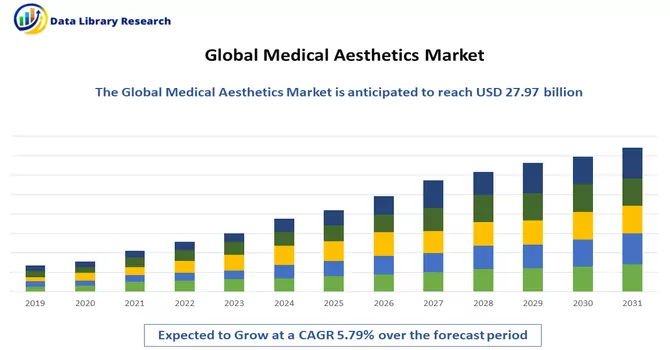

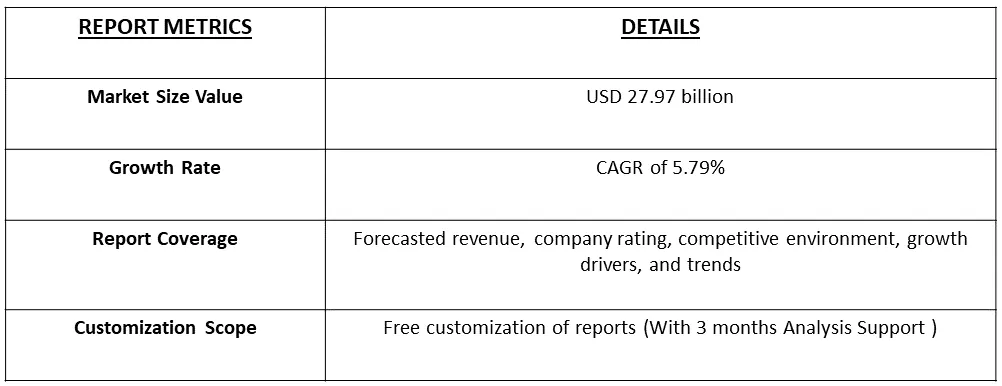

The Medical aesthetics Market is currently valued at USD 27.97 billion in the year 2022 and is expected to increase to USD 43.89 billion by the end of 2030, registering a CAGR of 5.79% over the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

Medical aesthetic devices refer to all medical devices that are used for various cosmetic procedures, which include plastic surgery, unwanted hair removal, excess fat removal, anti-aging, aesthetic implants, skin tightening, etc., that are used for beautification, correction, and improvement of the body. Factors such as the increasingly obese population, awareness regarding aesthetic procedures, rising adoption of minimally invasive devices, and technological advancement in aesthetic devices are propelling the growth of the market.

The expanded access to services (primarily via aesthetics clinic chains, med spas, and beauty bars) and growing consumer purchasing power have accelerated global penetration, especially in emerging markets. Shifting consumer attitudes about wellness, beauty, and healthy aging have increased awareness and acceptance of aesthetics, generating demand from new patient segments, including men and millennials. Meanwhile, next-generation products and procedures are continually expanding the range of offerings and making greater inroads into demographic groups that value aesthetics. New indications and an expanded portfolio of dermal fillers and biostimulators are helping to expand the market as well.

