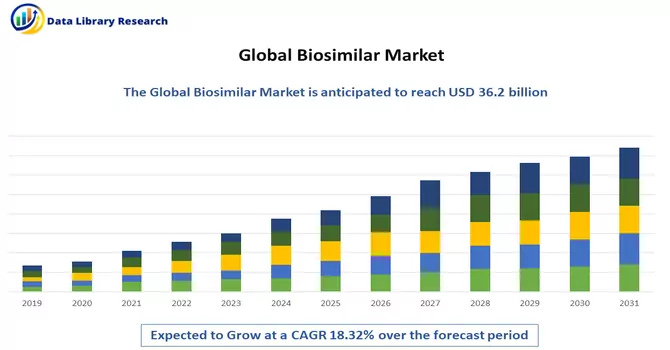

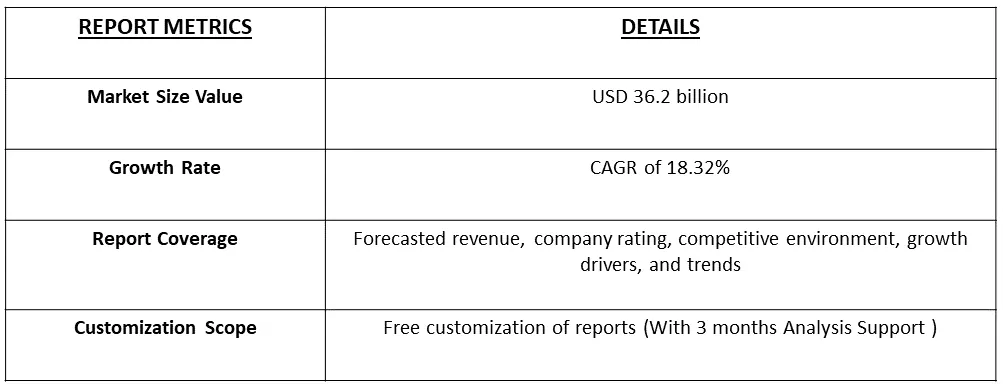

The Global Biosimilars Market size is estimated at USD 36.2 billion in 2023 and is expected to register a CAGR of 18.32% during the forecast period (2024-2031).

Get Complete Analysis Of The Report - Download Free Sample PDF

A biosimilar is a biological product that is highly similar to an already approved biologic reference product, with no clinically meaningful differences in terms of safety, efficacy, and quality. Unlike generic versions of small-molecule drugs, which are identical replicas of their reference counterparts, biosimilars are complex molecules produced using living cells. The development of biosimilars involves a rigorous comparison process to demonstrate similarity in terms of structural characteristics, biological activity, and clinical performance to the reference product. While biosimilars offer the potential for cost savings and increased patient access to biologic therapies, their approval and market entry require adherence to regulatory guidelines and thorough assessments to ensure patient safety and efficacy comparable to the original biologic product.

The biosimilar market is experiencing significant growth propelled by several key driving factors. Increasing demand for cost-effective alternatives to biologic drugs, coupled with the patent expirations of several high-profile biologics, is fostering the development and adoption of biosimilars. Governments and healthcare organizations worldwide are actively promoting the use of biosimilars to contain escalating healthcare costs while maintaining therapeutic efficacy. The expanding prevalence of chronic diseases, such as cancer and autoimmune disorders, is driving the need for affordable and accessible biologic treatments, further boosting the biosimilar market. Additionally, regulatory initiatives and guidelines supporting the approval and commercialization of biosimilars are streamlining market entry and fostering competition. As a result, pharmaceutical companies are increasingly investing in biosimilar development, contributing to a competitive landscape that offers diverse treatment options and improved patient access to biologic therapies across various therapeutic areas.

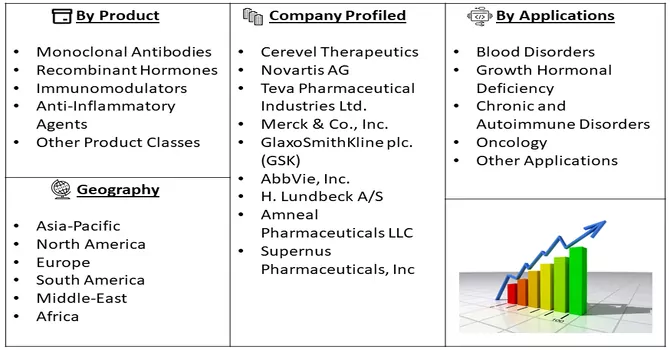

Market Segmentation: The Global Biosimilars Market is Segmented by Product Class (Monoclonal Antibodies, Recombinant Hormones, Immunomodulators, Anti-Inflammatory Agents, and Other Product Classes), Applications (Blood Disorders, Growth Hormonal Deficiency, Chronic and Autoimmune Disorders, Oncology, and Other Applications), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The Report Offers the Value (in USD Million) for the Above Segments.

