The Enterprise Risk Management Market size was valued at USD 43.22 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 12.12% over the forecast period, 2023 to 2030.

Get Complete Analysis Of The Report- Download Free Sample PDF

ERM is a comprehensive approach that enables businesses to identify, assess, and prepare for potential losses, dangers, hazards, and other risks that may hinder their operations and objectives. It is a top-down strategy that aims to shape the overall risk position of a firm by mandating certain business segments to engage or disengage from specific activities. By adopting ERM practices, companies can mitigate operational, financial, security, compliance, legal, and various other types of risks.

The expansion of this market can be ascribed to the advantages of adopting eGRC, which encompass stability, optimization, transparency, cost reduction, and consistency, among others. Moreover, the presence of companies like Microsoft, Oracle Corporation, SAP SE, and Software AG has led to a diverse array of products in the market due to their unique attributes, thereby propelling its growth.

The future of risk management is influenced by emerging trends and technologies that enable organizations to proactively identify, assess, and mitigate risks. Key pillars in this transformation include artificial intelligence, machine learning, cybersecurity, big data analytics, and effective risk governance.

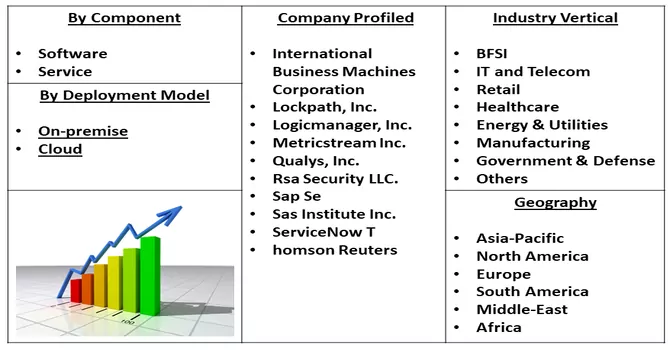

Segmentation:

The Risk Management Market is Segmented

By Component

By Deployment Model

Enterprise Size

Industry Vertical

Geography

For Detailed Market Segmentation - Download Free Sample PDF

Drivers:

Increase in data and security breaches among enterprises

Data and security breaches among enterprises have become a growing concern in recent years. These breaches can have severe consequences for businesses, including financial losses, reputational damage, and legal implications. Organizations are increasingly investing in data security measures to protect themselves from such breaches. According to a study, there were 68% more data breaches in 2021 compared to the previous year. In the first quarter of 2022, there were 14% more breaches compared to the same period in 2021. Enterprises are experiencing significant setbacks due to these breaches, with 10% paying USD 1,000,000 or more in ransoms tied to data security breaches annually. Data breaches can have a detrimental impact on a business’s bottom line.

Growth of the IoT landscape and Rise in adoption of risk management among financial institutions

The growth of the Internet of Things (IoT) landscape and the rise in the adoption of risk management among financial institutions are two significant trends that are shaping the future of risk management. The IoT is a network of interconnected devices that can communicate with each other and exchange data. The rise of IoT has led to an increase in the amount of data generated by these devices, which has created new opportunities for businesses to manage risks proactively. Financial institutions are increasingly adopting risk management practices to mitigate operational, financial, security, compliance, legal, and various other types of risks.

Furthermore, the recent development in this market segment is driving the growth of the studied market. For instance, in September 2021, Microsoft announced the general availability of its Azure Purview, a cloud-native data governance solution that helps businesses govern multi-cloud, SaaS, and on-premises data. Integrating AI with Enterprise Governance Risk and Compliances enhances the capabilities of the offered Enterprise Governance Risk and Compliances solution, which can help the solution be widely adopted in multiple industries to cater to high demand. Thus, the above-mentioned factors are driving the growth of the studied market.

Restraints:

High Cost and Complexity in Installation and Configuration of the Software

The high cost and complexity of installation and configuration of software can be a significant challenge for businesses. These factors can lead to delays in implementation, increased costs, and reduced efficiency. With these challenges, businesses can consider adopting cloud-based solutions that offer lower costs and simplified installation and configuration processes. Cloud-based solutions can also provide scalability, flexibility, and enhanced security features.

The COVID-19 pandemic has had a significant impact the various other markets globally and so has impacted enterprise risk management (ERM). The pandemic has forced ERM teams to focus on evaluating supply chains, cybersecurity risks, and remote work issues, among others. For instance, an article published by the National Center for Biotechnology Information in June 2022, reported that the COVID-19 crisis has caused companies to move away from siloed thinking in terms of risk management. Moving forward, it is all about finding the opportunities in risks and expanding upon them to create a positive outcome for your organization. Thus, initially, the market witnessed significant challenges, but with the presence of various industrial players and developments, the market is expected to witness significant growth over the forecast period.

