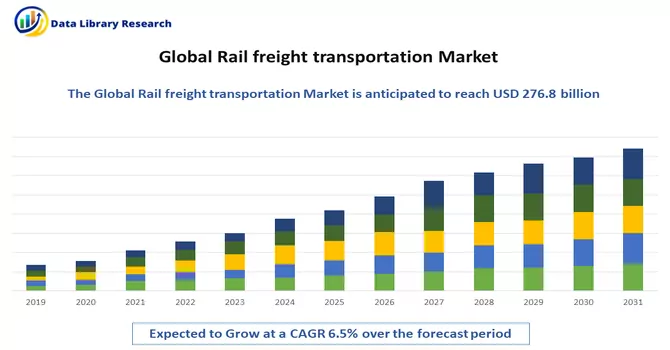

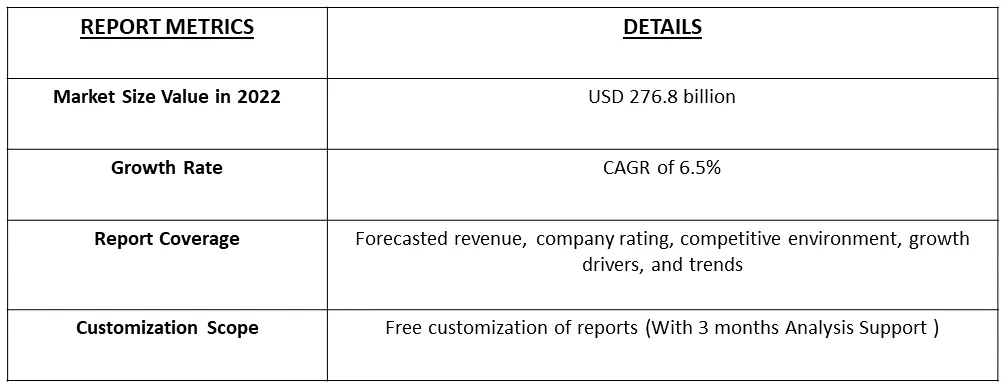

The rail freight transport market was valued at USD 276.8 billion in 2022, and it is expected to register a CAGR of about 6.5% during the forecast period, 2023-2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

Rail freight transportation, also referred to as rail cargo transportation or rail freight shipping, involves the transfer of goods and commodities via trains on an established railway network. This mode of transportation holds a crucial role in the logistics and supply chain sector, offering an efficient and cost-effective means of moving bulk goods across extensive distances. Rail freight is versatile, accommodating a diverse range of cargo, including raw materials, finished products, and containers.

The rail transport is particularly advantageous for long-haul shipments, especially when dealing with substantial quantities of bulk goods. The lower cost per ton-mile associated with rail freight renders it an appealing choice for businesses seeking to minimize transportation expenses. Trains exhibit greater fuel efficiency compared to trucks, resulting in reduced fuel consumption and lower greenhouse gas emissions per unit of cargo transported. This makes rail freight a environmentally and economically advantageous option for certain transportation needs.

The railway freight transportation sector is shaped by several market trends that impact its dynamics, growth, and competitiveness. A noteworthy trend is the growing significance of integrating various modes of transportation, such as rail, truck, and maritime. Railways are increasingly serving as a vital link in intermodal supply chains, facilitating seamless transfers of cargo to and from other transportation modes. Moreover, the rail freight industry is undergoing a transformation through the adoption of advanced technologies. Sensors, telematics, and Internet of Things (IoT) solutions are being implemented to elevate safety measures, enable real-time cargo tracking, and optimize overall operations. Automation and digitalization are also emerging as key contributors to enhancing efficiency and customer service within the rail freight industry.

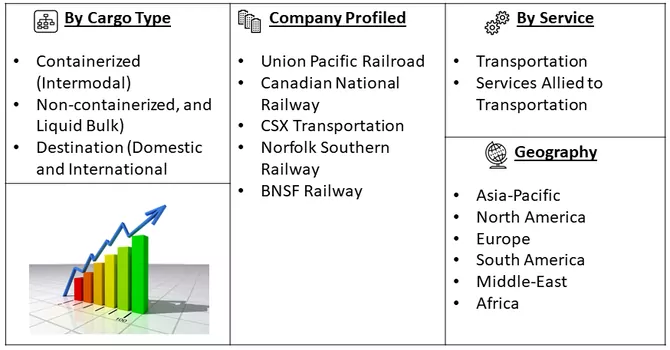

Market Segmentation: The Global Rail Freight Transportation Market is Segmented by Cargo Type (Containerized (Intermodal), Non-containerized, and Liquid Bulk), Destination (Domestic and International), Service Type (Transportation and Services Allied to Transportation), and Geography (North America, Europe, Asia-Pacific, and Rest of the World). The report offers the market size and forecasts in volume (thousand metric ton) and value (USD billion) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

High cost Efficiency

The pursuit of cost efficiency is a crucial determinant in the growth and sustainability of the rail freight transportation market. Inherent cost advantages make rail freight an appealing choice, influencing businesses and shippers to opt for rail as a viable transportation solution. Key elements of cost efficiency in the development of the rail freight market include: Rail transport excels in efficiently transporting large quantities of cargo across extensive distances, showcasing economies of scale. The larger the shipment, the more cost-effective rail becomes compared to alternative modes like trucking. This efficiency particularly encourages the movement of bulk goods such as coal, grains, and minerals via rail. Trains exhibit inherent fuel efficiency advantages over trucks, primarily attributable to lower rolling resistance and reduced wind resistance. This results in reduced fuel consumption per ton-mile, translating to significant cost savings, especially when transporting heavy or voluminous goods over extended distances. Thus, due to the above-mentioned reasons, the market is expected to witness significant growth over the forecast period

