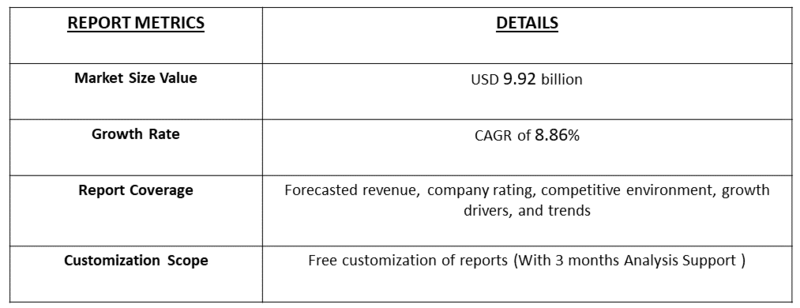

The global yeast market, valued at USD 5.4 billion in 2025, is projected to expand steadily at a CAGR of 8.86% during 2025–2032. By the end of the forecast period in 2032, the market is expected to reach approximately USD 9.9.2 billion, reflecting strong and sustained demand growth across food, beverage, and industrial applications.

Get Complete Analysis Of The Report - Download Free Sample PDF

Yeast is a single-celled microorganism from the fungus family that has the unique ability to convert sugars into alcohol and carbon dioxide through the process of fermentation. In the food and beverage industry, this natural capability makes yeast an essential ingredient across multiple applications. In baking, it enables dough to rise, producing soft, airy bread with enhanced flavor. In brewing and winemaking, yeast ferments sugars to create beer, wine, and spirits, with different strains influencing the aroma and taste profiles. Yeast extracts are also used as natural flavor enhancers, adding rich umami notes to soups, sauces, and snacks. Its versatility and natural origin make yeast a vital, sustainable solution in modern food and beverage production.

The global yeast market is witnessing significant trends shaped by evolving consumer preferences and industry innovation. There is a pronounced shift towards specialty yeast products, including nutritional yeast for vegan and health-focused diets, yeast extracts as natural flavor enhancers, and probiotic strains for functional foods and supplements. Sustainability is a key focus, with manufacturers investing in eco-friendly production processes and exploring yeast's role in alternative protein sources and biofuels. Clean-label and non-GMO products are gaining traction, driven by demand for transparency. Additionally, technological advancements in fermentation and strain development are enhancing yield and application scope, particularly in pharmaceuticals and animal nutrition, positioning yeast as a versatile, high-growth ingredient in the bioeconomy.

Segmentation:

The global yeast market is primarily segmented by Product Type (Baker’s Yeast, Brewer’s Yeast, Nutritional/ Specialty Yeasts, Yeast Derivatives), Source (Saccharomyces Cerevisiae, and Non-S. Cerevisiae Strains), Form (Dry, Liquid, Fresh), Applications (food & beverages, Animal Nutrition, Biofuels, Pharmaceuticals) and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

A major driver of the global yeast market is the rising demand for baked goods and convenience foods, driven by increasing urbanization, busier lifestyles, and higher disposable incomes in developing economies. Yeast is indispensable in the production of bread, cakes, pastries, and ready-to-bake mixes, while innovations such as gluten-free and organic products are broadening consumer options. The growth is further supported by the increasing popularity of home baking and the strong consumer preference for clean-label, natural ingredients, which yeast-based solutions effectively satisfy. Strengthening this trend, AB Mauri North America’s acquisition of Omega Yeast Labs LLC in August 2024 enhances its capabilities in the U.S. craft brewing liquid yeast segment, expanding product offerings and reinforcing its position across key end-use markets, thereby contributing to overall market growth.

The global yeast market is set to benefit significantly from advancements in biotechnology and sustainable production. For instance, Asahi Group Foods’ acquired Leiber GmbH in March 2025. Leiber, a long-established leader in brewer’s yeast-based products, brings expertise in functional ingredients, animal nutrition, and microbial culture media, supported by six factories and a strong international network. This acquisition enhances Asahi’s capacity to innovate in high-growth areas like probiotics, plant-based foods, and eco-friendly fermentation. By combining Asahi’s resources with Leiber’s specialized yeast solutions, the partnership will accelerate the development of sustainable, health-focused products, particularly in Europe and Asia-Pacific where green technologies are incentivized. Such strategic moves strengthen supply chains, broaden applications, and drive yeast market expansion globally.

