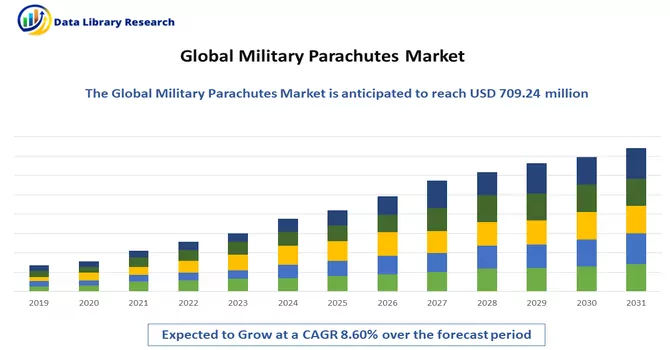

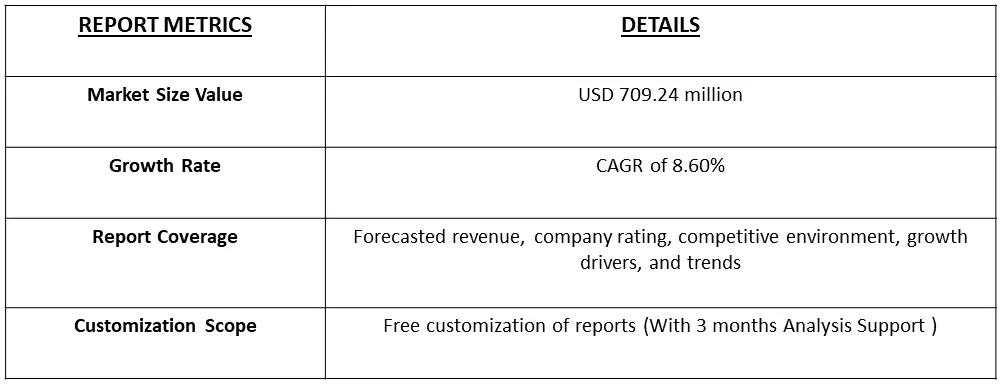

The Parachute Market size is estimated at USD 709.24 million in 2023 and is expected to have a CAGR of 8.60% during the forecast period (2024-2031).

Get Complete Analysis Of The Report - Download Free Sample PDF

The military parachute market plays a pivotal role in the defence sector, providing critical airborne capabilities for military operations and personnel safety. These parachutes serve a diverse range of functions, including personnel parachuting, cargo drops, and special operations. With advancements in technology, modern military parachutes are designed to meet stringent performance and safety standards, featuring innovations such as steerable parachutes, precision-guided systems, and advanced materials to enhance control and accuracy. The market is driven by the continuous modernization efforts of defence forces globally, emphasizing the need for reliable and technologically advanced parachute systems to support a wide array of missions. As military doctrines evolve and emphasize rapid deployment and mobility, the military parachute market remains integral to ensuring the success and safety of airborne operations in defence scenarios.

The growth of the military parachute market is propelled by a combination of strategic modernization initiatives, increasing global geopolitical tensions, and the evolving nature of military operations. As defence forces worldwide prioritize the enhancement of their airborne capabilities, there is a growing demand for technologically advanced and versatile parachute systems. Modern military doctrines, emphasizing rapid deployment, special operations, and expeditionary warfare, underscore the need for parachutes that offer precision, control, and adaptability. The incorporation of innovations such as steerable parachutes, guided systems, and advancements in materials not only ensures the safety of airborne personnel but also enables more effective cargo drops and mission success. The escalating focus on airborne forces and the continuous efforts to bolster defence capabilities in response to evolving security challenges contribute significantly to the sustained growth of the military parachute market.

