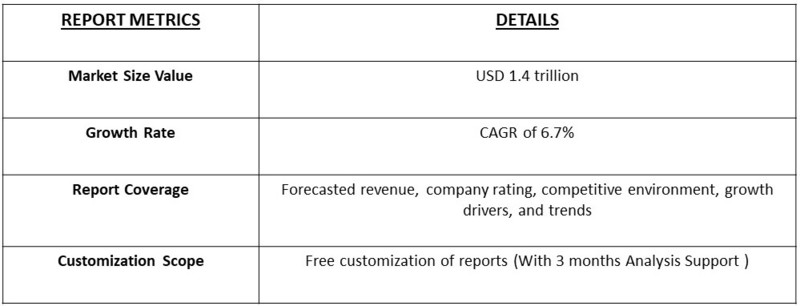

The global health and wellness food market is projected to reach a market value of approximately 1.4 trillion by 2023, growing at a Compound Annual Growth Rate (CAGR) of 6.7% from 2023 to 2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

The global health and wellness food market has experienced remarkable expansion, fueled by heightened consumer awareness of the crucial role diet plays in overall well-being. This market encompasses a wide range of products, including functional foods that offer specific health benefits, organic foods that avoid synthetic pesticides and fertilizers, and clean-label products free from artificial additives and allergens. Key drivers of this growth include the increasing prevalence of chronic diseases, an aging global population, and a rising emphasis on preventive healthcare measures.

The shift towards plant-based diets and a demand for transparency in food labeling are further transforming market dynamics. North America and Europe currently dominate the market due to their established consumer bases and advanced health awareness. However, the Asia-Pacific region is emerging as a significant growth area, driven by increasing disposable incomes and a growing consciousness about health and wellness among its consumers. To stay competitive, companies in this sector are focusing on innovation, such as developing new product formulations and incorporating sustainable practices, to meet evolving consumer preferences and capture a larger share of this dynamic and expanding market.

The global health and wellness food market is witnessing several key trends that are reshaping the industry. Consumers are increasingly demanding plant-based, organic, and clean-label products, driven by heightened awareness of the health benefits and environmental impact of their food choices. There's a significant shift towards functional foods and beverages fortified with ingredients that promote immune health, mental well-being, and gut health. Additionally, personalized nutrition is gaining traction, with advancements in technology enabling tailored dietary solutions based on individual health profiles. Sustainability is also a major trend, with both consumers and companies prioritizing eco-friendly sourcing, packaging, and production practices. As these trends converge, the market is evolving to meet the growing consumer demand for healthier, more sustainable food options.

Market Segmentation: The Global Health and Wellness Food Market is segmented by Product Type (Functional Foods, Organic Foods, Clean-Label Foods and Plant-Based Foods), Health Benefits (Weight Management, Heart Health, Digestive Health, and Immune Support), and geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The report offers the market size and forecasts for revenue (USD million) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Rising Health Consciousness and Preventive Healthcare:

One of the primary drivers of the global health and wellness food market is the growing awareness among consumers about the importance of maintaining a healthy lifestyle and diet. As chronic diseases such as obesity, diabetes, and heart disease become more prevalent, there is an increasing focus on preventive healthcare. Consumers are actively seeking foods that not only fulfill their nutritional needs but also contribute to overall well-being, such as those rich in antioxidants, vitamins, and minerals. Also, as per recent article published by NCBI, Eco-friendly and sustainable packaging solutions are becoming increasingly important, with 75% of consumers willing to pay more for products with minimal packaging waste.

This shift is further fueled by the availability of information on health and nutrition, which empowers consumers to make informed choices. The demand for functional foods that offer specific health benefits, such as boosting immunity or improving digestion, is rising as people prioritize long-term health outcomes.

Growing Demand for Natural and Organic Products:

Another significant driver is the increasing consumer preference for natural, organic, and clean-label products. As awareness of the potential negative effects of artificial additives, preservatives, and genetically modified organisms (GMOs) grows, consumers are gravitating towards foods that are perceived as healthier and more natural. Organic foods, in particular, are experiencing a surge in demand as they are associated with higher nutritional value, better taste, and environmental sustainability. The trend towards clean-label products, which are free from synthetic ingredients and clearly list all ingredients, is also gaining momentum. This demand is further supported by stringent regulations and standards that encourage transparency and authenticity in food production, pushing manufacturers to innovate and offer healthier, more natural product options.

