Traditional Glucose Monitoring (TGM) Devices Market Overview and Analysis:

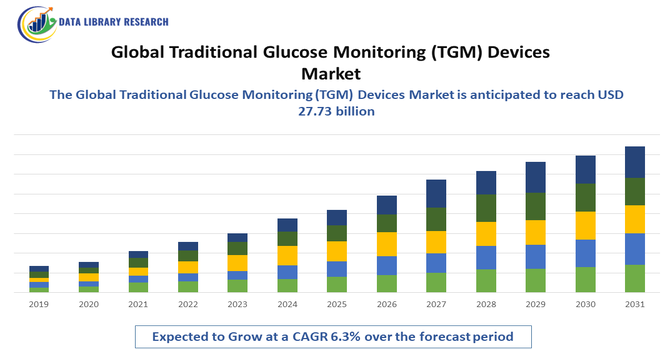

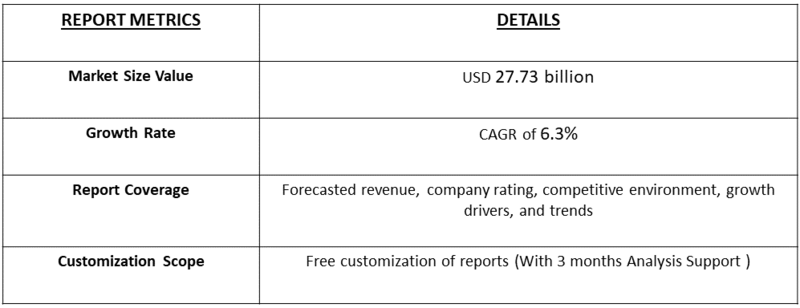

The Global Blood Glucose Monitoring System Market was valued at USD 17.20 billion in 2025 and is projected to reach USD 27.73 billion by 2032, with a compound annual growth rate (CAGR) of 6.3% from 2025-2032.

Get Complete Analysis Of The Report - Download Free Sample PDF

The Global Traditional Glucose Monitoring Device Market is experiencing steady growth, driven by the rising prevalence of diabetes worldwide and the increasing demand for reliable self-monitoring solutions. Key factors influencing market expansion include the growing elderly population, higher awareness of diabetes management, and the affordability of traditional glucose monitoring devices compared to continuous glucose monitoring (CGM) systems. The market is primarily supported by the widespread adoption of blood glucose meters, test strips, and lancets, which remain essential tools for daily diabetes care, particularly in emerging economies where cost sensitivity is high. Technological improvements in meter accuracy, user-friendly designs, and digital connectivity are further enhancing patient compliance and market adoption.

Traditional Glucose Monitoring (TGM) Devices Market Latest Trends:

The Global Traditional Glucose Monitoring Device Market is witnessing key trends such as the shift toward non-invasive and minimally invasive technologies like optical sensors and patches to reduce discomfort from frequent finger-prick tests, along with growing integration of devices with smartphones, apps, and digital health platforms for real-time monitoring and data sharing. The market is also seeing advancements in wearable glucose monitoring solutions, increased use of AI and machine learning for predictive analytics and personalized insights, and rising demand for cost-effective and accessible devices in emerging markets, driving innovation in affordable strips and over-the-counter testing solutions.

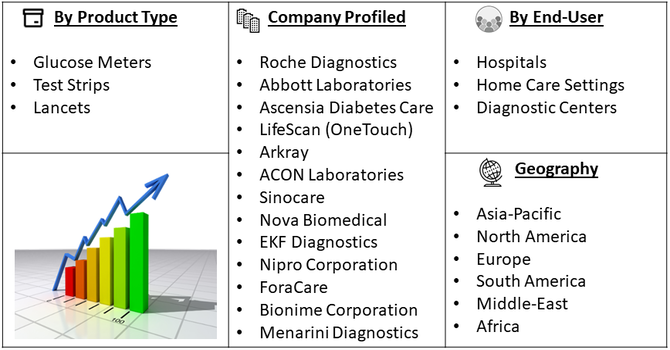

Segmentation: The Global Traditional Glucose Monitoring Device Market is segmented by Product Type (Glucose Meters, Test Strips, and Lancets), End User (Hospitals, Home Care Settings, and Diagnostic Centers) and Geography (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa, with North America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rising Prevalence of Diabetes Worldwide

The growing global burden of diabetes, fuelled by sedentary lifestyles, unhealthy dietary habits, and an aging population, is a major driver for the traditional glucose monitoring device market, as continuous monitoring becomes essential for effective disease management.

