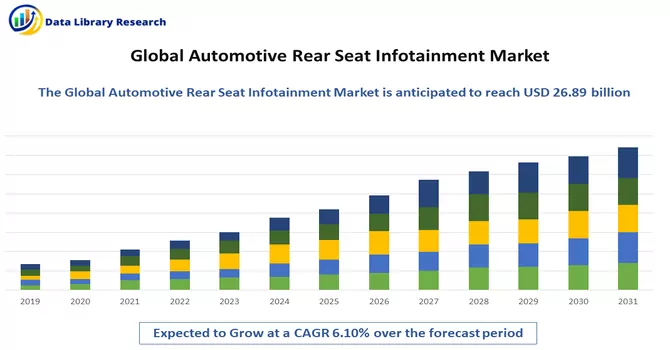

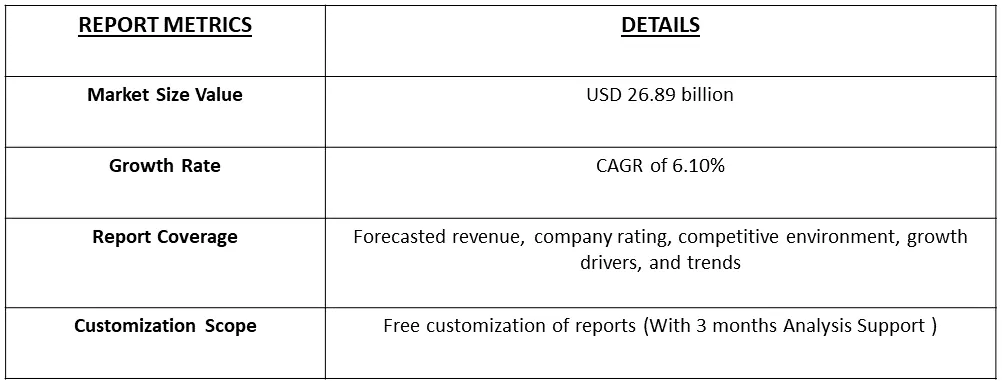

The Automotive Infotainment Systems Market size is estimated at USD 26.89 billion in 2023 and is expected to register a CAGR of 6.10% during the forecast period (2024-2031).

Get Complete Analysis Of The Report - Download Free Sample PDF

Automotive Rear Seat Infotainment refers to entertainment and information systems designed specifically for the rear seat passengers in a vehicle. These systems are integrated into the rear section of the vehicle, typically for the convenience and entertainment of passengers seated in the back. These systems often include one or more displays mounted on the back of the front seats, allowing rear-seat passengers to view content. The displays can be in the form of built-in screens or attachable devices. Automotive Rear Seat Infotainment systems provide a variety of entertainment options, such as movies, TV shows, music, games, and more. These can be accessed through various sources like DVDs, USB drives, streaming services, or integrated media players.

The Automotive Infotainment Systems Market is influenced by several driving factors that contribute to its growth and evolution. These factors reflect the dynamic changes and advancements in the automotive industry and consumer preferences. The increasing demand from consumers for seamless connectivity within vehicles is a major driving force. Consumers expect their vehicles to be equipped with advanced infotainment systems that provide connectivity features such as Bluetooth, Wi-Fi, and smartphone integration. Also, the emphasis on in-car entertainment has grown significantly, driven by consumers seeking enhanced driving experiences. Infotainment systems are pivotal in offering entertainment options, including music streaming, video playback, and gaming, to keep passengers entertained during journeys.

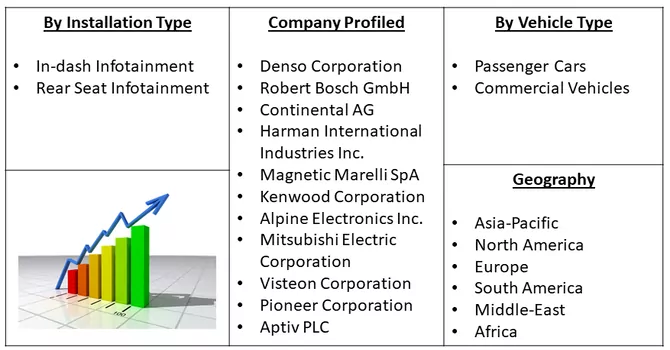

Market Segmentation: The Automotive Rear Seat Infotainment Market is Segmented by Installation Type (In-dash Infotainment and Rear Seat Infotainment), Vehicle Type (Passenger Cars and Commercial Vehicles), and Geography (North America (United States, Canada, and Rest of North America), Europe (Germany, United Kingdom, France, Italy, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Rest of Asia Pacific), and Rest of the World(Brazil, South Africa, and Other Countries)). The report offers the market size and forecasts in value (USD billion) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The automotive infotainment systems market is undergoing significant trends driven by technological advancements, changing consumer preferences, and the integration of smart features in vehicles. Seamless connectivity remains a dominant trend, with infotainment systems integrating with smartphones and other smart devices. Features like Apple CarPlay and Android Auto provide a familiar interface for users, enabling access to navigation, music, and other applications. Voice recognition technology is becoming more sophisticated, allowing drivers and passengers to control various functions using voice commands. Artificial intelligence (AI) is also being integrated to enhance the system's understanding of natural language and user preferences. Thus, such market trends are expected to drive the studied market growth over the forecast period.

