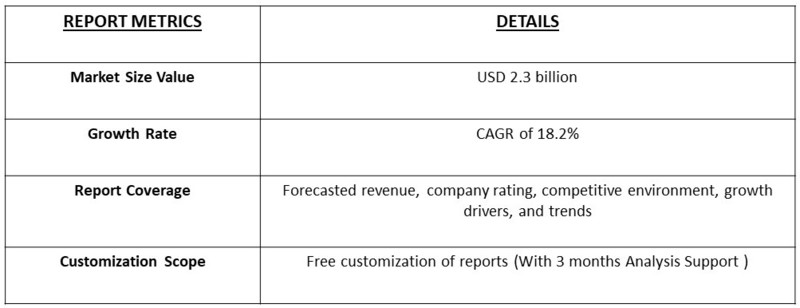

The global e-SIM (embedded SIM) market is projected to reach a market value of approximately 2.3 billion by 2023, growing at a Compound Annual Growth Rate (CAGR) of 18.2% from 2023 to 2031, driven by the increasing adoption of e-SIM technology in IoT devices, wearables, and automotive applications.

Get Complete Analysis Of The Report - Download Free Sample PDF

The global e-SIM (embedded SIM) market is rapidly expanding as telecommunications technology advances and consumer demand for more flexible and convenient connectivity solutions increases. Unlike traditional SIM cards, e-SIMs are integrated directly into devices, eliminating the need for physical cards and allowing for remote provisioning and management. This technology supports a wide range of applications, including smartphones, tablets, wearables, and IoT devices, facilitating seamless switching between carriers and enhancing global connectivity. Key drivers of the e-SIM market include the rising adoption of IoT devices, the proliferation of smart devices, and the need for streamlined and secure connectivity solutions.

Additionally, the shift towards 5G networks and the growing focus on digital transformation are fueling the demand for e-SIM technology. The market is characterized by rapid technological advancements and increased investments from major telecommunications companies and device manufacturers. However, challenges such as regulatory hurdles, interoperability issues, and security concerns need to be addressed as the market continues to evolve. Overall, the global e-SIM market is poised for substantial growth, driven by its advantages in convenience, flexibility, and support for emerging connectivity needs.

The global e-SIM market is witnessing several notable trends that are shaping its trajectory. A major trend is the increasing integration of e-SIM technology into a wide array of devices beyond smartphones, including tablets, wearables, and IoT devices, driven by the demand for seamless and always-on connectivity. The expansion of 5G networks is also accelerating the adoption of e-SIMs, as these networks require more sophisticated and flexible connectivity solutions. Additionally, there is a growing emphasis on remote provisioning and management capabilities, which enhance user convenience and support global travel without the need for physical SIM card swaps. The trend towards digital transformation and the Internet of Things (IoT) further supports the proliferation of e-SIM technology, as businesses and consumers alike seek more efficient and scalable connectivity solutions. Furthermore, increasing collaborations between telecom operators and device manufacturers are driving innovation and expanding the e-SIM ecosystem. These trends collectively underscore the e-SIM market’s shift towards greater flexibility, enhanced user experiences, and support for next-generation connectivity needs.

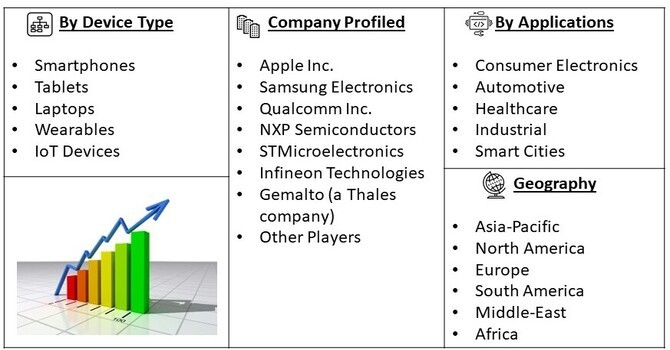

Market Segmentation: The Global E-SIM (embedded SIM) Market is segmented by Device Type (Smartphones, Tablets, Laptops, Wearables, and IoT Devices), Applications (Consumer Electronics, Automotive, Healthcare, Industrial, and Smart Cities), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The report offers the market size and forecasts for revenue (USD million) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Growing Adoption of IoT Devices and Smart Technologies:

The increasing adoption of Internet of Things (IoT) devices and smart technologies is a significant driver for the global e-SIM market. As IoT applications expand across various sectors, including automotive, healthcare, agriculture, and smart cities, the need for reliable, flexible, and secure connectivity solutions becomes more pronounced. E-SIM technology addresses these needs by enabling devices to connect to networks without the need for physical SIM cards, allowing for seamless integration and remote management. This flexibility is crucial for IoT devices that are often deployed in remote or challenging environments where physical SIM card changes are impractical. The growing number of connected devices and the need for streamlined and efficient connectivity solutions drive the demand for e-SIM technology, making it a key enabler for the widespread adoption of IoT applications and smart devices.