Market Restraints:

A major restraint in the global yeast market is the volatility in raw material prices, such as sugars, grains, and molasses, which directly impacts production costs and profitability. Fluctuations driven by factors like climate change, geopolitical tensions, and supply chain disruptions—exemplified by events like the Russia-Ukraine conflict—have led to unpredictable price surges, making it challenging for manufacturers to maintain stable operations. This issue is particularly acute in price-sensitive regions like Asia-Pacific and Africa, where small-scale producers struggle with margin pressures, potentially slowing market penetration. Additionally, reliance on these commodities exposes the industry to agricultural risks, such as crop failures from droughts or pests, which can cause shortages and delay product launches. As a result, companies face higher operational costs for hedging strategies or alternative sourcing, dampening investment in R&D and limiting overall market growth.

The global yeast market plays a vital socio-economic role by driving growth across food, beverage, bioethanol, and animal nutrition industries, creating jobs and supporting rural economies through demand for agricultural raw materials such as molasses and grains. Investments in advanced fermentation technologies and expanded production facilities contribute to industrial development, trade competitiveness, and sustainable economic growth. At the consumer level, yeast-based solutions enhance food security and nutrition by enabling healthier, natural, and functional products that align with evolving dietary preferences. Environmentally, yeast applications in bioethanol and bioproducts support renewable energy adoption and lower carbon footprints. Pre-COVID-19, market growth was steady and demand largely stable across traditional segments, while post-pandemic shifts accelerated interest in health-focused, functional, and sustainable yeast applications. Collectively, the yeast market not only fuels industrial innovation but also generates broad social and economic benefits worldwide.

Segmental Analysis

The brewer's yeast segment is poised to experience significant growth in the global yeast market over the forecast period. This growth is primarily driven by the increasing consumption of beer and other alcoholic beverages, particularly in emerging markets, where the adoption of Western-style drinking habits and the rise of craft brewing are creating a surge in demand for high-quality brewer's yeast. Brewer's yeast is a critical ingredient in the fermentation process, imparting the desired flavor, aroma, and carbonation to beer and other fermented beverages. As consumers become more discerning and seek out unique and premium beer offerings, the demand for specialized brewer's yeast strains that can enhance the flavor profile and improve the overall quality of the final product is expected to grow significantly. Furthermore, the growing popularity of home brewing and the increasing awareness of the nutritional benefits of brewer's yeast are further contributing to the segment's expansion.

The Saccharomyces cerevisiae segment is anticipated to witness substantial growth in the global yeast market over the forecast period. Saccharomyces cerevisiae, commonly known as baker's yeast, is the most widely used strain of yeast in various applications, including the production of bread, pastries, and other baked goods. The rising demand for artisanal and premium bakery products, driven by the growing consumer preference for natural and clean-label ingredients, is a key factor fueling the growth of this segment.

Additionally, the increasing use of Saccharomyces cerevisiae in the production of nutritional supplements, animal feed, and fermented beverages, such as wine and beer, is contributing to the segment's expansion. The versatility and functional properties of Saccharomyces cerevisiae, which include its ability to ferment sugars, produce carbon dioxide, and impart distinctive flavors, make it an indispensable ingredient in the food and beverage industry, driving its widespread adoption and market growth

The dry yeast segment is expected to experience significant growth in the global yeast market over the forecast period. Dry yeast, which is characterized by its longer shelf life and ease of storage and transportation, is increasingly preferred by both commercial and home bakers, as well as manufacturers in the food and beverage industry. The growing demand for convenience and shelf-stable products, coupled with the rising awareness of the benefits of dry yeast, such as its ability to withstand harsh environmental conditions and maintain consistent performance, is driving the segment's expansion.

Furthermore, the development of advanced drying technologies and the introduction of specialized dry yeast strains with enhanced functionalities, such as improved fermentation efficiency and flavor profiles, are contributing to the segment's growth. As consumers continue to seek out high-quality, consistent, and easy-to-use yeast products, the dry yeast segment is poised to capture a larger share of the global yeast market.