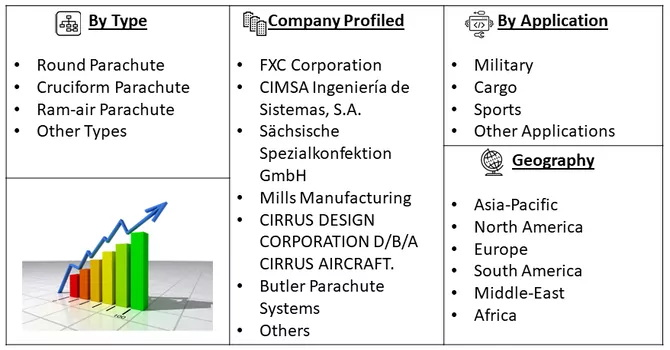

Market segmentation: Global Parachute Market Share & Companies and is Segmented by Type (Round Parachute, Cruciform Parachute, Ram-air Parachute, and Other Types), Application (Military, Cargo, Sports, and Other Applications), and Geography (North America, Europe, Asia-Pacific, Middle-East and Africa, and Latin America). The report offers the market sizes and forecasts for all the above segments in value (in USD billion).

For Detailed Market Segmentation - Download Free Sample PDF

Market trends in the military parachute industry reflect a continuous evolution driven by technological advancements and shifting defence priorities. One prominent trend is the integration of smart technologies into parachute systems, facilitating enhanced control, navigation, and precision landing capabilities. The development of guided parachutes equipped with GPS and advanced avionics addresses the demand for increased accuracy in airborne operations.Additionally, there is a noticeable focus on the use of lightweight and durable materials, improving the overall performance of parachutes while minimizing the logistical burden. Modular parachute systems, allowing for customization based on mission requirements, are gaining traction, providing flexibility to defence forces in diverse operational scenarios.The growing emphasis on training and simulation solutions within the military parachute market is another notable trend. Simulators and training aids contribute to more effective and safe parachute jump training, reducing risks and enhancing the proficiency of airborne forces.Furthermore, environmental sustainability is becoming a consideration in parachute design, with manufacturers exploring eco-friendly materials and manufacturing processes. As defense forces globally seek to modernize their airborne capabilities, these trends collectively shape the trajectory of the military parachute market, ensuring it remains adaptive to the dynamic landscape of contemporary military operations.

Military Parachutes Market Drivers:

The increasing emphasis on special operations:

The increasing emphasis on special operations within military strategies globally is a significant and influential trend. Special operations involve unconventional warfare scenarios, such as counterterrorism, reconnaissance, and clandestine missions, where precision, agility, and rapid deployment are paramount. As defence forces recognize the unique challenges and strategic advantages offered by special operations, there is a growing demand for specialized equipment and technologies, including advanced parachute systems. Parachutes designed for special operations are characterized by features such as stealth, manoeuvrability, and precision landing capabilities, catering to the specific needs of elite forces. This heightened emphasis on special operations underscores the evolving nature of modern warfare shaping military doctrines and driving innovation in equipment and technologies tailored for the intricacies of these specialized missions.

The continual advancements in parachute technology

Continual advancements in parachute technology represent a dynamic and crucial facet of the aerospace industry, revolutionizing the capabilities and safety of airborne operations. The evolution in parachute design encompasses a spectrum of innovations, ranging from the integration of smart technologies to the development of materials with enhanced durability and performance. Guided parachutes, equipped with advanced avionics and GPS systems, provide unprecedented control and precision during descent, aligning with the demand for more accurate and strategic landings. Steerable parachute systems offer increased manoeuvrability, enabling airborne forces to adapt to dynamic operational environments. Moreover, ongoing research and development efforts focus on lightweight yet robust materials, optimizing the balance between payload capacity and logistical efficiency. These continual advancements not only ensure the safety of airborne personnel but also contribute to the effectiveness of missions, reflecting the commitment of the aerospace industry to push the boundaries of parachute technology for the evolving needs of modern military and humanitarian operations.

