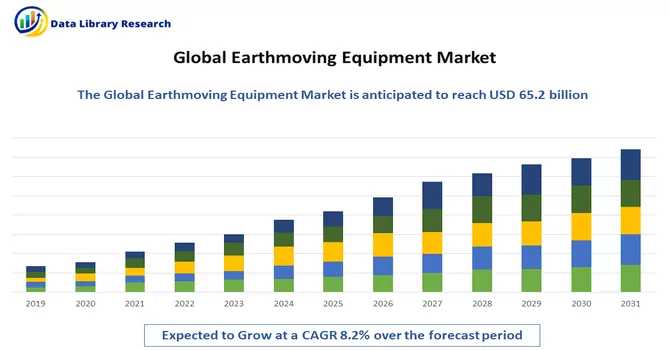

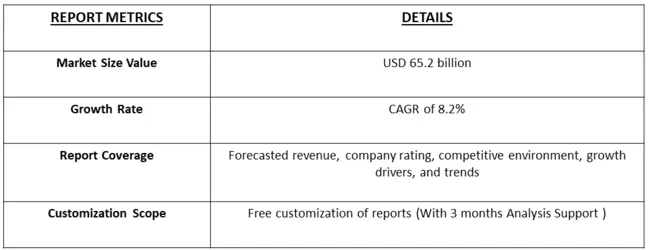

The global earthmoving equipment market size was valued at USD 65.2 billion in 2023 and is expected to grow at a CAGR of 8.2% from 2024 to 2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Earthmoving equipment refers to a diverse range of heavy machinery specifically designed for excavation, construction, and landscaping tasks involving the manipulation of large quantities of soil, rock, and other materials. These machines play a pivotal role in various industries, including construction, mining, agriculture, and infrastructure development. Common types of earthmoving equipment include excavators, bulldozers, loaders, graders, and trenchers, each tailored for specific functions. Excavators are adept at digging and material handling, bulldozers excel in pushing and grading, loaders facilitate material loading, graders level and finish surfaces, and trenchers are designed for digging narrow and deep trenches. Employing advanced hydraulics, powerful engines, and robust designs, earthmoving equipment significantly contributes to the efficiency and productivity of large-scale earthworks and construction projects.

Several key factors contribute to driving growth in the earthmoving equipment market. Firstly, ongoing urbanization and infrastructure development projects globally demand substantial earthmoving machinery for construction activities, including excavation, grading, and site preparation. Additionally, the expansion of the mining sector, driven by increasing demand for minerals and natural resources, boosts the need for specialized earthmoving equipment. Furthermore, technological advancements, such as the integration of telematics and GPS systems, enhance the efficiency, precision, and monitoring capabilities of earthmoving machinery, attracting businesses to upgrade their fleets. Environmental regulations focusing on sustainable construction practices and emissions standards also propel the adoption of newer, more eco-friendly equipment. Lastly, the growing trend toward rental services provides cost-effective solutions for businesses, promoting increased accessibility to earthmoving machinery and stimulating market growth. Collectively, these factors contribute to the dynamic and expanding nature of the earthmoving equipment market.

Market Segmentation: The Earth Moving Market is Segmented by Type of Equipment (Excavators, Bulldozers, Loaders (Wheel Loaders, Skid Steer Loaders), Graders, Trenchers, Scrapers and Type of Equipment), Application (Construction, Mining, Agriculture, Forestry, Landscaping, Road Building and Other Application), and Geography (North America, Europe, Asia-Pacific, and Rest of the World). The report offers market size and forecasts for the Robotic Lawn Market in value (USD Billion) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The earthmoving equipment market is undergoing significant shifts driven by technological advancements, including the integration of telematics and GPS systems, a heightened focus on sustainability with the development of eco-friendly machinery, and a rising preference for rental services to enhance flexibility and cost-effectiveness. The industry is witnessing a notable trend towards electric and hybrid-powered equipment, aligning with global initiatives for cleaner energy. Data analytics for predictive maintenance, increased customization to meet industry-specific needs, and a strong emphasis on safety features and ergonomic design are also shaping the market. The ongoing global infrastructure development, coupled with economic trends, plays a pivotal role in driving demand for earthmoving equipment, making it essential for businesses to stay abreast of these trends to remain competitive and capitalize on emerging opportunities.