Market Drivers:

Growing Advancements in Infotainment Systems

Automobile manufacturers are increasingly embracing modular hardware design strategies to achieve cost efficiencies in the procurement of infotainment systems. By adopting this approach, manufacturers can streamline the production process and reduce overall costs. Furthermore, they are actively developing technologies that facilitate the integration of smartphone functions seamlessly into in-vehicle infotainment systems, providing enhanced features at a lower cost. To stay competitive, manufacturers are focused on merging processing power and system capabilities. This strategic integration aims to enhance the overall performance of connected vehicles, ensuring that in-vehicle digital services can efficiently handle and process the substantial amount of data generated. The pursuit of robust and competitive systems is crucial in meeting the growing demands for advanced features in modern vehicles. In a notable development, in August 2021, Hyundai Motors made a strategic choice by selecting QT, a globally recognized software technology company, as its partner for human-machine interface (HMI) technology. This partnership extends across Hyundai, Kia, and Genesis vehicles, allowing Hyundai Motors to develop a connected car operating system that spans its entire range of vehicle infotainment systems. This move positions Hyundai Motors to deliver a cohesive and interconnected user experience, aligning with the evolving expectations of tech-savvy consumers. Thus, the automotive industry's adoption of modular hardware design, integration of smartphone functionalities, and strategic collaborations with technology partners like QT exemplify the concerted efforts of manufacturers to optimize costs, enhance system capabilities, and deliver innovative connected car experiences to consumers.

Rise of Electric and Hybrid Vehicles

The surge in the adoption of electric and hybrid vehicles has prompted a heightened emphasis on developing specialized infotainment systems designed for these environmentally conscious vehicles. These tailored systems frequently incorporate energy-efficient displays, contributing to the overall sustainability of the vehicle. Additionally, there is a notable integration with vehicle performance data, allowing users to access real-time information about their electric or hybrid vehicle's efficiency, range, and other relevant metrics. This intersection of eco-friendly technology and sophisticated infotainment highlights the industry's commitment to providing a seamless and informative driving experience for users of electric and hybrid vehicles.

Market Restraints:

Automotive Rear Seat Infotainment Market High Cost

The integration of advanced technologies and features into infotainment systems often results in higher production costs. This can be a significant restraint, especially for entry-level and budget-conscious vehicle models. Some infotainment systems may have complex user interfaces that can be challenging for users to navigate. Poor user experiences and difficulties in mastering the system can discourage adoption. Thus, such factors are expected to slow down the studied market's growth.

The automotive infotainment systems market felt the inevitable impact of the COVID-19 pandemic, primarily due to disruptions in vehicle sales and production, which are key drivers for this market. With widespread lockdowns and the temporary closure of manufacturing units, the automotive industry experienced a significant downturn in 2020. The initial half of 2020 saw a gradual recovery as global vehicle production and sales started to regain momentum. This positive trend continued into 2021, with notable growth in global vehicle sales compared to the previous year. However, it's important to note that the market did not fully recover to the levels observed in 2019, mainly due to the persistent global semiconductor shortage, which hampered the production of vehicles and their associated components. In response to the challenges posed by the pandemic, industry players have adapted by fostering collaborations and focusing on the development of new and innovative products. These collaborative efforts aim to overcome the lingering impacts of the pandemic on the automotive sector, including the supply chain disruptions caused by the semiconductor shortage.

As the automotive industry navigates the post-pandemic landscape, there is a concerted effort to not only recover from the setbacks but also to introduce advancements and improvements. Manufacturers and technology providers are investing in research and development to create innovative infotainment systems that meet the evolving needs and expectations of consumers in a changed post-pandemic environment. The collaborative initiatives and product innovations within the automotive infotainment systems market underscore the resilience of the industry in adapting to unforeseen challenges. Going forward, the focus remains on addressing supply chain vulnerabilities, exploring emerging technologies, and enhancing the overall in-car infotainment experience for consumers. The lessons learned during the pandemic are shaping the strategies of market participants as they navigate the road to recovery and future growth.