Market Restraints:

Market restraints in the military parachute sector stem from challenges associated with stringent budget constraints, technological complexities, and environmental concerns. Defence budget limitations in various countries may impact procurement capabilities, leading to delayed or reduced orders for new parachute systems. Additionally, the intricacies of developing and implementing advanced parachute technologies, including guided and smart systems, pose challenges related to research, testing, and integration, which can slow down the overall market growth.Moreover, environmental considerations, such as the disposal of parachute materials and their ecological impact, have become a growing concern. The industry is under pressure to adopt more sustainable practices and materials, which can incur additional costs and may require a significant overhaul of existing manufacturing processes. These combined factors present hurdles for market players striving to balance innovation with economic and environmental constraints, influencing the pace and scope of advancements within the military parachute market.

The COVID-19 pandemic has exerted notable effects on the military parachute market, introducing a mix of challenges and adaptations. Supply chain disruptions and manufacturing slowdowns due to lockdowns and restrictions have impacted the production and delivery of parachute systems, causing potential delays in fulfilling defence contracts. Budgetary constraints, exacerbated by pandemic-related economic impacts, have led some defence forces to reassess their spending priorities, potentially affecting procurement plans for parachute systems.Conversely, the pandemic has underscored the strategic importance of military parachutes in scenarios requiring rapid response and mobility. The heightened focus on maintaining operational readiness, especially in unpredictable and emergency situations, has sustained the demand for parachute systems. Moreover, the crisis has prompted a reevaluation of contingency plans, potentially leading to increased investments in airborne capabilities, including parachute technology, to enhance military preparedness for future challenges. As the global situation continues to evolve, the COVID-19 impact on the military parachute market reflects a complex interplay of challenges and opportunities, necessitating adaptability and resilience within the industry.

Segmental Analysis:

Round Parachute Segment is Expected to Witness Significant Growth Over the Forecast Period

Round parachutes offer reliability, simplicity, and ease of use, making them suitable for beginners and scenarios requiring quick deployment, such as emergency parachutes. They provide a stable descent, ideal for situations where a gentle landing is crucial, like military cargo drops or specific skydiving needs. Additionally, round parachutes are cost-effective to manufacture and maintain, making them practical for various applications. While they lack the manoeuvrability of other designs, their versatility in military operations, cargo drops, and some recreational skydiving contexts makes them a valuable choice in the parachuting world.

Sports Segment is Expected to Witness Significant Growth Over the Forecast Period

Sports and military parachutes serve distinct but overlapping purposes, each designed for specific needs and environments. In sports, parachutes are used primarily for skydiving and parachuting disciplines. Sports parachutes are typically rectangular or elliptical in shape, offering greater control, manoeuvrability, and speed compared to round parachutes. They are designed for precision landings and aerobatics, making them ideal for activities like skydiving competitions, formation skydiving, and BASE jumping. Sports parachutes are also used for training purposes, allowing skydivers to practice different manoeuvres and techniques safely. On the other hand, military parachutes are designed for tactical and logistical purposes, including troop insertion, cargo drops, and aerial resupply missions. Military parachutes come in various types, including round, ram-air, and parafoil parachutes. Round parachutes are still used in some military applications due to their reliability and simplicity, especially for cargo drops and emergencies. Ram-air parachutes and parafoils, however, offer greater control, precision, and glide ratio, making them more suitable for troop insertion and other tactical operations. Thus, while sports and military parachutes share some similarities in terms of design and function, they are tailored to meet the specific needs and requirements of their respective users and environments.

Asia Pacific Region is Expected to Witness Significant Growth Over the Forecast Period