Market Drivers:

Rise in Rental Services

The increasing popularity of equipment rental services signifies a transformative shift in the earthmoving equipment market, providing businesses with a cost-effective alternative to traditional ownership models. This trend is driven by the recognition that renting machinery offers greater financial flexibility, reducing the upfront capital investment required for acquiring earthmoving equipment. Businesses can now access a diverse range of earthmoving machinery without committing to long-term ownership, enabling them to allocate resources more efficiently. The rental model also proves advantageous for projects with fluctuating equipment requirements, allowing companies to scale their fleet according to specific job demands. As a result, this growing inclination towards rental services not only fosters enhanced accessibility to earthmoving equipment but also acts as a significant driver in propelling the overall demand for these machines, shaping a dynamic and adaptable landscape for industry participants.

Global Economic Growth

The nexus between overall economic growth, particularly in developing regions, and the demand for earthmoving equipment is undeniable. As developing economies experience robust economic expansion, there is a consequential surge in construction and infrastructure development projects. Increased investment in urbanization, transportation networks, and various construction initiatives becomes a hallmark of this growth. In response to this upswing, there is a heightened demand for earthmoving equipment to facilitate essential tasks such as excavation, grading, and site preparation. This demand is intrinsic to the pivotal role that earthmoving machinery plays in the realization of large-scale infrastructure projects. The machinery becomes a cornerstone for efficiently transforming ambitious development plans into tangible structures. Consequently, the positive correlation between economic growth and the need for earthmoving equipment underscores the pivotal role these machines play in the advancement and transformation of burgeoning economies.

Market Restraints:

Limited Infrastructure in Developing Regions

In certain developing regions, the growth of the earthmoving equipment market faces substantial impediments due to inadequate infrastructure. One of the primary challenges is the lack of well-maintained roads, which hinders the seamless transportation of heavy earthmoving machinery to construction or excavation sites. Poor road conditions not only contribute to logistical challenges but also result in increased wear and tear on the equipment during transit, affecting its overall lifespan and operational efficiency. Additionally, the absence of proper storage facilities poses a significant challenge. Earthmoving equipment, given its size and weight, requires secure and well-equipped storage spaces when not in use. In the absence of adequate storage facilities, the machinery may be exposed to harsh environmental conditions, leading to premature deterioration and higher maintenance costs. This limitation discourages businesses from investing in earthmoving equipment, as the lack of proper storage options can compromise the longevity and performance of the machinery.

The COVID-19 pandemic has significantly impacted the Earth Moving Equipment market, inducing both short-term disruptions and long-term transformations. The initial phase witnessed a slowdown in manufacturing and supply chain activities due to lockdowns and restrictions, leading to a temporary decline in the production and delivery of earthmoving machinery. Project delays and cancellations in the construction and infrastructure sectors further dampened demand. However, as economies adapted to new norms, increased investments in remote and automated technologies to ensure operational continuity became evident. The pandemic underscored the importance of technology integration, fueling a shift towards telematics and digital solutions in earthmoving equipment. Additionally, the construction industry's resurgence with stimulus measures and infrastructure projects in various regions has sparked a recovery in demand. The ongoing focus on sustainable practices post-pandemic has also influenced manufacturers to develop more environmentally friendly earthmoving solutions. Overall, the COVID-19 impact has prompted resilience and innovation within the Earth Moving Equipment market, shaping a sector that is more technologically advanced and adaptable to the evolving global landscape.

Segmental Analysis:

Skid Steer Loaders Segment is Expected to Witness Significant Growth Over the Forecast Period

Skid steer loaders play a pivotal role in the Earth Moving Equipment market, serving as versatile and compact machinery that excels in various applications. These agile loaders are characterized by their ability to navigate confined spaces with ease, making them indispensable for construction, landscaping, and agricultural tasks. The Earth Moving Equipment market has witnessed a growing demand for skid steer loaders due to their exceptional manoeuvrability, robust lifting capabilities, and compatibility with a diverse range of attachments, enhancing their versatility. As construction projects increasingly require efficient and adaptable machinery, skid steer loaders have become integral in meeting these demands. The market for skid steer loaders reflects a trend towards compact, high-performance equipment, contributing to the overall dynamism and evolution of the Earth Moving Equipment sector.

