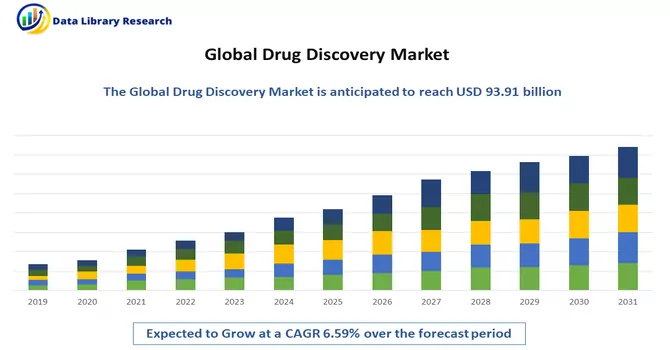

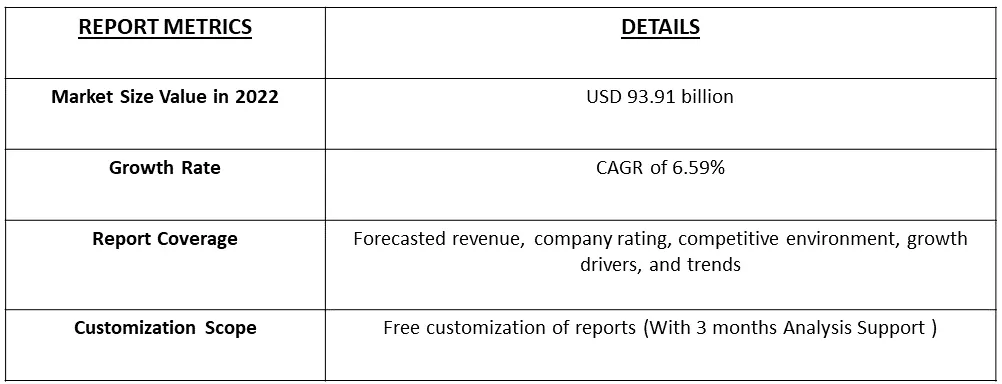

The Drug Discovery Market size is currently valued at USD 93.91 billion in 2022, registering a CAGR of 6.59% during the forecast period (2023-2030).

Get Complete Analysis Of The Report - Download Free Sample PDF

Drug discovery is the process of identifying and developing new medications or therapeutic compounds for the treatment of diseases and medical conditions. It involves the systematic search, design, and testing of chemical compounds, natural substances, or biological molecules to find those that can effectively and safely prevent, alleviate, or cure specific illnesses. The goal of drug discovery is to bring new drugs or therapies to the market that can improve patient outcomes, enhance the quality of healthcare, and address unmet medical needs. This complex and multifaceted process typically encompasses target identification, lead compound discovery, preclinical testing, clinical trials, and regulatory approval before a drug can be made available to patients.

The propelling factors for the growth of the drug discovery market include the rising burden of a wide range of diseases (such as cardiovascular and CNS-related disorders), rising healthcare expenditure, and the upcoming patent expiration of blockbuster drugs.

AI and machine learning were gaining prominence in drug discovery. These technologies were being used to analyze vast datasets, identify potential drug candidates, predict their efficacy, and streamline the drug development process. Drug discovery was increasingly moving towards personalized medicine, where treatments were tailored to an individual's genetic, environmental, and lifestyle factors. This approach aimed to increase drug efficacy and reduce adverse effects.

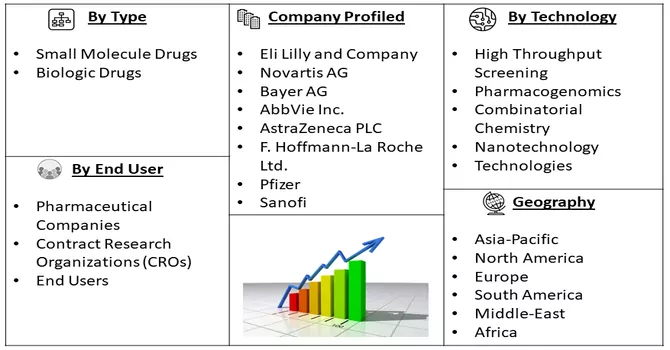

Market Segmentation: The Global Drug Discovery Market is Segmented by Drug Type (Small Molecule Drugs and Biologic Drugs), Technology (High Throughput Screening, Pharmacogenomics, Combinatorial Chemistry, Nanotechnology, and Other Technologies), End User (Pharmaceutical Companies, Contract Research Organizations (CROs), and Other End Users), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report offers market forecasts and revenues in terms of value in USD million for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers

Rising Burden of Various Chronic Diseases

Drug discovery for chronic diseases focuses on the development of targeted therapies. These medications are designed to address specific molecular and biological mechanisms associated with each condition, improving their efficacy and reducing side effects. The International Diabetes Federation (IDF) 10th Edition IDF Diabetes Atlas, reported that that there will be approximately 61.0 million people in Europe in 2021 with diabetes and that 22.0 million remain undiagnosed. in the Middle East, it is estimated there are approximately 22.4 million people with diabetes and 17.5 million remain undiagnosed. Thus, high incidence of chronic diseases is expected to drive the growth of the studied market over the forecast period.

