Nuclear Medicine Management Software Market Overview and Analysis

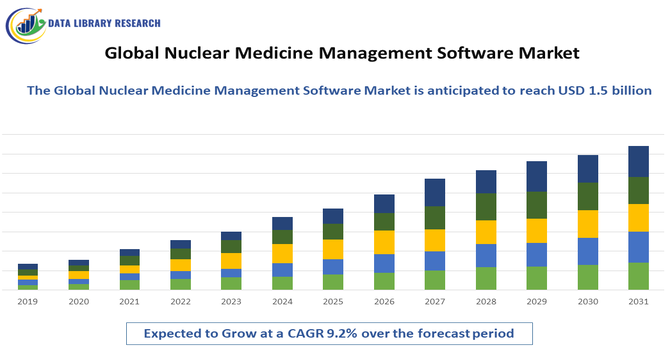

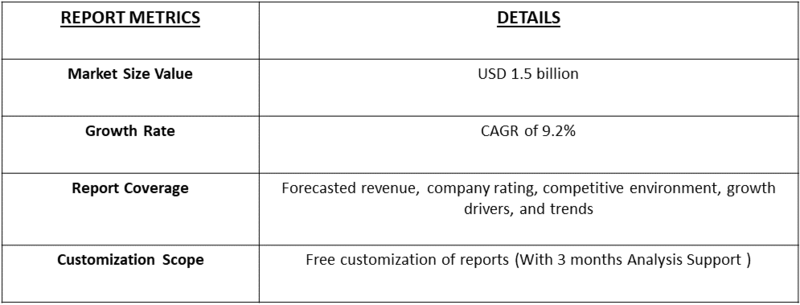

The Global Nuclear Medicine Management Software Market valued at USD 887.5 million in 2026, reaching 1.5 billion in 2033, growing at 9.2% CAGR from 2026-2033.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Nuclear Medicine Management Software Market refers to the industry focused on developing and providing software solutions that streamline the management of nuclear medicine departments and services. This software aids in scheduling, patient data management, radiopharmaceutical inventory, imaging workflow, and regulatory compliance. It enhances diagnostic accuracy, operational efficiency, and patient safety by integrating with imaging devices and hospital information systems. The market serves hospitals, diagnostic centers, and research institutions globally, aiming to improve clinical outcomes and administrative efficiency in nuclear medicine.

Nuclear Medicine Management Software Market Latest Trends

The Global Nuclear Medicine Management Software Market is witnessing rapid growth driven by technological advancements such as AI integration, cloud computing, and enhanced imaging analytics. Increasing demand for precision diagnostics and personalized therapies fuels adoption in hospitals and diagnostic centers. Regulatory compliance features and interoperability with hospital information systems are becoming critical. The rise of hybrid imaging systems and demand for streamlined workflow management boost software innovation. Telemedicine integration and remote monitoring capabilities are emerging trends, allowing for better patient management.

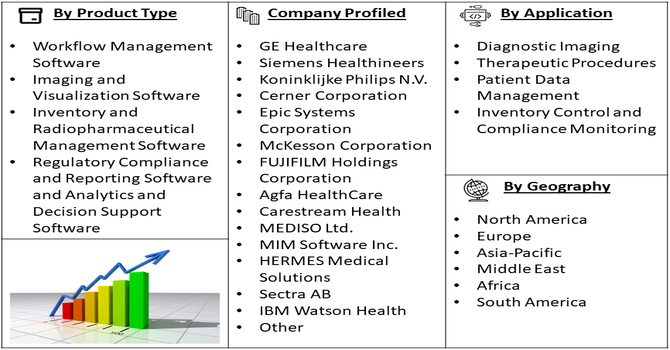

Segmentation: The Global Nuclear Medicine Management Software Market Software Type (Workflow Management Software, Imaging and Visualization Software, Inventory and Radiopharmaceutical Management Software, Regulatory Compliance and Reporting Software and Analytics and Decision Support Software), Deployment Mode (On-Premise and Cloud-Based), Application (Diagnostic Imaging, Therapeutic Procedures, Patient Data Management, Inventory Control and Compliance Monitoring), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Increasing Demand for Advanced Diagnostic and Therapeutic Solutions

The rising prevalence of chronic diseases such as cancer, cardiovascular disorders, and neurological conditions has increased reliance on nuclear medicine for accurate diagnosis and targeted therapy. Hospitals and diagnostic centers are adopting nuclear medicine management software to streamline imaging workflows, enhance diagnostic precision, and optimize radiopharmaceutical usage.

