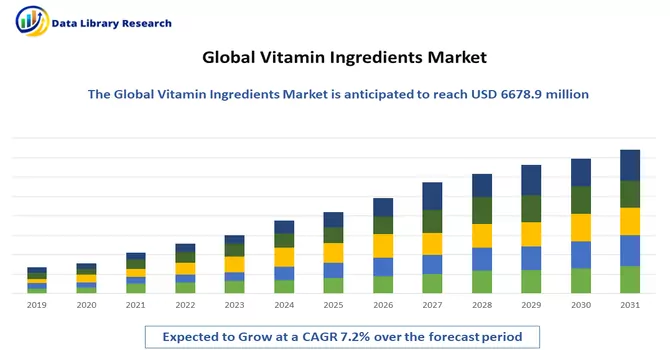

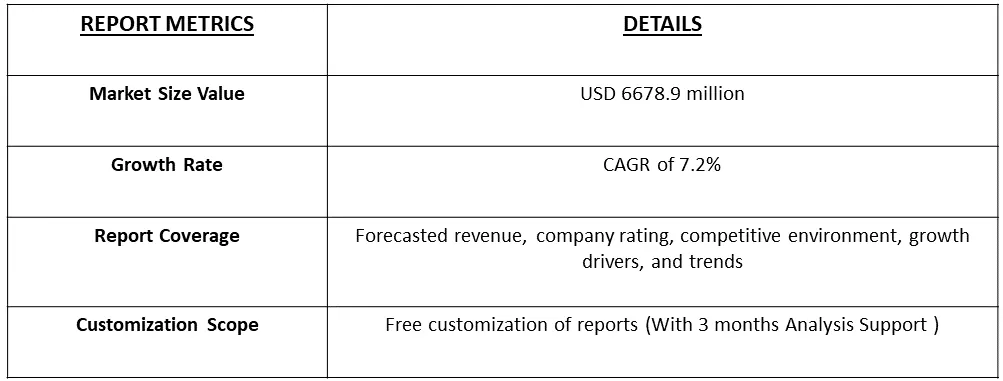

The global market size for Vitamin Ingredients reached USD 6678.9 million in 2022 and is projected to witness a robust CAGR of 7.2% during the forecast period from 2023 to 2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

This growth trajectory is attributed to the ongoing expansion of the wellness industry and the surging demand for healthier and more nutritious foods on a global scale. Vitamins, acknowledged as essential nutrients, play a pivotal role in various bodily functions, encompassing growth, digestion, and nerve functions. The increased awareness of lifestyle diseases has significantly fueled the demand for vitamin ingredients in recent years, contributing to the overall expansion of the market.

Vitamin ingredients, spanning vitamins A, B, C, D, E, and K, find versatile applications across diverse industries such as food and beverages, cosmetics, animal feed, pharmaceuticals, and more. Among these, vitamin A has attracted considerable attention due to its manifold benefits, including the treatment of eye-related disorders like myopia, night blindness, and cataracts. The market segment for vitamin D stands out as particularly lucrative, given its potential to prevent conditions such as diabetes and hypertension, coupled with its role in facilitating calcium absorption for bone health.

Market Segmentation: Vitamin Ingredients Market is Segmented by Type (Vitamin A, Vitamin B, Vitamin C, Vitamin D, Vitamin E, and Vitamin K), by Application (Pharmaceuticals, Food and Beverages, Animal Feed, and Cosmetics) and by Form (Solid, and Liquid, Powder) and Geography (North America, Europe, Asia-Pacific, Middle-East and Africa, and South America). The value is provided in terms of (USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The wellness industry's continuous expansion is a significant trend driving the demand for vitamin ingredients. Consumers' increasing focus on health and well-being, coupled with the pursuit of healthier lifestyles, has led to a rising demand for nutritional supplements and fortified foods containing essential vitamins. The global trend toward healthier eating habits and increased awareness of the role of vitamins in maintaining overall health has fueled a growing demand for nutritional foods. Consumers are actively seeking products that offer natural sources of essential vitamins, contributing to the popularity of vitamin-rich foods and beverages. The convenience of online shopping has extended to the vitamin ingredients market, with consumers increasingly opting for e-commerce platforms to purchase supplements and fortified products. Online channels provide a wide range of choices and information for consumers to make informed decisions. Thus, these market trends are expected to witness significant growth over the forecast period.

