Global Oligonucleotide Therapy Market Overview and Analysis:

The oligonucleotide synthesis market is currently valued at USD 12.5 billion in the year 2023 expected to register a CAGR of 12.3% over the forecast period, 2024-2031.

Oligonucleotide refers to a short sequence of nucleotides (the building blocks of nucleic acids such as DNA and RNA) that typically ranges from a few to several dozen nucleotides in length. These synthetic or naturally occurring molecules are composed of adenine (A), thymine (T), cytosine (C), guanine (G), and uracil (U) in the case of RNA. Oligonucleotides play a crucial role in various biological processes, serving as tools in molecular biology research, diagnostics, and therapeutic applications. They can be designed to specifically bind to complementary sequences of DNA or RNA, enabling precise targeting for purposes such as gene expression modulation, nucleic acid amplification (e.g., PCR), or serving as building blocks in the synthesis of longer DNA or RNA strands. In the context of therapeutics, oligonucleotides have gained prominence for their potential in treating genetic disorders, cancer, and other diseases by selectively interacting with and influencing the expression of specific genes.

The growth of the oligonucleotide market is propelled by several key factors. Increasing applications in molecular biology research, diagnostics, and therapeutics, especially in precision medicine and gene therapy, contribute significantly to market expansion. The rising prevalence of genetic disorders and chronic diseases necessitates advanced molecular tools, enhancing the demand for oligonucleotides. Ongoing advancements in oligonucleotide synthesis technologies, including innovative chemical modifications and delivery methods, further drive market growth. Additionally, the escalating focus on personalized medicine, coupled with substantial investments in research and development, fosters the development of novel oligonucleotide-based therapeutics, augmenting the overall market landscape. The convergence of these factors underscores the pivotal role of oligonucleotides in the rapidly evolving fields of genomics and molecular medicine, fueling their widespread adoption and market expansion.

Oligonucleotide Therapy Market Trends:

The oligonucleotide market is witnessing notable trends that shape its dynamics. The increasing adoption of oligonucleotides in personalized medicine and targeted therapies is a significant trend, emphasizing the growing focus on precision healthcare. Advances in chemical modifications and delivery technologies enhance the therapeutic potential of oligonucleotides, driving innovation in the market. The rise of RNA-based therapeutics, including small interfering RNA (siRNA) and messenger RNA (mRNA), reflects a shift toward exploiting the versatile applications of oligonucleotides in drug development. Moreover, strategic collaborations between pharmaceutical companies and research institutions for oligonucleotide-based research and development initiatives contribute to market growth. The evolving landscape of gene editing technologies and the exploration of CRISPR/Cas9 in conjunction with oligonucleotides represent additional trends shaping the future trajectory of the oligonucleotide market. Overall, the market trends underscore the dynamic nature of oligonucleotide applications across diverse fields, from therapeutics to molecular diagnostics and beyond.

Market Segmentation: The Report Covers Global Oligonucleotide Market Outlook & Size. The Market is Segmented by Product Type (Synthesized Oligonucleotide Products, Reagents, Equipment, and Services), Application (Research, Therapeutics, and Diagnostics), End-user (Academic Research Institutes, Pharmaceutical and Biotechnology Companies, and Hospital and Diagnostic Laboratories), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The market size and forecasts are provided in terms of value (in USD million) for the above segments.

Market Drivers:

Increasing Government Investments and R&D Expenditure in Pharmaceutical and Biotechnology Companies

The pharmaceutical and biotechnology sectors are witnessing a significant boost in growth due to increasing government investments and rising research and development (R&D) expenditures. Governments around the world are recognizing the pivotal role of these industries in addressing healthcare challenges, driving economic development, and fostering innovation. Consequently, there is a growing trend of governments allocating substantial funds to support pharmaceutical and biotech research initiatives. Government investments often take the form of grants, subsidies, and collaborative programs aimed at advancing drug discovery, vaccine development, and the creation of novel therapies. These financial injections provide crucial resources for companies in these sectors to conduct groundbreaking research, accelerate drug development timelines, and bring innovative products to market.

Simultaneously, pharmaceutical and biotechnology companies are escalating their internal R&D expenditures to stay competitive and address unmet medical needs. The intensification of R&D efforts is driven by a commitment to developing cutting-edge treatments, improving existing therapies, and exploring novel approaches such as precision medicine and gene therapies. This heightened focus on R&D is fostering a culture of innovation within the industry, leading to breakthroughs in areas like oncology, rare diseases, and infectious diseases. The convergence of increasing government investments and elevated R&D spending by pharmaceutical and biotechnology companies is amplifying the potential for transformative discoveries and advancements in healthcare. This collaborative approach supports the development of novel drugs, biologics, and therapies that have the potential to revolutionize patient care and address global health challenges. Overall, the synergy between government support and industry-driven R&D initiatives is fostering a dynamic and progressive landscape in the pharmaceutical and biotechnology sectors, with far-reaching implications for the future of medicine and healthcare.