The software’s ability to integrate with imaging devices, patient records, and hospital information systems ensures efficient data management and faster reporting. Growing awareness of personalized medicine further drives adoption, as healthcare providers seek software solutions that support precise diagnostics, treatment planning, and improved patient outcomes.

- Technological Advancements and Integration with Healthcare IT

Rapid technological advancements, including artificial intelligence (AI), cloud computing, and advanced imaging analytics, are fueling the growth of nuclear medicine management software. AI-driven algorithms enable automated image analysis, anomaly detection, and clinical decision support, improving workflow efficiency and reducing human error.

Cloud-based solutions offer scalability, remote access, and cost-effective deployment for hospitals and clinics of all sizes. For instance, in 2025, Ratio Therapeutics’ agreement with Macrocyclics advanced technological integration in healthcare IT and impacted the global nuclear medicine management software market. By enabling worldwide distribution of its Macropa chelator, it drove adoption of software for radiopharmaceutical tracking, inventory management, and clinical workflow integration, supporting enhanced efficiency and innovation in cancer diagnostics and therapy.

Market Restraints:

- High Implementation Costs and Complexity

Despite its benefits, nuclear medicine management software adoption is restrained by high implementation costs and operational complexity. Installing and integrating advanced software with existing hospital infrastructure requires significant investment in hardware, training, and IT support. Smaller hospitals or diagnostic centers may find the initial cost prohibitive. Additionally, the complexity of managing sensitive patient data, ensuring regulatory compliance, and maintaining system updates presents operational challenges. Mismanagement or technical errors can impact clinical workflows and patient safety. These factors limit widespread adoption, especially in developing regions, and can slow market growth despite rising demand for advanced nuclear medicine solutions.

Socioeconomic Impact on Nuclear Medicine Management Software Market

The market positively impacts healthcare quality by improving diagnostic accuracy and treatment planning in nuclear medicine, ultimately enhancing patient outcomes. It supports efficient resource utilization and reduces operational costs, making advanced nuclear medicine more accessible. By enabling faster workflows and regulatory compliance, the software helps healthcare providers serve growing populations amid rising chronic and complex diseases. This fosters public health improvements, particularly in regions adopting modern healthcare IT infrastructure. Moreover, the market creates jobs in software development, healthcare IT, and training, contributing to economic growth. However, disparities in technology access may widen healthcare gaps between developed and developing regions.

Segmental Analysis:

- Radiopharmaceutical Management Software segment is expected to witness highest growth over the forecast period

The radiopharmaceutical management software segment is expected to witness the highest growth over the forecast period due to increasing demand for precise tracking, inventory management, and safe handling of radiopharmaceuticals. Hospitals and diagnostic centers rely on these solutions to optimize usage, reduce wastage, and ensure regulatory compliance. Integration with imaging workflows and electronic health records enhances operational efficiency. Growing adoption of nuclear medicine procedures for diagnostics and therapy, coupled with the need for cost-effective resource management, is accelerating market expansion. Advanced analytics and automation features further improve safety, streamline workflows, and reduce human error in radiopharmaceutical handling.

- Cloud Based segment is expected to witness highest growth over the forecast period

The cloud-based deployment segment is projected to grow fastest during the forecast period, driven by the need for scalable, accessible, and cost-effective solutions. Cloud platforms enable healthcare providers to access nuclear medicine management software remotely, facilitating multi-site operations and telemedicine integration. Features such as automated updates, data security, and backup systems enhance efficiency and reduce IT maintenance costs. Cloud adoption allows seamless integration with electronic health records, PACS, and analytics tools, supporting real-time decision-making. Hospitals and diagnostic centers are increasingly favoring cloud-based solutions for their flexibility, reduced infrastructure requirements, and ability to rapidly deploy and scale across diverse clinical settings.

