US Adult Population: 2017-2020," which was published in the December 2021 issue of the Journal of the American Dental Association, revealed that both coronal and root caries had a prevalence of 17.9% and 10.1%, respectively. This high prevalence was notably observed among men aged 30-39 years and 40-49 years. Consequently, the substantial prevalence of dental diseases is expected to drive the demand for dental disease diagnosis through the use of dental X-rays, thus positively influencing the growth of the dental X-ray market under examination.

Technological Advancements in Dental Imaging Methodologies As dental imaging technology continues to advance, market players are actively engaged in innovation, introducing new products that are anticipated to augment the expansion of the dental X-ray system market. An illustrative example of this trend can be seen in the case of Athlos Oy, which secured 510(k) clearance for DC-Air in July 2021. DC-Air represents a cutting-edge intraoral X-ray imaging sensor, heralding a promising future for X-ray imaging. Consequently, owing to these factors outlined above, it is projected that the dental X-ray systems market will exhibit growth over the forecast period.

Restraints :

High Cost of Dental Radiography Systems

The high cost associated with dental radiography systems has become a significant impediment to the growth of the dental X-ray market. These costly systems can pose challenges for both dental practitioners and healthcare facilities, affecting market expansion. For instances as per the Clinic Spots the average cost of dental X-Ray service in developing countries like India ranges from INR 2500 to INR 3500. Thus, such high cost of dental X-ray services may slow down the growth of the studied market over the forecast period.

The dental X-ray system market experienced significant disruptions during the initial stages of the COVID-19 pandemic. To alleviate the strain on hospital emergency rooms and prevent the spread of the virus, the American Dental Association (ADA) issued recommendations in March 2020, advising dental offices to postpone elective dental procedures until April 30, 2020. Instead, they were encouraged to provide emergency dental care exclusively. However, by November 2020, the ADA revised its stance, expressing confidence that dental care could be safely administered during the pandemic. This change was based on lower COVID-19 prevalence rates among healthcare workers and the general public. As a consequence, the early days of the COVID-19 pandemic led to a temporary decline in demand for routine dental procedures, impacting the growth of the dental X-ray system market during that period.

Segmental Analysis:

Digital X-ray System is Expected to Witness Significant Growth Over the Forecast Period

The digital X-ray sector is poised for substantial growth, driven by a growing number of healthcare professionals transitioning from analog systems to digital ones. This shift is attributed to the various advantages offered by digital X-ray technology, including enhanced speed and flexibility. For instance, a November 2020 report by Ultimate Smile Design highlighted several benefits associated with using digital X-rays in dental practice. These advantages encompass the use of compact sensors for patient comfort, shorter waiting times, higher precision in imaging, reduced environmental waste, simplified file storage, and notably, lower radiation exposure. These distinct advantages, when compared to other X-ray methods in dentistry, are expected to propel the growth of the digital X-ray segment during the study period.

Furthermore, developments in artificial intelligence (AI) promote operational effectiveness and clinical consistency, which benefits digital X-rays and promotes the expansion of the digital X-ray market. For instance, in May 2022, VideaHealth received the 510(k) clearance from the United States Food and Drug Administration for Videa Caries Assist, an AI-powered dental caries (cavity) detection algorithm. Also, in April 2022, Carestream Dental introduced CBCT imaging, the Neo Edition of the CS 8200 3D Family. Thus, owing to the advantages and new technology developments in the digital X-ray segment, the market is expected to register a significant share and growth during the forecast period.

Panoramic X-rays Segment is Expected to Witness Significant Growth Over the Forecast Period

Panoramic X-rays, often referred to as panoramic radiographs or orthopantomograms (OPGs), are a type of dental imaging technique that provides a detailed and comprehensive view of the entire mouth, including the teeth, jaws, and surrounding structures. These X-rays are widely used in dentistry for various diagnostic and treatment planning purposes. Unlike traditional intraoral X-rays that capture individual teeth, panoramic X-rays create a single, wide-angle image of the entire oral and maxillofacial region. This includes the teeth, jaws, temporomandibular joints (TMJ), sinuses, and adjacent structures. Thus, owing to such advantages the segment is expected to witness significant growth over the forecast period.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North America is poised to claim a substantial market share within the dental X-ray systems sector. This commanding market presence can be attributed to several key factors, including a high level of awareness among the patient population and a pronounced trend of replacing medical technologies. As per data from the American Dental Association in 2020, more than 5 million Americans between the ages of 65 and 74 had experienced complete tooth loss, with a significant portion of nearly 3 million individuals being edentulous, primarily due to dental caries. Dental X-rays play a crucial role in diagnosing and addressing such issues effectively.

Furthermore, industry participants have been actively engaged in strategic initiatives, approvals, and product launches to advance the field. For instance, in March 2022, Pearl, a prominent player in dental AI solutions, secured clearance from the United States Food and Drug Administration (FDA) for its AI-powered real-time pathology detection solution, Second Opinion. This technology aids dentists in the accurate identification of a wide spectrum of common dental conditions from patient X-rays. Additionally, in August 2021, Surround Medical Systems received 510(k) pre-market clearance from the United States Food and Drug Administration for its patented PORTRAY dental imaging system, further underscoring the technological advancements in the field. In light of these compelling factors, the dental X-ray systems market is expected to experience significant growth in the United States during the study's forecast period

Get Complete Analysis Of The Report - Download Free Sample PDF

The dental X-ray systems market is fragmented in nature due to the presence of several companies operating globally. The major players include

Recent Development:

1. In February 2022, Overjet secured the United States Patent for its artificial intelligence (AI) tech that measures anatomical structures and quantifies disease on dental X-rays.

2. In April 2021, Carestream Dental launched the CS 2400P, a portable generator that delivers the powerful X-ray beam needed for great image quality while offering the full flexibility of use inherent to a mobile device.

Q1. What was the Dental X-Ray Market size in 2022?

The Dental X-ray Systems Market size is estimated at USD 3.60 billion.

Q2. At what CAGR is the market projected to grow within the forecast period?

Dental X-Ray Market is registering a CAGR of 7.34% during the forecast period

Q3. What are the factors driving the Dental X-Ray Market?

Key factors that are driving the growth include the Burden of Dental Diseases.

Q4. Which region has the largest share of the Dental X-Ray Market? What are the largest region's market size and growth rate?

North America has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model