The 2024, the WHO reported that the global number of people living with diabetes surged dramatically from 200 million in 1990 to 830 million in 2022, with the fastest increases occurring in low- and middle-income countries. Similarly, the 2025, the International Diabetes Federation, reported that 589 million adults (20-79 years) are living with diabetes – 1 in 9. This number is predicted to rise to 853 million by 2050. This rapid rise in diabetes prevalence is driving strong demand for Traditional Glucose Monitoring (TGM) devices, as more patients require regular blood glucose monitoring to manage their condition effectively. The growing diabetic population, especially in emerging markets, is expanding the user base and fuelling market growth for affordable, easy-to-use glucose monitoring solutions worldwide.

- Increasing Adoption of Home-Based Glucose Monitoring

The shift toward self-care and home-based diabetes management, supported by the affordability and ease of use of traditional glucose monitoring devices, is significantly boosting market demand, especially in developing economies with limited access to advanced healthcare facilities.

In August 2025, Abbott, launched FreeStyle Libre 2 Plus sensor, the newest addition to its FreeStyle Libre sensor lineup. This advanced device provides automatic glucose readings every minute directly to users’ smartphones, enabling people with diabetes to manage their condition more confidently and accurately. Users can continuously monitor their glucose levels without manual scanning and receive instant alerts on compatible smartphones when glucose levels are too low or too high, allowing timely and informed decision-making. This innovation is driving the increasing adoption of home-based glucose monitoring by offering greater convenience, real-time data, and enhanced control, encouraging more patients to embrace remote diabetes management.

Market Restraints:

- Inconvenience and Discomfort Associated with Frequent Finger-Prick Testing

The Global Traditional Glucose Monitoring Device Market faces restraints primarily due to the inconvenience and discomfort associated with frequent finger-prick testing, which often discourages patient compliance and consistent usage. Additionally, the growing popularity of advanced alternatives such as continuous glucose monitoring (CGM) systems and sensor-based devices is diverting demand away from traditional devices. High competition from innovative technologies, coupled with limited insurance coverage and reimbursement challenges in certain regions, further restricts market expansion. Moreover, issues related to accuracy and human error during manual testing also act as barriers to wider adoption.

Socio Economic Impact on Traditional Glucose Monitoring (TGM) Devices Market

The Global Traditional Glucose Monitoring (TGM) Devices Market significantly impacts socio-economic factors by improving diabetes management and reducing healthcare costs associated with complications. Enhanced glucose monitoring enables timely interventions, improving patients' quality of life and productivity. Increased accessibility to affordable TGM devices in low- and middle-income countries supports early diagnosis and management, alleviating the economic burden on healthcare systems. Additionally, widespread use promotes health awareness and empowers patients to take control of their condition, contributing to better public health outcomes and reducing long-term treatment expenses globally.

Segmental Analysis:

- Test strips segment is expected to witness highest growth over the forecast period

Test strips dominate the product type segment as they are an essential consumable for glucose meters and require regular replenishment, ensuring continuous demand. Their affordability, ease of use, and widespread availability make them the preferred choice among diabetic patients for self-monitoring. Rising diabetes prevalence, particularly in low- and middle-income countries, and the growing emphasis on frequent blood glucose checks are fueling steady growth in this segment.

Moreover, advancements in test strip technology, such as improved accuracy, smaller blood sample requirements, and faster results, are further boosting their adoption. Manufacturers are also focusing on reducing production costs to make test strips more accessible in emerging markets. Additionally, government initiatives and insurance reimbursements supporting diabetes management contribute to sustained demand. As a result, test strips remain a crucial driver within the Traditional Glucose Monitoring Device Market, underpinning consistent revenue streams for industry players worldwide.

