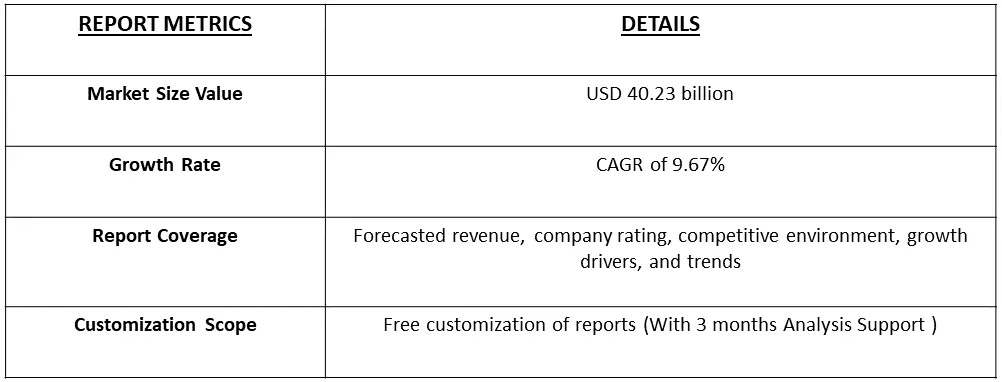

The Dermatological Therapeutics Market is poised for substantial growth, projected to reach USD 40.23 billion in 2023, with an estimated Compound Annual Growth Rate (CAGR) of 9.67% during the forecast period from 2023 to 2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

This market segment pertains to the pharmaceutical and medical products sector specializing in the research, production, and distribution of treatments for diverse skin-related conditions and diseases. Dermatological therapeutics encompass a broad spectrum of products, ranging from topical creams, ointments, and oral medications to injectables and other formulations tailored to address various dermatological disorders and promote skin health.

The escalating prevalence of skin disorders, including acne, psoriasis, eczema, and dermatitis, is a driving force behind the heightened demand for dermatological therapeutics. Given that these conditions affect a substantial portion of the global population, there is a growing imperative for effective treatment options. Furthermore, the aging population is particularly susceptible to diverse dermatological issues such as wrinkles, skin sagging, and skin cancer. With the global population aging, there is a concurrent surge in the demand for dermatological therapeutics geared towards addressing age-related skin concerns.

The dermatological therapeutics market is witnessing a growing demand for treatments targeting cosmetic concerns, including anti-aging interventions, dermal fillers, and botulinum toxin injections. Ongoing technological advancements, such as progress in laser therapies, light-based treatments, and minimally invasive procedures, are exerting a significant influence on the dynamics of the dermatological therapeutics market.

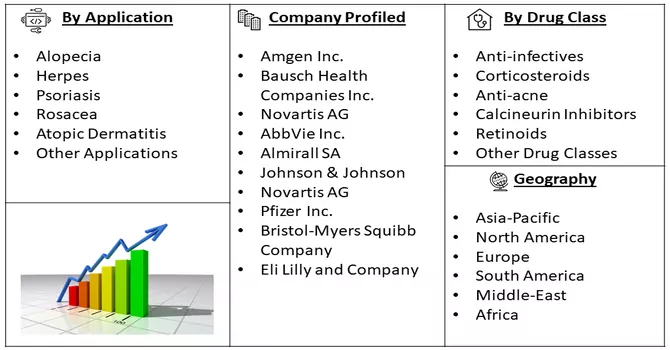

Market Segmentation: The Dermatological Therapeutics Market is Segmented by Application (Alopecia, Herpes, Psoriasis, Rosacea, Atopic Dermatitis, and Other Applications), Drug Class (Anti-infectives, Corticosteroids, Anti-acne, Calcineurin Inhibitors, Retinoids, and Other Drug Classes), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report offers the value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Growing Prevalence of Skin Disorders

The widespread occurrence of diverse skin disorders, such as acne, psoriasis, eczema, and skin cancers, plays a pivotal role in propelling the dermatological therapeutics market forward. Given the significant impact of skin conditions on a considerable segment of the global population, there is an escalating need for advanced and efficacious treatments. The growing emphasis on skin health awareness and the pursuit of enhanced aesthetics further fuel the market's expansion. Pharmaceutical companies and biotech firms specializing in dermatology are motivated to pioneer innovative therapeutic solutions, addressing the diverse requirements of individuals grappling with various dermatological conditions.

