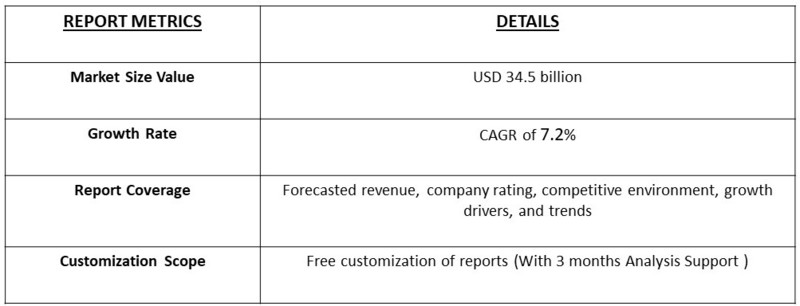

The global copper market is projected to reach a market value of USD 24.1 billion by 2023, growing at a Compound Annual Growth Rate (CAGR) of 7.2% from 2023 to 2031. By 2031, the market is expected to reach a value of USD 34.5 billion.

Get Complete Analysis Of The Report - Download Free Sample PDF

The Global Copper Market encompasses the production, distribution, and consumption of copper, a versatile metal used in various industries including construction, electronics, and transportation. Copper is valued for its excellent electrical and thermal conductivity, making it essential in electrical wiring, plumbing, and electronic devices. Market dynamics are influenced by industrial demand, technological advancements, and fluctuations in copper prices driven by global economic conditions. Key factors include infrastructure development, green energy initiatives, and supply chain constraints. The market is also impacted by regulatory policies and sustainability trends aiming to enhance recycling and reduce environmental impact.

The Global Copper Market is driven primarily by rising demand from the construction and electrical industries, particularly in emerging economies undergoing rapid urbanization and infrastructure development. The global transition towards renewable energy sources, such as wind and solar power, significantly boosts copper consumption due to its critical role in energy grids and electric vehicle manufacturing. Additionally, technological advancements in electronics and telecommunications continue to drive copper demand. Supply-side factors, including mining activities and recycling efforts, also shape market growth, with price volatility and environmental regulations influencing copper availability and sustainability efforts.

Current trends in the Global Copper Market include a significant shift towards sustainable and circular economy practices, with increased focus on recycling and reducing the environmental impact of copper extraction. Green energy initiatives are driving demand, as copper is crucial for renewable energy infrastructure and electric vehicle components. Additionally, technological advancements are leading to the development of new copper alloys and applications, enhancing performance and efficiency. There is also a growing emphasis on supply chain diversification and strategic stockpiling to mitigate risks associated with geopolitical uncertainties and price fluctuations. These trends collectively shape the market’s evolution towards more sustainable and innovative solutions.

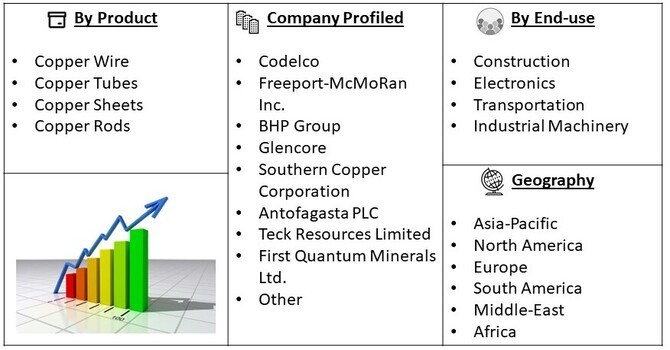

Market Segmentation: The Global Copper Market is segmented by technology By Product Form (Copper Wire, Copper Tubes, Copper Sheets, Copper Rods) By End-use Industry (Construction, Electronics, Transportation, Industrial Machinery) and geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The report offers the market size and forecasts for revenue (USD million) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Growing demand from electrical and electronic industries:

The global copper market is driven by the increasing demand from the electrical and electronics industries. The growing use of copper in applications such as wiring, circuits, and connectors is driving demand. According to a report by the International Copper Association, the demand for copper in the electrical and electronics industries is expected to grow by 5% annually between 2020 and 2025. This growth is driven by the increasing use of copper in renewable energy applications such as solar panels and wind turbines. As the world transitions to a more sustainable energy mix, we expect the demand for copper to increase, particularly in regions with high renewable energy adoption rates.

