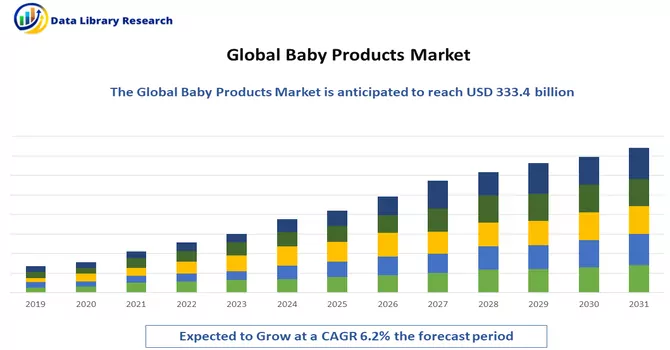

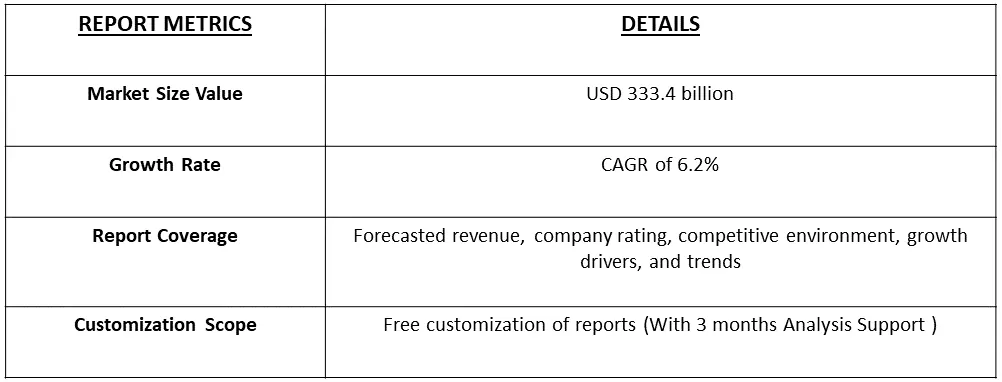

The global baby products market size was estimated at USD 333.4 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6.2% from 2024 to 2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Baby care products refer to a range of items specifically designed and formulated for the care and well-being of infants and young children. These products encompass various categories, including skincare, hygiene, nutrition, and safety. Common examples of baby care products include baby lotions, shampoos, diapers, wipes, baby food, formula, pacifiers, bottles, and safety accessories such as baby monitors and childproofing equipment. These products are created with consideration for the delicate nature of a baby's skin, nutritional needs, and safety requirements. Manufacturers often adhere to stringent quality standards to ensure that baby care products are gentle, safe, and suitable for use on infants, providing parents and caregivers with the tools necessary for nurturing and maintaining the health and comfort of their babies.

A pivotal factor fueling the expansion of the market is the change in consumer preferences towards premium, utility-focused, and high-quality baby products. The surge in awareness among parents regarding the health and hygiene of their infants is another significant driver propelling market growth. Increasingly, medical practitioners are advocating for the regular use of baby personal care products as a means to nurture the delicate skin of infants, further contributing to the overall growth of the market. This shifting consumer landscape, coupled with the growing emphasis on baby health and well-being, underscores a burgeoning demand for baby products that offer both quality and utility.

Baby care product trends are marked by rising demand for organic and natural options, emphasizing safety for infants. E-commerce growth has transformed the retail landscape, providing parents with convenient online access to a diverse range of products. Eco-friendly and sustainable offerings are gaining popularity, reflecting a broader environmental consciousness. Innovations in technology, such as smart monitors, cater to advanced monitoring needs. Personalization and inclusivity in marketing recognize diverse family structures. The clean label movement stresses ingredient transparency for safer formulations. Subscription services are on the rise, offering convenience and cost savings. Adherence to safety standards and pandemic-driven trends, like a focus on hygiene-related products, further shape the evolving landscape of the baby care product industry.

Market Segmentation: Baby Products Market Size, Share & Trends Analysis Report By Product (Cosmetics & Toiletries, Baby Food, Baby Feeding & Nursing, Baby Nursery & Furniture and Other Products), Distribution Channel (Hypermarkets & Supermarkets, Specialty Stores, Pharmacies & Drugstores, Online and Other Distribution Channel), and ), and Geography (North America, Europe, Asia-Pacific, and Rest of the World).

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Rising Birth Rates

The sustained increase in global birth rates is a driving force behind the consistent demand for various baby products, encompassing essentials such as diapers, feeding bottles, clothing, and nursery items, thereby fostering the expansion of the market. According to the United Nations' 2022 report, the average birth rate in 2021, calculated at 18.1 births per 1,000 total population, translates to an approximate rate of 4.3 births per second or around 259 births per minute worldwide. Notably, the average fertility rate, representing births per woman, has seen a substantial reduction from 5.9 in 1950 to below 2 today. While 2.1 is typically considered the replacement rate leading to a stable population, the report highlights that India's population continues to grow by over 10 million annually, surpassing China as the most populous country. This growth is attributed to India's large number of young people and increased life expectancy. The ongoing dynamics of global birth rates, particularly in countries like India, underscore the sustained demand for baby products on a worldwide scale.