- Home Care Settings segment is expected to witness highest growth over the forecast period

Home care settings are expected to register strong growth as patients increasingly prefer self-monitoring of blood glucose levels from the comfort of their homes. The convenience, cost-effectiveness, and ability to track glucose regularly without visiting healthcare facilities are driving adoption in this segment. Additionally, the rising awareness of preventive healthcare and the increasing elderly population managing diabetes independently support growth in home-based monitoring.

- North America region is expected to witness highest growth over the forecast period

The North America region is expected to witness the highest growth in the traditional glucose monitoring device market over the forecast period, primarily driven by the rising prevalence of diabetes and growing awareness about regular blood glucose monitoring. The region benefits from advanced healthcare infrastructure, favourable reimbursement policies, and strong adoption of home-based monitoring solutions, making devices like glucose meters and test strips widely accessible.

Additionally, the increasing geriatric population, combined with lifestyle-related risk factors such as obesity and sedentary habits, is fuelling demand. The presence of key market players, top universities & research centres and continuous technological advancements further strengthen North America’s leading position in this market. For instance, in September 2024, research published by Boston University, reported that a growing trend of continuous glucose monitoring (CGM) sensors being used by individuals without diabetes, fuelled by recent over-the-counter product launches by major companies like Dexcom and Abbott. This research is driving the Traditional Glucose Monitoring Device Market by expanding the potential user base beyond diabetic patients to health-conscious individuals seeking real-time glucose insights. As major companies launch over-the-counter CGM products for non-diabetics, demand is increasing for user-friendly, affordable devices. The need for clearer guidelines on normal glucose ranges also encourages innovation in data interpretation tools, fueling market growth and new product development.

To Learn More About This Report - Request a Free Sample Copy

Traditional Glucose Monitoring (TGM) Devices Market Competitive Landscape:

The competitive landscape of the Global Traditional Glucose Monitoring Device Market is fragmented and highly competitive, featuring a mix of large multinational diagnostics and medical-device companies alongside regional and niche manufacturers; established players compete on accuracy, strip cost, ease of use, and channel reach while smaller firms focus on affordability and local distribution, making the market dynamic across developed and emerging regions.

Innovation and technological advancements continue to shape the competitive dynamics in the Global Traditional Glucose Monitoring Device Market. Companies are increasingly investing in research and development to improve device accuracy, reduce sample sizes, and enhance user experience. Strategic partnerships, mergers, and acquisitions are also common as firms seek to expand their product portfolios and geographic presence. Additionally, growing awareness about diabetes management and rising demand in emerging markets are prompting manufacturers to tailor products for diverse patient needs, further intensifying competition and driving market growth.

Key companies in this space include:

- Roche Diagnostics

- Abbott Laboratories

- Ascensia Diabetes Care

- LifeScan (OneTouch)

- Arkray

- ACON Laboratories

- Sinocare

- Nova Biomedical

- EKF Diagnostics

- Nipro Corporation

- ForaCare

- Bionime Corporation

- Menarini Diagnostics

- Omron Healthcare

- Terumo Corporation

- Medtrum Technologies

- Dexcom, Medtronic

- HemoCue

- GlucoRx.

Recent Development:

- In June 2025, Glucotrack, Inc., announced that it had presented results from its completed first-in-human clinical study at the 85th Scientific Sessions of the American Diabetes Association (ADA). This development signals a potential shift away from traditional glucose monitoring methods that rely on finger-prick testing. As non-invasive technologies like Glucotrack advance, they may reduce demand for conventional glucometers and test strips, especially among patients seeking pain-free and user-friendly alternatives.

- In April 2025, Sequel Med Tech, LLC and Senseonics Holdings, Inc. announced a commercial development agreement. This partnership aims to integrate Sequel’s twiist Automated Insulin Delivery (AID) System, powered by Tidepool, with Senseonics’ Eversense 365 CGM. As a result, the twiist AID System will become the first to be compatible with the Eversense 365—the world’s only one-year implantable CGM—providing people with type 1 diabetes enhanced flexibility and personalized diabetes management options.

Frequently Asked Questions (FAQ) :

Q1. What the main growth driving factors for this market?