Growing use in renewable energy applications

The global copper market is also driven by the growing use of copper in renewable energy applications such as solar panels and wind turbines. Copper is a critical component in the production of solar panels and wind turbines, and its use is expected to increase as the world transitions to a more sustainable energy mix. According to a report by the National Renewable Energy Laboratory, the demand for copper in renewable energy applications is expected to grow by 10% annually between 2020 and 2025. As the world continues to invest in renewable energy, we expect the demand for copper to increase, particularly in regions with high renewable energy adoption rates.

Market Restraints:

The global copper market is facing challenges related to fluctuating copper prices and supply chain disruptions. Copper prices are subject to fluctuations due to factors such as changes in global demand, supply disruptions, and currency fluctuations. According to a report by the London Metal Exchange, copper prices have fluctuated significantly over the past year, with prices reaching a high of USD 6,500 per ton in March 2022 and a low of USD 4,500 per ton in September 2022. Supply chain disruptions caused by factors such as trade wars, tariffs, and logistics issues can also impact the availability of copper. As a result, copper manufacturers are facing challenges in maintaining consistent quality and prices, which may impact their competitiveness in the market. To mitigate these risks, manufacturers are adopting strategies such as diversifying their supplier base and investing in sustainable and resilient supply chains.

The COVID-19 pandemic significantly impacted the Global Copper Market, initially causing disruptions in mining operations, supply chains, and industrial production due to lockdowns and health-related restrictions. These disruptions led to temporary supply shortages and fluctuating copper prices. However, as economies began to recover, demand for copper surged, driven by increased investments in infrastructure, renewable energy projects, and electric vehicle production. The pandemic accelerated the focus on sustainability, leading to greater emphasis on copper recycling and circular economy practices. Overall, while the pandemic introduced short-term challenges, it also reinforced long-term trends towards green technologies and robust infrastructure development, shaping the market’s recovery and future growth trajectory.

Segmental Analysis:

Copper Wire Segment is Expected to Witness Significant Growth Over the Forecast Period

Copper wire remains a critical component in the Global Copper Market due to its essential role in electrical and telecommunications infrastructure. Recent developments in this sub-segment include advancements in wire technology to enhance conductivity and durability, catering to the growing demand for high-performance electrical systems. The rise in electric vehicle production and renewable energy installations has driven significant growth in copper wire demand, as these applications require extensive wiring solutions. The increasing emphasis on energy efficiency and expanding smart grid networks are key drivers for this segment, highlighting copper wire’s importance in modern electrical and electronic systems.

Refined Copper Segment is Expected to Witness Significant Growth Over the Forecast Period:

Refined copper is a cornerstone of the Global Copper Market, representing copper that has been purified and is ready for use in various applications. Recent trends include innovations in refining processes aimed at improving efficiency and reducing environmental impact. The demand for refined copper has been bolstered by its critical role in high-tech industries such as electronics, renewable energy, and electric vehicles. As global infrastructure projects and green energy initiatives expand, the need for high-quality refined copper continues to rise. Key drivers include the growing shift towards electrification and the increasing focus on sustainable practices in copper production and usage.

Asia Pacific Region is Expected to Witness Significant Growth Over the Forecast Period

The Asia-Pacific region is anticipated to experience significant growth in the Global Copper Market over the forecast period, driven by several key factors. Rapid urbanization and industrialization in countries like China, India, and Southeast Asian nations are fueling a substantial increase in demand for copper in construction, infrastructure, and electrical applications. The region's growing investments in renewable energy projects, such as solar and wind power, further drive the need for copper due to its essential role in these technologies. Additionally, the rise in electric vehicle production and expanding manufacturing capabilities contribute to the market's robust growth. As these economies continue to develop and modernize, the Asia-Pacific region is set to remain a major hub for copper consumption and market expansion.

