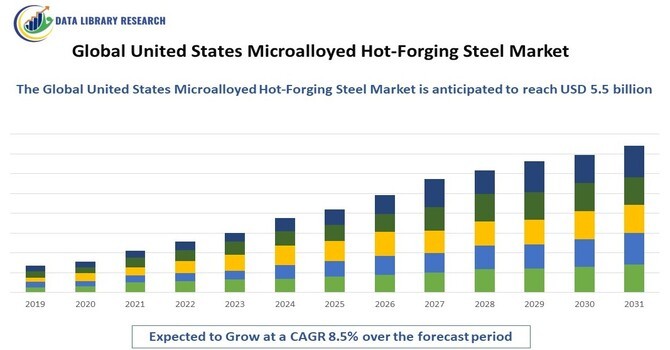

As of 2023, the U.S. microalloyed hot-forging steel market is valued at approximately $3 billion. By 2031, it is projected to reach around $5.5 billion. This represents a compound annual growth rate (CAGR) of about 8.5% from 2023 to 2031. The growth is driven by increasing demand in industries such as automotive, aerospace, and construction, where high-performance materials are essential.

Get Complete Analysis Of The Report - Download Free Sample PDF

Microalloyed hot-forging steel is a specialized type of steel that incorporates small amounts of alloying elements, such as niobium, vanadium, or titanium, to enhance its mechanical properties. During the hot-forging process, the steel is heated to a high temperature and shaped using pressure, allowing for improved strength, ductility, and toughness compared to conventional steels. The microalloying elements promote the formation of fine-grained structures, which contribute to superior performance characteristics, including better weldability and fatigue resistance. This type of steel is commonly used in demanding applications, such as automotive components, construction materials, and industrial machinery, where high strength and durability are crucial. The microalloyed hot-forging process also allows for reduced weight in applications, leading to improved fuel efficiency in vehicles. Overall, microalloyed hot-forging steel represents a significant advancement in material technology, enabling the production of lighter, stronger, and more resilient components.

The growth of the U.S. microalloyed hot-forging steel market is driven by several key factors. Increasing demand from the automotive and aerospace industries for lightweight, high-strength materials is a significant catalyst, as manufacturers seek to enhance fuel efficiency and performance. The construction sector's growing need for durable and resilient materials further boosts demand, especially for infrastructure projects. Technological advancements in steel processing and forging techniques are improving the efficiency and quality of microalloyed steel, making it more appealing to manufacturers. Additionally, stringent regulatory standards for safety and performance are pushing companies to adopt advanced materials that meet these requirements. The overall trend toward sustainability and the reduction of carbon footprints in manufacturing processes also support the growth of microalloyed hot-forging steel, as it enables the production of lighter, stronger components that contribute to energy efficiency.

The U.S. microalloyed hot-forging steel market is experiencing several notable trends shaping its future. A significant trend is the increasing adoption of advanced manufacturing techniques, such as precision forging and automation, which enhance the quality and efficiency of production. There is also a growing emphasis on sustainability, with manufacturers focusing on reducing the carbon footprint of steel production through innovative processes and recycling initiatives. The automotive industry is witnessing a shift towards electric and hybrid vehicles, driving demand for lightweight materials that improve efficiency and performance. Additionally, the integration of digital technologies, such as IoT and AI, is becoming more prevalent, enabling real-time monitoring and optimization of production processes. Furthermore, collaborations between steel manufacturers and end-users are fostering innovation in material properties, resulting in customized solutions that meet specific industry needs. These trends collectively indicate a dynamic and evolving landscape for microalloyed hot-forging steel in the coming years.

Market Segmentation

The U.S. microalloyed hot-forging steel market can be segmented by Product Type (Low-Alloy Microalloyed Steel and High-Alloy Microalloyed Steel), Application (Automotive Components (e.g., gears, axles), Aerospace Parts (e.g., landing gear, engine components), Industrial Machinery (e.g., hydraulic systems, valves), Construction Materials (e.g., beams, fasteners)), Form (Bars, Plates, Forged Components and Custom Shapes).