For Detailed Market Segmentation - Download Free Sample PDF

The biosimilar market is characterized by several notable trends that are shaping its trajectory. Firstly, an increasing emphasis on research and development activities to expand the biosimilar pipeline is evident, with a focus on developing biosimilars for a diverse range of therapeutic areas. Secondly, the evolution of regulatory frameworks and guidelines globally is fostering a more streamlined approval process, encouraging biosimilar developers to bring their products to market efficiently. Thirdly, collaborations and partnerships between pharmaceutical companies and biotechnology firms are on the rise, facilitating the pooling of resources, expertise, and technology to accelerate biosimilar development. Additionally, a growing awareness and acceptance of biosimilars among healthcare professionals and patients are contributing to increased market penetration. The market is also witnessing a trend toward the development of biosimilars for complex and high-value biologics, addressing unmet medical needs and offering more affordable alternatives. Furthermore, advancements in manufacturing technologies and process optimization are driving improvements in the quality, consistency, and scalability of biosimilar production. As the biosimilar market continues to evolve, these trends collectively contribute to a dynamic landscape that fosters innovation, competition, and increased accessibility to biological therapies.

Market Drivers:

Several Blockbuster Biopharmaceuticals Going Off-patent over the Next Five to Ten Years

In the pharmaceutical landscape, the impending expiration of patents for several blockbuster biopharmaceuticals over the next five to ten years is poised to usher in a significant era of opportunities for the biosimilar market. These high-profile biologics, having dominated the market due to their efficacy in treating various medical conditions, are approaching the end of their exclusivity, opening the door for biosimilar competition. The expiration of patents for biopharmaceutical giants provides an avenue for biosimilar manufacturers to introduce more affordable alternatives to these well-established treatments. This trend is expected to enhance market competition, promote cost-effective healthcare solutions, and expand patient access to crucial biologic therapies. However, navigating the regulatory landscape, ensuring the quality and safety of biosimilars, and gaining physician and patient trust remain essential challenges. The evolving dynamics between blockbuster biopharmaceuticals going off-patent and the emergence of biosimilars present a transformative shift in the pharmaceutical industry, emphasizing the increasing role of biosimilars in shaping the future of healthcare.

Growing Burden of Chronic Diseases and Increasing R&D Investments

The escalating burden of cancer, coupled with the rising mortality rates, underscores the imperative for affordable treatments, thereby catalyzing the expansion of the biosimilar market. This is particularly evident in the United States, where, according to GLOBOCAN 2020, there were an estimated 2,281,658 new cancer cases and nearly 612,390 deaths in 2020 alone. The substantial need for cost-effective therapeutic options to address such staggering figures is driving the growth of biosimilars, offering more accessible alternatives for cancer treatment. Moreover, key market players are actively fostering market growth through strategic initiatives, including product launches and corporate maneuvers such as mergers and acquisitions. A notable example is the FDA's approval in July 2021 of SEMGLEE, a biosimilar to LANTUS (insulin glargine), developed by Viatris Inc. (formerly Mylan Pharmaceuticals Inc.). These strategic activities not only contribute to market expansion but also signify a commitment to meeting the increasing demand for affordable and innovative biosimilar treatments in the evolving landscape of cancer care.

The COVID-19 pandemic has significantly impacted the biosimilar market, introducing a complex interplay of challenges and opportunities. On one hand, disruptions in global supply chains, limitations on manufacturing activities, and logistical challenges have led to uncertainties in the production and distribution of biosimilars. These disruptions, coupled with shifts in healthcare priorities and resource allocation, have affected the development timelines and market entry of some biosimilar products. On the other hand, the pandemic has underscored the importance of accessible and cost-effective healthcare solutions, potentially accelerating the adoption of biosimilars as governments and healthcare systems seek more affordable alternatives to biologics. The economic repercussions of the pandemic have also intensified the focus on cost containment, making biosimilars more attractive options for healthcare providers and payers. As the world navigates the complexities of the post-pandemic era, the biosimilar market is poised to witness both challenges and opportunities in the evolving landscape of global healthcare.

Segmental analysis:

Monoclonal Antibody Segment is Expected to Witness Significant Growth Over the Forecast Period

Monoclonal antibodies (mAbs) are laboratory-created molecules designed to mimic the immune system's ability to combat pathogens. These antibodies target specific antigens on cells and have diverse applications in medicine. In cancer therapy, mAbs can recognize and bind to proteins on cancer cells, aiding in their destruction or impeding their growth. Monoclonal antibodies also play a pivotal role in immunotherapy, leveraging the body's immune system to combat diseases. During the COVID-19 pandemic, some mAbs have been authorized for emergency use to treat individuals infected with the SARS-CoV-2 virus. The development process involves identifying a target on cells, generating identical antibodies in the laboratory, and mass-producing them for therapeutic use. Despite their efficacy, challenges such as production costs and potential side effects exist. Ongoing research aims to address these issues and expand the applications of monoclonal antibodies, offering targeted therapeutic solutions for a broad spectrum of diseases.