Growing Parental Awareness Regarding Child Safety and Well-Being and Technological Advancements

Increasing parental awareness regarding child safety and well-being is a driving force behind the heightened demand for baby products that prioritize safety features, organic materials, and health-centric attributes. The continuous innovations in baby product technology, including smart monitors, digital thermometers, and advanced feeding solutions, play a crucial role in fueling market growth by addressing the evolving needs of tech-savvy parents. Notably, in January 2023, Indian Cricketer Suresh Raina and his wife Priynaka has introduced their thoughtfully crafted 360° baby wellness brand, 'maate,' unveiling a new line of baby care products such as Coconut Oil, Baby Powder, Kids Foaming Face Wash, and Diaper Rash Cream. Grounded in a blend of traditional wisdom and modern science, maate is committed to delivering the finest products for babies, prioritizing efficacy over cosmetic allure. The brand's products are crafted with the purest natural ingredients and packaged responsibly, ensuring sustainability for the planet and holistic wellness for children. This reflects a broader industry trend where conscious parenting intersects with technological and natural advancements to meet the diverse needs of today's parents. Thus, such developments are expected to boost the growth of the studied market over the forecast period.

Market Restraints:

Regulator Compliance and Safety Standards

The baby care product industry encounters challenges stemming from rigorous regulations and safety standards, necessitating manufacturers to comply with stringent guidelines, undergo thorough testing, and obtain certification. The adherence to these demanding processes ensures that baby care products meet the highest standards of safety and quality. Manufacturers must navigate a complex regulatory landscape, often involving multiple regulatory bodies, to ensure that their products are free from harmful substances and adhere to established safety benchmarks. This stringent regulatory environment, while essential for safeguarding infant health, adds complexity to the manufacturing and marketing processes, requiring continuous diligence and investment in research and development to stay abreast of evolving standards and maintain a commitment to consumer safety.

The COVID-19 pandemic has significantly influenced the baby care market, creating both short-term disruptions and enduring shifts in consumer behavior. Global supply chains for baby care products experienced challenges due to lockdowns and logistical changes, leading to occasional shortages. Consumer priorities shifted during economic uncertainties, impacting the demand for non-essential baby care items. E-commerce platforms became pivotal for accessing essential products, contributing to a surge in online sales. The pandemic prompted heightened focus on essential baby care items like diapers and wipes, along with increased demand for products addressing hygiene and safety concerns. Remote working led to an uptick in demand for products facilitating at-home childcare. Manufacturers innovated to address new parental needs arising from the changed circumstances, emphasizing transparency and commitment to safety. The pandemic's long-term impact on birth rates may influence sustained demand for baby care products, making ongoing monitoring essential for effective adaptation in the post-pandemic era.

Segmental Analysis:

Cosmetics & Toiletries Segment is Expected to Witness Significant Growth Over the Forecast Period

Cosmetics and toiletries for babies constitute a specialized segment within the personal care industry, dedicated to addressing the unique needs and sensitivities of infants and young children. This category includes a diverse range of products designed to enhance the well-being of babies while maintaining the utmost safety and gentleness on their delicate skin. Common items within this segment encompass baby shampoos, gentle cleansers, moisturizers, diaper creams, and baby powders. Manufacturers in this space prioritize formulations with mild ingredients, avoiding harsh chemicals and fragrances that may irritate a baby's skin. Furthermore, baby cosmetics often adhere to stringent safety standards to ensure they are hypoallergenic and suitable for sensitive skin. The emphasis is on creating products that provide hydration, protection, and nourishment, catering to the unique requirements of infant skin. As parents increasingly seek natural and organic options, there is a growing trend in the market for eco-friendly and sustainable baby cosmetic products, further highlighting the industry's commitment to safety and environmental consciousness. Overall, the cosmetics and toiletries for baby segment reflects a dedication to promoting the health and comfort of the youngest members of society. Thus, owing to such advantages the segment is expected to witness significant growth over the forecast period.

Hypermarkets & Supermarkets Segment is Expected to Witness Significant Growth Over the Forecast Period

Hypermarkets and supermarkets play a pivotal role in the retail landscape for baby care products, offering a diverse and convenient shopping experience for parents. These large-scale retail outlets serve as one-stop destinations where parents can find an extensive range of baby care essentials, from diapers and wipes to formula, clothing, toys, and hygiene products. The dedicated baby care aisles within hypermarkets and supermarkets are strategically organized to provide easy navigation, allowing parents to access a comprehensive array of products catering to different age groups and specific needs. The availability of popular and trusted brands, along with an assortment of choices, contributes to the appeal of hypermarkets and supermarkets for parents seeking quality baby care items. Additionally, these retail giants often run promotions, discounts, and bundled offers, enhancing affordability for parents while incentivizing bulk purchases. The convenience of being able to fulfill multiple baby care needs in a single shopping trip, coupled with the potential for cost savings, makes hypermarkets and supermarkets key players in the distribution of baby care products, serving as reliable hubs for parents to access a wide variety of essentials for their little ones. Thus, owing to such advantages the segment is expected to witness significant growth over the forecast period.

