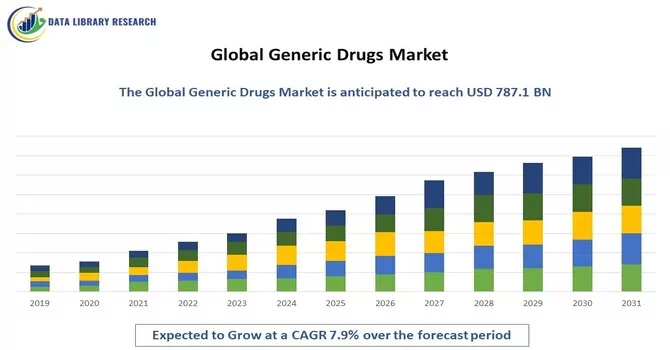

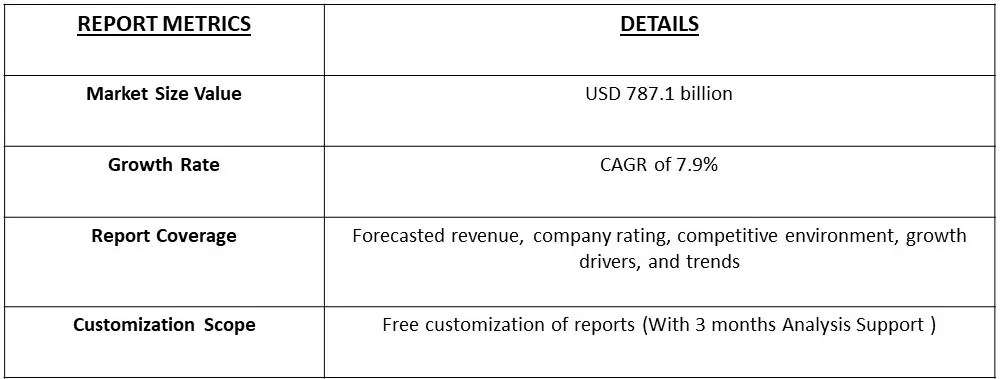

The global generic drugs market is expected to grow significantly, with estimates suggesting a market value of 417.1 billion in 2023 and 787.1 billion in 2031, representing a compound annual growth rate (CAGR) of 7.9% from 2023 to 2031.

Get a Complete Analysis Of The Report - Download Free Sample PDF

The global generic drugs market encompasses the sector involved in the production and distribution of medications that are equivalent to branded drugs in dosage form, strength, route of administration, and intended use, but are marketed under their chemical names without the brand label. These drugs are typically offered at lower prices compared to their branded counterparts, driving cost efficiency in healthcare. The market includes a wide range of pharmaceutical categories, including both prescription and over-the-counter drugs. Key factors influencing this market include patent expirations of branded drugs, regulatory approvals, and increasing healthcare access in emerging economies. The market dynamics are shaped by competitive pricing strategies, regulatory frameworks, and the growing demand for affordable healthcare solutions. ***The global generic drugs market is primarily driven by the expiration of patents for branded pharmaceuticals, which creates opportunities for generic alternatives to enter the market at reduced prices. Increasing healthcare costs and the growing demand for cost-effective treatments further fuel the adoption of generics. Additionally, supportive regulatory frameworks and streamlined approval processes for generic drugs enhance market accessibility and competitiveness. The rise in chronic diseases and an aging population also contribute to the increased need for affordable medication options. These factors collectively drive market growth and expansion across various regions.

The global generic drugs market is currently experiencing several notable trends, including the increasing adoption of biosimilars, which are driving significant growth in the biologics segment. As patents for blockbuster biologic drugs expire, biosimilars are becoming more widely accepted, offering cost-effective alternatives for treating complex conditions. Additionally, pharmaceutical companies are focusing on expanding their product portfolios by introducing generic versions of high-demand drugs, particularly in emerging markets where healthcare affordability is a priority. Digital transformation and e-commerce are also gaining traction, with more companies leveraging online platforms to enhance distribution and reach. Furthermore, regulatory harmonization across different regions is streamlining approval processes, allowing for faster market entry. These trends collectively underscore the market's shift towards greater accessibility, innovation, and global reach in the generic drugs sector.

