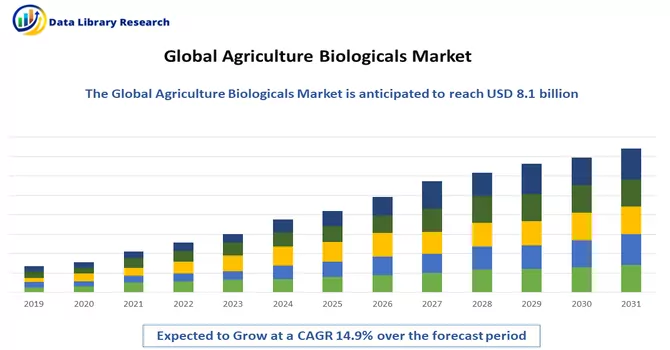

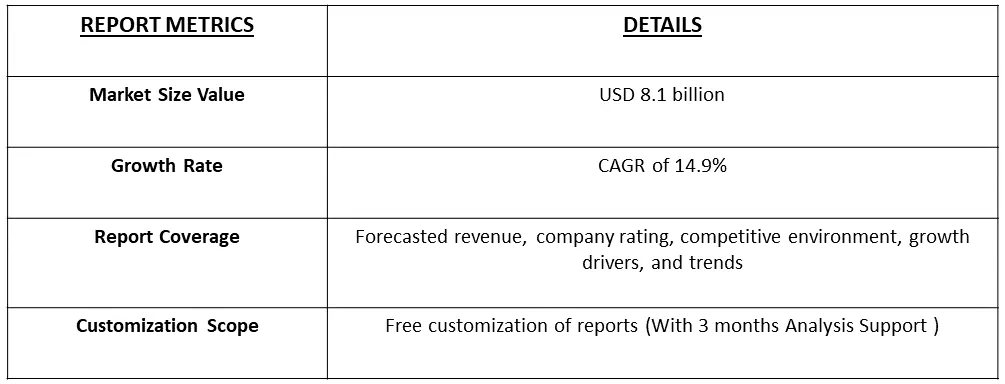

The Agricultural Biologicals Market size is estimated at USD 8.1 billion in 2023 and is expected to register a CAGR of 14.9% over the forecast period, 2024-2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Agriculture biologicals refer to naturally derived or microorganism-based products that are used in farming to enhance crop health, productivity, and sustainability. These products include biopesticides, which control pests using natural mechanisms, biostimulants, which promote plant growth and health, and biofertilizers, which improve soil fertility by adding beneficial microorganisms or nutrients. Agriculture biologicals are often considered environmentally friendly alternatives to traditional chemical-based agricultural products, as they typically have lower environmental impacts and can contribute to more sustainable farming practices.

The agriculture biologicals market is experiencing robust growth due to various interconnected factors. Firstly, there is a significant and increasing demand for organic food products, driven by consumer preferences for healthier and environmentally sustainable options. This demand has propelled the adoption of agriculture biologicals, which are essential in organic farming practices. Secondly, escalating environmental concerns regarding the use of chemical pesticides and fertilizers have led to a shift towards more sustainable agricultural practices. Agriculture biologicals, being eco-friendly alternatives, are gaining popularity as they offer effective pest and disease control without the negative environmental impacts associated with conventional chemicals. Additionally, supportive regulatory environments worldwide are encouraging the adoption of agriculture biologicals. Governments are implementing regulations to reduce the use of chemical inputs and promote sustainable agriculture, creating a conducive market environment for biological products. Furthermore, advancements in biotechnology and microbiology have led to the development of more efficient and cost-effective agriculture biologicals. These technological innovations have improved the efficacy and usability of biological products, driving their adoption among farmers. Moreover, the need for food security, driven by a growing global population, is fueling the demand for agriculture biologicals. These products help improve crop yield and quality, contributing to sustainable food production. Furthermore, changing climate conditions, characterized by more frequent and severe pest and disease outbreaks, are driving the need for effective and sustainable pest management solutions. Agriculture biologicals provide a viable option for managing these challenges. Additionally, increasing investment in research and development is leading to the development of innovative agriculture biological products. Companies are investing in new technologies and formulations to enhance the performance and applicability of biologicals, further driving market growth and competitiveness. Lastly, supportive government policies, such as subsidies and incentives, are encouraging farmers to adopt agriculture biologicals. These policies are aimed at promoting sustainable agriculture and reducing the environmental impact of farming practices, thus driving the growth of the agriculture biologicals market.