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers

One of the primary drivers of the U.S. microalloyed hot-forging steel market is the growing demand from the automotive and aerospace sectors. As manufacturers in these industries strive to enhance vehicle performance and fuel efficiency, they are increasingly turning to lightweight, high-strength materials like microalloyed hot-forging steel. This steel offers excellent mechanical properties, making it ideal for critical components such as gears, axles, and structural parts in vehicles and aircraft. The shift toward electric and hybrid vehicles further amplifies this demand, as lightweight materials are essential for optimizing battery performance and overall energy efficiency. Additionally, stringent safety regulations and performance standards in both industries compel manufacturers to adopt advanced materials that ensure reliability and durability. As a result, the expanding automotive and aerospace markets are significantly propelling the growth of microalloyed hot-forging steel.

Advancements in steel processing technologies are another crucial driver for the microalloyed hot-forging steel market. Innovations such as precision forging, heat treatment, and advanced metallurgical techniques are enhancing the quality and performance of microalloyed steel, making it more appealing to manufacturers. These technologies enable the production of steel with improved mechanical properties, such as increased strength, ductility, and fatigue resistance, which are essential for demanding applications. Moreover, automation and digitalization in the manufacturing process are streamlining production, reducing costs, and improving efficiency. The adoption of sustainable manufacturing practices, including the recycling of steel and reduction of energy consumption, is also gaining traction, aligning with industry trends toward environmental responsibility. These technological advancements not only enhance the competitiveness of microalloyed hot-forging steel but also contribute to its growing acceptance across various industries.

Market Restraints

A significant restraint in the U.S. microalloyed hot-forging steel market is the high production costs associated with manufacturing advanced steel grades. The incorporation of microalloying elements, combined with the specialized processing techniques required for hot forging, can lead to increased material and operational expenses. These costs may limit the accessibility of microalloyed steel for smaller manufacturers or companies operating in budget-sensitive markets. Additionally, fluctuations in raw material prices can further exacerbate production costs, making it challenging for producers to maintain competitive pricing. Economic pressures, such as inflation or downturns in key industries like automotive or aerospace, can lead to reduced investment in new projects and technologies, slowing market growth. As companies seek cost-effective alternatives, the high production costs associated with microalloyed hot-forging steel could hinder its adoption and limit its market potential in certain applications.

The COVID-19 pandemic had a notable impact on the U.S. microalloyed hot-forging steel market, causing both disruptions and opportunities. Initially, lockdown measures and supply chain interruptions led to reduced production capacity and delays in manufacturing processes, particularly in the automotive and aerospace sectors, which are key consumers of this material. However, as industries began to recover, there was a renewed focus on infrastructure and vehicle manufacturing, driving demand for advanced materials like microalloyed steel. The pandemic also accelerated the adoption of digital technologies and automation in manufacturing, which enhanced efficiency and safety measures in production facilities. Additionally, the push for sustainability became more pronounced, with companies looking for high-performance materials that contribute to reduced weight and improved fuel efficiency. Overall, while the pandemic presented challenges, it also catalyzed shifts that could benefit the microalloyed hot-forging steel market in the long term.

Segmental Analysis

The high-alloy microalloyed steel segment is expected to witness significant growth over the forecast period due to its superior mechanical properties and versatility in demanding applications. This type of steel is particularly valued in industries that require enhanced strength, ductility, and fatigue resistance, making it ideal for critical components in automotive, aerospace, and industrial machinery. As manufacturers seek materials that can withstand extreme conditions while minimizing weight, high-alloy microalloyed steel becomes increasingly appealing. Additionally, advancements in processing techniques are improving the quality and performance of these alloys, further driving their adoption. The ongoing trend towards high-performance applications in various sectors is set to position this segment for robust growth in the coming years.

The automotive segment is poised for significant growth as the industry shifts toward lightweight and high-strength materials to enhance fuel efficiency and performance. With the rising demand for electric and hybrid vehicles, manufacturers are increasingly relying on microalloyed steels to reduce overall vehicle weight without compromising safety and durability. The need for advanced materials that meet stringent regulatory standards for emissions and safety further propels the adoption of microalloyed steel in automotive applications. Additionally, innovations in vehicle design and engineering are driving the demand for specialized components made from this steel, reinforcing its importance in the evolving automotive landscape. As automakers focus on sustainability and efficiency, the automotive segment's growth will continue to be a key driver for the microalloyed hot-forging steel market.