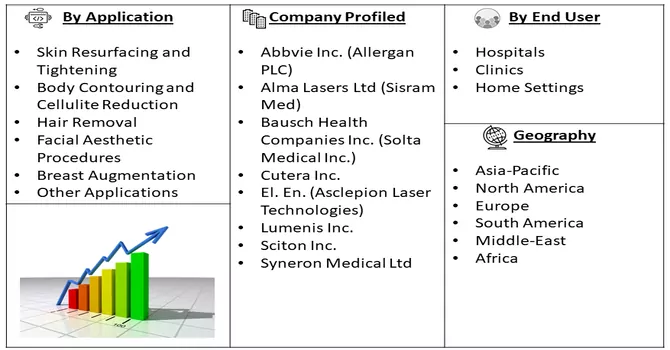

Segmentation: The Medical Aesthetic Equipment Market is Segmented by Type of Device (Energy-based Aesthetic Device (Laser-based Aesthetic Device, Radiofrequency (RF) Aesthetic Device, Light-based Aesthetic Device, and Ultrasound Aesthetic Device) and Non-energy-based Aesthetic Device (Botulinum Toxin, Dermal Fillers and Aesthetic Threads, Chemical Peels, Microdermabrasion, Implants (Facial Implants, Breast Implants, and Other Implants) and Other Aesthetic devices)), Application (Skin Resurfacing and Tightening, Body Contouring and Cellulite Reduction, Hair Removal, Facial Aesthetic Procedures, Breast Augmentation, and Other Applications), End-User (Hospitals, Clinics, and Home Settings), and Geography (North America, Europe, Asia-Pacific, Middle East, and Africa, and South America). The report offers the value in USD million for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Drivers :

The Increasing Volume of Aesthetic Procedures Worldwide is Also Contributing To The Market's Growth.

According to the ISAPS survey released in December 2021, 10,129,528 surgical procedures and 14,400,347 nonsurgical cosmetic procedures were performed around the globe in 2020. Furthermore, according to the BAAPS survey released in February 2021, 15,405 cosmetic surgical procedures were performed in the United Kingdom in 2021. The increasing number of aesthetic procedures requires medical aesthetic devices. This is creating the need for medical aesthetic devices and driving the market's growth.

Also, the Growing Adoption of Minimally Invasive and Non-Invasive Aesthetic Procedures Drives the Market Studied.

As per an article published in the Journal Archives of Plastic Surgery in November 2021, the demand for aesthetic procedures was on the rise all over the world, especially in East Asian countries. With the advent of the internet, information became accessible to everyone, and people started becoming more aware of aesthetic procedures. All these factors together increased the public's awareness of medical aesthetic procedures, which, in turn, increased the sales of medical aesthetic devices. This is resulting in a huge growth in the market size of medical aesthetic devices.

Approval of Products by Various Regulatory Authorities is also Boosting the Market's Growth.

In January 2022, Lumenis launched the Splendor X device, CE cleared for hair removal, vascular treatments, pigmented lesions, and wrinkles in the United Kingdom.

The COVID-19 pandemic significantly impacted the growth of the medical aesthetic devices market in early 2020 due to the lockdown imposed and many aesthetic procedures being canceled. An article published in the Journal of Clinics in Dermatology in June 2021 indicated that various procedures, such as deep peeling and laser treatments, were avoided during the COVID-19 pandemic because of the disruptions in the skin barrier. Also, the procedures, such as high-intensity focused ultrasound, fractional radiofrequency, and cryolipolysis equipped with stainless steel, gold, or plastic handpieces and probes, were postponed due to the risk of contamination.

Segmental Analysis

Laser-based Aesthetic Device Segment is Expected to Witness Significant Growth Over the Forecast Period

The increasing popularity of radiofrequency-based treatments is also driving the aesthetic Laser market. Radiofrequency-based devices, such as Picoway, LaseMD, FraxPro, and Pixel CO2 are gaining popularity as they are completely non-invasive and also have proven effective in treating different skin conditions. PicoWay, manufactured by Candela Medical, is a picosecond laser platform delivering high peak power and ultra-short pulse durations for a photoacoustic effect. The platform is used to treat Pigmented lesions, skin rejuvenation & and toning, and tattoo removal. Technological advancement in the field of laser technology has resulted in greater treatment outcomes and high patient satisfaction.

For instance, In March 2020, Lumenis introduced an intelligent skin innovative platform called the Stellar M22. It is a multi-application platform that is made to treat over 30 skin conditions like vascular lesions, uneven skin texture, acne, sagging skin hair removal, etc. This device is gaining popularity among practitioners as it can safely and effectively treat different indications in different skin types, ages, and genders.

