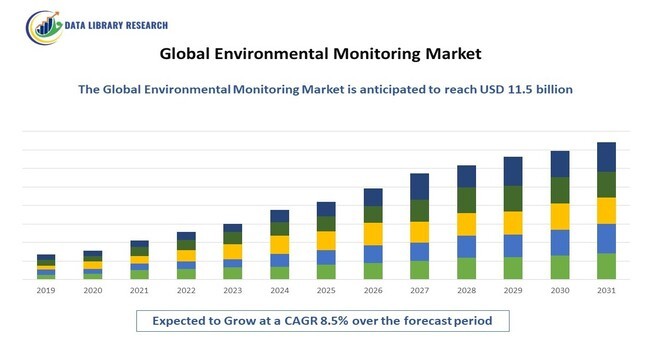

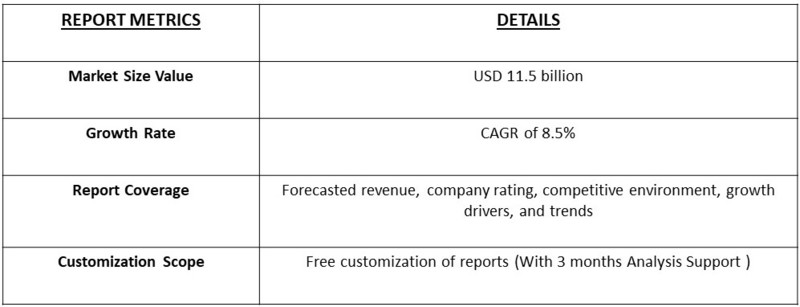

The Global Environmental Monitoring Market is projected to reach a market value of approximately 11.5 billion by 2023, growing at a Compound Annual Growth Rate (CAGR) of 8.5% from 2023 to 2031, driven by increasing government regulations and initiatives to monitor and mitigate the impact of climate change, as well as growing demand for real-time monitoring and data analytics in industries such as agriculture, energy, and healthcare.

Get a Complete Analysis Of The Report - Download Free Sample PDF

The Environmental Monitoring Market refers to the global industry that provides solutions and technologies for monitoring and tracking environmental parameters such as air and water quality, noise levels, and climate change. This market encompasses a wide range of products and services, including sensors, monitoring stations, data analytics software, and consulting services. The primary goal of environmental monitoring is to collect and analyze data to inform decision-making and mitigate the impact of human activities on the environment. The market is driven by increasing government regulations, growing awareness of environmental issues, and the need for sustainable development.

The Environmental Monitoring Market is driven by several key factors, including increasing government regulations and initiatives to monitor and mitigate the impact of climate change. Growing awareness of environmental issues and the need for sustainable development are also key drivers, as well as the need for real-time monitoring and data analytics in industries such as agriculture, energy, and healthcare. Additionally, the market is driven by the increasing adoption of IoT and AI technologies, which enable more accurate and efficient monitoring and analysis of environmental data.

The Environmental Monitoring Market is witnessing several key trends, including the increasing adoption of IoT and AI technologies, which enable more accurate and efficient monitoring and analysis of environmental data. Another trend is the growing demand for real-time monitoring and data analytics, particularly in industries such as agriculture, energy, and healthcare. Additionally, the market is seeing a shift towards more sustainable and eco-friendly monitoring solutions, such as solar-powered monitoring stations and biodegradable sensors.

The Global Environmental Monitoring Market is Segmented by Type (Air Quality Monitoring, Water Quality Monitoring, Soil Quality Monitoring, Noise Monitoring, and Radiation Monitoring), Technology (Sensors, Remote Sensing, Geographic Information Systems (GIS), Data Loggers and Analytical Instruments), Application (Government Agencies, Industrial Sector, Research and Academia, Healthcare and Agriculture), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The report offers the market size and forecasts for revenue (USD million) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The Environmental Monitoring market is driven by increasing government regulations and initiatives aimed at reducing environmental pollution and promoting sustainable development. For instance, the European Union's Green Deal aims to reduce greenhouse gas emissions by 55% by 2030, while the US Environmental Protection Agency (EPA) has set a goal to reduce methane emissions from the oil and gas sector by 45% by 2025. These regulations are driving demand for environmental monitoring solutions that can help companies comply with regulations and reduce their environmental impact. According to a recent report by the International Energy Agency (IEA), the global energy sector is expected to account for 60% of greenhouse gas emissions by 2030, highlighting the need for increased monitoring and regulation to reduce emissions.

