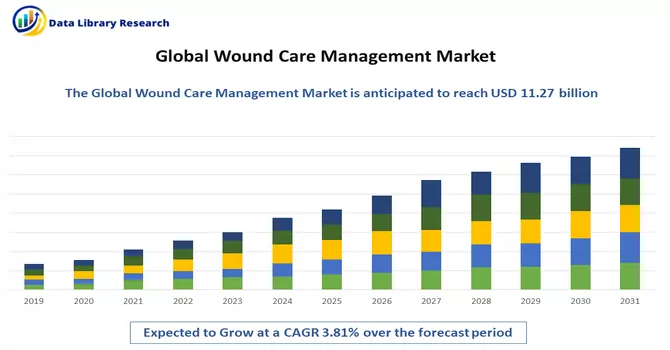

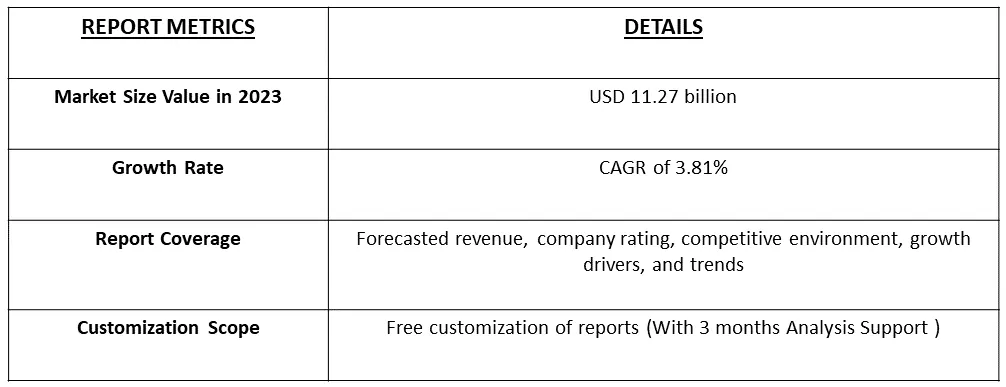

The Wound Management Market size is expected to grow from USD 11.27 billion in 2023 registering a CAGR of 3.81% during the forecast period (2023-2030).

Get Complete Analysis Of The Report - Download Free Sample PDF

Wound management is an ongoing treatment of a wound, by providing an appropriate environment for healing, by both direct and indirect methods, together with the prevention of skin breakdown.

The increasing incidences of chronic wounds, ulcers, and diabetic ulcers, the rising volume of surgical procedures worldwide, and the increasing product advancements are the major factors propelling the market's growth. Diabetes is a major wound-causing disease, along with other chronic diseases.

The development of innovative wound dressings, including hydrocolloids, hydrogels, foam dressings, and antimicrobial dressings, is on the rise. These dressings provide better moisture management, infection control, and improved healing outcomes.

Segmentation:

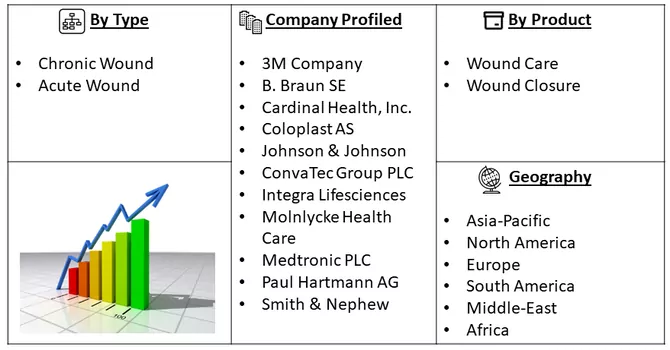

The Wound Care Management Market is Segmented

By Product :

Wound Type :

Geography

The report offers the value (in USD million) for the above segments. The use of biological products, such as growth factors, stem cells, and tissue-engineered skin substitutes, is gaining traction. These biologics promote tissue regeneration and accelerate wound healing.

For Detailed Market Segmentation - Download Free Sample PDF

Drivers:

The prevalence of chronic wounds, particularly diabetic foot ulcers, is on the rise, primarily driven by the increasing diabetic population. According to the 2021 report from the International Diabetes Federation (IDF), there were approximately 537.0 million individuals living with diabetes globally. This report also highlights the alarming trend of a continuous increase in the number of people affected by diabetes each year. This surge in diabetes cases is a significant factor contributing to the growing incidence of diabetic ulcers, thereby contributing to the studied market growth.

The growth in the elderly population is significantly driving the demand for wound care management. For instance, according to a 2021 report from the Germany Federal Statistical Office, Germany had a total population of approximately 83.0 million people, with 16.2 million individuals aged 67 years and above. Projections indicate that this figure will climb to 21.4 million by the year 2040. Considering that the elderly population is more susceptible to chronic conditions such as diabetes and the associated diabetic foot ulcers, the expanding geriatric demographic is poised to fuel the demand for wound care management. As the number of older individuals continues to rise in various countries, there is an expected increase in the requirement for wound management, particularly in cases related to diabetes and other chronic ailments. Consequently, substantial market growth is anticipated throughout the forecast period.