Asia Pacific Region is Expected to Witness Significant Growth Over the Forecast Period

Asia Pacific represents a dynamic and rapidly growing market for baby care products, driven by evolving demographics, rising incomes, and an increasing emphasis on child health and well-being. The region encompasses diverse cultures and consumer preferences, leading to a wide array of baby care products catering to varying needs. Countries like China, India, Japan, and South Korea are key players in this market, with a substantial population of infants and young children. The demand for baby care products in Asia Pacific is influenced by the growing awareness among parents regarding the importance of using safe and high-quality products for their babies. This has led to an increased preference for natural and organic formulations, driving innovation in the industry. Brands are investing in research and development to introduce products that are not only effective but also align with the cultural and environmental expectations of consumers in the region. E-commerce has played a transformative role in the distribution of baby care products across Asia Pacific. Online platforms provide parents with easy access to a wide range of products, enabling them to make informed choices and often offering the convenience of doorstep delivery. At the same time, traditional brick-and-mortar retail outlets, including hypermarkets and specialty baby stores, continue to be significant channels for purchasing baby care items.

The market in Asia Pacific also reflects a trend toward premiumization, with parents increasingly willing to invest in higher-priced products that promise superior quality, safety, and innovative features. This includes a variety of products such as organic baby food, eco-friendly diapers, and technologically advanced baby monitors.

Government initiatives and regulations related to product safety and standards have gained prominence, fostering consumer trust and confidence. Additionally, cultural factors and social influences contribute to the diversity of baby care products available in the market, ranging from traditional remedies to modern formulations.

In June 2023, Plum, recognized as India's inaugural 100% vegan beauty brand, has expanded its product portfolio by venturing into the baby care sector with the introduction of 'Baby Plum.' This new line, meticulously crafted with the delicate nature of baby skin in focus, undergoes clinical testing by pediatricians and features pH-balanced and tear-free formulas. The range encompasses various Stock Keeping Units (SKUs), including baby lotion, body wash, baby shampoo, and massage oil, ensuring a comprehensive offering to cater to the diverse needs of parents seeking gentle and effective care for their little ones.

In conclusion, the Asia Pacific baby care products market is characterized by its vast and diverse consumer base, a growing preference for natural and premium products, the influence of e-commerce, and a focus on safety and innovation. As the region continues to experience economic growth and changing lifestyles, the baby care industry is poised for further expansion and innovation to meet the evolving demands of parents across Asia Pacific.

Get Complete Analysis Of The Report - Download Free Sample PDF

The baby product market encompasses a diverse array of both international and domestic participants. Manufacturers in this industry are actively directing investments into research and development initiatives with the goal of introducing novel and innovative baby products. This entails the creation of items that not only exhibit heightened effectiveness but also prioritize enhanced safety and convenience for parents. Additionally, manufacturers are strategically unveiling new product lines to align with the evolving needs of parents. These innovative offerings are often tailored to cater to distinct stages of baby development, spanning from newborn to infant and toddler phases. This strategic approach reflects a commitment to providing parents with a comprehensive range of solutions that align with the specific requirements and preferences associated with each stage of a child's growth and development. Key Baby Products Companies:

Recent Development:

1) In February 2023, Walmart unveiled the introduction of an exclusive line of soft and organic baby clothing named M + A by Monica + Andy. Crafted from 100% organic cotton, the apparel features gentle and comfortable designs tailored for infants aged from newborn to 24 months. This collection is made accessible through both online platforms and the extensive network of over 1,100 Walmart stores across the United States.

2) In October 2022, Nature's One expanded its Baby's Only Formula range with the addition of an organic infant formula, marking a pioneering achievement in the market. Recognized as the first of its kind, the Baby's Only Organic Premium Infant Formula is meticulously formulated to meet all FDA nutrient requirements. It serves as a comprehensive source of nourishment for infants from birth, providing essential nutrients or supplementing breastfeeding as needed.

Q1. What was the Baby Products Market size in 2023?

As per Data Library Research the global baby products market size was estimated at USD 333.4 billion in 2023.

Q2. What is the Growth Rate of the Baby Products Market ?

Baby Products Market is expected to grow at a compound annual growth rate (CAGR) of 6.2% over the forecast period.

Q3. What are the factors on which the Baby Products market research is based on?

By Product, By Distribution Channel and Geography are the factors on which the Baby Products market research is based.

Q4. Which Region is expected to hold the highest Market share?

North America region is expected to hold the highest Market share.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model