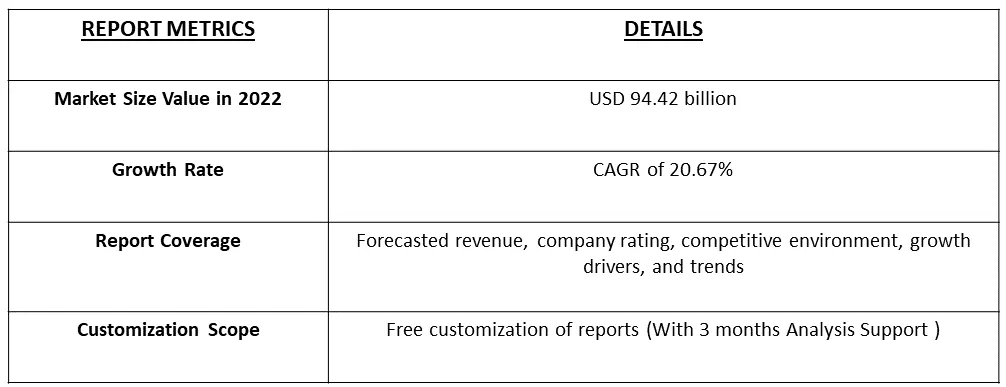

The Industry 4.0 Market size is expected to grow from USD 94.42 billion in 2022 to USD and is expected to register, at a CAGR of 20.67% during the forecast period (2023-2030).

Get Complete Analysis Of The Report - Download Free Sample PDF

Digital transformation in the manufacturing industry marks the advent of Industry 4.0, which addresses several global issues within the industry. It modernizes and automates the supply chains of manufacturing companies, which not only helps in data-driven planning but also provides a competitive advantage over counterparts and helps the companies stay ahead in the market. Industry 4.0 market for the study defines the revenues generated from the type such as industrial robotics, IIoT, AI and ML, blockchain, extended reality, digital twin, 3D Printing, and other technology types that are being used in various end-user industries across the globe. The study also analyses the overall impact of the COVID-19 pandemic on the ecosystem. The study includes qualitative coverage of the most adopted strategies and an analysis of the key base indicators in emerging markets.

With the introduction of Industry 4.0 in the production sector, numerous industrial facilities are adopting digital technology to improve, automate, and modernize the whole operation, enhancing the plants' productivity parameters.

Drivers:

Industry 4.0 persuaded OEMs to adopt IoT across their operations

The gradual increase in the adoption of IoT and digital transformation across several industries. For instance, according to the International Data Corporation's (IDC) Worldwide Semiannual Internet of Things Expenditure Guide, expenditure on the Internet of Things (IoT) in Europe exceeded USD 202 billion in 2021. It will likely increase at a double-digit rate through 2025. Maryville University estimates that by 2025 over 180 trillion gigabytes of data will be created worldwide every year. IIoT-enabled industries will generate a large portion of this.

Increasing collaborations among global companies to adopt innovative technologies and digital solutions.

In March 2021, NOKIA Firm partnered with WEG Industries, a Brazilian energy and automation company, to accelerate the evolution of the Nokia Digital Automation Cloud (DAC) technology and present an industrial 4.0 solution. Similarly, in June 2023: GE HealthCare Introduced Sonic DL, an advanced, FDA-Cleared AI Deep Learning Technology for Faster MRI. Sonic DL is a deep learning (DL) technology that primarily acquires high-quality magnetic resonance (MR) images up to around 12 times faster than conventional methods, allowing cardiac imaging within a single heartbeat. Thus, such developments are fueling the growth of the studied market

Restraints:

Relative Lack of Awareness on the ROI Related to Adoption of Industry 4.0

The majority of modestly-sized manufacturers have a low level of awareness regarding how Industry 4.0 can impact or benefit their firms. The developing nation’s small and mid-sized manufacturers can match the pace of Industry 4.0 adoption of their larger counterparts and customers, domestic manufacturing growth, and the creation of well-paying manufacturing jobs, will not be maximized. This, however, presents a challenge, as smaller companies lack the technology awareness, internal capabilities, immediate access to external consultants and financial resources comparable to their larger colleagues

For Detailed Market Segmentation - Download Free Sample PDF

Industry 4.0 technologies played a decisive role in the pandemic response at many companies, but the crisis is creating pressure for many companies. In the current scenario, companies have started to restore (localize) some of their production. Furthermore, the transformation of the industrial sector in the Fourth Industrial Revolution will have major implications for SME entrepreneurs, and so in this report, we discuss secular shifts in the context of the COVID-19 health crisis.