Market Drivers:

High Adoption from Varieties of Industries

Vitamins are essential organic compounds that play a crucial role in various physiological functions within the human body. The widespread recognition of their health benefits has led to a surge in the adoption of vitamin ingredients across a diverse range of industries. This trend is driven by the growing awareness of the importance of nutrition and wellness, as well as advancements in research and technology. The food and beverage industry has witnessed a significant integration of vitamin ingredients into a variety of products. From fortified cereals and beverages to snacks and dairy products, manufacturers are leveraging the nutritional value of vitamins to meet consumer demand for healthier options. The high adoption of vitamin ingredients across a diverse range of industries underscores their universal appeal and recognition as vital components for human health and well-being. Thus, owing to the above-mentioned reasons the market is expected to witness significant growth over the forecast period.

High Prevalence of Vitamin Deficiency all Around the World

Vitamin deficiency remains a pervasive global health challenge, affecting populations across diverse regions and socio-economic groups. Despite advancements in healthcare and nutrition awareness, the prevalence of vitamin deficiencies persists, leading to a range of health issues. For instance, an article published by NCBI in March 2023, during this study, a comprehensive review of 67,340 records was conducted, leading to the inclusion of 308 studies encompassing a total of 7,947,359 participants from 81 countries. Among these, 202 studies (involving 7,634,261 participants), 284 studies (involving 1,475,339 participants), and 165 studies (involving 561,978 participants) were specifically focused on determining the prevalence of serum 25(OH)D levels below 30, 50, and 75 nmol/L, respectively. The global analysis revealed that 15.7% (95% CrI 13.7-17.8) of participants had serum 25-hydroxyvitamin D levels below 30 nmol/L, while 47.9% (95% CrI 44.9-50.9) and 76.6% (95% CrI 74.0-79.1) had levels below 50 and 75 nmol/L, respectively. Despite a slight decrease from the period spanning 2000-2010 to 2011-2022, the prevalence of vitamin D deficiency remained notably high. Thus, such vitamin deficiency is expected to increase the demand for vitamin supplements, which is expected to drive the growth of the studied market.

Market Restraints :

Regulatory Challenges and Price Fluctuations of Raw Materials

The stringent regulatory frameworks and evolving compliance standards in different regions can pose challenges for companies operating in the vitamin ingredients market. Compliance with varying regulations across countries often demands significant investments and may slow down market entry and expansion. Moreover, the prices of raw materials, such as vitamins sourced from natural or synthetic origins, can be volatile. Fluctuations in raw material prices directly impact production costs for manufacturers, potentially leading to reduced profit margins and pricing challenges in the market.

The COVID-19 pandemic has had a multifaceted impact on the global economy, including the vitamin ingredient market. The pandemic led to widespread disruptions in global supply chains, affecting the sourcing and transportation of raw materials for vitamin ingredients. Lockdowns, travel restrictions, and logistical challenges resulted in delays and shortages, impacting the overall production capacity of manufacturers. For instance, an article published by NIL in June 2022, reported that the pandemic prompted a shift in consumer behaviour towards health and wellness a significantly increased awareness of the importance of vitamins for immunity and overall health, purchasing patterns were influenced by factors such as product availability, affordability, and perceived necessity. Thus, the pandemic increased the demand for vitamin supplements, and with growing awareness, the market is expected to witness significant growth over the forecast period.

Segmental Analysis :

Vitamin D Segment by Vitamin Types, the Segment is Expected to Witness Significant Growth Over the Forecast Period

Vitamin D is a fat-soluble vitamin that plays a crucial role in various physiological functions, including bone health, immune system support, and modulation of cell growth. Unlike other vitamins, the body can produce vitamin D when exposed to sunlight, and it is also obtained through dietary sources and supplements. Vitamin D is essential for the maintenance of strong and healthy bones as it facilitates the absorption of calcium and phosphorus. It also contributes to immune system function, and cardiovascular health, and may play a role in preventing certain chronic diseases. The vitamin D market is expected to continue growing, driven by ongoing research on its health benefits and the increasing adoption of preventive healthcare practices. As consumers become more proactive about their health, the demand for vitamin D supplements and fortified products is likely to remain robust. Thus, owing to such advantages, the segment is expected to witness significant growth over the forecast period.

