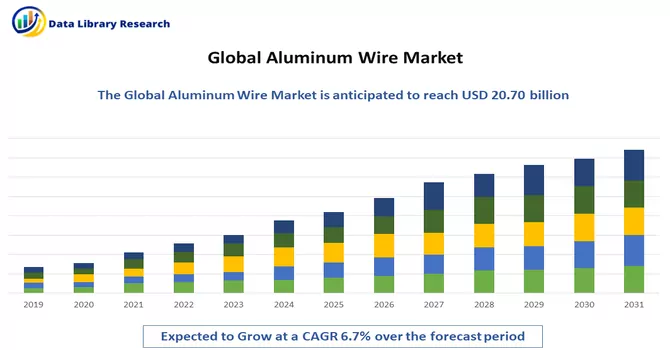

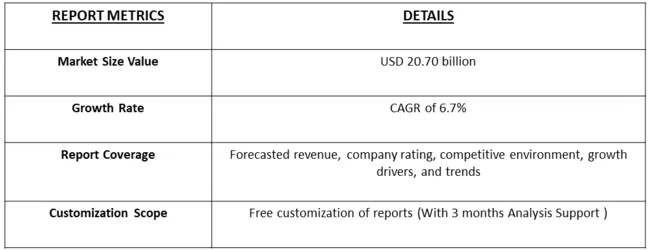

The global aluminum wire market size was valued at USD 20.70 billion in 2022 and is estimated to grow at a CAGR of 6.7% from 2023 to 2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

Aluminum wire refers to electrical conductors made primarily of aluminum. These wires are commonly used for various applications, including electrical transmission and distribution, as well as in wiring systems for residential, commercial, and industrial buildings. Aluminum wire is chosen for its lightweight properties, cost-effectiveness, and good electrical conductivity. Aluminum wire can come in different forms, such as solid or stranded, and it may be insulated or bare, depending on the specific application. While aluminum is a popular choice for many electrical applications, it is important to note that aluminum wiring has some characteristics that differ from copper wiring. For instance, aluminum has a higher electrical resistance and can be more prone to oxidation, which may affect its long-term performance. Special considerations and installation practices may be necessary to ensure the safety and reliability of aluminum wiring in various electrical systems.

Aluminum is generally more cost-effective than copper, making it an attractive choice for industries seeking to reduce material costs in their electrical projects. Also, aluminum is significantly lighter than copper, which can be advantageous in applications where weight is a critical factor, such as in aerospace or automotive industries. Thus, these factors collectively contribute to the market demand for aluminum wires, and as industries evolve and technology advances, the role of aluminum in various applications is likely to continue growing.

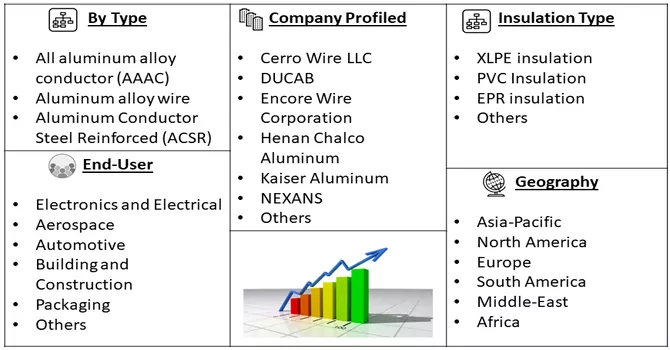

Market Segmentation: The Aluminum Wire Market is Segmented Type (All aluminum alloy conductor (AAAC), Aluminum alloy wire, Aluminum Conductor Steel Reinforced (ACSR))) Insulation Type (XLPE insulation, PVC Insulation, EPR insulation, Others), End Use Industry (Electronics and Electrical, Aerospace , Automotive, Building and Construction, Packaging, Others) and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report offers the value (in USD million) for the above-mentioned segments.

For Detailed Market Segmentation - Download Free Sample PDF

The demand for aluminum wire in electrical transmission and distribution systems was on the rise, driven by the need for lightweight and cost-effective materials in power infrastructure projects. Also, with the increasing focus on renewable energy sources, aluminum wires were experiencing higher demand in the construction of solar and wind energy projects due to their suitability for these applications. The automotive industry was showing a trend toward adopting aluminum wiring harnesses, especially with the growing production of electric vehicles (EVs). The lightweight nature of aluminum contributed to the overall weight reduction in EVs, improving efficiency and range.