Get Complete Analysis Of The Report - Download Free Sample PDF

Global Copper Market is characterized by a mix of large multinational corporations and regional players, each vying for market share through strategic investments, technological advancements, and supply chain optimization. Major companies are focusing on increasing production capacities, enhancing recycling capabilities, and developing new copper alloys to meet evolving industry demands.

Key competitors in the market include;

Recent Development:

1) Freeport-McMoRan Inc. announced in 2024 a major expansion of its Morenci Mine in Arizona, increasing its annual copper production capacity by 200,000 metric tons. This investment aims to meet the growing global demand for copper driven by the surge in electric vehicle manufacturing and renewable energy projects. The expansion includes upgrading existing facilities and implementing advanced extraction technologies to enhance efficiency and environmental sustainability.

2) BHP Group launched a new copper production initiative in 2023, focusing on its Olympic Dam site in Australia. This project involves the development of innovative processing techniques designed to improve copper recovery rates and reduce operational costs. The initiative is part of BHP's strategy to boost its copper output while addressing environmental concerns and supporting the transition to a low-carbon economy. The company’s investment reflects its commitment to meeting the rising global demand for copper in a sustainable manner.

Q1. What are the driving factors for the Global Copper Market?

The global copper market is primarily driven by the increasing demand from various industries, notably construction, electronics, and renewable energy sectors. As urbanization accelerates, the construction of residential and commercial buildings continues to rise, significantly increasing copper consumption for wiring and plumbing. Additionally, the shift towards electric vehicles (EVs) and renewable energy sources, such as solar and wind power, requires substantial amounts of copper for electrical wiring and components. Furthermore, government initiatives promoting green technologies and infrastructure development are expected to bolster demand. The growing awareness of copper's recyclability also plays a role in driving its market growth.

Q2. What are the restraining factors for the Global Copper Market?

Despite its strong demand, the global copper market faces several restraining factors. One of the most significant challenges is price volatility, influenced by fluctuating global economic conditions and trade tensions, which can deter investment in copper-related projects. Environmental regulations and sustainability concerns also pose challenges, as mining and production processes can have substantial ecological impacts. Additionally, the rise of alternative materials, such as aluminum and synthetic substitutes, in certain applications may reduce copper demand. Supply chain disruptions, exacerbated by geopolitical tensions or natural disasters, can further hinder market growth, creating uncertainty for manufacturers and investors alike.

Q3. Which segment is projected to hold the largest share in the Global Copper Market?

The electrical and electronics segment is projected to hold the largest share in the global copper market. This sector encompasses a wide range of applications, including wiring, motors, and circuit boards, which require high-quality copper for optimal performance and conductivity. With the ongoing advancement in technology and the increasing penetration of smart devices, the demand for copper in electronics is expected to surge. Moreover, as industries transition towards electric mobility and automation, the requirement for copper in battery manufacturing and electronic components will further cement this segment’s dominant position. The growing trend towards renewable energy technologies also bolsters copper demand in electrical applications.

Q4. Which region holds the largest share in the Global Copper Market?

Asia-Pacific is anticipated to hold the largest share in the global copper market, driven primarily by robust industrial growth and urbanization in countries like China and India. China, as the world’s largest consumer of copper, utilizes it extensively in construction, infrastructure projects, and electronics. The rapid development of smart cities and the increasing investment in renewable energy projects in this region significantly contribute to copper demand. Furthermore, the rise in manufacturing activities and the expansion of electric vehicle production facilities further enhance the copper market's prospects in Asia-Pacific. Emerging economies in the region are also ramping up their copper consumption, reinforcing the area’s leading position.

Q5. Which are the prominent players in the Global Copper Market?

Key players in the global copper market include major mining and manufacturing companies such as BHP Group, Freeport-McMoRan, and Glencore. These companies are renowned for their extensive mining operations and significant contributions to global copper production. Additionally, firms like Southern Copper Corporation and Codelco play crucial roles, leveraging their large reserves and operational expertise. These players are continuously investing in technology and sustainable practices to enhance efficiency and reduce environmental impact. Partnerships and mergers within the industry are also prevalent, as companies aim to consolidate resources and expand their market reach. Overall, these prominent players are central to shaping the dynamics of the global copper market.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model