Increasing R&D Expenditure and Investment in the Development of Novel Drug Molecules

The increase in approvals granted by global regulatory agencies for biologics is anticipated to be a significant driver of growth in this segment. A notable example of this is the FDA's acceptance of the Prior Approval Supplement (PAS) to the Biologics License Application (BLA) for ABRILADA (adalimumab-afzb) as an interchangeable biosimilar to Humira (adalimumab) in February 2022. Such regulatory actions are poised to fuel the expansion of the biologics segment.

Market Restraints :

Huge Capital Investment with Low Profit Margins and Stringent Government Regulations

Drug discovery is a complex and resource-intensive process. From target identification and lead compound screening to preclinical and clinical trials, it demands substantial financial investments. Innovative technologies, such as genomics, high-throughput screening, and advanced analytical tools, require ongoing capital commitment. Developing a new drug can take several years, with no guarantee of success. The extended timelines mean that substantial financial resources are tied up for extended periods before any returns on investment are realized. Thus, such instances are expected to slow down the growth of the studied market.

The COVID-19 pandemic, healthcare systems worldwide made rapid and substantial investments in research and development aimed at combatting the virus. To identify potential treatment options, extensive screening of compounds from sources like CHEMBL, ZINC, FDA-approved drugs, and molecules undergoing clinical trials took place. Research teams globally were diligent in evaluating both new and existing drugs to ascertain their efficacy in alleviating symptoms and inhibiting viral replication in the quest to find effective COVID-19 treatments. Consequently, the drug discovery market experienced a significant positive impact due to the urgent need for a cure.

Segmental Analysis:

Biologic Drugs Segment is Expected to Witness Significant Growth Over the Forecast Period

Biologic drugs have revolutionized drug discovery and the treatment of various medical conditions. Their complexity and specificity, versatility, and personalized medicine applications make them a valuable addition to the pharmaceutical arsenal. Advancements in biotechnology, particularly in genetic engineering and bioprocessing techniques, have facilitated the discovery and production of biologic drugs. Techniques like recombinant DNA technology, gene editing, and high-throughput screening have accelerated the development of novel biologics. Thus, owing to such advantages, the segment is expected to witness significant growth over the forecast period.

High Throughput Screening is Expected to Witness Significant Growth Over the Forecast Period

High Throughput Screening (HTS) is a pivotal technique in the field of drug discovery, significantly enhancing the process of identifying potential drug candidates. This innovative approach combines automation, robotics, and data analysis to expedite the screening of large compound libraries, ultimately leading to the discovery of novel therapeutics. HTS has revolutionized the drug development pipeline, enabling researchers to assess a vast number of compounds for their biological activity and potential as new drugs. The success of HTS largely depends on the design and optimization of biological assays. These assays are carefully constructed to measure the interaction of compounds with specific drug targets, such as proteins, enzymes, or receptors. Thus, owing to such advantages, the segment is expected to witness significant growth over the forecast period.

Pharmaceutical Companies is Expected to Witness Significant Growth Over the Forecast Period

North America is Expected to Witness Significant Growth Over the Forecast Period

North America commands a substantial portion of global pharmaceutical and biologics research and development (R&D) spending, with various factors propelling its growth. These contributing factors encompass increased investments by pharmaceutical companies, substantial government grants from the United States, the presence of major drug development firms, a well-established healthcare infrastructure, and a rising prevalence of chronic diseases, among others. For instance, as reported in the American Cancer Society's "Cancer Facts & Figures 2022," an estimated 1,918,030 new cancer cases and 609,360 cancer-related deaths are expected in the United States by the close of 2022. Such a high incidence of cancer in this region is poised to stimulate drug discovery efforts, particularly in the field of oncology, consequently bolstering market growth. Moreover, the surge in technological advancements within the United States is anticipated to be a significant driver of the drug discovery market in the region. Notably, in September 2022, CytoReason initiated a multi-year partnership with Pfizer, integrating CytoReason's artificial intelligence technology into Pfizer's drug development initiatives. Collaborative endeavors between key market players in the United States, leveraging AI technology for drug discovery, are projected to further propel market growth. Thus, due to the aforementioned factors, the drug discovery market is poised for significant expansion during the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

The drug discovery market is characterized by intense competition, featuring numerous prominent players. These market participants are actively deploying inventive strategies and integrating artificial intelligence and machine learning into their drug discovery processes to accelerate the pace of innovation. Additionally, leading market entities are forging strategic partnerships aimed at the development of groundbreaking drug compounds. Some of the companies in this market includes:

Recent Developments:

1. October 2022: Verge Genomics, a clinical-stage and technology-enabled biotechnology company pioneering the use of artificial intelligence (AI) and human data to transform drug discovery, announced dosing the first subject in its Phase 1 clinical trial of VRG50635.

2. October 2022: NGM Bio released topline results from the CATALINA Phase 2 Trial of NGM621 in patients with geographic atrophy (GA) secondary to age-related macular degeneration.

Q1. What is the current Drug Discovery Market size?

The Drug Discovery Market size is currently valued at USD 93.91 billion.

Q2. At what CAGR is the Drug Discovery Market projected to grow within the forecast period?

Drug Discovery Market is registering a CAGR of 6.59% during the forecast period.

Q3. What are the factors driving the Drug Discovery Market?

Key factors that are driving the growth include the Rising Burden of Various Chronic Diseases and Increasing R&D Expenditure and Investment in the Development of Novel Drug Molecules

Q4. Which region has the largest share of the Drug Discovery Market? What are the largest region's market size and growth rate?

North America has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model