The bars segment of the microalloyed hot-forging steel market is expected to experience significant growth due to its wide range of applications across various industries. Bars made from microalloyed steel are essential in manufacturing critical components such as shafts, gears, and fasteners, which require high strength and durability. As sectors like automotive, aerospace, and construction expand, the demand for high-quality bars will rise correspondingly. Furthermore, advancements in manufacturing processes are enhancing the performance characteristics of these bars, making them increasingly attractive to manufacturers. The trend toward custom and specialized solutions is also driving innovation within the bars segment, positioning it for sustained growth as industries seek to optimize performance and reduce weight in their products.

To Learn More About This Report - Request a Free Sample Copy

The competitive landscape of the U.S. microalloyed hot-forging steel market is characterized by a mix of established players and emerging companies, each striving to innovate and meet the growing demand for high-performance materials. Major manufacturers like Siemens Mobility, Wabtec Corporation, and Alstom leverage their extensive experience and technological advancements to offer a wide range of microalloyed steel products tailored for diverse applications. These companies focus on enhancing their manufacturing processes, incorporating automation and digital technologies to improve efficiency and product quality. Additionally, strategic partnerships and collaborations among steel producers, automotive manufacturers, and technology firms are becoming increasingly common, enabling the development of customized solutions that meet specific industry needs. As competition intensifies, factors such as product innovation, cost efficiency, and sustainability initiatives are critical for companies aiming to capture market share and respond effectively to the evolving demands of end users.

Here are 20 major players in the U.S. microalloyed hot-forging steel market

Recent Development

Q1. What the main growth driving factors for this market?

The main growth driving factors for the U.S. microalloyed hot-forging steel market include increasing demand from the automotive and aerospace sectors for lightweight, high-strength materials that enhance fuel efficiency and performance. Additionally, technological advancements in steel processing and manufacturing are improving product quality and efficiency, making microalloyed steels more appealing. Regulatory pressures for safety and emissions also drive the adoption of advanced materials in these industries. Furthermore, the ongoing trend towards sustainability and reduced environmental impact is encouraging manufacturers to utilize microalloyed steels, which can contribute to lighter and more efficient products.

Q2. What are the main restraining factors for this market?

The primary restraining factors for the microalloyed hot-forging steel market include high production costs associated with the manufacturing of advanced steel grades. The incorporation of microalloying elements and specialized processing techniques can lead to increased material and operational expenses, which may limit accessibility for smaller manufacturers. Additionally, fluctuations in raw material prices can further escalate production costs, making it challenging for companies to remain competitive. Economic downturns or slowdowns in key industries, such as automotive or aerospace, can also adversely impact demand for microalloyed steels.

Q3. Which segment is expected to witness high growth?

The automotive segment is expected to witness significant growth in the microalloyed hot-forging steel market. As the automotive industry increasingly focuses on fuel efficiency, safety, and sustainability, there is a rising demand for lightweight, high-strength materials that can improve vehicle performance. The shift towards electric and hybrid vehicles further drives the need for advanced microalloyed steels, which help reduce overall vehicle weight while ensuring structural integrity. This segment's growth is supported by ongoing innovations in vehicle design and manufacturing processes, making it a key driver for the market.

Q4. Which region is expected to witness high growth?

The Midwest region of the United States is expected to witness high growth in the microalloyed hot-forging steel market, largely due to its robust manufacturing base and concentration of automotive and aerospace industries. This region is home to many major manufacturers and suppliers of steel products, facilitating collaboration and innovation in microalloyed steel applications. Additionally, the Midwest's focus on advanced manufacturing technologies and sustainability initiatives aligns well with the growing demand for high-performance materials. As the automotive and aerospace sectors continue to expand, the Midwest is positioned to capitalize on these trends, driving growth in the microalloyed hot-forging steel market.

Q5. Who are the top major players for this market?

Siemens Mobility is a leader in transportation solutions, specializing in rail systems and smart infrastructure, offering microalloyed hot-forging steel technologies that enhance safety and efficiency. Wabtec Corporation plays a significant role in the railway sector, providing advanced signaling and automated barriers while integrating technology into its safety solutions. Alstom focuses on comprehensive rail infrastructure solutions, emphasizing microalloyed steel applications to improve safety and efficiency. Thales Group excels in critical information systems for rail transport, delivering innovative steel solutions that enhance operational efficiency. Lastly, Nippon Steel Corporation, one of the world's largest steel producers, prioritizes innovation and sustainability, providing high-quality microalloyed steels for various industries, including automotive and construction.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model