Oncology Segment is Expected to Witness Significant Growth Over the Forecast Period

The biosimilars market is poised to witness substantial growth, with the oncology segment expected to dominate, driven primarily by the escalating global incidence of cancers. According to the International Agency for Research on Cancer (IARC) in 2020, there were an estimated 474,519 new cases of leukemia globally, with a staggering 311,594 deaths attributed to the disease. Projections from the IARC indicate a concerning trend, with an expected surge in global cancer cases to 27.5 million by 2040, leading to 16.3 million deaths. This rising burden underscores the pressing need for advanced cancer drugs to effectively treat patients. Furthermore, heightened research and development endeavors by key industry players focusing on oncology, coupled with increased regulatory approvals, are poised to propel the growth of the biosimilars market. Illustratively, in December 2020, Amgen secured approval from the United States Food and Drug Administration (USFDA) for RIABNI (rituximab-arrx), a biosimilar to Rituxan (rituximab), catering to adult patients with non-Hodgkin's lymphoma, chronic lymphocytic leukemia, granulomatosis with polyangiitis, and microscopic polyangiitis. Additionally, in May 2022, Biocon Biologics Ltd. and Viatris Inc. received Health Canada's approval for their biosimilar, Abevmy (Bevacizumab), across four oncology indications, offering an alternative to Roche's Avastin (Bevacizumab). Considering these factors, the oncology segment is anticipated to experience significant growth throughout the forecast period, driven by the imperative demand for innovative and accessible treatments amidst the increasing prevalence of cancer worldwide.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

Anticipated to exhibit a noteworthy Compound Annual Growth Rate (CAGR) throughout the forecast period, North America emerges as a key player in the biosimilars market, driven by several compelling factors. The region experiences a high prevalence of chronic diseases, particularly cancers, contributing significantly to the market's growth. In 2020, the United States alone witnessed 2,281,658 newly diagnosed cancer cases, resulting in 612,390 deaths, with breast cancer ranking highest in incidence at 253,465 cases, followed by lung, prostate, and colon cancers. Notably, North America serves as a focal point for major market players, including Pfizer Inc., Mylan NV, Amgen Inc., and Coherus Biosciences Inc. The region's robust biosimilars market is further propelled by an upsurge in research and development investments by these industry leaders. The continuous expansion of product pipelines and frequent product launches significantly contribute to the market's upward trajectory. For instance, in June 2020, Pfizer Inc. secured United States approval for Nyvepria, a pegfilgrastim biosimilar, indicated for reducing infection incidence. Additionally, in February 2021, Coherus BioSciences, Inc. reported the United States Food and Drug Administration's acceptance for review of the 351(k) Biologics License Application (BLA) for CHS-1420, a biosimilar product candidate for Humira (adalimumab). Given the prevalence of chronic diseases, particularly cancer, coupled with the robust R&D activities and continuous product advancements, the biosimilars market is poised to witness significant growth in North America over the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

The biosimilar market exhibits intense competition, with numerous key players asserting dominance. Prominent contributors to this dynamic market include the following companies, which play a substantial role in shaping and influencing the competitive landscape.

Recent Development:

1) In May 2022, Amneal Pharmaceuticals, Inc. secured approval from the United States Food and Drug Administration (FDA) for a Biologics License Application (BLA) pertaining to pegfilgrastim-pbbk, a biosimilar referencing Neulasta. The approved product, named FYLNETRA, will now be introduced to the market.

2) In September 2021, a collaborative effort between Samsung Bioepis and Biogen resulted in FDA approval for BYOOVIZ (ranibizumab-nuna), marking it as the first ophthalmology biosimilar authorized in the United States. BYOOVIZ, a biosimilar to LUCENTIS (ranibizumab), gained approval for treating neovascular age-related macular degeneration, macular edema following retinal vein occlusion, and myopic choroidal neovascularization. These approvals underscore the continuous progress and diversification within the biosimilar landscape, offering alternatives for critical therapeutic areas and contributing to increased accessibility to biologic therapies.

Q1. What was the Biosimilar Market size in 2023?

As per Data Library Research the Global Biosimilars Market size is estimated at USD 36.2 billion in 2023.

Q2. At what CAGR is the Biosimilar market projected to grow within the forecast period?

Biosimilar Market is expected to register a CAGR of 18.32% during the forecast period.

Q3. What are the factors on which the Biosimilar market research is based on?

By Product Class, Application and Geography are the factors on which the Biosimilar market research is based.

Q4. Who are the key players in Biosimilar market?

Some key players operating in the market include

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model