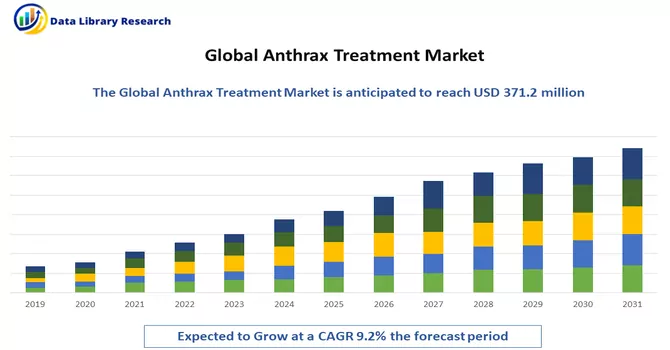

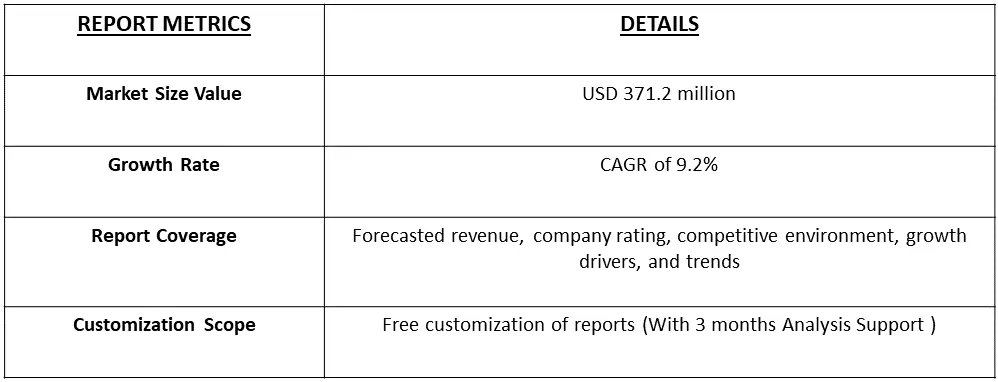

The global anthrax treatment market size was valued at USD 371.2 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 9.2% from 2023 to 2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Anthrax treatment involves the use of antibiotics to eliminate the anthrax bacteria and may also include supportive care to manage symptoms. Anthrax is a bacterial infection caused by Bacillus anthracis. The choice of antibiotics is typically based on the type of anthrax infection (cutaneous, inhalation, or gastrointestinal) and the severity of the illness. Commonly used antibiotics include ciprofloxacin, doxycycline, and levofloxacin. In severe cases or cases of inhalation anthrax, intravenous antibiotics may be administered. Treatment is most effective when initiated early. In addition to antibiotics, supportive care such as wound care, pain management, and respiratory support may be provided as needed. Vaccination against anthrax is also available for individuals at high risk of exposure, such as certain military personnel and laboratory workers. Anthrax is a serious and potentially life-threatening condition, and prompt medical attention is crucial for a successful outcome. It's important to note that the information provided here is a general overview, and specific treatment plans should be determined by healthcare professionals based on individual cases and circumstances.

Anticipated growth in the anthrax treatment market is driven by an increasing number of novel and innovative developments dedicated to delivering more effective solutions for anthrax. This growth is fueled by advancements in research and the pursuit of treatments that can enhance the efficacy of combating anthrax infections. The market's trajectory is shaped by a commitment to developing cutting-edge therapies, reflecting a collective effort to address the challenges posed by anthrax through continuous innovation. As a result, the landscape of anthrax treatment is expected to evolve with the introduction of new and improved approaches aimed at better managing and treating this infectious disease.