Botulinum Toxin Segment is Expected to Witness Significant Growth Over the Forecast Period

Botulinum toxin is a neurotoxic protein produced by the bacterium Clostridium botulinum. As a result, highly diluted concentrations of botulinum toxin are used for cosmetic and non-cosmetic purposes, such as for the treatment of frown lines between the eyebrows, dystonia, chronic migraine, and other purposes. The increasing demand for aesthetic procedures is expected to be the major driver for the market's growth over the forecast period.

The survey conducted by the American Society of Plastic Surgeons in 2022 mentioned that in the United States, 76% of plastic surgeons witnessed increased demand for cosmetic procedures and 23% reported that their business has doubled. The report also mentioned that Botulinum Toxin Type A is one of the top minimally invasive cosmetic procedures among patients during 2021-2022. Such increasing demand for botulinum toxin procedures is expected to contribute to the segment’s growth over the forecast period.

Breast Augmentation Segment in Application is Expected to Witness High Growth Over the Forecast Period

Breast implants are medical devices used to augment the size of breasts, either for cosmetic applications or reconstruction purposes or to correct a congenital abnormality. The procedure involves the usage of breast implants to enhance and improve the size of the breasts. Furthermore, the market players in the area are continuously working toward better and more efficient solutions and evolving the life of available products through awareness campaigns regarding breast implants, product launches, collaborations, and mergers and acquisitions, which will complement the market growth.

For instance, in June 2020, Allergan Aesthetics, a part of AbbVie Inc., announced the initiation of a digital campaign to improve device tracking and identification and increase its reach to patients having Allergan breast implants called BIO CELL and to inform women about the risks of breast implant-associated anaplastic large cell lymphoma (BIA-ALCL). Such introduction of advanced breast implants is expected to contribute to the segment's growth.

North America Holds a Significant Share and is expected to do the Same During the Forecast Period

North America's medical aesthetic devices market is expected to project significant growth owing to the increasing volume of different aesthetic procedures, rising awareness about aesthetic and minimally invasive procedures, and technological advancement in the region. The large volume of aesthetic procedures in the region creates the need for aesthetic devices and thus drives the growth of the market. According to the AAFPRS survey released in March 2022, an estimated 1.4 million surgical and non-surgical procedures were performed in the United States in 2021, an increase of 40% over the procedures performed in 2020.

Additionally, according to the ISAPS survey released in December 2021, 860,718 aesthetic procedures were performed in Mexico in 2021, of which 456,489 were aesthetic surgical procedures and 404,229 were non-surgical aesthetic procedures. Thus, the increasing number of cosmetic procedures among the population is anticipated to boost the growth of the market during the forecast period. Also, the high concentration of key players in the region and subsequent product launches play a vital role in the growth of the market in the region. For instance, in April 2021, Alma Lasers launched Alma PrimeX, the ultimate non-invasive platform for body contouring and skin tightening. Thus, the aforementioned factors are expected to boost the market during the forecast period in North America.

Get Complete Analysis Of The Report - Download Free Sample PDF

The medical aesthetic devices market is moderately competitive and consists of many players. Companies like :

Hold a substantial share in the market.

Key Developments

1) June 2022: Cynosure launched the PicoSure Pro device, its latest upgrade to the PicoSure platform. PicoSure Pro is one of the first 755nm picosecond lasers cleared by the US FDA.

2) May 2022: GC Esthetics Inc. launched an innovative nipple-areola complex (NAC) reconstructive implant called FixNip NRI in Europe under an exclusive partnership agreement with FixNip LTD.

Q1. How big is the Medical Aesthetics Market ?

The Medical aesthetics Market is currently valued at USD 27.97 billion in the year 2022 and is expected to increase to USD 43.89 billion by the end of 2030.

Q2. At what CAGR is the Medical Aesthetics market projected to grow within the forecast period?

Medical Aesthetics market is registering a CAGR of 5.79% over the forecast period.

Q3. What segments are covered in the Medical Aesthetics Market Report?

Type of Device, Type of Application, End-User and Geography are the segments covered in the Medical Aesthetics Market Report.

Q4. Which region has the largest share of the Medical Aesthetics market? What are the largest region's market size and growth rate?

North America has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model