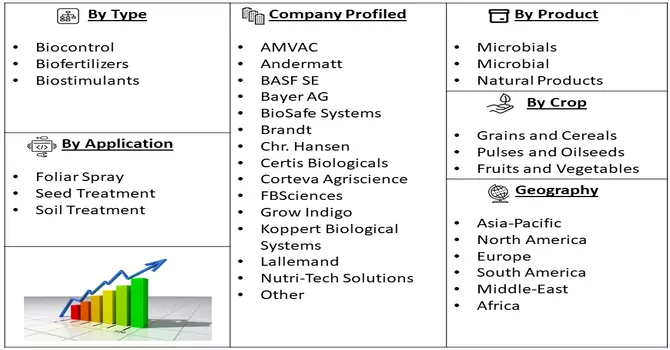

Market Segmentation: The Global Agricultural Biologicals Market is segmented by Function Type (Biocontrol, Biofertilizers, and Biostimulants) Product Type (Microbials, Microbial, and Natural Products) Application (Foliar Spray, Seed Treatment, and Soil Treatment), Crop (Grains and Cereals, Pulses and Oilseeds, and Fruits and Vegetables), and Geography. The market sizes and forecasts are provided in terms of value (USD million) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The agriculture biologicals market is witnessing several trends that are shaping its growth trajectory. There is a noticeable surge in demand for sustainable agriculture practices, leading to increased adoption of agriculture biologicals. Moreover, the organic farming sector is expanding rapidly, further driving the demand for biologicals. Technological advancements in biotechnology and microbiology are leading to the development of more effective products, while microbial seed treatments and biopesticides are gaining popularity due to their safety and environmental benefits. Integrated Pest Management (IPM) practices are also on the rise, contributing to the growth of the biologicals market. Additionally, regulatory support, collaborations among industry players, increased investment, and growing awareness among farmers are key trends driving the agriculture biologicals market forward.

Market Drivers:

Increasing Need for Food Security

As the global population continues to grow, the demand for food is escalating, putting pressure on the agricultural sector to increase production. Agriculture biologicals, which encompass a range of naturally derived or microorganism-based products, are emerging as crucial tools in meeting this demand while ensuring food security. These products play a pivotal role in enhancing crop yield and quality, thereby addressing the challenge of feeding a growing population sustainably. One of the key advantages of agriculture biologicals is their ability to improve the efficiency of farming practices. Unlike conventional chemical inputs, which can have negative environmental impacts and contribute to soil degradation, agriculture biologicals offer sustainable solutions that promote soil health and biodiversity. For example, biofertilizers, which contain beneficial microorganisms, help improve soil fertility and nutrient uptake by plants, leading to increased crop yields. Moreover, agriculture biologicals reduce the reliance on chemical pesticides, which can harm beneficial insects and pollinators. Biopesticides, which are derived from natural substances such as plants, bacteria, and fungi, offer effective pest control while minimizing the environmental impact. This is particularly important in the context of increasing concerns about the decline of pollinators and the need to protect biodiversity. Additionally, agriculture biologicals contribute to long-term food security by promoting environmentally friendly and resource-efficient agricultural practices. By enhancing soil health and reducing the need for chemical inputs, agriculture biologicals help to conserve natural resources such as water and energy. This is critical in the face of climate change, which is expected to impact agricultural productivity and exacerbate food insecurity in many regions. Furthermore, the adoption of agricultural biologicals can lead to economic benefits for farmers. While the initial costs of these products may be higher than conventional inputs, the long-term benefits, such as improved soil health and reduced pest resistance, can result in higher yields and lower input costs. This can improve the resilience of farming systems and enhance the livelihoods of farmers, particularly in developing countries where agriculture is a primary source of income. In conclusion, agriculture biologicals are essential for addressing the challenges of feeding a growing population while ensuring environmental sustainability. By improving crop yield and quality, reducing reliance on chemical inputs, and promoting resource-efficient practices, agriculture biologicals offer a path towards long-term food security. As such, continued investment in research and development, as well as policies that support the adoption of these technologies, are crucial for harnessing the full potential of agriculture biologicals in feeding the world's population sustainably.

Increasing Investment in Research and Development

Firms across the agricultural sector are recognizing the critical importance of research and development (R&D) in driving innovation and growth, particularly in the realm of agriculture biologicals. These companies are making significant investments in R&D to develop groundbreaking agriculture biological products. This strategic focus on R&D is not only propelling market expansion but also enhancing competitiveness within the industry. The investments in R&D are primarily aimed at advancing the efficacy, sustainability, and applicability of agriculture biologicals. Companies are seeking to develop products that are not only more effective in enhancing crop yield and quality but also more sustainable and environmentally friendly. This focus on sustainability aligns with the increasing global demand for environmentally responsible agricultural practices. Furthermore, the R&D investments are geared towards improving the applicability of agriculture biologicals, making them easier to use and integrate into existing farming practices. This includes developing formulations that are more user-friendly and effective in diverse environmental conditions. Moreover, the R&D-driven approach is not just about developing new products but also about improving existing ones. Companies are continuously working to enhance the performance, stability, and shelf life of agriculture biologicals, ensuring that they meet the evolving needs of farmers and regulators. Thus, the emphasis on R&D in the agriculture biologicals sector is fostering a culture of continuous innovation. This approach is not only driving market growth but also leading to the development of more sustainable and effective solutions for modern agriculture.

