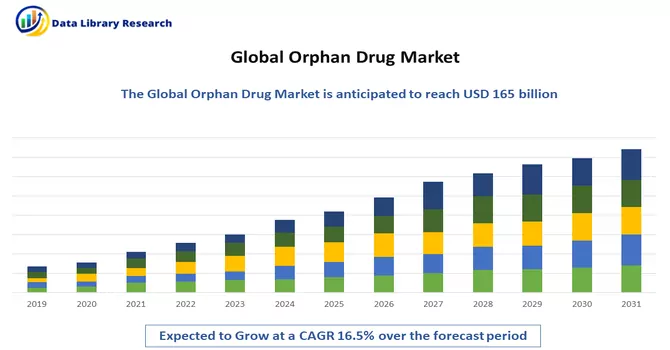

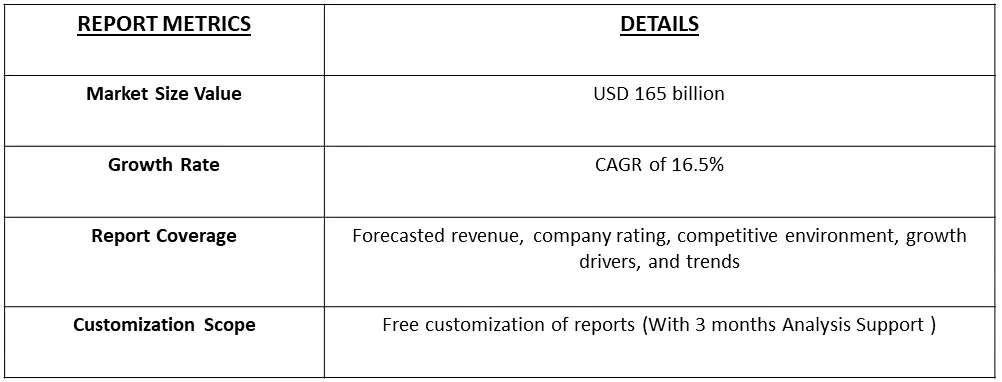

The global orphan drugs market size accounted for USD 165 billion in 2022 and is projected to have a notable compound annual growth rate (CAGR) of 16.5% during the forecast period from 2024 to 2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Orphan drugs, also known as orphan medicines, refer to pharmaceutical agents developed to treat rare medical conditions or diseases, often referred to as orphan diseases. These conditions are considered rare because they affect a small population of individuals. Orphan drugs are designed to address the medical needs of patients with rare diseases, which may not attract significant attention from the pharmaceutical industry due to the limited market size. The development and commercialization of orphan drugs are incentivized by various regulatory frameworks, such as orphan drug designation in the United States and orphan medicinal product designation in the European Union. These designations provide pharmaceutical companies with certain benefits and incentives, including market exclusivity, financial incentives, and streamlined regulatory processes, to encourage the development of treatments for rare diseases.

Orphan drugs often benefit from a period of market exclusivity, during which competing products are restricted. This exclusivity provides pharmaceutical companies with the opportunity to recoup development costs and generate returns on their investments, making orphan drug development financially attractive. Moreover, increased awareness and advocacy for rare diseases have led to greater funding for research and development in this area. Public and private organizations, as well as government initiatives, provide grants and funding to support the discovery and development of orphan drugs. Thus, such factors are driving the growth of the studied market over the forecast period.

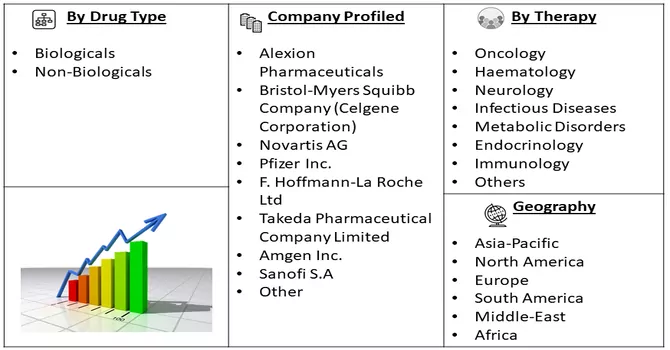

Market Segmentation: Orphan Drugs Market by Drug Type (Biologicals and Non-Biologicals) Therapy (Oncology, Haematology, Neurology, Infectious Diseases, Metabolic Disorders, Endocrinology, Immunology, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World). The value is provided (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The global orphan drug market is witnessing a surge in the number of orphan drug designations granted by regulatory authorities. This trend signifies a growing emphasis on developing therapies for rare diseases and incentivizes pharmaceutical companies to invest in orphan drug research. Gene therapies, with their potential to target the underlying genetic causes of rare diseases, are experiencing significant growth in the orphan drug market. Advances in gene editing technologies, such as CRISPR, are contributing to the development of innovative gene therapies for previously untreatable genetic disorders. Thus, these market trends are expected to drive the growth of the studied market over the forecast period.