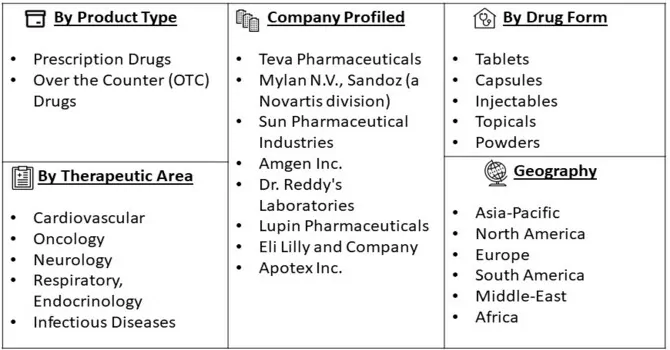

Market Segmentation: The Global Generic Drugs market is segmented by Product Type (Prescription Drugs and Over the Counter (OTC) Drugs), Drug Form (Tablets, Capsules, Injectables, Topicals and Powders), Therapeutic Area (Cardiovascular, Oncology, Neurology, Respiratory, Endocrinology, and Infectious Diseases) and geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The report offers the market size and forecasts for revenue (USD million) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Patent Expirations of Blockbuster Drugs

One of the primary drivers of the global generic drugs market is the expiration of patents on blockbuster branded drugs. When a pharmaceutical company's patent on a popular medication expires, it opens the door for generic drug manufacturers to produce and market bioequivalent versions at a lower cost. These generics can be sold at a fraction of the price of the original branded drugs, making them highly attractive to both healthcare providers and patients, particularly in markets where cost-containment is a priority. As a result, generic versions quickly capture significant market share, driving the overall growth of the generic drugs industry. This trend is particularly pronounced in markets like North America and Europe, where patent cliffs—periods during which several high-revenue drugs lose their patent protection—have led to a surge in generic drug approvals and market entry.

The expiration of patents on blockbuster branded drugs, such as Humira, which is expected to lose its patent protection in 2023. When a patent expires, the original manufacturer's exclusive rights to produce and sell the drug are lost, allowing generic manufacturers to enter the market and produce similar versions of the medication. This leads to increased competition, which in turn drives down prices, making the medication more affordable for patients and healthcare systems. As a result, the expiration of patents on blockbuster drugs like Humira is expected to lead to significant price reductions and increased competition, driving growth in the global generic drugs market

Government Initiatives and Cost-Containment Measures

Governments worldwide are increasingly promoting the use of generic drugs as part of broader healthcare cost-containment strategies. With the rising burden of healthcare expenses, especially in aging populations, many governments are encouraging the substitution of branded medications with more affordable generics to reduce public healthcare spending. This is supported by policies that streamline the approval process for generic drugs, provide incentives for generic drug manufacturers, and promote awareness among healthcare providers and patients about the safety and efficacy of generics. *** For example, in the United States, the Food and Drug Administration (FDA) has implemented initiatives to expedite the review of generic drug applications, while in Europe, similar efforts are underway to harmonize regulatory processes across member states. In emerging markets, governments are also investing in local production of generics to enhance access to essential medicines. These government initiatives and policies are key drivers that are expanding the reach and adoption of generic drugs globally, ensuring broader access to affordable healthcare.

Market Restraints:

The global generic drugs market faces several significant restraints that could limit its growth. Stringent regulatory requirements are a major challenge, as generic drug manufacturers must navigate complex and varied approval processes across different regions, which can be time-consuming and costly. These regulations are particularly rigorous for biosimilars, where demonstrating equivalence to the original biologic drug adds an additional layer of complexity. Pricing pressures also constrain the market, as governments and insurance companies often push for lower prices to control healthcare costs, squeezing the margins for generic drug producers. Additionally, intense competition from both branded drugs and other generic manufacturers leads to price erosion and reduced profitability. Furthermore, patent litigation and legal battles with original drug manufacturers can delay the entry of generics into the market, while the increasing consolidation in the pharmaceutical industry can limit market opportunities for smaller players. These factors collectively pose challenges that generic drug manufacturers must overcome to sustain growth in a highly competitive and regulated market.