Market Restraints:

Limited Shelf Life and Storage Requirements

The shelf life of numerous agricultural biologicals is limited, and they need specific storage conditions. This can pose challenges for farmers, especially in remote or resource-limited regions. Ensuring proper storage conditions, such as temperature and humidity control, can be difficult in these areas, leading to potential losses in product efficacy and economic impact for farmers. This limitation underscores the need for innovative solutions, such as improved packaging or alternative storage methods, to make agriculture biologicals more accessible and practical for farmers in all regions.

The COVID-19 pandemic has had both positive and negative impacts on the agriculture biologicals market. Initially, during the early stages of the pandemic, disruptions in the supply chain and restrictions on movement led to challenges in the availability and distribution of agricultural biologicals. This impacted farmers' ability to access these products, particularly in remote or rural areas. However, as the pandemic continued, there was a growing awareness of the importance of sustainable agriculture and food security. This led to an increased interest in agriculture biologicals as farmers sought alternative solutions to maintain crop health and productivity. Additionally, the focus on reducing the use of chemical inputs and promoting sustainable farming practices further boosted the demand for agriculture biologicals. Moreover, the pandemic has highlighted the need for resilient food systems, leading to increased investment in research and development in the agriculture biologicals sector. Companies are focusing on developing innovative products and solutions to address the challenges posed by the pandemic and enhance the resilience of agricultural systems. Overall, while the COVID-19 pandemic initially posed challenges for the agriculture biologicals market, it has also presented opportunities for growth and innovation in the sector. As the world continues to recover from the pandemic, the importance of sustainable agriculture and the role of agriculture biologicals are likely to become even more pronounced.

Segmental Analysis:

Biofertilizers Segment is Expected to Witness Significant Growth Over the Forecast Period

Biofertilizers, a key component of agriculture biologicals, are comprised of living microorganisms like bacteria, fungi, and algae that enhance soil fertility and plant nutrition. They form symbiotic relationships with plants, facilitating nutrient uptake and growth. Biofertilizers, used as alternatives or supplements to chemical fertilizers, offer benefits including improved soil health by fixing atmospheric nitrogen and enhancing soil structure and microbial activity. They promote plant growth and yield through the production of growth-promoting substances, leading to increased crop productivity and quality. Environmentally friendly, biofertilizers reduce the need for synthetic fertilizers, thus decreasing environmental pollution and soil degradation risks. Safe for humans and animals, biofertilizers are expected to play a growing role in sustainable agriculture, aligning with the increasing demand for environmentally conscious farming practices.

Microbials Segment is Expected to Witness Significant Growth Over the Forecast Period

Microbials, a crucial category within agriculture biologicals, encompass beneficial microorganisms like bacteria, fungi, and protozoa that positively influence soil and plant health. These microorganisms play key roles in nutrient cycling, disease suppression, and promoting plant growth. In agriculture, microbial-based products are used as biopesticides, biofertilizers, and biostimulants. Biopesticides derived from microbials offer effective pest control while being environmentally friendly. Biofertilizers enhance soil fertility by fixing nitrogen and solubilizing phosphorus, improving nutrient availability to plants. Biostimulants, on the other hand, contain beneficial microorganisms that stimulate plant growth and enhance stress tolerance. The use of microbials in agriculture biologicals reflects a shift towards sustainable farming practices, reducing reliance on synthetic chemicals and enhancing soil and plant health for long-term agricultural sustainability.

Soil Treatment Segment is Expected to Witness Significant Growth Over the Forecast Period

Soil treatment using agriculture biologicals involves the application of natural or beneficial microorganisms to improve soil health and fertility. These treatments can enhance nutrient availability, promote plant growth, and suppress soil-borne diseases, ultimately leading to improved crop yields and quality. Agriculture biologicals used in soil treatment include biofertilizers, which introduce nitrogen-fixing bacteria or mycorrhizal fungi to enhance nutrient uptake by plants, and biopesticides, which contain beneficial microorganisms that suppress harmful pests and pathogens. Soil treatments with agriculture biologicals can also improve soil structure, water retention, and overall soil health, reducing the need for chemical fertilizers and pesticides. Overall, soil treatment with agriculture biologicals offers a sustainable and environmentally friendly approach to enhancing soil fertility and crop productivity.