Segmental Analysis:

Software By Component Segment is Expected to Witness Significant Growth Over the Forecast Period

The software segment is expected to occupy the largest share of the eGRC market during the forecast period. This growth can be attributed to the large number of players in the market offering software solutions. Additionally, many companies in the eGRC market have a global presence, which has resulted in wider adoption of the software segment during the forecast period. For example, Oracle has user communities in 97 countries and 5 million registered members of Oracle customer and developer communities as of 2021. The wide reach of major companies in the market has resulted in high market growth during the forecast period.

Cloud Based Model by Deployment Segment is Expected to Witness Significant Growth Over the Forecast Period

Cloud computing offers numerous benefits for risk management, including scalability, flexibility, cost-efficiency, and innovation. By leveraging cloud services, you can conveniently access and manage your data and systems from any location, at any time, and on any device. Risk management enables organizations to ensure any potential threats to cloud-deployment security, assets, and business plans are identified and treated before they derail the organization's goals. It has far-reaching benefits that can fundamentally change the decision-making process of the organization. Thus, due to the above-mentioned factors the market is expected to witness significant growth over the forecast period.

Small Size Enterprise is Expected to Witness Significant Growth over the Forecast Period

The number of small businesses is increasing, and the statistics number for financial loss or business failure will grow accordingly. Therefore, managing risks to reduce and minimize the loss exposure is essential for every small business. ERM supports better structure, reporting, and analysis of risks. Standardized reports that track enterprise risks can improve the focus of directors and executives by providing data that enables better risk mitigation decisions. Thus, due to the growing small-size enterprises and the benefits associated with risk management systems, the segment is expected to witness significant growth over the forecast period.

The Healthcare Industrial Vertical Segment is Expected to Witness Significant Growth Over the Forecast Period

Risk management in healthcare, also known as medical risk management, encompasses the practices implemented to ensure the safe operation of medical facilities in compliance with financial and governmental regulations. It is a comprehensive approach that aims to protect patient safety and the organization’s assets, market share, accreditation, reimbursement levels, brand value, and community standing. Healthcare risk management involves a range of areas, including operational risks such as staffing and training, clinical and patient safety risks, strategic risks related to brand reputation and goal achievement, and financial risks such as malpractice litigation costs.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North America is projected to hold the largest share in the enterprise governance, risk & compliance (eGRC) market by region. This can be attributed to the presence of major players in the eGRC market, including Dell Inc., IBM, Microsoft, and Oracle, among others.

The strong presence of these companies has directly contributed to the growth of this region. For instance, in June 2023, SAI360 announced the launch of 2023 Release Two, unveiling new tools and resources to help companies accelerate and operationalise their ESG initiatives. Further, the release also includes software & educational resources to support initiatives related to governance, compliance, environment, learning, health, safety, and sustainability.

Additionally, businesses in North America have demonstrated a positive attitude towards digitalization, cybersecurity, and data protection. For example, a report published by the International Institute for Management Development in September 2022 named “2022 IMD World Digital Competitiveness Ranking” ranked the U.S. second among all countries in terms of digital competitiveness. Thus, the region is expected to witness significant growth over the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

Competitive Landscape:

The Enterprise Risk Management Market is highly fragmented, due to the presence of many companies working globally and regionally. Some of the major players working in this industrial segment are

Recent Developments:

1) In June 2023, MetricStream unveiled the launch of AiSPIRE, an AI-driven GRC, for boosting decision-making capabilities and enhancing efficiency. The solution was aimed at delivering cognitive insights throughout all aspects of eGRC.

2) In June 2023, Microsoft Corporation announced its partnership with Moody. The aim of this strategy was to deliver next-generation data, analytics, research, collaboration, and risk solutions for financial services and global knowledge workers.

Q1. What is the market size of the Enterprise Risk Management Market?

Enterprise Risk Management Market is projected to grow at a compound annual growth rate (CAGR) of 12.12% over the forecast period.

Q2. What are the factors on which the Enterprise Risk Management Market research is based on?

By Component, By Deployment model, By Enterprise size, By Industrial vertical & Geography are the factors on which the Enterprise Risk Management Market research is based.

Q3. What are the Growth Drivers of the Enterprise Risk Management Market?

Increase in data and security breaches among enterprises & Growth of the IoT landscape and Rise in adoption of risk management among financial institutions are the Growth Drivers.

Q4. Which Region is expected to hold the highest Market share?

North America region is expected to hold the highest Market share.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model