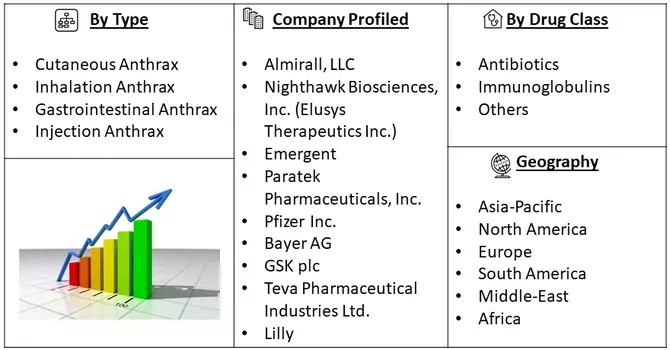

Market Segmentation: The Anthrax Treatment Market is Segmented by Anthrax Type (Cutaneous Anthrax, Inhalation Anthrax, Gastrointestinal Anthrax, and Injection Anthrax), Drug Class (Antibiotics, Immunoglobulins, and Others) and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South America). The report offers the value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The anthrax treatment market is characterized by dynamic trends driven by concerted efforts to advance therapeutic approaches and effectively address the challenges posed by this infectious disease. Ongoing research and development activities are at the forefront, focusing on the discovery of novel antibiotics, exploration of innovative therapies such as immunotherapies and antitoxins, and the development of advanced treatment modalities. Global preparedness and response initiatives have gained prominence, with governments and organizations investing in the development and stockpiling of anthrax treatments to ensure swift and effective responses in the event of an outbreak. Collaborations and partnerships between pharmaceutical companies, research institutions, and government agencies are increasingly common, aiming to leverage combined resources, expertise, and funding to expedite the development of new treatment options.

Market Drivers:

Increase in Research Funding

The anthrax treatment market is anticipated to experience substantial growth, primarily attributed to the increasing number of innovative developments aimed at effectively treating anthrax. The heightened threat of exposure to Bacillus anthracis, affecting both civilian populations and military forces, has spurred a surge in the development of novel therapies. A noteworthy example is the research conducted by USAMRIID researchers in December 2021, where they identified a method to prevent mice from contracting anthrax by modifying an enzyme produced by the causative bacterium. This breakthrough not only holds promise for new antibiotics targeting various bacterial illnesses but also presents a potential therapeutic avenue for addressing multidrug-resistant anthrax strains. The ongoing efforts to counter the growing threat of anthrax exposure through the development of advanced therapies are expected to positively impact the anthrax treatment market, fostering its growth in the foreseeable future.

Development of Novel Therapies for Treatment of Anthrax

Likewise, the emergence of new anthrax cases among animals plays a pivotal role in shaping the market dynamics, as the infection can transmit to humans through animal spores. An illustrative example comes from a public notice released by the government of Sierra Leone in May 2022, revealing the discovery of fresh anthrax disease cases among animals in the northern district of Port Loko in the city of Sierra Leone, West Africa. This development has the potential to escalate the transmission to humans, thereby increasing the demand for anthrax treatment. The resultant surge in demand is expected to act as a driving force for market growth throughout the study period.

Market Restraints:

High Cost Associated with Diagnostic Treatment

The elevated costs associated with diagnostic treatments pose a potential impediment to the growth of the anthrax treatment market. The financial burden linked to diagnostic procedures, including testing and monitoring, may act as a deterrent for both healthcare providers and patients. High costs can limit accessibility to anthrax diagnostic tools and treatments, particularly in regions with constrained healthcare budgets. Additionally, the economic constraints on individuals may lead to delayed or deferred medical consultations, impacting timely diagnosis and treatment initiation. This financial barrier may, in turn, slow the overall growth trajectory of the anthrax treatment market, emphasizing the need for strategic considerations to address cost-related challenges and ensure broader accessibility to effective diagnostic and treatment solutions.