Also, the growing demand for natural and organic products is driven by consumers seeking healthier and more sustainable options, with 75% of global consumers willing to pay more for organic products, according to a survey by the International Food Information Council. This trend is particularly evident in the global health and wellness food market, where natural and organic products are expected to account for 30% of the market share by 2025, up from 20% in 2020, driven by the increasing popularity of plant-based diets, functional foods, and clean labeling.

Market Restraints:

The global health and wellness food market faces several restraints that could hinder its growth despite strong demand. One of the primary challenges is the higher cost associated with producing health and wellness foods, particularly organic and clean-label products. These products often require more expensive raw materials, stringent quality control processes, and sustainable farming practices, which result in higher prices for consumers. This premium pricing can limit accessibility, especially in price-sensitive markets or among lower-income consumers, thus restricting market expansion.

Additionally, the complex regulatory environment governing health and wellness foods poses a significant restraint. Compliance with varying international standards, certifications (such as organic or non-GMO labels), and health claims regulations can be costly and time-consuming for manufacturers, particularly for smaller companies or startups. Furthermore, the market faces challenges related to consumer scepticism and misinformation. While there is growing demand for healthier options, some consumers remain wary of new ingredients or sceptical about the actual health benefits claimed by products, especially in the absence of clear and standardized labelling. These factors combined create a barrier to widespread adoption and market penetration, potentially slowing down the overall growth of the health and wellness food market.

The COVID-19 pandemic had a profound impact on the global health and wellness food market, accelerating its growth as consumers became more health-conscious and prioritized immune-boosting and nutritious foods. The crisis heightened awareness of the link between diet and overall health, driving demand for functional foods, supplements, and organic products that could support immune function and well-being. Panic buying and stockpiling of healthy food items became common, leading to short-term spikes in sales. Additionally, the pandemic fuelled a shift towards home cooking, as lockdowns and social distancing measures limited dining out options, prompting consumers to seek healthier ingredients and recipes to prepare at home. E-commerce platforms also saw a significant boost, as consumers turned to online shopping for their health and wellness food needs due to convenience and safety concerns. However, the pandemic also disrupted supply chains, leading to challenges in sourcing raw materials and manufacturing, which caused delays and increased costs. Despite these challenges, the pandemic ultimately reinforced the importance of health and wellness, leading to a sustained increase in demand for products that promote physical and mental well-being, and reshaping consumer preferences in the long term.

Segmental Analysis:

Functional Foods Segment is Expected to Witness Significant Growth Over the Forecast Period

Functional foods are gaining significant traction as consumers seek products that offer more than basic nutrition. These foods are enhanced with ingredients that provide specific health benefits, such as probiotics for digestive health or omega-3 fatty acids for heart health. Recent developments include the growing incorporation of functional ingredients like adaptogens and prebiotics into mainstream products. For instance, probiotic yogurts and fortified cereals have become popular choices. The rise in chronic health conditions and increasing awareness about preventive health care are major driving factors for this sub-segment. Consumers are increasingly looking for foods that support overall wellness and address specific health concerns, which is driving innovation in functional food offerings.

The Organic Foods Segment is Expected to Witness Significant Growth Over the Forecast Period

The organic foods sub-segment has seen a notable rise in popularity as more consumers become conscious of food production methods and their impact on health and the environment. Organic foods are produced without synthetic pesticides, fertilizers, or genetically modified organisms (GMOs), which appeals to health-conscious individuals and those concerned about environmental sustainability. This trend is supported by growing consumer demand for transparency in food labeling and a preference for natural and minimally processed foods. Developments include expanded product lines, such as organic snacks and beverages, and greater availability in mainstream supermarkets. The driving factors behind this growth include increasing awareness of the health benefits associated with organic food and a broader movement towards sustainable living.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

The growth of the global health and wellness food market in North America is driven by several key factors. Firstly, there is a strong consumer focus on health and preventive care, leading to increased demand for products that support overall well-being. The rising prevalence of chronic diseases such as diabetes and heart disease has heightened awareness about the importance of diet in managing and preventing these conditions. Additionally, the aging population in North America is seeking health-enhancing foods to improve quality of life and longevity.

Another significant factor is the trend towards healthier lifestyles, with consumers increasingly opting for organic, functional, and clean-label foods. The growing interest in plant-based diets and sustainable eating practices also contributes to market expansion. North American consumers are increasingly demanding transparency in food labeling and are willing to pay a premium for products that meet their health and ethical standards.

