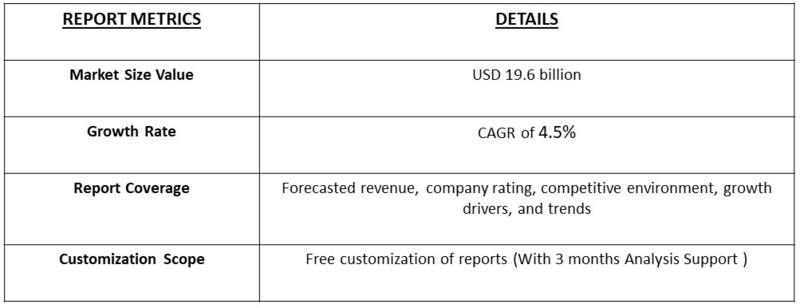

The global non-selective herbicide market is projected to reach a market value of USD 13.4 billion by 2023, growing at a Compound Annual Growth Rate (CAGR) of 4.5% from 2023 to 2031. By 2031, the market is expected to reach USD 19.6 billion.

Get Complete Analysis Of The Report - Download Free Sample PDF

The Non-Selective Herbicide Market encompasses the global trade of chemical agents used to eliminate a wide range of plant species, without distinguishing between desired crops and weeds. These herbicides are predominantly employed in agriculture, landscaping, and industrial weed control to enhance crop yield and manage unwanted vegetation. Key drivers include rising demand for higher agricultural productivity, expanding adoption of no-till farming practices, and increasing global concerns over invasive species management. Market dynamics are influenced by stringent regulatory frameworks, innovation in herbicide formulations, and evolving environmental sustainability goals.

The Non-Selective Herbicide Market is primarily driven by the growing need for enhanced agricultural productivity to meet rising global food demand. Increased adoption of no-till farming practices, which require effective weed management, has further accelerated market demand. Additionally, urbanization and industrial expansion have amplified the need for non-selective herbicides in landscape and infrastructure maintenance. Technological advancements in herbicide formulations, including more efficient and environmentally sustainable products, are also stimulating growth. Moreover, climate change-induced weed proliferation has created a heightened focus on herbicide solutions for weed control.

The non-selective herbicide market is poised for significant growth, driven by increasing demand for effective weed control solutions in various industries. Key trends include the adoption of glyphosate-resistant crops, growing popularity of organic farming methods, and rising concerns over environmental sustainability. Additionally, the market is witnessing a shift towards more targeted and precision-based herbicide applications, fueled by advancements in technology and increasing awareness of the importance of efficient resource utilization. Furthermore, the market is expected to see a surge in demand for herbicides with improved safety profiles and reduced environmental impact.

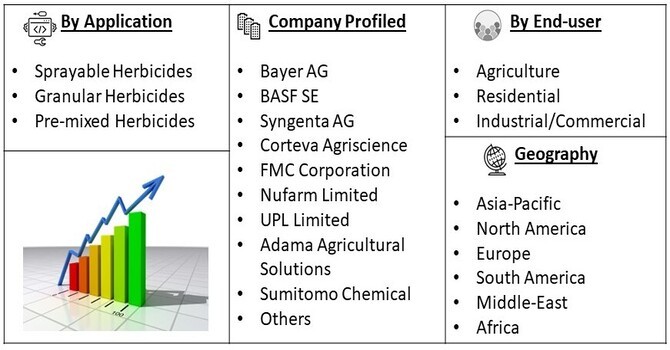

Market Segmentation:

The Global Non Selective Herbicide Market is segmented by technology By Mode of Application (Sprayable Herbicides, Granular Herbicides, Pre-mixed Herbicides) By End-user (Agriculture, Residential, Industrial/Commercial) and geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The report offers the market size and forecasts for revenue (USD million) for all the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

Increasing demand for food security

The global population is projected to reach 9.7 billion by 2050, putting immense pressure on the agricultural sector to increase food production. Non-selective herbicides play a crucial role in ensuring crop yields by controlling weeds that compete with crops for water, nutrients, and sunlight. According to the Food and Agriculture Organization (FAO), the use of herbicides has increased by 15% globally between 2010 and 2020, driven by the need to boost food production. As the global population continues to grow, we expect the demand for non-selective herbicides to increase, particularly in regions with limited arable land and water resources.