The global antibiotics and immunoglobulins specific to the anthrax market faced notable challenges during the COVID-19 pandemic due to disruptions in pharmaceutical supply chains and treatment protocols worldwide. While the pandemic had a relatively infrequent impact in developed countries, developing and underdeveloped nations experienced more substantial effects. A report from the Annals of Medicine and Surgery in September 2022 highlighted anthrax outbreaks in Zimbabwe and southern Kenya during the pandemic, demonstrating significant morbidity and low mortality. Initiatives implemented in these regions to curb disease spread positively influenced market growth. For instance, countries like Nigeria, Zambia, São Tomé and Príncipe, and Burkina Faso engaged telecommunications firms to disseminate information about preventative measures. This approach had a considerable impact on anthrax treatment in developing regions during the pandemic, contributing to market expansion. The eventual reinstatement of supply chains and healthcare facilities is anticipated to further boost the market, allowing it to reach its full potential in the post-pandemic phase.

Segmental Analysis:

Cutaneous Anthrax Segment is Expected to Witness Significant Growth over the Forecast Period

Cutaneous anthrax is a form of anthrax infection caused by the bacterium Bacillus anthracis. It is the most common and least severe type of anthrax infection, accounting for the majority of reported cases. The infection occurs when spores of the bacterium come into contact with the skin, often through cuts, abrasions, or open wounds. Cutaneous anthrax typically presents with the development of painless, itchy papules that progress to fluid-filled vesicles and eventually form ulcerations with a characteristic black center, giving rise to the term "eschar." While cutaneous anthrax is generally a localized and self-limiting infection, without appropriate treatment, the bacteria can enter the bloodstream, leading to more severe systemic forms of anthrax. Early diagnosis and prompt treatment with antibiotics such as ciprofloxacin or doxycycline are crucial for successful outcomes. Cutaneous anthrax is not known to spread from person to person and is often associated with occupational or environmental exposure to infected animals or their products. Public health measures focus on identifying and addressing potential sources of exposure, as well as implementing preventive strategies. Vaccination is available for individuals at high risk of occupational exposure, such as veterinarians and laboratory workers. While cutaneous anthrax is generally considered treatable, its potential for progression to systemic forms underscores the importance of timely medical intervention and public health vigilance. Thus, such factors are expected to drive the studied segment’s growth over the forecast period.

Immunoglobulins Segment is Expected to Witness Significant Growth over the Forecast Period

Immunoglobulins, also known as antibodies, play a crucial role in the immune system's defense against infections, including anthrax. Anthrax is caused by the bacterium Bacillus anthracis, and the development of effective antibodies is essential for the host's immune response. There are different classes of immunoglobulins, such as IgG, IgM, and IgA, each with specific functions in the immune system. In the context of anthrax, antibodies are generated in response to exposure to the bacterium or through vaccination. These antibodies can neutralize the toxins produced by Bacillus anthracis, providing protection against the harmful effects of the infection. The two major toxins produced by the bacterium, protective antigen (PA), edema factor (EF), and lethal factor (LF), are primary targets for the immune response. The administration of specific antibodies, either through passive immunization or as a component of anthrax vaccines, can enhance the body's ability to combat the infection. Passive immunization involves the direct introduction of pre-formed antibodies into an individual, providing immediate protection. This approach is particularly useful in emergency situations or for individuals with compromised immune systems. Anthrax vaccines, such as Anthrax Vaccine Adsorbed (AVA), stimulate the production of antibodies in the vaccinated individual. The antibodies generated target the protective antigen component of the bacterium, preventing the toxins from exerting their harmful effects. Research continues to explore innovative immunotherapeutic approaches for anthrax, including the development of monoclonal antibodies with enhanced efficacy. These antibodies, when strategically designed, can offer targeted and potent neutralization of anthrax toxins. In summary, immunoglobulins play a pivotal role in the immune response to anthrax. Understanding and harnessing the power of antibodies, whether through natural immune responses, vaccination, or passive immunization, contribute significantly to the development of effective strategies for anthrax prevention and treatment.