Expansion of 5G Networks and Demand for Enhanced Connectivity:

The global rollout of 5G networks is another major driver of the e-SIM market. As 5G technology advances, it necessitates more sophisticated connectivity solutions to support its high-speed, low-latency, and massive device connectivity requirements. E-SIM technology is well-suited to meet these demands by providing enhanced flexibility and scalability compared to traditional SIM cards. The ability to remotely provision and manage e-SIMs aligns with the dynamic nature of 5G deployments, where network operators need to efficiently handle a large number of connections and rapidly adapt to changing requirements. Additionally, e-SIMs support the global nature of 5G networks by allowing users to switch carriers seamlessly and use multiple profiles on a single device, further driving their adoption. The convergence of e-SIM technology with 5G advancements supports the growth of the market, as it facilitates the deployment and management of next-generation connectivity solutions.

Market Restraints:

The global e-SIM market faces several restraints that could impact its growth and widespread adoption. One of the primary challenges is the slow pace of regulatory and industry standardization across different regions, which can hinder the seamless integration of e-SIM technology and create interoperability issues between devices and networks. Additionally, while e-SIM technology offers numerous benefits, its adoption is constrained by security concerns, including potential vulnerabilities in remote provisioning and management processes that could be exploited by cyber threats. Another significant restraint is the resistance from some telecom operators who may be reluctant to fully embrace e-SIM technology due to concerns over revenue loss from traditional SIM card sales and the need to update their infrastructure and business models. Moreover, the initial cost of implementing e-SIM technology and the need for substantial investment in supporting systems and platforms can be prohibitive for smaller players in the market. These factors collectively present challenges for the widespread adoption of e-SIM technology, requiring ongoing efforts to address regulatory, security, and financial barriers to facilitate its growth.

The COVID-19 pandemic had a nuanced impact on the global e-SIM market, reflecting both challenges and opportunities. Initially, the pandemic disrupted supply chains and delayed the deployment of e-SIM technology as production and distribution faced setbacks due to lockdowns and restrictions. The economic uncertainty and reduced consumer spending also led to slower adoption rates for new technology, including e-SIM-enabled devices. However, the pandemic accelerated the digital transformation of various industries, highlighting the need for flexible and remote connectivity solutions, which favor the adoption of e-SIM technology. As remote work, telehealth, and online education surged, the advantages of e-SIMs, such as their ability to support seamless global connectivity and remote provisioning, became more apparent. The increased reliance on connected devices and the expansion of IoT applications during the pandemic underscored the benefits of e-SIMs, driving interest and investment in the technology. Additionally, the shift towards digital and contactless solutions, combined with the growing rollout of 5G networks, supported the continued growth and innovation in the e-SIM market, positioning it for a strong recovery and long-term expansion as the world adapted to new connectivity demands.

Segmental Analysis:

Smartphone Segment is Expected to Witness Significant Growth Over the Forecast Period

The growth of e-SIM technology in smartphones is driven by the increasing demand for seamless connectivity and convenience. e-SIMs eliminate the need for physical SIM cards, allowing users to switch carriers and manage plans remotely with ease. This technology supports multiple network profiles, which enhances flexibility for frequent travelers and users in need of dual-SIM functionality. The rapid adoption of 5G technology in smartphones further fuels the demand for e-SIMs, as they are well-suited to support advanced network features and provide a smoother user experience. Additionally, the push towards slimmer and more compact smartphone designs benefits from the space-saving nature of e-SIMs, driving their integration into new devices.

Consumer Electronics Segment is Expected to Witness Significant Growth Over the Forecast Period

The e-SIM market in consumer electronics is expanding as manufacturers increasingly incorporate this technology into various devices like tablets, laptops, and wearables. e-SIMs provide a streamlined and reliable connectivity solution for these devices, supporting mobile internet access without the need for physical SIM cards. This is particularly beneficial for tablets and laptops, which are often used on the go and require constant connectivity. The rise in remote work and digital nomadism further accelerates the adoption of e-SIMs in these devices, as users seek easy and flexible connectivity solutions. The increasing integration of e-SIMs enhances the user experience by simplifying device management and connectivity.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

In North America, the e-SIM market is experiencing robust growth due to high adoption rates of advanced technology and a strong consumer preference for connected devices. The region’s well-developed telecommunications infrastructure and supportive regulatory environment foster rapid e-SIM adoption. Major smartphone manufacturers and consumer electronics brands in the U.S. and Canada are increasingly incorporating e-SIMs into their devices, driven by the demand for innovative and flexible connectivity solutions. The expansion of 5G networks in North America also boosts e-SIM usage, as these cards are essential for leveraging the full benefits of next-generation mobile technology. The growing ecosystem of e-SIM-compatible devices and services in the region supports continued market growth.

