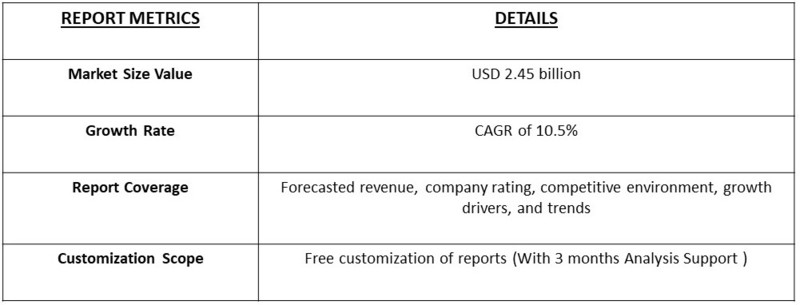

The global malaria rapid antigen test market is expected to grow significantly from 2023 to 2031, with an estimated value of USD 1.13 billion in 2023, increasing to USD 2.45 billion by 2031, representing a compound annual growth rate (CAGR) of 10.5% over the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

The Malaria Rapid Antigen Test market encompasses the production and distribution of diagnostic kits designed for quick and accurate detection of malaria antigens in patients. These tests provide results within minutes, making them essential for early diagnosis and treatment in regions with high malaria prevalence. The market is driven by the increasing need for rapid, cost-effective, and point-of-care diagnostic tools in developing countries, as well as global initiatives to control and eradicate malaria. Additionally, advancements in diagnostic technology and rising awareness of early malaria detection are fueling market growth across endemic regions.

The Malaria Rapid Antigen Test market includes the growing prevalence of malaria in tropical and subtropical regions, leading to increased demand for quick and reliable diagnostic solutions. Government-led health initiatives, global funding from organizations like the WHO and UNICEF, and efforts toward malaria elimination are boosting the adoption of rapid antigen tests. The tests’ ability to deliver immediate results in remote and resource-limited areas is another critical factor driving market growth. Additionally, technological advancements improving test accuracy and affordability are further fueling market expansion, particularly in high-burden areas.

The global malaria rapid antigen test market is poised for significant growth, driven by the increasing demand for rapid and accurate diagnostic tests. The trend towards decentralized healthcare and point-of-care testing is expected to continue, with malaria rapid antigen tests emerging as a key solution for remote and resource-constrained settings. Additionally, the growing focus on global health initiatives and disease control programs is also driving demand for malaria rapid antigen tests. Furthermore, the increasing adoption of digital health technologies and telemedicine is expected to transform the malaria rapid antigen test market, enabling greater accessibility and convenience.

Market Segmentation: Malaria Rapid Antigen Test Market is segmented by test Type (Lateral Flow Assays, Dipstick Tests, Cassette Tests) By End-User (Hospitals, Clinics, Laboratories, Laboratories) and geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The report offers the market size and forecasts for revenue (USD million) for all the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

Increasing demand for rapid and accurate diagnostic tests:

The global malaria rapid antigen test market is being driven by the increasing demand for rapid and accurate diagnostic tests. The World Health Organization (WHO) recommends the use of rapid diagnostic tests (RDTs) for malaria diagnosis, particularly in resource-constrained settings where microscopy is not available. The increasing adoption of RDTs is driven by their ease of use, rapid results, and high accuracy. For instance, the WHO estimates that RDTs have improved malaria diagnosis by 80% in some African countries. Additionally, the growing focus on global health initiatives and disease control programs is also driving demand for malaria rapid antigen tests. Furthermore, the increasing awareness of malaria as a public health threat is also driving demand for rapid and accurate diagnostic tests.

Growing adoption for point-of-care testing:

The global malaria rapid antigen test market is also being driven by the growing adoption of point-of-care testing. Point-of-care testing allows healthcare providers to diagnose and treat patients at the point of care, rather than requiring them to travel to a central laboratory. This approach is particularly important in resource-constrained settings where patients may not have access to centralized laboratories. The increasing adoption of point-of-care testing is driven by its convenience, cost-effectiveness, and ability to improve patient outcomes. For instance, a study in Ghana found that point-of-care testing improved malaria diagnosis by 90% compared to traditional laboratory testing. Additionally, the growing focus on digital health technologies and telemedicine is also driving demand for point-of-care testing and malaria rapid antigen tests.

Market Restraints:

The global malaria rapid antigen test market is facing significant restraints due to limited awareness and education about the importance of rapid and accurate diagnostic tests. Many healthcare providers and patients are not aware of the benefits of RDTs, leading to a lack of adoption and utilization. Additionally, the limited availability of trained healthcare workers and laboratory technicians in resource-constrained settings can also hinder the adoption of RDTs. Furthermore, the high cost of RDTs and the need for regular calibration and maintenance can also be a barrier to adoption. As a result, malaria rapid antigen test manufacturers must invest in awareness and education campaigns to increase the adoption and utilization of their products.

The COVID-19 pandemic significantly impacted the global malaria rapid antigen test market by initially disrupting supply chains and diagnostic testing activities. During the pandemic, resources were redirected towards COVID-19 testing and treatment, leading to delays in malaria diagnosis and treatment programs. However, as healthcare systems adapted and the focus returned to malaria control, there was an increased emphasis on improving and distributing rapid diagnostic tests to ensure continued malaria management in endemic regions. The pandemic also highlighted the need for robust and rapid diagnostic tools, driving innovation and investment in the malaria testing sector.