Construction Segment is Expected to Witness Significant Growth Over the Forecast Period

The Construction and Earth Moving Equipment market is witnessing dynamic growth fueled by escalating urbanization, infrastructure development, and construction activities globally. With a surge in large-scale projects, such as road construction, residential and commercial buildings, and urban redevelopment initiatives, there is an increasing demand for specialized machinery. Excavators, bulldozers, loaders, and other earthmoving equipment are essential for tasks ranging from excavation and grading to material handling. Moreover, technological advancements, including telematics and automation, are enhancing the efficiency and precision of these machines. The market's trajectory is further influenced by sustainability considerations, leading to the development of eco-friendly equipment. As construction and infrastructure projects continue to expand, the Construction and Earth Moving Equipment market is poised for sustained growth, driven by the evolving needs of the industry and advancements in machinery technology.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

The Moving Equipment Market and Earthmoving Equipment Market represent vital segments within the broader construction and logistics industries. The Moving Equipment market encompasses a diverse range of products like forklifts, conveyor systems, and pallet jacks, crucial for material handling and warehouse operations. On the other hand, the Earthmoving Equipment Market focuses on heavy machinery such as excavators, bulldozers, and loaders, essential for construction, mining, and infrastructure projects. Both markets share common ground in facilitating efficient movement and management of materials, albeit in different operational contexts. As industries prioritize efficiency, safety, and technological advancements, the synergies between the Moving Equipment and Earthmoving Equipment markets underscore their complementary roles in driving productivity across various sectors.

Get Complete Analysis Of The Report - Download Free Sample PDF

The analyzed market exhibits a high degree of fragmentation, primarily attributable to the presence of numerous players operating on both a global and regional scale. The competitive landscape is characterized by a diverse array of companies, each contributing to the overall market dynamics. This fragmentation arises from the existence of specialized solution providers, established industry players, and emerging entrants, all vying for market share. The diversity in market participants is underscored by the adoption of various strategies aimed at expanding the company presence. On a global scale, companies within the studied market are strategically positioning themselves through aggressive expansion initiatives. This often involves entering new geographical regions, targeting untapped markets, and establishing a robust global footprint. The pursuit of global expansion is driven by the recognition of diverse market opportunities and the desire to capitalize on emerging trends and demands across different regions. Simultaneously, at the regional level, companies are tailoring their approaches to align with local market dynamics. Regional players are leveraging their understanding of specific market nuances, regulatory environments, and consumer preferences to gain a competitive edge. This regional focus allows companies to cater to the unique needs of local clientele, fostering stronger market penetration. To navigate the complexities of the fragmented market, companies are implementing a range of strategies. These strategies include investments in research and development to stay at the forefront of technological advancements, mergers and acquisitions to consolidate market share, strategic partnerships for synergies, and innovation to differentiate products and services. The adoption of such multifaceted strategies reflects the competitive nature of the market, with participants continually seeking avenues for growth and sustainability. In essence, the high fragmentation in the studied market not only signifies the diversity of players but also underscores the dynamism and competitiveness that drive ongoing strategic manoeuvres. As companies explore various avenues for expansion, the market continues to evolve, presenting both challenges and opportunities for industry stakeholders. Some of the key market players working in this segment are:

Recent Development:

1) In April 2022, Doosan Corporation unveiled its latest additions to the mini-excavator lineup with the introduction of the DX27Z-7, weighing 2.8 tons, and the DX35Z-7, with a weight of 3.9 tons. These new models comply with Stage V emission standards and boast an expanded operating range, surpassing both their predecessors and other mini excavators in the market. Notably, they feature enhanced lifting capacity and digging forces, further solidifying their versatility across a diverse range of applications. This strategic product launch positions Doosan Corporation to effectively address a broad spectrum of excavation needs, catering to the demands of various industries.

2) In the early days of 2023, Zoomlion Heavy Industry Science & Technology achieved a significant milestone by dispatching close to 200 units of earthmoving machinery from its Earthmoving Machinery Park in the Zoomlion Smart City. This event, which took place on January 8, marked a promising commencement for the year 2024. The strategic distribution of this substantial fleet to Australia and Europe underscores Zoomlion's commitment to expanding its global presence and contributing to the growth of the earthmoving machinery market on a global scale.

Q1. What was the Earthmoving Equipment Market size in 2023?

As per Data Library Research the global earthmoving equipment market size was valued at USD 65.2 billion in 2023.

Q2. What is the Growth Rate of the Earthmoving Equipment Market ?

Earthmoving Equipment Market is expected to grow at a CAGR of 8.2% over the forecast period.

Q3. What are the factors on which the Earthmoving Equipment market research is based on?

By Type of Equipment, By Application and Geography are the factors on which the Earthmoving Equipment market research is based.

Q4. What are the factors driving the Earthmoving Equipment market?

Key factors that are driving the growth include the Rise in Rental Services and Global Economic Growth.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model