The COVID-19 pandemic had a profound impact on the global generic drugs market, presenting both challenges and opportunities. Initially, the market faced significant disruptions due to supply chain interruptions, factory shutdowns, and export restrictions, particularly in key manufacturing hubs like India and China. These disruptions led to shortages of raw materials and active pharmaceutical ingredients (APIs), causing delays in the production and distribution of generic drugs. However, the pandemic also highlighted the critical role of generic drugs in ensuring affordable access to essential medications, driving increased demand for generics, especially for treating COVID-19 symptoms and related conditions. Governments and healthcare systems worldwide prioritized the availability of cost-effective treatments, leading to accelerated approvals for certain generic drugs and a renewed focus on strengthening local manufacturing capabilities. The crisis also spurred innovation in supply chain management and digital healthcare solutions, positioning the generic drugs market for resilience and growth in the post-pandemic era.

Segmental Analysis:

Prescription Drugs Segment is Expected to Witness Significant Growth Over the Forecast Period

The prescription drugs sub-segment of the global generic drugs market plays a crucial role, driven by the expiration of patents on branded drugs and the increasing demand for cost-effective treatment options. Recent developments in this area include the launch of generic versions of high-cost specialty medications, such as biologics, which are now available due to the introduction of biosimilars. The driving factors for this sub-segment include the high cost of branded drugs, which motivates healthcare providers and patients to seek more affordable generic alternatives. Additionally, the growing prevalence of chronic diseases and an aging population contribute to the increased demand for generic prescription drugs. Regulatory approvals for new generics and the continuous efforts to streamline approval processes also support the expansion of this market segment.

The Injectable Segment is Expected to Witness Significant Growth Over the Forecast Period

The injectables sub-segment in the global generic drugs market is experiencing rapid growth due to the increasing use of injectable medications for various therapeutic areas, including oncology and diabetes. Recent advancements in this area include the development of generic versions of complex biologic injectables and biosimilars, which offer significant cost savings compared to their branded counterparts. The driving factors for this sub-segment include the rising demand for effective and long-acting injectable treatments, as well as the need to reduce healthcare expenses. Innovations in drug delivery systems and manufacturing technologies are also contributing to the growth of generic injectables, enabling the production of high-quality, affordable alternatives that meet the needs of patients and healthcare providers.

Cardiology Segment is Expected to Witness Significant Growth Over the Forecast Period

In the global generic drugs market, the cardiology segment represents a significant and growing area, driven by the increasing prevalence of cardiovascular diseases and the subsequent demand for affordable treatment options. The market for generic cardiovascular drugs is expanding as patents for key branded medications expire, providing opportunities for cost-effective generics to enter the market. This growth is supported by advancements in drug formulations and regulatory approvals that facilitate the development of high-quality, lower-cost alternatives. The emphasis on reducing healthcare costs and improving patient access to essential medications further accelerates the adoption of generic drugs in cardiology, positioning this segment as a critical component of the broader pharmaceutical landscape.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

In the global generic drugs market, North America holds a dominant position due to its advanced healthcare infrastructure, high vehicle ownership rates, and significant expenditure on pharmaceuticals. The region benefits from a robust regulatory environment that supports the approval and distribution of generic drugs, coupled with a strong demand for cost-effective alternatives to branded medications. The expiration of patents for several high-cost drugs and the increasing focus on reducing healthcare costs drive the growth of generic drugs in North America. Additionally, the region's well-established distribution networks and the presence of major pharmaceutical companies further enhance its market share, making it a pivotal player in the global generic drugs sector.

