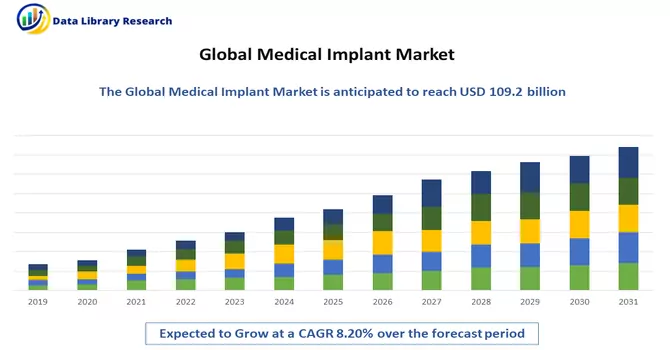

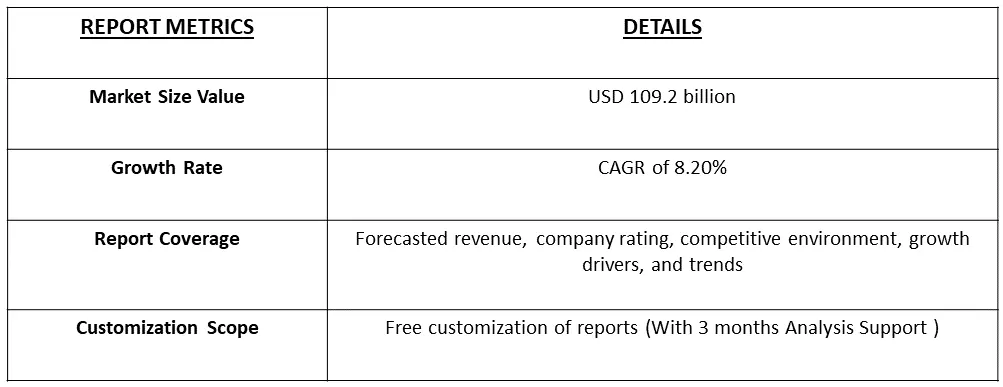

The Medical Implants Market involves an increase from USD 109.2 billion in 2022, registering a Compound Annual Growth Rate (CAGR) of 8.20% over the forecast period spanning from 2023 to 2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

Medical implants are devices or tissues that are placed inside or on the surface of the body for the purpose of supporting or replacing damaged biological structures, enhancing bodily functions, or delivering therapeutic treatments. These implants can be permanent or temporary and are designed to interact with the body in various ways, such as providing structural support, replacing missing body parts, monitoring physiological parameters, or delivering medications. Examples of medical implants include joint replacements, pacemakers, artificial organs, dental implants, and contraceptive devices.

The increasing global aging population is associated with a higher prevalence of chronic diseases and degenerative conditions. Medical implants, such as joint replacements and cardiovascular devices, are often necessary for managing and improving the quality of life for elderly individuals. The growing incidence of chronic diseases, such as cardiovascular diseases, diabetes, and orthopedic disorders, drives the demand for medical implants. Implants are frequently used for therapeutic purposes, including the management and treatment of chronic conditions.

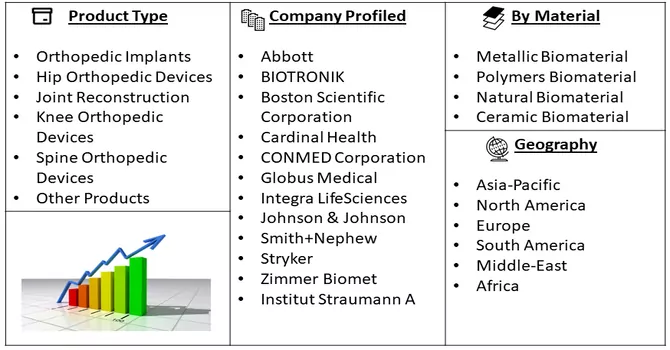

Market Segmentation: The Global Medical Implant Market is Segmented by Product (Orthopedic Implants (Hip Orthopedic Devices, Joint Reconstruction, Knee Orthopedic Devices, Spine Orthopedic Devices, Other Products), Type of Material (Metallic Biomaterial, Polymers Biomaterial, Natural Biomaterial, and Ceramic Biomaterial), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The value is provided (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Trends:

There is a growing trend toward the customization and personalization of medical implants to meet individual patient needs. Advanced manufacturing techniques, including 3D printing, enable the production of implants tailored to specific anatomical structures, improving overall efficacy and patient outcomes. The shift towards value-based healthcare models encourages a focus on delivering improved patient outcomes at optimized costs. This influences the selection and adoption of medical implants based on their long-term value and impact on overall healthcare efficiency. These trends collectively reflect the dynamic nature of the medical implant market, emphasizing the importance of technological innovation, patient-centric approaches, and a holistic view of healthcare delivery.