Segmental Analysis

Lateral Flow Assays (Test Type Sub-segment) is Expected to Witness Significant Growth Over the Forecast Period

Lateral flow assays are widely used in the malaria rapid antigen test market due to their simplicity and effectiveness in detecting malaria antigens. These tests are designed for ease of use and rapid results, making them ideal for point-of-care settings in endemic regions. Recent advancements have improved the sensitivity and specificity of these assays, allowing for more accurate diagnoses. For instance, new lateral flow assays can now detect multiple strains of malaria with higher precision. The driving factors include the need for quick, on-the-spot testing in remote areas, the growing focus on malaria eradication efforts, and advancements in assay technology that enhance test reliability and user convenience.

Field and Community Health (End-User Sub-segment) is Expected to Witness Significant Growth Over the Forecast Period

The field and community health sector represents a crucial application for malaria rapid antigen tests, particularly in remote and underserved areas. These settings benefit from rapid diagnostic tests that provide immediate results and enable timely treatment of malaria. Recent developments include the deployment of mobile health units and community-based health workers equipped with rapid antigen tests to reach isolated populations. The increasing emphasis on decentralized healthcare and community health initiatives drives this sub-segment. Key factors include the need for accessible and affordable testing solutions in high-burden areas, the expansion of global health programs, and the commitment to improving malaria diagnosis and treatment accessibility in rural and remote regions.

Asia Pacific Region is Expected to Witness Significant Growth Over the Forecast Period

In the Asia-Pacific region, the malaria rapid antigen test market is experiencing significant growth due to the high burden of malaria in countries like India, China, and Southeast Asian nations such as Thailand and Indonesia. The region's diverse climate and extensive malaria-endemic areas drive the demand for efficient and accessible diagnostic solutions. Recent developments include the increased deployment of rapid antigen tests in remote and rural areas to improve malaria detection and treatment outcomes. For example, India has scaled up its malaria testing programs as part of its national strategy to combat the disease. The driving factors in this region include the high incidence of malaria, government and NGO initiatives to enhance diagnostic capabilities, and the need for rapid, reliable testing in areas with limited healthcare infrastructure.

To Learn More About This Report - Request a Free Sample Copy

The global malaria rapid antigen test market is characterized by the presence of several key players who focus on innovation, quality, and global distribution to meet increasing demand.

Leading companies include;

Recent Development:

1) In 2023, Abbott Laboratories introduced an upgraded rapid malaria antigen test with improved sensitivity and specificity. This new test is designed to provide more accurate results and reduce false negatives, which is crucial for effective malaria management in high-burden regions. The enhanced test features a streamlined design for ease of use in remote settings and supports faster diagnosis, contributing to quicker treatment and better disease management.

2) In early 2024, Roche Diagnostics significantly expanded its distribution network for malaria rapid antigen tests in Southeast Asia. This strategic move aims to enhance accessibility and support malaria control efforts in countries like Thailand, Indonesia, and Myanmar. The expansion includes partnerships with local health organizations to ensure widespread availability and effective implementation of rapid testing solutions in underserved areas. This initiative is expected to bolster Roche's market presence and contribute to improved malaria diagnosis and treatment in the region.

Q1. What are the driving factors for the Global Rapid Malaria Antigen Market?

The global rapid malaria antigen market is primarily driven by the increasing prevalence of malaria, particularly in endemic regions such as sub-Saharan Africa and Southeast Asia. Rapid diagnostic tests (RDTs) for malaria are essential due to their ability to provide quick and accurate results, which is crucial for effective disease management and control. The growing focus on early diagnosis and prompt treatment to curb malaria transmission is a significant factor propelling market growth. Additionally, the rise in government and NGO initiatives aimed at improving malaria detection and control, along with advancements in RDT technology, further boosts the demand for rapid malaria antigen tests.

Q2. What are the restraining factors for the Global Rapid Malaria Antigen Market?

Despite the growth potential, the rapid malaria antigen market faces several restraints. One major challenge is the high cost of RDTs compared to other diagnostic methods, which can limit their accessibility in low-resource settings. The accuracy of some rapid tests can be variable, leading to potential false negatives or positives, which impacts their reliability. Additionally, issues related to the supply chain, including the availability of quality control and effective distribution in remote areas, can hinder market expansion. Furthermore, the emergence of alternative diagnostic technologies and potential resistance to malaria treatments also pose challenges to market growth.

Q3. Which segment is projected to hold the largest share in the Global Rapid Malaria Antigen Market?

The malaria RDTs (Rapid Diagnostic Tests) segment is projected to hold the largest share in the global rapid malaria antigen market. RDTs are favored for their ease of use, speed, and accuracy in diagnosing malaria, making them essential tools in both clinical and field settings. The demand for these tests is driven by their effectiveness in detecting malaria antigens quickly, which is critical for timely treatment and controlling outbreaks. As public health initiatives and malaria control programs emphasize rapid diagnosis, the RDT segment is expected to dominate the market.

Q4. Which region holds the largest share in the Global Rapid Malaria Antigen Market?

Sub-Saharan Africa holds the largest share in the global rapid malaria antigen market. The region is heavily affected by malaria, with a high incidence rate that drives the demand for effective diagnostic tools. The presence of numerous malaria control programs and international aid organizations focused on improving diagnostic capabilities further strengthens this region's market share. Additionally, the efforts of governments and NGOs to distribute rapid diagnostic tests widely in endemic areas contribute to the dominance of Sub-Saharan Africa in the market.

Q5. Which are the prominent players in the Global Rapid Malaria Antigen Market?

Prominent players in the global rapid malaria antigen market include companies such as SD Biosensor, Inc., known for its advanced rapid diagnostic tests for malaria. Another key player is Abbott Laboratories, which offers a range of malaria diagnostic solutions with a strong focus on accuracy and ease of use. Companies like F. Hoffmann-La Roche Ltd and Premier Medical Corporation also play significant roles, providing reliable and widely used malaria RDTs. These companies are crucial in driving innovation and ensuring the availability of effective diagnostic tools in the fight against malaria.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model