Technological Advancements in Dermatology

Continual technological progress in dermatology serves as a pivotal force propelling the dermatological therapeutics market. Advancements like laser therapies, light-based treatments, microneedle patches, and targeted drug delivery systems are instrumental in shaping more potent and less invasive dermatological treatments. These innovations not only elevate the effectiveness of current therapies but also open avenues for introducing novel treatment approaches. Another noteworthy technological trend is the incorporation of artificial intelligence in dermatology for diagnostic applications, contributing to precise and efficient assessments of skin conditions and influencing the evolution of customized therapeutics. The dermatological therapeutics market is poised for significant growth, driven by promising opportunities arising from collaborations, acquisitions, and the introduction of new products. As an illustration, in December 2021, LEO Pharma Inc. revealed that the US FDA granted approval for Adbry (tralokinumab-ldrm) to treat moderate-to-severe atopic dermatitis in adults aged 18 or older whose condition is not effectively managed with topical prescription therapies or when such treatments are not recommended.

Market Restraints:

Stringent Regulatory Requirements

The dermatological therapeutics market is subject to rigorous regulatory scrutiny and adherence to compliance standards. Securing regulatory approvals for new dermatological products is a time-consuming and expensive undertaking. Stringent regulatory requirements, including extensive clinical trials and safety assessments, can impede the timely entry of innovative therapeutics into the market. This regulatory burden poses a considerable challenge, particularly for smaller companies with limited resources. Moreover, the high research and development process for dermatological therapeutics entail substantial expenses. The journey from preclinical and clinical trials to formulation optimization and the acquisition of intellectual property rights incurs significant development costs. The necessity for substantial research investments acts as a hindrance, particularly for smaller pharmaceutical and biotech firms. These financial challenges not only limit the entry of new companies into the market but may also lead to higher product prices to offset the expenses associated with development. Thus, these factors are expected to slow down the growth of the market over the forecast period.

The global pandemic has disrupted supply chains worldwide, affecting the manufacturing and distribution of pharmaceuticals, including dermatological therapeutics. This disruption in the supply chain can result in shortages of specific products, thereby affecting the accessibility of treatments for dermatological conditions. The pandemic has also had a notable impact on research and development activities within the pharmaceutical industry. Clinical trials related to dermatological therapeutics may have encountered delays or modifications, consequently affecting timelines for product development and regulatory approvals. Across the globe, the widespread transmission of COVID-19 has placed a substantial burden on economies and healthcare systems, impacting manufacturing units of healthcare companies and causing disruptions in transportation across both developed and emerging markets.

The dermatology market experienced both direct and indirect effects during the pandemic. For example, a study published by PubMed Central in January 2021 revealed that the COVID-19 outbreak had an adverse impact on dermatology services, leading to a significant reduction in consultation time for chronic patients. Consequently, the pandemic had a considerable influence on the growth of the market. However, as the pandemic abates, the market is expected to witness stable growth during the forecast period.

Segmental Analysis:

Psoriasis Segment is Expected to Witness Significant Growth Over the Forecast Period

Psoriasis is a persistent autoimmune skin disorder characterized by the accelerated production of skin cells, leading to the formation of thick, red, and scaly patches on the skin. The increasing incidence of psoriasis stands out as a significant driver for this segment. For example, recent data from the National Psoriasis Foundation, updated in December 2022, reveals that approximately 125 million people worldwide were affected by psoriasis in 2022, constituting about 2-3% of the global population. Furthermore, more than 8 million Americans were reported to have psoriasis in the same year. This substantial prevalence of psoriasis is anticipated to propel the adoption of dermatological therapeutics. Given the association of psoriasis with the elderly, the growing geriatric population is also expected to contribute to the growth of this segment.