The Environmental Monitoring market is also driven by growing demand for real-time monitoring and data analytics, particularly in industries such as agriculture, energy, and healthcare. For instance, farmers are increasingly using real-time monitoring systems to track soil moisture, temperature, and other environmental factors to optimize crop yields and reduce water consumption. Similarly, energy companies are using real-time monitoring systems to track energy consumption and reduce energy waste. According to a recent report by the World Economic Forum, the use of real-time monitoring and data analytics in agriculture can increase crop yields by up to 20% and reduce water consumption by up to 30%.

One of the key restraints on the Environmental Monitoring market is the high initial investment costs associated with deploying monitoring systems. For instance, installing a network of sensors and monitoring stations can require significant upfront capital expenditures, which can be a barrier to entry for smaller companies or those with limited budgets. Additionally, the cost of maintaining and upgrading these systems can also be high, which can be a deterrent for companies that are not willing or able to commit to long-term investments. According to a recent report by the International Renewable Energy Agency (IRENA), the cost of solar panels has fallen by 70% over the past decade, making them more competitive with fossil fuels. However, the cost of monitoring and maintaining these systems can still be high, highlighting the need for more affordable and accessible monitoring solutions.

The COVID-19 pandemic has had a significant impact on the Environmental Monitoring market, with the global lockdowns and travel restrictions leading to a temporary slowdown in the demand for environmental monitoring solutions. However, the pandemic has also accelerated the adoption of remote monitoring and digital technologies, as governments and organizations seek to maintain environmental monitoring capabilities while minimizing the risk of human exposure. As a result, the pandemic has created new opportunities for the Environmental Monitoring market, including the development of more advanced and cost-effective monitoring solutions that can be deployed remotely.

The growth of the air quality monitoring segment is driven by increasing concerns over pollution and its impact on public health. Rising levels of urbanization and industrial activities contribute to deteriorating air quality, necessitating more comprehensive monitoring. Advancements in sensor technology have improved the accuracy and affordability of air quality measurements, making it more accessible to both governmental and private entities. Stringent regulations and policies aimed at reducing air pollution also push for enhanced monitoring systems. Additionally, growing public awareness and demand for cleaner air further fuel the expansion of this segment.

The sensors sub-segment is experiencing significant growth due to advancements in technology and increased application across various environmental monitoring areas. Innovations in sensor technology have led to more precise, reliable, and cost-effective devices for measuring pollutants, radiation, and other environmental factors. The development of compact, smart sensors with enhanced connectivity capabilities supports real-time data collection and analysis. Increased adoption in both developed and developing regions, driven by regulatory requirements and technological advancements, further propels the growth of the sensor market. Additionally, the integration of sensors into consumer products and industrial applications continues to expand their use.

Government agencies are crucial drivers of the environmental monitoring market due to their role in enforcing regulations and policies related to environmental protection. Increased funding and investment in environmental monitoring programs by governments are driven by rising concerns over climate change, pollution, and public health. Agencies use monitoring data to develop and implement policies, track environmental trends, and ensure compliance with regulations. Additionally, collaboration between governments and private sector organizations enhances the effectiveness of monitoring programs. The growing emphasis on sustainability and environmental stewardship further accelerates the need for comprehensive monitoring solutions by government bodies.

North America holds a leading position in the global environmental monitoring market due to its advanced technology infrastructure and strong regulatory framework. The region’s high levels of investment in environmental monitoring technologies, driven by stringent regulations and policies, support market growth. Both the U.S. and Canada have established comprehensive environmental monitoring programs that address air, water, and soil quality. Additionally, growing public awareness and demand for improved environmental quality drive technological innovations and adoption. The presence of major players and technology providers in North America also contributes to the region’s dominant position in the global market.