The food and beverage segment is expected to witness significant growth in the global yeast market over the forecast period. Yeast is a critical ingredient in a wide range of food and beverage applications, including the production of breads, pastries, alcoholic beverages, and nutritional supplements. The rising demand for artisanal and premium bakery products, driven by the growing consumer preference for natural and clean-label ingredients, is a key factor driving the segment's expansion. Additionally, the increasing popularity of functional and health-conscious foods, which often incorporate specialty yeast products like nutritional yeast, is further contributing to the segment's growth. The expanding beer and wine industries, particularly in emerging markets, are also fueling the demand for high-quality brewer's yeast. As consumers continue to seek out products that offer enhanced flavor, nutrition, and overall quality, the food and beverage segment is poised to capture a larger share of the global yeast market.The

North America is projected to experience significant growth in the global yeast market over the coming years, supported by its mature food and beverage industry, growing consumer preference for high-quality yeast-based products, and increasing health awareness among the population. The United States remains a dominant force in the region, with the presence of major manufacturers and a strong distribution network fueling market expansion. Key trends such as the rising popularity of artisanal and premium bakery goods, the rapid growth of the craft brewing industry, and the adoption of nutritional yeast in dietary supplements and functional foods are further driving demand.

Another important factor shaping the North American yeast market is continuous innovation. Companies in the region are heavily investing in new strains and formulations that align with evolving consumer demands for convenience, health benefits, and premium-quality food and beverage options. This focus on R&D keeps North America at the forefront of yeast-related applications. For instance, in September 2025, CHO Plus, Inc. secured a U.S. patent for a breakthrough technology that fuses yeast cells to create hybrids capable of producing higher levels of recombinant proteins. This innovation strengthens biotechnology applications and further boosts market growth. This advancement highlights how North America not only leads in food, beverages, and dietary applications but also plays a central role in driving biotech innovation. Thus, these trends expand its dominance in the yeast market in the region.

To Learn More About This Report - Request a Free Sample Copy

The competitive landscape of the global yeast market is characterized by the presence of both large multinational corporations and regional players. The market is dominated by a few major players, such as Lesaffre, Archer Daniels Midland Company, Associated British Foods plc, Angel Yeast Co., Ltd., and Kerry Group plc, who leverage their extensive production capacities, global distribution networks, and robust research and development capabilities to maintain a strong foothold. These companies continuously invest in innovative product development, process optimization, and strategic acquisitions to enhance their market share and cater to the evolving consumer preferences. Regional players, on the other hand, often focus on catering to specific geographic markets or niche applications, leveraging their proximity to customers and agility to compete with the larger multinational firms. The competitive dynamics within the global yeast market are further shaped by the growing demand for specialty yeast products, such as baker's yeast, brewer's yeast, and nutritional yeast, which have diverse applications in the food, beverage, and nutraceutical industries. As the market continues to evolve, the ability of companies to offer cost-effective, sustainable, and high-quality yeast products that address the diverse needs of end-users will be a key differentiator in this dynamic competitive landscape.

Here are 10 major players in the Global Yeast Market:

Recent Developments:

Q1. What are the main growth driving factors for this market?

The market expands on rising demand in baking, bioethanol, and health/nutrition sectors, with innovations in fermentation efficiency, enzyme integration, and sustainable production boosting output. Growth is reinforced by rising disposable incomes, urbanization, and the shift toward organic and specialty yeasts in food and sustainability-focused industries.

Q2. What are the main restraining factors for this market?

The market's growth is constrained by the volatility in raw material prices, strict regulations, and the availability of alternative leavening agents. Additionally, the limited shelf life of yeast products and the potential health concerns associated with excessive yeast consumption pose challenges for the market.

Q3. Which segment is expected to witness high growth?

The specialty yeast segment, encompassing products like baker's yeast, brewer's yeast, and nutritional yeast, is expected to witness significant growth due to their diverse applications in the food, beverage, and nutraceutical industries.

Q4. Who are the top major players for this market?

The global yeast market is dominated by major players such as Lesaffre, Archer Daniels Midland Company, Associated British Foods plc, Angel Yeast Co., Ltd., and Kerry Group plc.

Q5. Which country is the largest player?

China is the largest producer and consumer of yeast globally, driven by its extensive food and beverage industry, growing population, and rising demand for convenience and functional food products.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model