North America Region is Expected to Witness Significant Growth over the Forecast Period

North America is poised to assert dominance in the global anthrax treatment market, driven by factors such as substantial government funding, supportive strategies, and the presence of key industry players in the region. While anthrax is considered rare in the United States, sporadic outbreaks do occur among wild and domestic grazing animals, necessitating yearly vaccination of livestock in susceptible areas. In addition to these preventive measures, anthrax infections, should they occur, are treatable with antibiotics, including intravenous options tailored to individual medical histories. The Anthrax Vaccine Adsorbed (AVA) or BioThrax, manufactured by Emergent BioSolutions, Inc., has been a licensed anthrax vaccine since 1970, offering active immunization for individuals aged 18-65 at high risk of exposure. The United States, in particular, has experienced instances of anthrax infection linked to activities such as crafting traditional African drums from the skins of infected animals.Initiatives by organizations like the CDC further bolster market growth by supporting the development of novel anthrax therapies. A notable example comes from a report by the American Chemical Society in September 2022, where researchers took strides towards a non-antibiotic therapeutic for anthrax treatment, utilizing an engineered Fc-fusion of a capsule-degrading enzyme.Additionally, new contracts with government entities contribute to market expansion. For instance, Heat Biologics, Inc. (now NightHawk Biosciences) and Elusys Therapeutics secured a contract with the Canadian government in April 2022 to supply ANTHIM, a treatment for inhalation anthrax, enhancing preparedness against potential anthrax attacks. In conclusion, the confluence of government support, innovative research, and strategic collaborations positions North America as a frontrunner in the growth of the anthrax treatment market.

Get Complete Analysis Of The Report - Download Free Sample PDF

The anthrax treatment market exhibits fragmentation owing to the abundance of treatment options offered by various market players. A substantial number of companies are actively engaged in the development of therapeutics, contributing to a competitive landscape. The market dynamics are characterized by a significant intensity of efforts from multiple players. Key factors contributing to this landscape include the upsurge in the development of new therapies and a notable increase in research funding. These factors not only enhance the diversity of available treatment options but also present considerable growth opportunities for manufacturers involved in anthrax treatment. As research and development efforts intensify and funding continues to support innovative solutions, the market is poised to see further advancements and a broader spectrum of treatments, ultimately benefiting both the industry and patients.

Recent Development:

1) In April 2022, NightHawk Biosciences successfully concluded the acquisition of Elusys Therapeutics, Inc., a biodefense company with a proven track record, particularly as the developer of ANTHIM (obiltoxaximab), a treatment designed for inhalation anthrax. This strategic move by NightHawk Biosciences signifies a significant development in the realm of biodefense and anthrax treatment. Notably, Elusys

2) In January 2022, finalized a crucial contract with the office of the assistant secretary for preparedness and response (ASPR) within the United States Department of Health and Human Services (HHS). This agreement was established to ensure the continued supply of ANTHIM (obiltoxaximab), an anthrax antitoxin, underscoring the strategic importance of sustaining anthrax preparedness efforts. The collaboration aims to fortify the nation's readiness to respond effectively in the event of a potential anthrax attack, highlighting the critical role of ANTHIM as a key component in the nation's biodefense capabilities.

Q1. What was the Anthrax Treatment Market size in 2023?

As per Data Library Research the global anthrax treatment market size was valued at USD 371.2 million in 2023.

Q2. At what CAGR is the Anthrax Treatment market projected to grow within the forecast period?

Anthrax Treatment Market is expected to grow at a compound annual growth rate (CAGR) of 9.2% over the forecast period.

Q3. What segments are covered in the Anthrax Treatment Market Report?

By Anthrax Type, By Drug Class, By End-User and Geography these segments are covered in the Anthrax Treatment Market Report.

Q4. What are the factors driving the Anthrax Treatment Market?

Key factors that are driving the growth include the Increase in Research Funding and Development of Novel Therapies for Treatment of Anthrax.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model