Pharmaceuticals Segment is Expected to Witness Significant Growth Over the Forecast Period

Vitamins play a crucial role in pharmaceuticals, where they are incorporated into various medications and supplements to address specific health conditions. Pharmaceutical formulations often include vitamins to enhance therapeutic effects, support patient recovery, and prevent nutritional deficiencies. Some pharmaceutical products are enriched with specific vitamins to enhance their efficacy. For example, vitamin E may be included in skincare medications for its antioxidant benefits, while vitamin K is incorporated into certain blood clotting medications. Thus, the integration of vitamins into pharmaceuticals reflects a holistic approach to healthcare, acknowledging the significant impact of nutrition on overall well-being. As research progresses and healthcare becomes more personalized, the synergy between pharmaceuticals and the vitamin ingredient market is likely to contribute to advancements in preventive and therapeutic healthcare solutions.

Solid Segment is Expected to Witness Significant Growth Over the Forecast Period

Solid-form vitamins play a crucial role in fortifying a variety of food and beverage products. Powdered or granulated forms are added to cereals, energy bars, and beverages to enhance nutritional content without compromising taste or texture. Solid forms offer enhanced stability and longer shelf life for vitamin ingredients compared to liquid forms. This characteristic is particularly beneficial in industries where extended product shelf life is a critical factor, such as in pharmaceuticals and packaged food products. The solid form of vitamin ingredients is vital in the formulation of animal feed. Pelleted or granulated vitamins are incorporated into animal feeds to ensure optimal nutrition for livestock, poultry, and pets. Thus, owing to such benefits, the segment is expected to witness significant growth over the forecast period.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North America is a significant player in the global vitamin ingredient market, driven by a growing focus on health and wellness, a robust pharmaceutical industry, and increasing consumer awareness about the importance of nutritional supplementation. The North American population's heightened awareness of health and wellness has led to a surge in demand for dietary supplements and functional foods, contributing to the growth of the vitamin ingredient market. Consumers are proactively seeking products that offer nutritional benefits and support overall well-being. The North American vitamin ingredient market is poised for continued growth, driven by ongoing trends in health consciousness, innovations in product formulations, and the integration of vitamins into a diverse range of consumer products. The market is expected to witness further expansion as research continues to uncover the health benefits associated with various vitamin formulations. Thus, owing to such advancement in the region, the region is expected to witness significant growth over the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

The key players in the market are strategically positioning themselves for growth through a combination of partnerships, mergers and acquisitions, product innovation, global expansions, packaging enhancements, and other tactical approaches. These multifaceted strategies underscore their commitment to adapt to market dynamics and maintain a competitive edge in the vitamin ingredient industry. Top Players in the Vitamin Ingredients Market are:

Key Developments:

1) In February 2023, Amway Corp. unveiled a new series of nutritional supplements under its Nutrilite brand. Tailored to cater to the nutritional requirements of the bustling millennial demographic, the product line includes innovative offerings such as gummies and jelly strips. Covering a spectrum of health aspects, the range encompasses supplements targeting overall health and immunity, bone health, and eye health.

2) In February 2023, Bayer AG made a significant announcement regarding the expansion of its "Nutrient Gap Initiative." The initiative, aimed at enhancing access to crucial nutrition, is geared towards reaching 50 million individuals in underserved communities by the year 2030. This expansive program places a strong emphasis on the role of nutritional supplementation as a pivotal tool in fortifying these populations against malnutrition, thereby fostering improved health outcomes.

Q1. What was the Vitamin Ingredients Market size in 2022?

As per Data Library Research the global market size for Vitamin Ingredients market reached USD 6678.9 million in 2022.

Q2. At what CAGR is the Vitamin Ingredients market projected to grow within the forecast period?

Vitamin Ingredients market is projected to witness a robust CAGR of 7.2% during the forecast period.

Q3. What are the factors driving the Vitamin Ingredients market?

Key factors that are driving the growth include the High Adoption from Varieties of Industries and High Prevalence of Vitamin Deficiency all Around the World.

Q4. Which region has the largest share of the Vitamin Ingredients market? What are the largest region's market size and growth rate?

North America has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model