Market Drivers:

Rising Geriatric Population and Burden of Chronic Diseases and Increasing Demand for Cosmetic Dentistry

The vulnerability of the immune system in the geriatric population makes them more susceptible to autoimmune diseases such as arthritis. Consequently, the growing elderly demographic is linked to an elevated risk of orthopedic and other chronic conditions, contributing to the expansion of the studied market. For example, according to the World Social Report 2023 released in January 2023, the global population of adults aged 65 and older is projected to more than quadruple from 761 million to 1.6 billion between 2021 and 2050. The number of individuals aged 80 years or older is experiencing an even more rapid increase. This surge in older adults is identified as a key factor amplifying the prevalence of orthopedic disorders, subsequently driving the demand for medical implants and anticipated to propel market growth throughout the forecast period. Moreover, the escalating incidence of breast cancer is expected to fuel the demand for breast implants. For instance, a report from the American Cancer Society in 2023 predicts that 297,790 new cases of invasive breast cancer will be diagnosed in women in the United States, compared to 287,850 new cases in 2022. Consequently, the rising occurrence of breast cancer contributes to an increased demand for breast augmentation through the use of breast implants, thereby fostering market growth. Several other factors are also playing crucial roles in accelerating the medical implants market, including the rise in disposable income, technological advancements in implantology, the availability of improved medical facilities, and a growing number of cases involving limb or organ damage due to various accidents.

Technological Advancements in the Medical Implants

Furthermore, the anticipated growth of the orthopedic implant segment is poised to be propelled by the increasing introduction of orthopedic implants by key market players. For example, in April 2022, the Orthopaedic Implant Company obtained FDA clearance and introduced its high-value dorsal spanning plate in the United States. This new addition to the company's orthopedic trauma implant portfolio serves to broaden the potential clinical impact of its DRPx wrist fracture plating system, establishing it as a comprehensive and value-driven alternative to other premium-priced plating systems. Consequently, given the prevalence of orthopedic diseases and the continuous introduction of new products, there is expected to be a surge in demand for orthopedic implants, leading to substantial growth in this segment throughout the forecast period.

Restraints :

The growth of the medical implant market faces potential challenges due to reimbursement issues and the high costs associated with these advanced medical devices. Obtaining reimbursement for medical implants can be a complex and time-consuming process. Healthcare providers often face challenges in securing adequate reimbursement for the cost of implants, impacting their willingness to adopt these technologies. Stringent reimbursement policies and delays in reimbursement approvals can hinder the widespread adoption of medical implants, particularly in regions where healthcare payment systems are intricate. Thus, such factors are expected to slow down the growth of the studied market.

The growth of the medical implants market experienced a notable setback in the initial stages of the COVID-19 pandemic, primarily due to constraints in the supply chain and a decrease in hospital visits by patients. As the number of COVID-19 cases began to decrease, clinics resumed surgical operations, including the utilization of operating suites and recovery beds for elective treatments in 2021. However, the market continued to be significantly affected by prolonged wait times for various replacement surgeries during and post the pandemic. For instance, a report from the Canadian Institute for Health Information in March 2023 highlighted the persistent longer wait times for joint replacements, such as hip and knee surgeries, attributed to the impact of the pandemic. Consequently, these extended wait periods resulted in a growing pool of patients awaiting such procedures, subsequently contributing to an increased demand for orthopedic implants. This heightened demand is expected to exhibit substantial growth in the medical implants market in the forthcoming years.

Segmental Analysis

Knee Orthopedic Devices is Expected to Witness Significant Growth Over the Forecast Period

Knee orthopedic devices play a pivotal role in the field of orthopedic surgery, offering solutions to a range of conditions affecting the knee joint. These devices are designed to address issues such as arthritis, ligament injuries, fractures, and degenerative joint diseases that can cause pain, immobility, and a decline in the overall quality of life. Knee orthopedic devices, particularly those used in total knee replacement surgeries, aim to restore functionality and alleviate pain in individuals with severely damaged or diseased knee joints. Knee orthopedic devices are typically made from materials such as metal alloys (e.g., cobalt-chromium or titanium), high-grade plastics (polyethylene), and ceramic materials. These materials are chosen for their durability, biocompatibility, and ability to withstand the mechanical stresses of daily activities. Thus, the segment is expected to witness significant growth over the forecast period.