The Use of Synthesized Oligonucleotides in Molecular Diagnostics and Clinical Applications

Synthesized oligonucleotides have become indispensable in molecular diagnostics and clinical applications, offering unparalleled precision in genetic analysis and disease management. In molecular diagnostics, these custom-designed sequences serve as key components in techniques like PCR, enabling the specific amplification of DNA for the detection of pathogens, genetic mutations, and cancer-associated alterations. In clinical applications, particularly in antisense oligonucleotide therapeutics, synthesized oligonucleotides play a crucial role by selectively modulating gene expression, offering targeted treatments for genetic disorders, neurodegenerative diseases, and cancers. Additionally, the versatility of oligonucleotides is evident in CRISPR/Cas9 gene editing applications, where they serve as repair templates for precise genomic modifications. The ongoing advancements in synthesized oligonucleotide technologies continue to drive progress in molecular diagnostics and therapeutic interventions, contributing to the evolution of personalized medicine and precision healthcare.

Market Restraints:

High Treatment Cost of Oligonucleotide

The oligonucleotide market faces a potential impediment to its growth due to the high treatment cost associated with oligonucleotide therapeutics. The intricate nature of their production processes, coupled with advanced technologies and specialized expertise required, contributes to elevated manufacturing expenses, ultimately translating into higher treatment costs for patients. This cost factor poses a challenge to widespread adoption and accessibility of oligonucleotide-based therapies, potentially limiting patient reach, especially in regions with constrained healthcare budgets. Efforts in research and development to optimize manufacturing efficiencies and explore cost-effective strategies, along with collaborative initiatives among industry stakeholders, policymakers, and healthcare providers, are essential to address affordability concerns and ensure broader patient access to the innovative therapeutic benefits offered by oligonucleotide-based treatments. Striking a balance between therapeutic innovation and cost considerations will be pivotal for the sustained growth and widespread adoption of oligonucleotide therapeutics in diverse healthcare landscapes.

COVID-19 Impact on Global Oligonucleotide Therapy Market:

The oligonucleotide synthesis market experienced notable effects due to the COVID-19 pandemic. The disruptions caused by the global health crisis led to supply chain challenges, temporary closures of manufacturing facilities, and delays in research and development activities. The widespread uncertainty and economic downturn impacted investment decisions and led to a shift in priorities, affecting the demand for oligonucleotide synthesis services. However, the industry demonstrated resilience as it adapted to the changing landscape, with a renewed focus on innovation and collaborative efforts to address challenges. The increased emphasis on healthcare and research in the wake of the pandemic is expected to drive future growth in the oligonucleotide synthesis market, as the industry continues to play a crucial role in advancing therapeutic and diagnostic applications.

Segmental Analysis:

Synthesized Oligonucleotide Products Segment is Expected to Witness Significant Growth Over the Forecast Period

Synthesized oligonucleotide products represent a pivotal category within the field of molecular biology, offering diverse applications in areas such as genetic research, diagnostics, and therapeutic development. These products are artificially created sequences of nucleotides, typically DNA or RNA, designed for specific purposes in laboratory experiments or clinical settings. In genetic research, synthesized oligonucleotides serve as indispensable tools for tasks like polymerase chain reaction (PCR), DNA sequencing, and gene expression analysis. Researchers utilize these custom-designed sequences to probe and manipulate genetic material, enabling a deeper understanding of gene function and regulation. Diagnostic applications leverage synthesized oligonucleotide products for detecting specific DNA or RNA sequences associated with genetic disorders, infectious diseases, or cancer. These products play a crucial role in techniques like DNA microarrays and nucleic acid hybridization, facilitating precise and targeted identification of genetic markers. In therapeutic development, synthesized oligonucleotides have gained prominence in areas such as antisense therapy, where they are designed to modulate gene expression for treating various diseases. Additionally, RNA-based therapeutics, including small interfering RNA (siRNA) and messenger RNA (mRNA), rely on synthesized oligonucleotides to deliver therapeutic payloads with precision. The market for synthesized oligonucleotide products is dynamic, with advancements in chemical synthesis techniques, automation, and purification methods enhancing the efficiency and scalability of production. Companies operating in this space continually expand their product portfolios to meet the evolving demands of researchers, clinicians, and biopharmaceutical developers. Overall, synthesized oligonucleotide products constitute a fundamental resource in life sciences, genomics, and medicine, driving advancements in research and contributing to the development of innovative diagnostics and therapies. The ongoing progress in this field underscores the critical role of synthesized oligonucleotide products in advancing molecular biology and personalized medicine.