Get Complete Analysis Of The Report - Download Free Sample PDF

The Industry 4.0 Market is fragmented, with the presence of major players like :-

Players in the market are adopting strategies such as partnerships, investments, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

Segmental Analysis :

IoT Technology Type Segment is Expected to Hold Significant Market Share

Positive market expansion is being fueled by the expanding use of IoT technology across end-user industries, including manufacturing, automotive, and healthcare. The Internet of Things (IoT) is driving the next industrial revolution of intelligent connectivity as the traditional manufacturing sector undergoes a digital transformation. This is altering how businesses handle the increasingly sophisticated systems and machinery they use to increase productivity and decrease downtime. Industry 4.0 and IoT are at the center of new technological approaches for the development, production, and management of the entire logistics chain, otherwise known as smart factory automation. Massive shifts in manufacturing due to Industry 4.0 and the acceptance of IoT require enterprises to adopt agile, smarter, and innovative ways to advance production with technologies that complement and augment human labor with robotics and reduce industrial accidents caused by process failure.

Asia Pacific is Expected to Hold Significant Market Share

Asia Pacific is constantly creating pertinent plans and laws to support local industry upgrading and reorganization for Industry 4.0. As its middle-class population increases and incomes continue to climb, Asia Pacific is automating more quickly than any other nation in the world in an effort to update its processes and maintain its cost advantage in international trade.

Manufacturers in the Asia Pacific region are currently focusing on the potential for revenue growth and risk management. Global manufacturers are thus anticipated to play increasingly significant roles as Asia-Pacific shifts to higher-value manufacturing as manufacturers look for alternative production sites close to the region's developing consumer markets.

The industrial development in India is supported by its growing economy and its significant youth population. For employment generation, the Government of India is focusing on increasing the manufacturing facilities in the country, which is likely to fuel the adoption of Industry 4.0 in India because by implementing advanced systems and technology under Industry 4.0, the manufacturing sector of the country can increase its efficiency and productivity.

Recent Developments:

1) In June 2023, Siemens unveiled its investment strategy to foster future growth, drive innovation, and enhance resilience. The strategy entails allocating EUR 2 billion (USD 2.18 billion) primarily to establish new manufacturing facilities, innovation labs, education centers, and other company-owned sites. As part of this initiative, Siemens also announced the construction of a factory in Singapore strategically positioned to cater to the rapidly expanding markets in Southeast Asia.

2) In February 2023, Johnson Controls International and Willow, a provider of digital twin solutions for critical infrastructure and real estate, announced a global collaboration to transform buildings and facilities digitally. Johnson Controls and Willow have jointly committed to bringing next-generation solutions to their customers. Digital twins are becoming more critical in designing, constructing, and maintaining healthy buildings and facilities. They can be accommodating when analyzing large datasets and predicting patterns and trends.

Q1. What is the market size of the Industry 4.0 Market ?

Industry 4.0 Market is expected to register, at a CAGR of 20.67% during the forecast period 2023-2030).

Q2. Which Region is expected to hold the highest Market share ?

Asia Pacific Region is expected to hold the highest Market share.

Q3. What are the Latest Trends in the Industry 4.0 Market ?

Industry 4.0 in the production sector, numerous industrial facilities are adopting digital technology to improve, automate, and modernize the whole operation, enhancing the plants' productivity parameters.

Q4. Which are the major companies in the Industry 4.0 Market?

ABB Ltd, Siemens AG and Robert Bosch GmbH are some of the major companies of Industry 4.0 Market.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model