The key growth drivers for the Traditional Glucose Monitoring (TGM) Devices Market include the rising global prevalence of diabetes, increasing awareness about glucose monitoring, and growing healthcare access in emerging markets. The affordability and ease of use of traditional devices like glucometers and test strips make them ideal for daily at-home monitoring, especially in low- and middle-income countries. Government initiatives promoting early diabetes diagnosis and patient education also contribute significantly to market expansion.

Q2. What are the main restraining factors for this market?

Major restraints for the TGM Devices Market include the growing shift toward continuous glucose monitoring (CGM) systems, which offer real-time data and greater convenience. Traditional methods require finger-pricking, which can be painful and discourage regular use. Additionally, limited insurance coverage for frequent test strip use in some regions and environmental concerns over disposable components may also hinder market growth. The advancement of non-invasive alternatives is gradually reducing reliance on traditional glucose monitoring methods.

Q3. Which segment is expected to witness high growth?

Within the traditional glucose monitoring market, the test strips segment is expected to witness the highest growth. This is driven by the recurring nature of test strip usage, as each glucose check requires a new strip. As diabetes management becomes more frequent and standardized, demand for consumables like test strips continues to rise, especially in home-care settings and among elderly diabetic populations who prefer easy-to-use monitoring methods. Bulk purchasing and home-based testing further fuel this segment's growth.

Q4. Who are the top major players for this market?

Leading players in the Traditional Glucose Monitoring Devices Market include Roche Diagnostics, Abbott Laboratories, Ascensia Diabetes Care, LifeScan Inc., and ARKRAY Inc. These companies dominate the space through a combination of strong product portfolios, global distribution networks, and continuous improvements in device accuracy and ease of use. Their focus on affordability and accessibility, particularly in emerging markets, has helped them maintain a strong foothold in the TGM market despite growing competition from digital and wearable technologies.

Q5. Which country is the largest player?

The United States is the largest player in the Traditional Glucose Monitoring Devices Market due to its high diabetes prevalence, strong healthcare infrastructure, and widespread consumer awareness. The presence of leading market players, favorable reimbursement policies, and a proactive approach to chronic disease management further support its dominance. However, countries like India and China are rapidly emerging as high-growth markets, driven by large diabetic populations, rising health consciousness, and increased government focus on non-communicable disease control.

List of Figures

Figure 1: Global Traditional Glucose Monitoring (TGM) Devices Market Revenue Breakdown (USD Billion, %) by Region, 2019 & 2027

Figure 2: Global Traditional Glucose Monitoring (TGM) Devices Market Value Share (%), By Segment 1, 2019 & 2027

Figure 3: Global Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 4: Global Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 5: Global Traditional Glucose Monitoring (TGM) Devices Market Value Share (%), By Segment 2, 2019 & 2027

Figure 6: Global Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 7: Global Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 8: Global Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 3, 2016-2027

Figure 9: Global Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Others, 2016-2027

Figure 10: Global Traditional Glucose Monitoring (TGM) Devices Market Value Share (%), By Segment 3, 2019 & 2027

Figure 11: Global Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 12: Global Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 13: Global Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 3, 2016-2027

Figure 14: Global Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Others, 2016-2027

Figure 15: Global Traditional Glucose Monitoring (TGM) Devices Market Value (USD Billion), by Region, 2019 & 2027

Figure 16: North America Traditional Glucose Monitoring (TGM) Devices Market Value Share (%), By Segment 1, 2019 & 2027

Figure 17: North America Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 18: North America Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 19: North America Traditional Glucose Monitoring (TGM) Devices Market Value Share (%), By Segment 2, 2019 & 2027

Figure 20: North America Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 21: North America Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 22: North America Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 3, 2016-2027

Figure 23: North America Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Others, 2016-2027

Figure 24: North America Traditional Glucose Monitoring (TGM) Devices Market Value Share (%), By Segment 3, 2019 & 2027

Figure 25: North America Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 26: North America Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 27: North America Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 3, 2016-2027

Figure 28: North America Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Others, 2016-2027

Figure 29: North America Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by U.S., 2016-2027

Figure 30: North America Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Canada, 2016-2027