Grain and Cereals Segment is Expected to Witness Significant Growth Over the Forecast Period

Grains and cereals are staple crops that play a crucial role in global food security. Agriculture biologicals are increasingly being used in the production of these crops to improve yield, quality, and sustainability. Biofertilizers containing nitrogen-fixing bacteria or mycorrhizal fungi can enhance nutrient uptake, particularly important for nitrogen-hungry cereals like maize and wheat. Biopesticides derived from natural sources offer effective pest control, reducing the reliance on chemical pesticides and minimizing environmental impact. Additionally, biostimulants containing beneficial microorganisms can promote root growth and stress tolerance, helping grains and cereals withstand environmental challenges. The use of agriculture biologicals in grain and cereal production reflects a growing trend towards sustainable farming practices, ensuring the long-term health and productivity of these vital crops.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

In North America, agriculture biologicals are gaining traction as farmers and regulators alike increasingly recognize their potential to address sustainability challenges in farming practices. The region has a robust market for agriculture biologicals, driven by factors such as the growing demand for organic and sustainably produced food, stringent regulations on chemical pesticide use, and a strong focus on environmental stewardship. Biopesticides, biofertilizers, and biostimulants are among the key agriculture biologicals used in the region. Biopesticides, in particular, are witnessing significant growth, driven by their efficacy in pest management and their eco-friendly nature. Additionally, the adoption of agriculture biologicals in North America is supported by a well-established research and development infrastructure, which is driving innovation and the development of new products tailored to the region's diverse agricultural landscape. Overall, North America is poised to continue leading the way in the adoption of agriculture biologicals, paving the path for more sustainable and environmentally friendly agricultural practices.

Get Complete Analysis Of The Report - Download Free Sample PDF

The analyzed market exhibits a high degree of fragmentation, primarily attributable to the presence of numerous players operating on both a global and regional scale. The competitive landscape is characterized by a diverse array of companies, each contributing to the overall market dynamics. This fragmentation arises from the existence of specialized solution providers, established industry players, and emerging entrants, all vying for market share. The diversity in market participants is underscored by the adoption of various strategies aimed at expanding the company presence. On a global scale, companies within the studied market are strategically positioning themselves through aggressive expansion initiatives. This often involves entering new geographical regions, targeting untapped markets, and establishing a robust global footprint. The pursuit of global expansion is driven by the recognition of diverse market opportunities and the desire to capitalize on emerging trends and demands across different regions. Simultaneously, at the regional level, companies are tailoring their approaches to align with local market dynamics. Regional players are leveraging their understanding of specific market nuances, regulatory environments, and consumer preferences to gain a competitive edge. This regional focus allows companies to cater to the unique needs of local clientele, fostering stronger market penetration. To navigate the complexities of the fragmented market, companies are implementing a range of strategies. These strategies include investments in research and development to stay at the forefront of technological advancements, mergers and acquisitions to consolidate market share, strategic partnerships for synergies, and innovation to differentiate products and services. The adoption of such multifaceted strategies reflects the competitive nature of the market, with participants continually seeking avenues for growth and sustainability. In essence, the high fragmentation in the studied market not only signifies the diversity of players but also underscores the dynamism and competitiveness that drive ongoing strategic manoeuvres. As companies explore various avenues for expansion, the market continues to evolve, presenting both challenges and opportunities for industry stakeholders. Major Companies in the Market Include

Recent Development:

1) In August 2023, The Mosaic Company unveiled its new biologic crop solutions platform, Mosaic Biosciences. This platform aims to offer agricultural biologics that will assist farmers in naturally enhancing soil biology and optimizing crop yield potential.

2) In June 2023, AgBiome entered into a product development agreement with Ginkgo Bioworks, a prominent biotech company based in the United States. According to the agreement, Ginkgo Bioworks will leverage its cutting-edge ultra-high throughput screening platform to support AgBiome in developing innovative microbial crop protection products for sustainable agriculture. These strategic partnerships and initiatives underscore the growing importance of agricultural biologics in modern farming practices. By harnessing the power of natural processes and innovative technologies, companies like The Mosaic Company and AgBiome are paving the way for more sustainable and efficient agriculture, ultimately benefiting farmers, consumers, and the environment.

Q1. What was the Agriculture Biologicals Market size in 2023?

As per Data Library Research the Agricultural Biologicals Market size is estimated at USD 8.1 billion in 2023.

Q2. At what CAGR is the Agricultural Biologicals market projected to grow within the forecast period?

Agricultural Biologicals Market is expected to register a CAGR of 14.9% over the forecast period.

Q3. Which Region is expected to hold the highest Market share?

North America region is expected to hold the highest Market share.

Q4. Who are the key players in Agricultural Biologicals Market?

Some key players operating in the market include

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model