Segmental Analysis:

In-dash Infotainment Segment is Expected to Witness Significant Growth Over the Forecast Period

In-dash infotainment systems play a pivotal role in shaping the automotive infotainment systems market, providing a centralized hub for entertainment, navigation, connectivity, and vehicle control within the vehicle's dashboard. These integrated systems have become a standard feature in modern vehicles, offering a seamless and user-friendly interface for drivers and passengers. In-dash infotainment serves as a centralized control hub, consolidating various functions such as audio and video playback, navigation, hands-free calling, and vehicle settings into a single interface. This simplifies the user experience and reduces driver distraction. In-dash systems integrate advanced technologies, including voice recognition, gesture control, and smartphone mirroring (e.g., Apple CarPlay and Android Auto). These features enhance user convenience and keep the driver focused on the road. Thus, owing to such advantages, the segment is expected to witness significant growth over the forecast period.

Commercial Cars Segment is Expected to Witness Significant Growth Over the Forecast Period

Commercial cars, encompassing a wide range of vehicles used for business purposes, are experiencing a transformative shift in their automotive infotainment systems. The integration of advanced infotainment features in commercial vehicles enhances the driving experience, productivity, and connectivity for both drivers and passengers. Automotive infotainment systems in commercial cars go beyond entertainment. They serve as productivity tools by providing connectivity features such as hands-free calling, messaging, and access to business applications. This helps drivers stay connected while on the road. In commercial fleets, infotainment systems often incorporate features related to fleet management. This includes real-time tracking, monitoring fuel efficiency, and providing data on vehicle diagnostics. Fleet managers can access vital information for efficient operation. Thus, owing to such advantages, the segment is expected to witness significant growth over the forecast period.

Asia Pacific Region is Expected to Witness Significant Growth Over the Forecast Period

The Asia-Pacific region plays a significant role in the automotive infotainment systems market, witnessing dynamic growth and technological advancements in the automotive sector. Asia-Pacific is home to some of the world's largest and fastest-growing automotive markets, including China, India, and Japan. The region's robust automotive industry, marked by increasing vehicle production and sales, fuels the demand for advanced infotainment systems. The Asia-Pacific region is witnessing a growing adoption of electric vehicles (EVs), and manufacturers are incorporating advanced infotainment systems into electric models. Infotainment features in EVs contribute to a futuristic and tech-forward image.

In July 2021, during the World Artificial Intelligence Conference, it was highlighted that China's automobile market was at the forefront of smart cockpit development, boasting over 82,300 patent applications related to intelligent cockpits. This surpassed the figures from Japan and the United States, with 31,900 and 19,300 patent applications, respectively. The surge in patent applications underscores the significant role of intelligent cockpits in shaping the contemporary driving experience. Notable technologies integrated into these intelligent vehicle cockpits include voice recognition and advanced navigation systems, reflecting the pivotal role of innovation in enhancing the overall driving interface. Thus, such developments are expected to drive the studied market growth in the region.

Get Complete Analysis Of The Report - Download Free Sample PDF

Prominent players in the automotive infotainment systems market, including Robert Bosch, Alpine Electronics, Panasonic Corporation, HARMAN International, and Mitsubishi Electric Corporation, exert significant influence. These industry leaders boast robust global distribution networks and a comprehensive portfolio of products. To maintain their market dominance, these companies employ strategic initiatives like introducing new products, fostering collaborations, and entering into contracts and agreements. These strategies are integral to sustaining their positions and ensuring continued success in the competitive landscape of the automotive infotainment systems market.

Recent Developments:

1) In August 2022, Maruti made significant strides in automotive infotainment systems with the introduction of its revamped Baleno. The vehicle comes equipped with the Smart Play Pro+, a cutting-edge touchscreen infotainment system featuring an impressive 9-inch display for passengers. While retaining all the features of the Smart Play Pro, Maruti incorporated several enhancements based on constructive feedback from auto enthusiasts, including improved navigation, enhanced CarPlay functionality, and other advancements.

2) In March 2022, Acura MDX launched its highly anticipated Type S version, garnering acclaim from car enthusiasts. The company exerted considerable effort to design this fleet, aligning it with current consumer expectations. The car boasts a touchpad infotainment system that includes a remarkable OLED display, offering a visually stunning and user-friendly interface for occupants. This move reflects Acura's commitment to delivering an enhanced driving and entertainment experience by incorporating state-of-the-art infotainment technology into their vehicles.

Q1. What was the Automotive Rear Seat Infotainment Market size in 2023?

As per Data Library Research the Automotive Infotainment Systems Market size is estimated at USD 26.89 billion in 2023.

Q2. At what CAGR is the Automotive Infotainment Systems Market projected to grow within the forecast period?

Automotive Infotainment Systems Market is expected to register a CAGR of 6.10% during the forecast period.

Q3. Which Region is expected to hold the highest Market share?

Asia-Pacific region is expected to hold the highest Market share.

Q4. What are the factors driving the Automotive Infotainment Systems market?

Key factors that are driving the growth include theGrowing Advancements in Infotainment Systems and Rise of Electric and Hybrid Vehicles.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model