Figure 31: Latin America Traditional Glucose Monitoring (TGM) Devices Market Value Share (%), By Segment 1, 2019 & 2027

Figure 32: Latin America Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 33: Latin America Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 34: Latin America Traditional Glucose Monitoring (TGM) Devices Market Value Share (%), By Segment 2, 2019 & 2027

Figure 35: Latin America Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 36: Latin America Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 37: Latin America Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 3, 2016-2027

Figure 38: Latin America Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Others, 2016-2027

Figure 39: Latin America Traditional Glucose Monitoring (TGM) Devices Market Value Share (%), By Segment 3, 2019 & 2027

Figure 40: Latin America Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 41: Latin America Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 42: Latin America Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 3, 2016-2027

Figure 43: Latin America Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Others, 2016-2027

Figure 44: Latin America Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Brazil, 2016-2027

Figure 45: Latin America Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Mexico, 2016-2027

Figure 46: Latin America Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Rest of Latin America, 2016-2027

Figure 47: Europe Traditional Glucose Monitoring (TGM) Devices Market Value Share (%), By Segment 1, 2019 & 2027

Figure 48: Europe Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 49: Europe Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 50: Europe Traditional Glucose Monitoring (TGM) Devices Market Value Share (%), By Segment 2, 2019 & 2027

Figure 51: Europe Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 52: Europe Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 53: Europe Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 3, 2016-2027

Figure 54: Europe Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Others, 2016-2027

Figure 55: Europe Traditional Glucose Monitoring (TGM) Devices Market Value Share (%), By Segment 3, 2019 & 2027

Figure 56: Europe Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 57: Europe Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 58: Europe Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 3, 2016-2027

Figure 59: Europe Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Others, 2016-2027

Figure 60: Europe Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by U.K., 2016-2027

Figure 61: Europe Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Germany, 2016-2027

Figure 62: Europe Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by France, 2016-2027

Figure 63: Europe Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Italy, 2016-2027

Figure 64: Europe Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Spain, 2016-2027

Figure 65: Europe Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Russia, 2016-2027

Figure 66: Europe Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Rest of Europe, 2016-2027

Figure 67: Asia Pacific Traditional Glucose Monitoring (TGM) Devices Market Value Share (%), By Segment 1, 2019 & 2027

Figure 68: Asia Pacific Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 69: Asia Pacific Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 70: Asia Pacific Traditional Glucose Monitoring (TGM) Devices Market Value Share (%), By Segment 2, 2019 & 2027

Figure 71: Asia Pacific Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 72: Asia Pacific Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 73: Asia Pacific Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 3, 2016-2027

Figure 74: Asia Pacific Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Others, 2016-2027

Figure 75: Asia Pacific Traditional Glucose Monitoring (TGM) Devices Market Value Share (%), By Segment 3, 2019 & 2027

Figure 76: Asia Pacific Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 77: Asia Pacific Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 78: Asia Pacific Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 3, 2016-2027

Figure 79: Asia Pacific Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Others, 2016-2027

Figure 80: Asia Pacific Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by China, 2016-2027

Figure 81: Asia Pacific Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by India, 2016-2027

Figure 82: Asia Pacific Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Japan, 2016-2027

Figure 83: Asia Pacific Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Australia, 2016-2027

Figure 84: Asia Pacific Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Southeast Asia, 2016-2027

Figure 85: Asia Pacific Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Rest of Asia Pacific, 2016-2027

Figure 86: Middle East & Africa Traditional Glucose Monitoring (TGM) Devices Market Value Share (%), By Segment 1, 2019 & 2027

Figure 87: Middle East & Africa Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 88: Middle East & Africa Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 89: Middle East & Africa Traditional Glucose Monitoring (TGM) Devices Market Value Share (%), By Segment 2, 2019 & 2027

Figure 90: Middle East & Africa Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 91: Middle East & Africa Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 92: Middle East & Africa Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 3, 2016-2027

Figure 93: Middle East & Africa Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Others, 2016-2027

Figure 94: Middle East & Africa Traditional Glucose Monitoring (TGM) Devices Market Value Share (%), By Segment 3, 2019 & 2027

Figure 95: Middle East & Africa Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 96: Middle East & Africa Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 97: Middle East & Africa Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Sub-Segment 3, 2016-2027