Metallic Biomaterial Segment is Expected to Witness Significant Growth Over the Forecast Period

Metallic biomaterials play a crucial role in the field of medical implants, providing essential properties that make them suitable for various implantable devices. These materials are chosen for their strength, durability, biocompatibility, and resistance to corrosion. Medical implants utilizing metallic biomaterials are employed in a range of applications, including orthopedics, cardiovascular interventions, dental procedures, and more. Metallic biomaterials, especially titanium and cobalt-chromium alloys, are frequently used in orthopedic joint replacements, including hip and knee implants. These materials provide the necessary mechanical properties to withstand the demands of load-bearing joints. Thus, owing to such advantages, the segment is expected to witness significant growth over the forecast period.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North America is poised to play a significant role in the medical implants market, primarily attributed to the increasing prevalence of conditions like arthritis and the growing adoption of cosmetic dental procedures to address tooth loss. The region benefits from well-established insurance policies and a robust healthcare infrastructure, which are expected to propel market growth throughout the forecast period. According to data from the Oral Health Bulletin of the National Institute of Dental and Craniofacial Research (NIDCR) in 2022, a striking 9 out of 10 adults aged 20 to 64 in the United States suffer from tooth decay. Furthermore, among individuals aged 45 to 64, over 2 in 5 individuals are affected by periodontal (gum) disease. Tooth decay often leads to tooth loss, a common occurrence that fuels the demand for dental implants as a solution to replace lost teeth. The prevalence of these dental issues underscores the significance of dental implants in addressing oral health concerns within the population.

Moreover, technological advancements in medical implants contribute to the market's growth in the region. A noteworthy example is the development of bioresorbable vascular scaffolds (BVS). According to a report from the Icahn School of Medicine at Mount Sinai in May 2023, first-generation BVS has been deemed safe and effective for treating heart diseases, comparable to drug-eluting metallic stents. This positive evaluation has spurred advancements in BVS technology, with ongoing improvements and future clinical applications anticipated among interventional cardiologists in the United States. These technological strides are expected to fuel market growth over the forecast period, showcasing the region's commitment to innovation and cutting-edge medical solutions.

Get Complete Analysis Of The Report - Download Free Sample PDF

The landscape of the medical implant market is characterized by fragmentation, featuring the presence of numerous key players. While the market is diverse, a handful of major players exert significant influence, holding substantial market share. These prominent industry leaders are actively engaged in strategic acquisitions aimed at consolidating their positions on a global scale. The competitive dynamics within the medical implant market, characterized by the strategic maneuvers of key players, contribute to the ongoing evolution and innovation in the industry. As these major players continue to engage in acquisitions and collaborations, the market landscape is expected to witness further consolidation and the emergence of new opportunities for growth and development

Recent Development:

1) March 2023: Miach Orthopaedics, Inc. entered a distribution agreement with Veteran’s Health Medical Supply (VHMS). The agreement provides customers in 236 Department of Defense (DOD) and Department of Veterans Affairs (VA) healthcare facilities access to the Bridge Enhanced ACL Restoration (BEAR) Implant via the ECAT federal contract.

2) February 2023: CurvaFix, Inc. launched its smaller-diameter, 7.5mm CurvaFix IM Implant, designed to simplify surgery and provide strong, stable fixation in small-boned patients.

Q1. What was the Medical Implant Market size in 2022?

As per Data Library Research the Medical Implants Market involves an increase from USD 109.2 billion in 2022.

Q2. What is the Growth Rate of the Medical Implant Market?

Medical Implant Market is registering a Compound Annual Growth Rate (CAGR) of 8.20% over the forecast period.

Q3. What Impact did COVID-19 have on the Medical Implant Market?

The growth of the medical implants market experienced a notable setback in the initial stages of the COVID-19 pandemic, primarily due to constraints in the supply chain and a decrease in hospital visits by patients. For detailed insights request s sample here.

Q4. Who are the key players in Medical Implant Market?

Some key players operating in the market include

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model