Fuel Efficiency

Fuel efficiency stands as a pivotal element in both cost savings and environmental sustainability within the rail freight development market. Recognized for its fuel efficiency, rail transportation plays a crucial role in enhancing the industry's competitiveness and attractiveness. The contemporary design of locomotives prioritizes high energy efficiency. Incorporating advanced technologies such as electronically controlled engines and regenerative braking systems, these locomotives optimize fuel consumption. Rail tracks, characterized by smooth steel rails, result in minimal rolling resistance compared to road surfaces. This quality minimizes friction, enabling trains to maintain momentum with reduced energy expenditure.

Market Restraints :

Infrastructure Limitations and Cost and Pricing Challenges

Numerous rail networks, especially those with older systems, grapple with aging infrastructure that demands significant investments in maintenance, repairs, and upgrades. Deteriorating tracks, bridges, tunnels, and signaling systems pose challenges, often leading to service interruptions and diminished capacity. Some rail networks operate close to or at their full capacity, constraining their ability to handle escalating freight volumes. Consequently, this may result in congestion, delays, and an inability to meet the growing demand for rail services. The pricing structure of rail freight services, encompassing tariffs and fees, can be intricate and may not consistently align with the preferences and expectations of shippers. Striking a balance between competitive pricing and covering operational costs remains a noteworthy challenge in the rail freight industry.

The rail freight transportation sector experienced significant effects from the COVID-19 pandemic, presenting both favorable and adverse outcomes for the industry. In the initial stages of the pandemic, lockdowns, restrictions, and uncertainty disrupted supply chains, leading to fluctuations in rail freight volumes. The flow of goods was affected as a consequence. Thus, the COVID-19 pandemic had a dual impact on rail freight transportation. While it introduced challenges and disruptions, it also underscored the industry's vital role in ensuring the movement of essential goods. This period prompted innovation and adaptation within the rail sector to address changing market conditions. The experience of the pandemic has instigated a heightened focus on building resilience and preparedness within the rail freight industry.

Segmental Analysis. :

Internodal Segment is Expected to Witness Significant growth Over the Forecast Period

The intermodal and rail freight development markets play pivotal roles within the broader transportation and logistics industry, combining multiple modes to create an integrated supply chain. Intermodal transportation seamlessly transfers cargo containers or trailers between different transport modes such as trains, trucks, and ships. The extensive rail network connects various regions, making it a valuable component of intermodal supply chains. Intermodal transportation relies on digitalization and telematics for real-time tracking and efficient coordination between modes. The economic activity growth tends to increase the demand for transportation services, including intermodal and rail freight. Moreover, the regulations related to safety, emissions, and infrastructure investments shape the development of both markets. Thus, owing to above advantages, the segment is expected to witness significant growth over the forecast period.

North America is Expected to Witness Significant growth Over the Forecast Period

North America boasts one of the most sophisticated and expansive rail freight transportation networks globally, characterized by extensive infrastructure, substantial freight volumes, and a diverse mix of Class I railroad companies alongside smaller regional and short-line railroads. The region is served by seven major Class I railroads, prominent long-haul carriers crucial to North America's freight transportation landscape. These key players encompass Union Pacific, BNSF Railway, CSX Transportation, Norfolk Southern, Canadian National, Canadian Pacific, and Kansas City Southern. Collectively, they manage an extensive network of rail lines spanning the United States and Canada.

North America's rail system is complemented by a well-developed intermodal transportation framework, seamlessly integrating rail with other modes such as trucking and maritime. This connectivity holds particular significance for the efficient movement of goods over extended distances, constituting a vital element of the region's supply chain. Rail freight transportation stands as a cornerstone of the North American economy, providing essential support to diverse industries including agriculture, manufacturing, energy, and automotive sectors. The reliable and cost-effective transportation of goods by rail contributes significantly to economic growth and enhances overall competitiveness.

Get Complete Analysis Of The Report - Download Free Sample PDF

The rail freight transportation market demonstrates a moderate level of consolidation, featuring a diverse array of both global and local players. Over the past decade, the rail industry has encountered substantial competition from alternative transportation providers like road and air transport services. Considerable investments in railway infrastructure development have been witnessed globally, with notable funding allocated in the Americas and Europe. Key market players in this segment include:

Recent Development:

Q1. What was the Rail freight transportation Market size in 2022?

The rail freight transport market was valued at USD 276.8 billion in 2022.

Q2. At what CAGR is the Rail freight transportation Market projected to grow within the forecast period?

Rail freight transportation Market is expected to register a CAGR of about 6.5% during the forecast period

Q3. What are the factors on which the Rail freight transportation Market research is based on?

By Cargo Type, By Service, By Destination and Geographyare the factors on which the Rail freight transportation Market research is based.

Q4. What are the factors driving the Rail freight transportation Market?

Key factors that are driving the growth include the High cost Efficiency and Fuel Efficiency.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model