Growing demand for precision agriculture

Precision agriculture is transforming the way farmers manage their crops, and non-selective herbicides are a critical component of this approach. By using precision agriculture techniques, farmers can apply herbicides more efficiently, reducing waste and environmental impact. According to a report by the International Association of Agricultural Information Specialists, precision agriculture is expected to increase crop yields by 10-15% globally by 2025. As farmers adopt precision agriculture practices, we expect the demand for non-selective herbicides to increase, driven by the need for targeted and efficient weed control.

Market Restraints:

The non-selective herbicide market is facing increasing regulatory scrutiny and environmental concerns, which are expected to restrain market growth. The European Union's ban on glyphosate, a widely used herbicide, has led to a shift towards alternative products, which may impact the demand for non-selective herbicides. Additionally, the increasing awareness of the environmental impact of herbicides, such as soil degradation and water pollution, is driving calls for more sustainable solutions. According to a report by the European Environment Agency, the use of herbicides is expected to decrease by 10% globally between 2020 and 2025 due to environmental concerns. As regulatory scrutiny and environmental concerns continue to grow, we expect the non-selective herbicide market to face significant headwinds, particularly in regions with strict environmental regulations. This may lead to a shift towards more targeted and precision-based herbicide applications, as well as the development of more sustainable and environmentally friendly products.

The COVID-19 pandemic initially caused significant disruptions in the Non-Selective Herbicide Market, primarily due to supply chain interruptions, transportation restrictions, and workforce shortages across key regions. These challenges led to delays in production and distribution, temporarily affecting market growth. However, as global food security became a critical concern, demand for agricultural inputs, including herbicides, saw a strong recovery. The pandemic also accelerated the adoption of digital platforms for herbicide purchases, with e-commerce channels gaining prominence as traditional retail outlets faced limitations. Additionally, heightened awareness of environmental sustainability during the pandemic prompted a shift towards eco-friendly herbicide solutions, shaping future market trends.

Segmental Analysis:

Chemical Herbicides Segment is Expected to Witness Significant Growth Over the Forecast Period

Chemical herbicides dominate the Non-Selective Herbicide Market, driven by their high efficacy in controlling a broad range of weed species across various agricultural and industrial applications. Glyphosate, a key chemical herbicide, remains widely used despite increasing regulatory scrutiny and public concern over its environmental and health impacts. However, advancements in chemical formulations, including low-toxicity options and enhanced targeting capabilities, are driving continued demand. In the Asia-Pacific region, the growing agricultural sector, particularly in countries like China and India, is fueling demand for chemical herbicides to increase crop yields. Additionally, rising food demand and the expansion of commercial farming practices are key factors supporting this sub-segment’s growth.

Sprayable Herbicides Segment is Expected to Witness Significant Growth Over the Forecast Period:

Sprayable herbicides are one of the most widely used application methods in the market, favored for their ease of use and effectiveness in evenly covering large areas. These herbicides are especially popular in large-scale agricultural operations where fast and efficient application is crucial. Technological advancements in sprayer equipment, including drones and precision agriculture tools, are driving the adoption of sprayable herbicides in the Asia-Pacific region. For instance, in countries like Japan and Australia, the use of drone technology in farming has seen significant growth, enabling more precise application and reducing waste. The rising labor shortages and the need for time-efficient solutions are also critical drivers of this sub-segment.

Asia Pacific Region is Expected to Witness Significant Growth Over the Forecast Period

The Asia-Pacific region is projected to witness significant growth in the Non-Selective Herbicide Market over the forecast period, driven by the region's expanding agricultural sector and rapid urbanization. Countries such as China, India, and Southeast Asian nations are seeing increasing demand for herbicides to enhance crop yields and manage large-scale weed infestations. The shift towards modern farming techniques, including precision agriculture and mechanized farming, is further accelerating the adoption of non-selective herbicides in the region. Additionally, rising government initiatives to improve food security and productivity, coupled with growing industrialization and infrastructure projects, are boosting herbicide demand for industrial applications. The region’s large population base, increasing food demand, and favorable regulatory frameworks for agricultural advancements are key factors supporting the market’s robust growth in Asia-Pacific.