- Compliance Monitoring segment is expected to witness highest growth over the forecast period

The compliance monitoring segment is expected to experience significant growth due to stringent regulations governing nuclear medicine procedures and radiopharmaceutical usage. Software solutions in this segment help healthcare providers track regulatory standards, maintain accurate records, and ensure adherence to safety protocols. Automation of documentation, reporting, and audit trails reduces the risk of violations and enhances patient safety. Growing awareness of regulatory compliance among hospitals and diagnostic centers, along with increasing inspections and safety mandates, is driving adoption. Advanced compliance monitoring features, integrated with imaging and radiopharmaceutical management, streamline operations, mitigate legal risks, and ensure that nuclear medicine practices meet international and local regulatory requirements.

- North American Region is expected to witness highest growth over the forecast period

North America is expected to witness the highest growth in the nuclear medicine management software market due to advanced healthcare infrastructure, high adoption of technology, and strong regulatory frameworks.

The region has a growing number of hospitals and diagnostic centers investing in nuclear medicine solutions for cancer, cardiology, and neurology diagnostics. For instance, in 2024, The partnership Sanofi-RadioMedix-Orano Med Agreement accelerated demand for sophisticated management software across North America. As AlphaMedix™ entered late-stage trials, facilities required upgraded systems to handle Lead-212’s unique handling protocols. This collaboration pushed providers to adopt automated tracking for targeted alpha therapies, ensuring precise dose management and regulatory compliance for rare cancer treatments, which ultimately modernized the regional nuclear medicine infrastructure.

Increasing awareness of personalized medicine, integration of AI and cloud-based technologies, and emphasis on workflow efficiency further fuel market expansion. Presence of leading software vendors, favorable reimbursement policies, and high healthcare spending contribute to adoption. North America is likely to continue leading the market, setting benchmarks for software innovation and patient-centric nuclear medicine practices.

To Learn More About This Report - Request a Free Sample Copy

Nuclear Medicine Management Software Market Competitive Landscape

The competitive landscape is marked by established healthcare IT companies and niche players specializing in nuclear medicine solutions. Key companies focus on innovation, software integration, and strategic partnerships with imaging device manufacturers and healthcare providers. Competition centers on product features like AI-enabled diagnostics, user-friendly interfaces, cloud compatibility, and regulatory compliance. Companies invest heavily in R&D and mergers to expand market share. Vendors differentiate by offering customizable solutions tailored to various clinical settings and regional regulatory environments. Market fragmentation exists due to diverse healthcare needs globally, with emerging players leveraging digital technologies to challenge incumbents and cater to specific regional demands.

The major players for above market are:

- GE Healthcare

- Siemens Healthineers

- Koninklijke Philips N.V.

- Cerner Corporation

- Epic Systems Corporation

- McKesson Corporation

- FUJIFILM Holdings Corporation

- Agfa HealthCare

- Carestream Health

- MEDISO Ltd.

- MIM Software Inc.

- HERMES Medical Solutions

- Manteia Medical Imaging

- Siemens Syngo (part of Siemens Healthineers)

- Sectra AB

- IBM Watson Health

- Intelerad Medical Systems

- Infinitt Healthcare

- Comarch Healthcare

- NucleusHealth

Recent Development

- In October 2025, The expanded partnership between START, XenoSTART, and Minerva Imaging significantly influenced the global nuclear medicine management software market. By integrating PDX model repositories with advanced molecular imaging and radionuclide therapy capabilities, it enhanced end-to-end radiopharmaceutical development, driving demand for software solutions that support discovery, translational research, and manufacturing workflows.

- In September 2025, The launch of Cadena Research by CPDC impacted the global nuclear medicine management software market by boosting demand for integrated solutions supporting preclinical radiopharmaceutical development. Its comprehensive in vitro, in vivo, imaging, and GLP capabilities, combined with end-to-end project management, drove adoption of software for workflow tracking, data analysis, and regulatory compliance.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The rising prevalence of cancer and cardiovascular diseases is significantly driving demand for nuclear imaging. Growth is fueled by the need for integrated workflow solutions that manage radiopharmaceutical inventory, patient scheduling, and regulatory compliance. Furthermore, the shift toward precision medicine and hybrid imaging techniques like PET-CT necessitates advanced data management software.