Market Drivers:

Increase in the Adoption of Ethernet

The demand for higher data transfer speeds and bandwidth has been a driving force behind the increased adoption of Ethernet. With the growth of data-intensive applications, including video streaming, cloud computing, and big data analytics, organizations are seeking faster and more reliable network connectivity. Also, the widespread adoption of cloud services has increased the reliance on robust and high-speed networks. Ethernet is well-suited for connecting data centers and facilitating efficient communication between cloud-based services and end-users. With the deployment of 5G networks, Ethernet is playing a crucial role in connecting and managing the various components of these networks. Ethernet provides the necessary backbone for high-speed, low-latency communication in 5G infrastructure. Thus, these factors are expected to drive the growth of the studied market over the forecast period.

Increasing Demand for Aluminum Wire from Various End-Use Industries

The electrical and electronics sector is a major consumer of aluminum wire. It is used in power transmission and distribution systems, wiring for residential and commercial buildings, as well as in the production of electrical equipment and appliances. Similarly, the growth of renewable energy projects, such as solar and wind power, has driven the demand for aluminum wire. Aluminum's lightweight nature makes it suitable for applications like solar panel wiring and wind turbine connections. Aluminum also wire finds applications in various industrial processes for electrical connections and wiring. Its versatility, along with favorable mechanical and electrical properties, makes it a preferred choice in manufacturing and industrial settings. Thus, the demand for aluminum wire is likely to continue growing as industries seek lightweight, cost-effective, and sustainable materials for their diverse applications.

Restraints :

Price Volatility and Installation Challenges

The price of aluminum, like any commodity, can be subject to fluctuations in the global market. This volatility can impact the overall cost of manufacturing aluminum wires and may influence purchasing decisions. Aluminum wires can be softer and more prone to breakage during installation compared to copper wires. Specialized installation techniques and equipment may be required, and installers need to be trained to work with aluminum wiring properly. Thus, these factors are expected to slow down the growth of the studied market over the forecast period.

The COVID-19 pandemic has had a notable impact on various industries, including the aluminum wire market. The pandemic disrupted global supply chains, affecting the production and distribution of raw materials, components, and finished goods. This led to potential delays in the manufacturing of aluminum wire and other related products. Economic uncertainties and lockdown measures resulted in fluctuations in demand for aluminum wire. Some industries, particularly those related to construction and automotive, experienced slowdowns, impacting the demand for aluminum products. Also, changes in consumer behavior, such as reduced spending on non-essential items, impacted industries that utilize aluminum wire in the production of consumer goods and appliances. Thus, initially the growth of the market was hampered, however with resumption of services, the market is expected to witness significant growth over the forecast period.

Segmental Analysis:

Aluminum Conductor Steel Reinforced Segment is Expected to Witness Significant Growth Over the Forecast Period

Aluminum Conductor Steel Reinforced (ACSR) is a type of electrical conductor that consists of a central core made of steel wires surrounded by aluminum strands. This design combines the strength of steel with the lightweight and conductivity properties of aluminum, making ACSR a widely used material in overhead transmission and distribution lines for electrical power. The central core of ACSR is typically made of high-strength galvanized steel wires. This provides mechanical strength and support to the conductor. ACSR conductors are installed using typical methods for overhead lines, such as being strung between towers or poles. Installation practices must consider factors like sag, tension, and environmental conditions. Thus, these factors are expected to slow down the growth of the studied market over the forecast period.

EPR insulation Segment is Expected to Witness Significant Growth Over the Forecast Period

Aluminum wires are commonly used as conductors in electrical cables. The lightweight nature and cost-effectiveness of aluminum make it a popular choice for power transmission and distribution. EPR, as a synthetic rubber insulation material, is frequently employed to coat and insulate aluminum wires. The EPR insulation provides electrical insulation, protecting the conductor and ensuring the integrity of the electrical signal. EPR insulation offers excellent dielectric properties, contributing to the efficient transmission of electrical power. This insulation helps prevent electrical leakage and maintains the overall electrical performance of the cable. Thus, owing to such advantages, the segment is expected to witness significant growth over the forecast period.