Therapeutics Segment is Expected to Witness Significant Growth Over the Forecast Period

Oligonucleotide products are pivotal in therapeutics, offering targeted interventions for treating diseases at the molecular level. Antisense oligonucleotides modulate gene expression, holding promise in genetic disorders and neurodegenerative diseases. Small interfering RNA (siRNA) and messenger RNA (mRNA) therapeutics enable gene silencing and protein production, showcasing potential applications in various conditions. The emerging field of RNA interference (RNAi) utilizes oligonucleotide products to suppress specific gene expression, offering solutions for viral infections and metabolic disorders. Oligonucleotide-based therapeutics contribute to the development of personalized medicine, tailoring treatments to individual genetic profiles. Despite challenges, such as delivery methods, ongoing advancements position oligonucleotide products as transformative agents in precision medicine, revolutionizing therapeutic approaches across a spectrum of diseases.

Academic Research Institutes Segment is Expected to Witness Significant Growth Over the Forecast Period

Academic research institutes play a crucial role in advancing the field of oligonucleotide products, contributing to the development of innovative applications and expanding the understanding of nucleic acid-based technologies. These institutions serve as hubs for cutting-edge research, providing a fertile ground for scientists and researchers to explore the potential of oligonucleotides in various fields. In academic settings, researchers leverage oligonucleotide products for diverse applications such as genetic studies, molecular biology experiments, and therapeutic investigations. Oligonucleotides serve as essential tools in gene editing, RNA interference (RNAi), and the exploration of genetic functions. Academic research institutes actively contribute to the optimization of oligonucleotide design, synthesis methods, and delivery strategies, fostering advancements that have broad implications for both basic science and translational research. The collaboration between academia and industry is vital for the progression of oligonucleotide-based technologies. Academic research institutes often engage in partnerships with biotechnology companies to translate fundamental discoveries into practical applications. These collaborations accelerate the development of novel oligonucleotide products, ranging from diagnostic tools to therapeutic interventions. Furthermore, academic researchers contribute significantly to the understanding of the biological mechanisms underlying oligonucleotide-based therapeutics. Investigations into the safety, efficacy, and delivery mechanisms of oligonucleotide products conducted in academic settings provide valuable insights that guide the development of these products toward clinical applications. In summary, academic research institutes serve as catalysts for innovation and exploration in the realm of oligonucleotide products. Their contributions to the optimization of technologies and the generation of foundational knowledge play a pivotal role in shaping the future of nucleic acid-based research and applications.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North America is poised to lead the oligonucleotide therapeutics market in the foreseeable future, driven by factors such as the escalating prevalence of chronic and rare diseases, substantial research and development investments by companies, and the concentration of key industry players in the region. The burgeoning cancer burden, with over 1.9 million new cases expected in the United States in 2022, underscores the demand for advanced therapeutics, propelling the growth of oligonucleotide therapeutics. Additionally, the rising diabetic population in Canada, projected to reach 3.4 million by 2045, is fostering demand for antisense oligonucleotides in developing antidiabetic agents. The market is further fueled by the continuous drug development and regional product launches, exemplified by the FDA approval of inclisiran injection for managing cholesterol levels. Ongoing clinical trials, such as TME Pharma Agis' Phase II study for metastatic pancreatic cancer patients, exemplify the industry's commitment to advancing treatment options. Notably, increasing investments in oligonucleotide drug production and facility expansion, as demonstrated by Nitto Denko Corporation's substantial investment in its subsidiary, contribute significantly to market growth. With a confluence of factors such as the rising cancer burden, notable product launches, robust clinical trial activities, and increased company focus on oligonucleotides, North America is poised for substantial growth in the oligonucleotide therapeutics market over the forecast period.

Global Oligonucleotide Therapy Market Competitive Landscape:

The oligonucleotide synthesis market exhibits fragmentation, characterized by a multitude of players implementing diverse strategies to gain a foothold. These approaches encompass acquisitions of entities in emerging markets, the establishment of distribution partnerships, and collaborative efforts aimed at advancing novel technologies. Furthermore, companies within the oligonucleotide synthesis industry are actively engaged in expanding and diversifying their product portfolios. This collective effort not only propels the overall market forward but also contributes to intensifying competition within the industry, reflecting a dynamic landscape shaped by strategic maneuvers and ongoing innovation. Some of the companies which are currently dominating the market are:

- Agilent Technologies

- Thermo Fisher Scientific

- Merck KGaA

- Danaher Corporation

- Bio-Synthesis Inc.