Restraints:

The absence of comprehensive reimbursement policies for wound care management procedures presents a significant challenge to both patients and healthcare providers. Wound care treatments often involve a range of specialized services, including wound assessment, debridement, dressings, and ongoing monitoring. These treatments can be costly, and without adequate reimbursement mechanisms in place, patients may face financial burdens. Healthcare facilities and providers also encounter challenges in delivering wound care services without appropriate reimbursement. This can impact the availability and quality of wound care treatment, potentially leading to delays in care and less favorable patient outcomes. Thus, reimbursement issues may slow down the growth of the studied market.

The COVID-19 pandemic had a notable impact on the wound care management market. It disrupted the global economy and significantly affected the regular provision of healthcare services in hospitals, particularly for non-COVID-19 patients. Research, such as a September 2021 article published by the NCBI, indicates that a substantial proportion of patients with chronic wounds postponed both preventive and urgent wound care during the pandemic. Furthermore, during the pandemic, there was a heightened emphasis on wound care to prevent severe wound-related complications, which would otherwise necessitate hospitalizations and surgeries. For instance, a June 2022 article by UpToDate Inc. highlighted that the delivery of wound care recognized as an essential medical service, underwent changes during the COVID-19 pandemic. This shift resulted in limited access to wound care management services during the pandemic, negatively affecting the market. However, as COVID-19 cases decline and healthcare services gradually resume normal operations, the market is witnessing a resurgence and is expected to sustain this positive trajectory throughout the forecast period.

Segmental Analysis:

The diabetic foot ulcer segment is poised for substantial growth during the forecast period, primarily driven by the rising incidence of diabetic foot ulcers.

These ulcers typically develop on the soles of diabetic patients and are a significant contributor to the segment's expansion. For instance, data from the University of Michigan Health in 2021 revealed that approximately 15.0% of individuals with diabetes are affected by ulcers. Furthermore, diabetic foot ulcers can lead to hospitalization in about 6.0% of diabetic patients. Given the large global diabetic population, the prevalence of associated foot ulcers is expected to drive demand for proper wound care management, consequently fueling the growth of this segment.

Additionally, a research article published in the Journal of Foot in February 2022 highlighted that nearly 67.0% of leg amputations in the United States were linked to diabetes. Governments in major countries are taking proactive measures to address the issue of diabetic foot ulcers, further contributing to the segment's growth. For example, in July 2021, the National Institute of Health (NIH) funded six research institutions in North America to establish the Diabetic Foot Consortium (DFC). This consortium focuses on creating a clinical trial network to enhance diabetic wound healing and prevent amputations among the 27 million American adults with diabetes. Supported by the NIH’s National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK), these initiatives are expected to significantly drive the growth of the diabetic foot ulcer segment during the forecast period.

North America is Expected to Witness Significant Growth During the Forecast Period

North America is poised for significant growth during the forecast period, primarily attributed to the increasing incidence of chronic diseases and the resulting wounds and ulcers. The region's growth is driven by the rising cases of chronic wounds, necessitating effective pain management and addressing comorbidities associated with these conditions. For example, data from the International Diabetes Federation Diabetes Atlas Tenth Edition reveals that in 2021, approximately 32.2 million individuals in the United States had diabetes, and this number is projected to increase to 36.3 million by 2045. The growing diabetic population in the region is expected to lead to a rise in diabetic ulcer cases, further contributing to the growth of the wound care management market.

Several factors are driving the growth of the wound care management market in the United States. These include key product launches, a high concentration of market players and manufacturers, strategic acquisitions and partnerships among major industry players, and an increasing prevalence of chronic wounds across the country. As an example, research published in the Journal Foot and Ankle Research in June 2021 highlighted that rural Americans with diabetic foot ulcers faced a 50.0% risk of major amputation compared to their urban counterparts. The demand for effective wound care management in rural areas of the United States is expected to bolster market growth.

Furthermore, a significant portion of the U.S. population is affected by chronic diseases, which are common precursors to chronic wounds. A March 2021 article in the Journal of Advances in Wound Care indicated that chronic wounds negatively impact the quality of life (QoL) of nearly 2.5% of the U.S. population. Therefore, the increasing number of individuals affected by chronic wounds, ulcers, and diabetic ulcers is anticipated to drive the growth of the U.S. wound care management market throughout the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

The wound care management market is competitive and consists of several major players. The market players are committed to developing innovative healing solutions for customers and patients across the care continuum, generating proven clinical outcomes. The companies are also showing continuous growth and developing new and differentiated products and services, which address the evolving healthcare needs of patients, providers, and consumers. Some of the companies currently dominating the market are:

Key Players :

Recent Developments:

1. In October 2022, Healthium Medtech launched a new wound dressing portfolio, Theruptor Novo, for the management of chronic wounds like diabetic foot ulcers and leg ulcers. With the launch of Theruptor Novo, Healthium strengthened its existing portfolio of patented products in the advanced wound dressing segment.

2. In June 2022, Smith+Nephew announced its plans to build a new R&D and manufacturing facility for its Advanced Wound Management franchise on the outskirts of Hull, United Kingdom.

Q1. What is the current Wound Care Management Market size?

The Wound Management Market size is expected to grow USD 11.27 billion.

Q2. What is the Growth Rate of the Wound Care Management Market?

Wound Care Management Market is registering a CAGR of 3.81% during the forecast period.

Q3. Which region has the largest share of the Wound Care Management Market? What are the largest region's market size and growth rate?

North America region has the largest share of the market . For detailed insights on the largest region's market size and growth rate request a sample here

Q4. What segments are covered in the Wound Care Management Market Report?

By Wound Type, By Product and Geography are the segments covered in the Wound Care Management Market.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model