Innovation plays a crucial role as well, with companies continuously developing new products and formulations to meet evolving consumer preferences. The strong retail infrastructure, including the presence of numerous health-focused stores and online platforms, facilitates easy access to health and wellness foods. These factors collectively drive robust growth in the North American health and wellness food market.

Health and Wellness Food Market Competitive Landscape:

The competitive landscape of the health and wellness food market in North America is highly dynamic and characterized by a mix of established industry giants and emerging players. Major food companies are increasingly investing in innovation to cater to evolving consumer preferences, focusing on product development in organic, functional, and plant-based categories. Additionally, there is a strong emphasis on sustainability and clean-label products to meet the demand for transparency and ethical sourcing. New entrants and startups are disrupting the market with novel formulations and health-centric offerings, often leveraging direct-to-consumer models and digital platforms to reach niche audiences. Strategic partnerships, acquisitions, and mergers are common as companies seek to expand their product portfolios and market reach. This competitive environment is further intensified by consumer trends towards healthier lifestyles and the growing demand for transparency, driving companies to continuously adapt and innovate to maintain a competitive edge.

Get Complete Analysis Of The Report - Download Free Sample PDF

Key Health and Wellness Food Market Companies:

Recent Development:

1) In January 2024, Nestle Health Science, a leading player in the global health and wellness food market, announced the launch of its new probiotic-based product line, "Nestle Probiotics+, " designed to support gut health and immune system function. This innovative product line leverages Nestle's expertise in probiotics and gut health, and is expected to disrupt the functional foods market with its unique blend of probiotics and prebiotics.

2) In March 2023, Danone, a global leader in the dairy and plant-based food industry, acquired a majority stake in Wild, a US-based plant-based food company, for $300 million. This strategic acquisition enables Danone to expand its presence in the rapidly growing plant-based market, and to leverage Wild's expertise in developing innovative, plant-based products that cater to the growing demand for healthier and more sustainable food options.

Q1. What are the driving factors for the Global health and wellness food market?

The global health and wellness food market is primarily driven by increasing consumer awareness about the importance of a healthy diet in preventing chronic diseases. As conditions like diabetes and heart disease become more prevalent, people are seeking foods that offer specific health benefits. Additionally, the aging population is driving demand for products that support long-term health and longevity. The trend towards preventive healthcare, along with a growing preference for plant-based and clean-label foods, further fuels market growth. Technological advancements in food production also contribute to the development of innovative health-oriented products.

Q2. What are the restraining factors for the Global health and wellness food market?

The growth of the health and wellness food market faces several challenges, including the high cost of premium products, which can limit consumer access. Stringent regulatory requirements for health claims and certifications can complicate market entry and product development. In emerging markets, lower awareness and education about health benefits may slow growth. Additionally, complex supply chains for sourcing quality ingredients can be costly and challenging. Consumer scepticism about the effectiveness of health claims or product authenticity may also impact market growth.

Q3. Which segment is projected to hold the largest share in the Global health and wellness food market?

The functional foods segment is projected to hold the largest share in the global health and wellness food market. This segment includes foods enhanced with ingredients that offer specific health benefits, such as improved digestion or heart health. Growing consumer demand for products that support overall well-being and help prevent chronic diseases is driving the popularity of functional foods. Innovations in this area, along with increasing awareness about their benefits, contribute to their dominant market position.

Q4. Which region holds the largest share in the Global health and wellness food market?

North America holds the largest share of the global health and wellness food market. The region benefits from a strong consumer base with high health awareness and access to a wide range of health-focused products. Advanced retail infrastructure and significant investments in innovation further strengthen North America's market position. Additionally, rising health consciousness and the prevalence of chronic diseases drive demand for health and wellness foods in this region.

Q5. Which are the prominent players in the Global health and wellness food market?

Prominent players in the global health and wellness food market include major companies like Nestlé S.A., PepsiCo, Inc., and Danone S.A., which lead the market through extensive product portfolios and innovation. Other key players such as The Kellogg Company, General Mills, Inc., and Unilever PLC are also significant contributors, offering a variety of health-focused products. Additionally, companies like Beyond Meat, Inc. and WhiteWave (now part of Danone) are known for their innovative approaches in plant-based and organic food segments.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model