The Asia Pacific region has seen a growing interest in both military and sports parachuting activities in recent years. In the military context, countries in the region have been investing in airborne forces and capabilities for various tactical and strategic purposes. Military parachuting exercises and training are conducted to ensure readiness for rapid deployment and mission execution. Parachuting is used for troop insertion, special operations, and aerial resupply, among other military operations, highlighting its importance in the region's defence strategies. In the realm of sports parachuting, the Asia Pacific region has witnessed a surge in popularity, with more people taking up skydiving and related disciplines. Countries like Australia, New Zealand, and Japan have active skydiving communities, hosting events and competitions that attract participants from around the world. Sports parachuting offers thrill-seekers an adrenaline-pumping experience, with disciplines such as formation skydiving, freestyle skydiving, and canopy piloting showcasing the skill and athleticism of participants. The use of parachutes in both military and sports contexts in the Asia Pacific region reflects the diverse applications and appeal of parachuting activities. Whether for military readiness or recreational pursuits, parachuting continues to be a dynamic and impactful activity in the region. Thus, the segment is expected to witness significant growth over the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

The analyzed market exhibits a high degree of fragmentation, primarily attributable to the presence of numerous players operating on both a global and regional scale. The competitive landscape is characterized by a diverse array of companies, each contributing to the overall market dynamics. This fragmentation arises from the existence of specialized solution providers, established industry players, and emerging entrants, all vying for market share. The diversity in market participants is underscored by the adoption of various strategies aimed at expanding the company presence. On a global scale, companies within the studied market are strategically positioning themselves through aggressive expansion initiatives. This often involves entering new geographical regions, targeting untapped markets, and establishing a robust global footprint. The pursuit of global expansion is driven by the recognition of diverse market opportunities and the desire to capitalize on emerging trends and demands across different regions. Simultaneously, at the regional level, companies are tailoring their approaches to align with local market dynamics. Regional players are leveraging their understanding of specific market nuances, regulatory environments, and consumer preferences to gain a competitive edge. This regional focus allows companies to cater to the unique needs of local clientele, fostering stronger market penetration. To navigate the complexities of the fragmented market, companies are implementing a range of strategies. These strategies include investments in research and development to stay at the forefront of technological advancements, mergers and acquisitions to consolidate market share, strategic partnerships for synergies, and innovation to differentiate products and services. The adoption of such multifaceted strategies reflects the competitive nature of the market, with participants continually seeking avenues for growth and sustainability. In essence, the high fragmentation in the studied market not only signifies the diversity of players but also underscores the dynamism and competitiveness that drive ongoing strategic manoeuvres. As companies explore various avenues for expansion, the market continues to evolve, presenting both challenges and opportunities for industry stakeholders. Some of the major players operating in the commercial and military parachute market report are:

Recent Development:

1) In July 2021, Lockheed Martin secured a substantial contract valued at USD 62 million for the provision of Parachute and drag chute systems intended for integration into the F-35 Lightning II fighter jets. The contract encompasses the procurement of 190 parachutes and 56 drag chute systems, specifically designated for non-Department of Defense (DOD) participants and Foreign Military Sales (FMS) customers. This procurement underlines Lockheed Martin's pivotal role in enhancing the airborne capabilities of the F-35 fleet, catering to both domestic and international defence requirements.

2) In January 2021, the US Airborne and Special Operations Test Directorate (ABNSOTD) conducted exhaustive tests on the new T-11R Single Pin Troop reserve parachute. These tests, conducted across both rotary-winged and fixed-winged high-performance aircraft, aimed to eliminate any potential for premature reserve activations. The successful outcomes of these tests signify a milestone in ensuring the reliability and safety of the reserve parachute system, paving the way for its widespread adoption in large numbers across diverse airborne platforms. This advancement aligns with the commitment to continually enhance the precision and dependability of parachute systems utilized in various operational contexts.

Q1. What was the Military Parachutes Market size in 2023?

As per Data Library Research the Military Parachute Market size is estimated at USD 709.24 million in 2023.

Q2. At what CAGR is the market projected to grow within the forecast period?

Military Parachutes Market is expected to have a CAGR of 8.60% during the forecast period.

Q3. What are the factors driving the Military Parachutes Market?

Key factors that are driving the growth include the increasing emphasis on special operations and The continual advancements in parachute technology

Q4. Which region has the largest share of the Military Parachutes market? What are the largest region's market size and growth rate?

Asia-Pacific has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model