Get Complete Analysis Of The Report - Download Free Sample PDF

The competitive landscape of the global environmental monitoring market is robust and diverse, featuring a mix of established multinational companies and specialized regional players. Key players like Thermo Fisher Scientific, Siemens AG, and Horiba Ltd. lead the market with advanced technologies and comprehensive product portfolios, including air quality sensors, water testing equipment, and analytical instruments. These companies leverage their strong R&D capabilities and extensive distribution networks to maintain a competitive edge. Additionally, emerging players and technology innovators contribute to market dynamics by introducing novel solutions and enhancing data accuracy and connectivity. The competitive environment is further shaped by strategic collaborations, acquisitions, and partnerships aimed at expanding product offerings and market reach. The growing emphasis on sustainability and regulatory compliance drives continuous innovation and competition, ensuring that both technological advancements and customer needs are addressed effectively.

Here are ten prominent market players in the global environmental monitoring market:

Recent Development:

Q1. What are the driving factors for the Global Environmental monitoring Market?

The global environmental monitoring market is driven by several key factors including increasing awareness of environmental issues and stricter regulations aimed at pollution control. Growing concerns about climate change, air and water pollution, and public health spur demand for effective monitoring solutions. Advances in technology, such as improved sensors and data analytics, enhance the accuracy and efficiency of environmental monitoring systems. Additionally, the rise in industrial activities and urbanization necessitates robust monitoring to manage environmental impacts. Government initiatives and funding for environmental protection further support market growth, as do increasing public and corporate commitment to sustainability practices.

Q2. What are the restraining factors for the Global Environmental monitoring Market?

The global environmental monitoring market faces several restraining factors, including high initial costs associated with advanced monitoring technologies. Budget constraints, particularly in developing regions, can limit the adoption of sophisticated systems. Technical challenges, such as the need for regular maintenance and calibration of monitoring equipment, can also impede market growth. Furthermore, a lack of standardization and varying regulatory requirements across regions can create complexities for market players. Additionally, the integration of new technologies into existing systems may be hindered by compatibility issues and the need for extensive training.

Q3. Which segment is projected to hold the largest share in the Global Environmental monitoring Market?

The air quality monitoring segment is projected to hold the largest share in the global environmental monitoring market. Increasing urbanization and industrial activities have heightened concerns about air pollution and its impact on health, driving demand for comprehensive air quality monitoring solutions. Technological advancements have led to more accurate and cost-effective air quality sensors, making them widely adopted across various sectors. Governments and organizations worldwide are investing in air quality monitoring to comply with regulations and address public health concerns, further solidifying the segment’s dominant position in the market.

Q4. Which region holds the largest share in the Global Environmental monitoring Market?

North America holds the largest share in the global environmental monitoring market. The region benefits from advanced technological infrastructure, stringent environmental regulations, and substantial investments in monitoring technologies. The United States and Canada have well-established environmental monitoring programs and a high level of public and governmental awareness regarding environmental issues. Additionally, the presence of leading market players and continuous innovation in environmental technologies support North America's dominant position. The region’s emphasis on sustainability and regulatory compliance further drives market growth.

Q5. Which are the prominent players in the Global Environmental monitoring Market?

Prominent players in the global environmental monitoring market include Thermo Fisher Scientific, known for its comprehensive range of environmental analysis instruments; Siemens AG, which provides advanced monitoring systems and sensors; Horiba Ltd., specializing in air and water quality measurement technologies; ABB Ltd., offering automation solutions and environmental monitoring technologies; and Schneider Electric, known for its smart sensors and energy management systems. Other notable players include RKI Instruments, Aeroqual Ltd., Environnement S.A., Honeywell International Inc., and Yokogawa Electric Corporation, all of which contribute to the market through innovative solutions and extensive product portfolios.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model