Generic Drugs Market Competitive Landscape:

The competitive landscape of the global generic drugs market is highly dynamic, characterized by a diverse range of key players vying for market share through strategic mergers, acquisitions, and partnerships. These companies leverage their extensive manufacturing capabilities, broad product portfolios, and global distribution networks to capture a significant portion of the market. Competition is driven by factors such as the expiration of patents, regulatory approvals, and the ongoing demand for cost-effective alternatives to branded drugs. The landscape is further shaped by innovations in drug formulations and technology, as well as the strategic focus on expanding into emerging markets.

Major competitors include:

Get a Complete Analysis Of The Report - Download a Free Sample PDF

Recent Development:

1) Teva Pharmaceuticals has recently expanded its generic drug portfolio by acquiring a portfolio of complex generics from the pharmaceutical company Allergan in early 2024. This acquisition enhances Teva’s capabilities in providing high-value generics, including complex formulations and biosimilars, addressing a growing market demand for these types of drugs. This strategic move is aimed at bolstering Teva’s position in the global market and diversifying its product offerings to include more high-margin, complex generics that cater to therapeutic areas with significant unmet needs.

2) Mylan N.V., now part of Viatris, has announced the launch of its first generic version of a high-profile oncology drug, Keytruda, in the European market in late 2023. This launch is a major development as it introduces a cost-effective alternative to one of the most widely used cancer treatments, potentially improving access for patients while capitalizing on the substantial market potential in the oncology segment. This move underscores Mylan’s strategic focus on expanding its presence in the oncology space and addressing the growing demand for affordable cancer therapies.

Q1. What are the driving factors for the Global generic drugs market?

The driving factors for the global generic drugs market include the expiration of patents on branded drugs, which opens opportunities for generic alternatives. The rising healthcare costs and the increasing demand for cost-effective medications further fuel the market growth. Additionally, supportive regulatory frameworks and streamlined approval processes facilitate the entry of generics into the market. The growing prevalence of chronic diseases and an aging population also contribute to the increased need for affordable generic medications. Advances in drug development and manufacturing technologies enhance the availability and quality of generics, driving further market expansion.

Q2. What are the restraining factors for the Global generic drugs market?

The global generic drugs market faces several restraining factors, including high initial investment costs for advanced manufacturing and regulatory compliance, which can be challenging for new entrants. Additionally, operational costs, such as those related to quality control and regulatory adherence, can impact profitability. Seasonal fluctuations and varying market conditions can affect revenue stability. Patent litigations and regulatory hurdles can delay the introduction of generics. Competition from branded drugs with extended exclusivity and the preference for premium products among certain consumer segments also pose challenges to the market.

Q3. Which segment is projected to hold the largest share in the Global generic drugs market?

The prescription drugs segment is projected to hold the largest share in the global generic drugs market. This is due to the significant number of high-cost branded prescription medications whose patents have expired, creating substantial opportunities for generic versions. The demand for affordable treatment options for a wide range of conditions drives this segment’s growth. Additionally, the large volume of prescription medications compared to over-the-counter drugs and the focus on reducing healthcare costs further solidify the dominance of this segment in the market.

Q4. Which region holds the largest share in the Global generic drugs market?

North America holds the largest share in the global generic drugs market. This region benefits from a well-established healthcare infrastructure, a high rate of pharmaceutical expenditure, and a strong regulatory framework that supports the approval and distribution of generic drugs. The expiration of patents for several major branded drugs and the focus on reducing healthcare costs drive the demand for generics in North America. The presence of leading pharmaceutical companies and a robust distribution network further contributes to North America's dominant position in the market.

Q5. Which are the prominent players in the Global generic drugs market?

Prominent players in the global generic drugs market include Teva Pharmaceuticals, Mylan N.V. (now part of Viatris), Sandoz (a Novartis division), Sun Pharmaceutical Industries, Dr. Reddy's Laboratories, Lupin Pharmaceuticals, Amgen Inc., Apotex Inc., and Cipla Limited. These companies are key players due to their extensive portfolios of generic medications, advanced manufacturing capabilities, and global distribution networks. Their strategic initiatives, such as acquisitions, product launches, and innovations, drive their significant presence and influence in the global market.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model