Figure 98: Middle East & Africa Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Others, 2016-2027

Figure 99: Middle East & Africa Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by GCC, 2016-2027

Figure 100: Middle East & Africa Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by South Africa, 2016-2027

Figure 101: Middle East & Africa Traditional Glucose Monitoring (TGM) Devices Market Forecast (USD Billion), by Rest of Middle East & Africa, 2016-2027

List of Tables

Table 1: Global Traditional Glucose Monitoring (TGM) Devices Market Revenue (USD Billion) Forecast, by Segment 1, 2016-2027

Table 2: Global Traditional Glucose Monitoring (TGM) Devices Market Revenue (USD Billion) Forecast, by Segment 2, 2016-2027

Table 3: Global Traditional Glucose Monitoring (TGM) Devices Market Revenue (USD Billion) Forecast, by Segment 3, 2016-2027

Table 4: Global Traditional Glucose Monitoring (TGM) Devices Market Revenue (USD Billion) Forecast, by Region, 2016-2027

Table 5: North America Traditional Glucose Monitoring (TGM) Devices Market Revenue (USD Billion) Forecast, by Segment 1, 2016-2027

Table 6: North America Traditional Glucose Monitoring (TGM) Devices Market Revenue (USD Billion) Forecast, by Segment 2, 2016-2027

Table 7: North America Traditional Glucose Monitoring (TGM) Devices Market Revenue (USD Billion) Forecast, by Segment 3, 2016-2027

Table 8: North America Traditional Glucose Monitoring (TGM) Devices Market Revenue (USD Billion) Forecast, by Country, 2016-2027

Table 9: Europe Traditional Glucose Monitoring (TGM) Devices Market Revenue (USD Billion) Forecast, by Segment 1, 2016-2027

Table 10: Europe Traditional Glucose Monitoring (TGM) Devices Market Revenue (USD Billion) Forecast, by Segment 2, 2016-2027

Table 11: Europe Traditional Glucose Monitoring (TGM) Devices Market Revenue (USD Billion) Forecast, by Segment 3, 2016-2027

Table 12: Europe Traditional Glucose Monitoring (TGM) Devices Market Revenue (USD Billion) Forecast, by Country, 2016-2027

Table 13: Latin America Traditional Glucose Monitoring (TGM) Devices Market Revenue (USD Billion) Forecast, by Segment 1, 2016-2027

Table 14: Latin America Traditional Glucose Monitoring (TGM) Devices Market Revenue (USD Billion) Forecast, by Segment 2, 2016-2027

Table 15: Latin America Traditional Glucose Monitoring (TGM) Devices Market Revenue (USD Billion) Forecast, by Segment 3, 2016-2027

Table 16: Latin America Traditional Glucose Monitoring (TGM) Devices Market Revenue (USD Billion) Forecast, by Country, 2016-2027

Table 17: Asia Pacific Traditional Glucose Monitoring (TGM) Devices Market Revenue (USD Billion) Forecast, by Segment 1, 2016-2027

Table 18: Asia Pacific Traditional Glucose Monitoring (TGM) Devices Market Revenue (USD Billion) Forecast, by Segment 2, 2016-2027

Table 19: Asia Pacific Traditional Glucose Monitoring (TGM) Devices Market Revenue (USD Billion) Forecast, by Segment 3, 2016-2027

Table 20: Asia Pacific Traditional Glucose Monitoring (TGM) Devices Market Revenue (USD Billion) Forecast, by Country, 2016-2027

Table 21: Middle East & Africa Traditional Glucose Monitoring (TGM) Devices Market Revenue (USD Billion) Forecast, by Segment 1, 2016-2027

Table 22: Middle East & Africa Traditional Glucose Monitoring (TGM) Devices Market Revenue (USD Billion) Forecast, by Segment 2, 2016-2027

Table 23: Middle East & Africa Traditional Glucose Monitoring (TGM) Devices Market Revenue (USD Billion) Forecast, by Segment 3, 2016-2027

Table 24: Middle East & Africa Traditional Glucose Monitoring (TGM) Devices Market Revenue (USD Billion) Forecast, by Country, 2016-2027

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model