Aerospace Segment is Expected to Witness Significant Growth Over the Forecast Period

Aluminum wires play a crucial role in the aerospace industry, where the demand for lightweight yet high-performance materials is paramount. Weight is a critical factor in aerospace design. Aluminum's low density makes it an attractive choice for wiring systems in aircraft, contributing to overall weight reduction and fuel efficiency. Thus, aluminum wires are indispensable in the aerospace industry, contributing to the efficiency, safety, and overall performance of aircraft. The combination of aluminum's unique properties, such as low weight, high strength, and electrical conductivity, makes it an ideal material for various wiring applications in both traditional and emerging aerospace technologies.

North America Segment is Expected to Witness Significant Growth Over the Forecast Period

Aluminum wires find extensive use in the construction industry for wiring systems in residential, commercial, and industrial buildings. Aluminum's lightweight nature and cost-effectiveness make it a popular choice for electrical wiring. The rising demand for electricity consumption in the United States is poised to drive an increased need for aluminum wires throughout the forecast period. Notably, projections from the U.S. Energy Information Administration indicate a 2.7% growth in retail electricity sales in 2021, following a 3.9% decline in 2020. Furthermore, a significant development in February 2021 involved the approval of the New York Energy Solution Project by the New York State Public Service Commission. This project entails the construction of a 54.5-mile, 345-kilovolt transmission line with an estimated investment of USD 530.0 million. This initiative is expected to further contribute to the demand for aluminum wires in the context of expanding and enhancing the electrical infrastructure. Thus, such factors are expected to drive the growth of the studied market in the region over the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

The key market players engaging in capacity expansions, mergers and acquisitions (M&A), and research and development (R&D) activities is a strategic approach aimed at staying competitive, enhancing market share, and fostering innovation. Companies may invest in new manufacturing facilities, upgrade existing plants, or invest in advanced technologies to enhance production efficiency. This strategic move positions them to fulfill increased orders, capitalize on emerging market opportunities, and respond effectively to changes in customer demand. Some of the prominent players in the global aluminum wire market include

Recent Developments:

1) In March 2023, the Innovative Manufacturing Cooperative Research Center (IMCRC) and AML3D entered into a partnership. The partnership between the Innovative Manufacturing Cooperative Research Center (IMCRC) and AML3D, a metal additive manufacturing company, has successfully completed a research and development (R&D) project. The outcome is the introduction of a high-strength aluminum wire feedstock designed for welding and 3D printing applications. AML3D will continue its efforts, including testing the Alloy Type to meet industry standards, as part of the ongoing journey towards full commercialization. This innovative high-strength aluminum wire feedstock, developed in collaboration with Deakin University’s Institute for Frontier Materials (IFM), holds the potential to transform the way we manufacture complex metal objects. The project represents a significant advancement in enhancing the capabilities of welding and 3D printing technologies for producing sturdy and intricate metal components.

2) In March 2023, Magellan Aerospace Corporation has officially announced the signing of a significant long-term agreement (LTA) extension with Collins Aerospace, a business under Raytheon Technologies. The extended agreement focuses on the manufacturing of intricate magnesium and aluminum castings designed for a variety of military and commercial aerospace platforms. Magellan will be responsible for producing these castings at its facilities located in Renfrew, Ontario, and Glendale, Arizona. This extension underscores the ongoing partnership between Magellan and Collins Aerospace, showcasing their commitment to delivering high-quality components for a diverse portfolio of military and commercial aircraft. Magellan's facilities in both Ontario and Arizona will play pivotal roles in meeting the demands of these crucial aerospace programs.

Q1. What was the Aluminum Wire Market size in 2022?

As per Data Library Research the global aluminum wire market size was valued at USD 20.70 billion in 2022.

Q2. At what CAGR is the Aluminum Wire market projected to grow within the forecast period?

Aluminum Wire Market is estimated to grow at a CAGR of 6.7% over the forecast period.

Q3. What are the factors driving the Aluminum Wire market?

Key factors that are driving the growth include the Increase in the Adoption of Ethernet and Increasing Demand for Aluminum Wire from Various End-Use Industries

Q4. Which region has the largest share of the Aluminum Wire market? What are the largest region's market size and growth rate?

North America has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model