Get Complete Analysis Of The Report - Download Free Sample PDF

The global e-SIM (embedded SIM) market is characterized by a competitive landscape with multiple players vying for market share. Industry giants such as Gemalto, Giesecke & Devrient, and STMicroelectronics are well-established players, while newer entrants like NXP Semiconductors and Infineon Technologies are gaining traction. Additionally, technology companies like Apple and Google are also entering the market, leveraging their expertise in software and hardware to develop innovative e-SIM solutions. The market is also witnessing consolidation, with mergers and acquisitions being a key strategy for companies to expand their offerings and strengthen their position in the market.

Key Companies:

Recent Development:

1) In March 2024, Gemalto, a leading provider of e-SIM solutions, announced the launch of its new e-SIM platform, "Gemalto eSIM 2.0," designed to enable seamless connectivity and secure data management for IoT devices, wearables, and automotive applications. This innovative platform leverages Gemalto's expertise in e-SIM technology and provides a scalable and secure solution for the growing demand for connected devices.

2 ) In January 2023, STMicroelectronics, a global semiconductor leader, acquired the e-SIM business of Sierra Wireless, a leading provider of IoT solutions, for $1.2 billion. This strategic acquisition enables STMicroelectronics to expand its presence in the e-SIM market, leveraging Sierra Wireless' expertise in IoT and wireless connectivity to develop innovative e-SIM solutions for a wide range of applications.

Q1. What are the driving factors for the Global E-Sim Market?

The global e-SIM market is driven by several key factors. Increasing demand for seamless and flexible connectivity solutions is a major driver, as e-SIMs eliminate the need for physical SIM cards and allow users to switch carriers easily. The rise of connected devices, including smartphones, tablets, and IoT devices, further boosts e-SIM adoption due to their compact size and integration benefits. Additionally, the expansion of 5G networks necessitates e-SIM technology for enhanced connectivity and network management. Consumer preference for more streamlined and efficient device management solutions, along with growing digital nomadism and remote work trends, also contribute to the market’s growth.

Q2. What are the restraining factors for the Global E-Sim Market?

Despite its growth, the global e-SIM market faces several challenges. High initial costs for e-SIM technology and integration can deter some manufacturers and consumers. Additionally, there are concerns regarding security and privacy, as e-SIMs are susceptible to cyber threats if not properly managed. The transition from traditional SIM cards to e-SIMs may also face resistance due to consumer reluctance to adopt new technology. Moreover, regulatory and interoperability issues between different carriers and regions can complicate e-SIM adoption. These factors collectively pose obstacles to the widespread acceptance and deployment of e-SIM technology.

Q3. Which segment is projected to hold the largest share in the Global E-Sim Market?

The smartphones segment is projected to hold the largest share in the global e-SIM market. Smartphones are among the most common devices incorporating e-SIM technology, driven by their need for flexible and seamless connectivity. e-SIMs enhance smartphone functionality by allowing users to easily switch carriers and manage multiple network profiles without needing to physically change SIM cards. The continued demand for advanced features and compact designs in smartphones supports the growth of this segment. As major smartphone manufacturers increasingly adopt e-SIM technology, the segment’s dominance in the market is expected to continue.

Q4. Which region holds the largest share in the Global E-Sim Market?

North America holds the largest share in the global e-SIM market. The region benefits from high technology adoption rates and a strong consumer preference for connected devices. Major telecommunications companies and device manufacturers in the U.S. and Canada are early adopters of e-SIM technology, integrating it into a wide range of products. The well-developed telecommunications infrastructure and the rapid expansion of 5G networks in North America further contribute to the region's leading position in the e-SIM market. The combination of technological advancement and high consumer demand supports North America's dominant market share.

Q5. Which are the prominent players in the Global E-Sim Market?

Prominent players in the global e-SIM market include major technology and semiconductor companies. Apple Inc. and Samsung Electronics lead with their integration of e-SIMs into smartphones and other devices. Qualcomm Inc. and STMicroelectronics provide crucial e-SIM chipsets and technologies. NXP Semiconductors and Infineon Technologies offer e-SIM solutions and secure elements for a range of applications. Gemalto (a Thales company) and HID Global are key providers of e-SIM management solutions and secure connectivity services. Giesecke+Devrient (G+D) also plays a significant role with its e-SIM technology and management solutions.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model