Q2. What are the main restraining factors for this market?

High implementation costs and the complexity of integrating specialized software with existing hospital Information Systems (HIS) act as major barriers. Additionally, a shortage of trained nuclear medicine professionals capable of operating sophisticated platforms limits adoption. Stringent regulatory requirements regarding radiation safety and patient data privacy also lengthen the product approval cycles.

Q3. Which segment is expected to witness high growth?

The Radiopharmaceutical Management Software segment is expected to witness the highest growth over the forecast period due to increasing demand for efficient tracking, inventory control, and safe handling of radioactive materials. Enhanced workflow automation, regulatory compliance, and integration with imaging systems are driving adoption across hospitals and nuclear medicine centers globally.

Q4. Who are the top major players for this market?

The market is led by major healthcare technology providers including GE HealthCare, Siemens Healthineers, and Philips Healthcare. Other influential players specializing in nuclear medicine workflows are Eckert & Ziegler, Hermes Medical Solutions, and Mirada Medical. These companies focus on AI integration and automated dose tracking to maintain their dominance.

Q5. Which country is the largest player?

The United States is currently the largest player in this market. This leadership is sustained by a robust healthcare infrastructure, high adoption rates of advanced medical imaging technologies, and significant investment in oncology research. Furthermore, strict federal mandates for electronic health records and radiation dose monitoring drive the widespread implementation of management software.

List of Figures

Figure 1: Global Nuclear Medicine Management Software Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Nuclear Medicine Management Software Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Nuclear Medicine Management Software Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Nuclear Medicine Management Software Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Nuclear Medicine Management Software Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Nuclear Medicine Management Software Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Nuclear Medicine Management Software Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Nuclear Medicine Management Software Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Nuclear Medicine Management Software Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Nuclear Medicine Management Software Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Nuclear Medicine Management Software Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Nuclear Medicine Management Software Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Nuclear Medicine Management Software Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Nuclear Medicine Management Software Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Nuclear Medicine Management Software Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Nuclear Medicine Management Software Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Nuclear Medicine Management Software Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Nuclear Medicine Management Software Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Nuclear Medicine Management Software Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Nuclear Medicine Management Software Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Nuclear Medicine Management Software Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Nuclear Medicine Management Software Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Nuclear Medicine Management Software Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Nuclear Medicine Management Software Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Nuclear Medicine Management Software Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Nuclear Medicine Management Software Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Nuclear Medicine Management Software Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Nuclear Medicine Management Software Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Nuclear Medicine Management Software Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Nuclear Medicine Management Software Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Nuclear Medicine Management Software Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Nuclear Medicine Management Software Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Nuclear Medicine Management Software Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Nuclear Medicine Management Software Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Nuclear Medicine Management Software Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Nuclear Medicine Management Software Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Nuclear Medicine Management Software Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Nuclear Medicine Management Software Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Nuclear Medicine Management Software Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Nuclear Medicine Management Software Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Nuclear Medicine Management Software Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Nuclear Medicine Management Software Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Nuclear Medicine Management Software Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Nuclear Medicine Management Software Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Nuclear Medicine Management Software Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Nuclear Medicine Management Software Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Nuclear Medicine Management Software Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Nuclear Medicine Management Software Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Nuclear Medicine Management Software Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Nuclear Medicine Management Software Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Nuclear Medicine Management Software Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Nuclear Medicine Management Software Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Nuclear Medicine Management Software Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Nuclear Medicine Management Software Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Nuclear Medicine Management Software Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Nuclear Medicine Management Software Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Nuclear Medicine Management Software Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Nuclear Medicine Management Software Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Nuclear Medicine Management Software Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Nuclear Medicine Management Software Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Nuclear Medicine Management Software Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Nuclear Medicine Management Software Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Nuclear Medicine Management Software Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Nuclear Medicine Management Software Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Nuclear Medicine Management Software Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Nuclear Medicine Management Software Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Nuclear Medicine Management Software Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Nuclear Medicine Management Software Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Nuclear Medicine Management Software Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Nuclear Medicine Management Software Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Nuclear Medicine Management Software Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Nuclear Medicine Management Software Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Nuclear Medicine Management Software Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Nuclear Medicine Management Software Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Nuclear Medicine Management Software Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Nuclear Medicine Management Software Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Nuclear Medicine Management Software Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Nuclear Medicine Management Software Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model