To Learn More About This Report - Request a Free Sample Copy

The competitive landscape of the Non-Selective Herbicide Market is highly consolidated, with key players dominating through extensive product portfolios, strategic acquisitions, and strong distribution networks. Leading companies are focused on innovation, with an emphasis on developing eco-friendly and highly efficient herbicide formulations to meet evolving regulatory standards and consumer preferences. In the Asia-Pacific region, global and regional players are competing for market share by expanding their presence and investing in research and development.

Major competitors in the market include:

Recent Development:

1) Bayer AG announced in early 2023 the launch of its next-generation line Roundup® product, featuring advanced glyphosate formulations with improved environmental safety and efficacy. The new products are designed to meet evolving regulatory requirements and increasing demand for more sustainable farming solutions. This development aligns with Bayer’s commitment to innovation in herbicide technologies and strengthens its leadership position in the Non-Selective Herbicide Market.

2) In 2024, Corteva Agriscience introduced a new non-selective herbicide, Rinskor® Active, targeting both row crops and industrial applications. This herbicide boasts a novel mode of action that enhances weed control while reducing the environmental footprint. The product has been well-received in key markets, including the Asia-Pacific region, where Corteva is focusing on expanding its product offerings to meet the growing demand for effective and eco-friendly herbicides.

Q1. What are the driving factors for the Global Non-Selective Herbicide Market?

The global non-selective herbicide market is primarily driven by the growing need for efficient weed management in agriculture. As global food demand rises, farmers are increasingly adopting non-selective herbicides to enhance crop yields by effectively controlling unwanted vegetation. These herbicides are particularly favoured for their ability to eliminate a wide range of weeds, which is crucial for maintaining productivity in various crop systems. Additionally, advancements in formulation technology are making these products more effective and user-friendly, further boosting their adoption. The trend towards large-scale monoculture farming also contributes to the demand for non-selective herbicides, as they simplify weed control across vast areas.

Q2. What are the restraining factors for the Global Non-Selective Herbicide Market?

Despite their advantages, the global non-selective herbicide market faces several restraining factors. Growing concerns about the environmental impact and potential health risks associated with herbicide use have led to increased regulatory scrutiny and restrictions in some regions. The rise of herbicide-resistant weed species also poses significant challenges, as it reduces the effectiveness of existing products and compels farmers to seek alternatives. Furthermore, the shift towards organic farming practices and sustainable agriculture is limiting the market growth for synthetic non-selective herbicides. Public perception and demand for safer, more sustainable pest management solutions can also affect market dynamics negatively.

Q3. Which segment is projected to hold the largest share in the Global Non-Selective Herbicide Market?

The glyphosate segment is projected to hold the largest share in the global non-selective herbicide market. Glyphosate is widely used due to its effectiveness in controlling a broad spectrum of weeds and its compatibility with various crops. Its popularity in glyphosate-resistant genetically modified crops has further solidified its position in the market. As farmers increasingly seek cost-effective solutions for weed management, glyphosate remains a preferred choice due to its affordability and ease of application. Despite regulatory challenges and controversies surrounding its safety, glyphosate's market dominance is expected to continue, driven by its integral role in modern agricultural practices.

Q4. Which region holds the largest share in the Global Non-Selective Herbicide Market?

North America is expected to hold the largest share in the global non-selective herbicide market, largely due to its extensive agricultural landscape and high adoption rates of herbicides. The United States, in particular, is a significant contributor, where glyphosate and other non-selective herbicides are widely used in crop production. The prevalence of large-scale farming operations and advanced agricultural practices in this region drives demand for effective weed control solutions. Additionally, ongoing research and development initiatives focused on improving herbicide formulations further bolster market growth in North America. However, increasing scrutiny over herbicide safety and environmental impacts may influence future trends in the region.

Q5. Which are the prominent players in the Global Non-Selective Herbicide Market?

Key players in the global non-selective herbicide market include major agricultural chemical companies such as Bayer AG, Corteva Agriscience, and Syngenta. These companies dominate the market through extensive product portfolios and significant investment in research and development to innovate herbicide formulations. Other notable players include BASF, FMC Corporation, and Dow AgroSciences, which also contribute to the competitive landscape. These firms are actively engaged in partnerships and collaborations to enhance their product offerings and address the challenges posed by herbicide resistance. Their focus on sustainability and development of environmentally-friendly alternatives is shaping the future of the non-selective herbicide market.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model