- Eurofins Scientific

- Kaneka Corporation (Eurogentec)

- GenScript

- LGC Limited (LGC Biosearch Technologies)

Recent Development:

1) In July 2022, WuXi STA, a subsidiary of WuXi AppTec, inaugurated a state-of-the-art large-scale oligonucleotide and peptide manufacturing facility at its Changzhou campus. This significant expansion underscores WuXi STA's commitment to meeting the escalating global demand for oligonucleotide and peptide therapeutics development and manufacturing. The new facility enhances both capacity and capability, positioning WuXi STA to efficiently address the rapidly growing needs of customers worldwide in these critical areas.

2) In a strategic move in April 2022, Bachem forged a collaboration with Eli Lilly & Company to jointly develop and manufacture active pharmaceutical ingredients centered on oligonucleotides, an emerging and intricate class of molecules. The partnership involves Bachem leveraging its engineering infrastructure and expertise to implement Lilly's innovative oligonucleotide manufacturing technology. This collaboration not only showcases the industry's emphasis on advancing oligonucleotide-based therapeutics but also highlights the synergy between companies to drive progress in this evolving field.

Frequently Asked Questions (FAQ) :

Q1. What was the Oligonucleotide Therapy Market size in 2023?

As per Data Library Research the oligonucleotide synthesis market is currently valued at USD 12.5 billion in the year 2023.

Q2. At what CAGR is the Oligonucleotide Therapy market projected to grow within the forecast period?

Oligonucleotide Therapy market is expected to register a CAGR of 12.3% over the forecast period.

Q3. What segments are covered in the Oligonucleotide Therapy market Report?

By Product Type, By Application, End-User and Geography these segments are covered in the Oligonucleotide Therapy market Report.

Q4. Which region has the largest share of the Oligonucleotide Therapy market? What are the largest region's market size and growth rate?

North America has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here.

Request for TOC

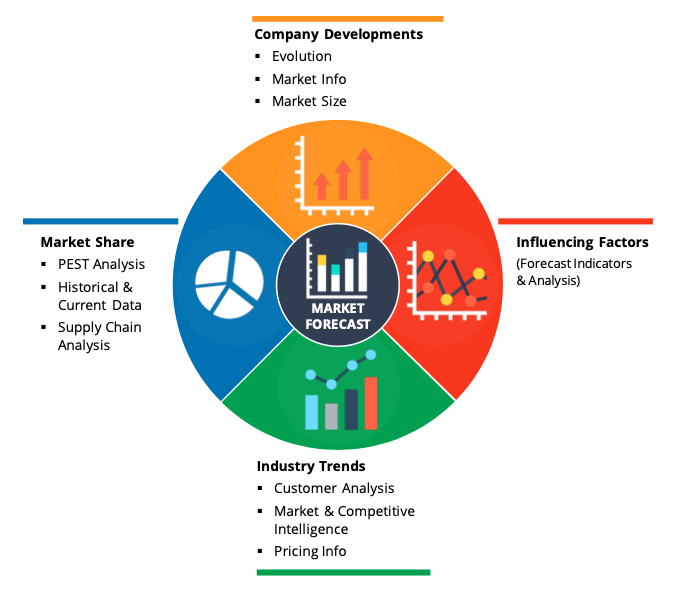

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

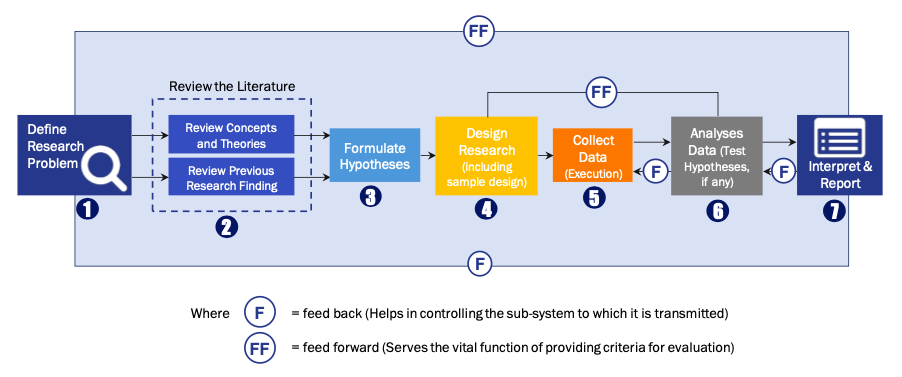

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model