Clinical trial data published by clinicaltrials.gov in February 2023 indicates that approximately 325 ongoing clinical trials globally are focused on developing treatments for psoriasis. The potential approvals resulting from these trials are poised to drive further growth in this segment. Moreover, new product launches, the strategic focus of market players on expanding their dermatology therapeutics portfolios, and collaborations and acquisitions are anticipated to further enhance the segment's trajectory. For instance, in December 2021, the US FDA granted approval for the expanded use of Amgen Inc.'s drug Otezla to treat adults with mild to moderate plaque psoriasis. In light of these factors, including the increasing prevalence of psoriasis, the growing elderly population, ongoing developments by key industry players, and a rising number of psoriasis clinical trials, the segment is expected to experience consistent growth throughout the forecast period.

Anti-infectives Segment is Expected to Witness Significant Growth Over the Forecast Period

Antibiotics are used to treat bacterial infections on the skin. They work by inhibiting the growth of bacteria or killing them. Topical antibiotics like mupirocin are used for bacterial skin infections, including impetigo. Antifungals are employed to treat fungal infections of the skin, such as ringworm, athlete's foot, and candidiasis. Topical antifungals like clotrimazole, terbinafine, and oral antifungals like fluconazole are commonly prescribed.

North America represents one of the largest markets for dermatological therapeutics globally.

The market has experienced steady growth, driven by factors such as an aging population, increased awareness of skin health, and a growing demand for cosmetic dermatology procedures. The prevalence of skin conditions, including acne, psoriasis, eczema, skin cancers, and infectious skin diseases, contributes to the demand for dermatological therapeutics. These conditions are common reasons for patient visits to dermatologists and other healthcare providers.

The new product launches by key regional market players are also anticipated to boost the market’s growth. For instance, in July 2021, Sol-Gel Technologies Ltd announced that the FDA approved its first proprietary drug product, TWYNEO (tretinoin/benzoyl peroxide) cream, 0.1%/3%, indicated for the treatment of acne vulgaris in adults and pediatric patients nine years of age and older. Similarly, in September 2021, Incyte announced that the US FDA approved Opzelura (ruxolitinib) cream for the short-term and non-continuous chronic treatment of mild to moderate atopic dermatitis (AD) in non-immunocompromised patients 12 years of age and older whose disease is not adequately controlled with topical prescription therapies, or when those therapies are not advisable. Thus, the rising product launches by key market players are mainly driving the North American market. Similarly, in January 2022, Abbvie announced that the FDA approved Rinvoq to treat people aged 12 years and older with refractory, moderate-to-severe atopic dermatitis who do not respond to or cannot take previous oral or injectable systemic medications. Thus, the above-mentioned reasons the market is expected to witness significant growth over the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

The dermatological therapeutics market exhibits a moderate level of fragmentation, with the emergence of numerous new players drawn by the promising growth prospects in the field. The impending expiration of patents for key drugs is fostering heightened competition, particularly within the generic sector, thereby fueling the overall expansion of the market. Anticipated growth in the dermatological diagnostics and therapeutics industry is poised to be substantial, with a notable presence of generic players securing significant market share, particularly in developing regions. Some of the market players include:

Recent Developments:

1) In September 2022, the US FDA approved Sotyktu (deucravacitinib), an oral treatment for adults with moderate-to-severe plaque psoriasis who are candidates for systemic therapy or phototherapy.

2) In July 2022, the FDA approved roflumilast cream (ZORYVE) 0.3%, a topical phosphodiesterase-4 (PDE4) inhibitor, as a treatment for plaque psoriasis in patients aged 12 years and above.

Q1. What was the Dermatological Therapeutics Market size in 2023?

As per Data Library Research the Dermatological Therapeutics Market projected to reach USD 40.23 billion in 2023.

Q2. What is the Growth Rate of the Dermatological Therapeutics Market?

Dermatological Therapeutics Market is estimated Compound Annual Growth Rate (CAGR) of 9.67% during the forecast period.

Q3. What are the Growth Drivers of the Dermatological Therapeutics Market?

Growing Prevalence of Skin Disorders and Technological Advancements in Dermatology are the Growth Drivers of the Dermatological Therapeutics Market.

Q4. Which Region is expected to hold the highest Market share?

North America region is expected to hold the highest Market share.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model