Market Drivers:

Growing Market Exclusivity for Orphan Drug Developers

There has been a noticeable trend towards the expansion of market exclusivity for developers of orphan drugs. Market exclusivity refers to the period during which a particular drug enjoys protection from competition, allowing the developer to be the sole provider of that therapeutic option in the market. Regulatory agencies, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), grant orphan drug designations to drugs developed for rare diseases. This designation comes with various incentives, including extended market exclusivity, providing developers with an extended period to recoup investments. Moreover, governments often provide tax incentives for orphan drug developers, further supporting their financial viability. These tax credits contribute to the overall attractiveness of orphan drug development and enhance the exclusivity period for developers. Thus, owing to such factors the segment is expected to witness significant growth over the forecast period.

Rising R&D Studies for Rare Diseases

Moreover, the upward trajectory of the market is being propelled by a surge in research and development endeavours focused on creating novel therapies for rare diseases. A concrete example is the research landscape highlighted by ClinicalTrials.gov in December 2021. The study titled "Oral Health-Related Quality of Life of Patients With Rare Diseases: a Qualitative Approach (RaroDentAXE3)," conducted by Assistance Publique - Hôpitaux de Paris, is anticipated to conclude its investigation by December 2022. This exemplifies the increasing attention and commitment to understanding and addressing the unique healthcare challenges posed by rare diseases. The proliferation of such research initiatives is poised to contribute significantly to market growth throughout the forecast period.

Market Restraints:

High Per Patient Treatment Cost and Limited Patient Pool for Clinical Trials and Product Marketing

Orphan drugs often involve complex development processes, including precision medicine, gene therapies, and advanced technologies. These factors contribute to elevated research and development expenses, driving up the per-patient treatment cost. The need for specialized manufacturing and intricate formulations further amplifies the overall expenses associated with orphan drug development. Also, regulatory processes for orphan drugs, while designed to incentivize development, can still present challenges. Navigating complex regulatory pathways, obtaining orphan drug designations, and satisfying stringent criteria demand significant resources. Delays in regulatory approvals can impede market entry and commercialization. Thus, such factors are expected to slow down the growth of the studied market over the forecast period.

The orphan drug market experienced both challenges and opportunities amid the COVID-19 pandemic. The pandemic led to disruptions in ongoing clinical trials, affecting the development timelines for orphan drugs. For instance, an article published by NCBI in July 2023, reported that 34.8% of clinical trial studies on Orphan drugs came to a halt in the year 2020, as more focus was given to the COVID-19 vaccine and drug development. However, the heightened awareness of healthcare vulnerabilities emphasized the importance of addressing rare diseases, potentially garnering more attention and resources for orphan drug development.

Segmental Analysis:

Biological Segment is Expected to Witness Significant Growth Over the Forecast Period

Biological orphan drugs are derived from living cells or organisms. Unlike traditional small-molecule drugs, which are chemically synthesized, biological drugs are produced using biotechnological processes involving recombinant DNA technology, cell culture, or other biological systems. Some biological orphan drugs fall into the category of enzyme replacement therapies. These drugs are developed for conditions where patients lack specific enzymes crucial for normal physiological functions. By replacing or augmenting deficient enzymes, ERTs aim to restore normal cellular activities and ameliorate disease symptoms. Moreover, Cytokines and growth factors, which play vital roles in regulating immune responses, cell growth, and tissue repair, are another class of biological orphan drugs. They are utilized to modulate specific signalling pathways and restore balanced physiological functions disrupted in certain rare diseases. Thus, such factors are expected to drive the growth of the studied segment over the forecast period.

Oncology Segment is Expected to Witness Significant Growth Over the Forecast Period

Oncology and orphan drugs intersect in a unique and critical manner, as rare and orphan cancers often present significant challenges due to their limited prevalence. Orphan cancers refer to malignancies that affect a small number of individuals, making them rare and often neglected in terms of drug development. These cancers may include certain subtypes of leukaemia, sarcomas, and neuroendocrine tumours, among others. The field of oncology has witnessed a paradigm shift towards precision medicine, which involves tailoring treatments based on the genetic and molecular characteristics of tumours. This approach is particularly relevant in rare cancers where a one-size-fits-all strategy may not be effective. Thus, owing to such factors, the segment is expected to witness significant growth over the forecast period.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North America currently holds a dominant position in the orphan drugs market, and this trend is anticipated to persist for the foreseeable future. Within North America, the United States emerges as the key contributor, boasting the largest market share. The robust growth in this region is fueled by several factors, notably the regulatory incentives provided to orphan drugs. In the United States, drugs designated with orphan status enjoy significant benefits, including seven years of marketing exclusivity upon FDA approval for a specific indication. This exclusivity, coupled with additional advantages like tax credits and user fee waivers, incentivizes pharmaceutical companies to invest in the development of orphan drugs. Also, the prevalence of rare diseases further propels the growth of the orphan drugs market in North America. Recent data, updated in May 2022 by the Genetic and Rare Diseases Information Center (GARD), reveals that around 30 million Americans are affected by rare diseases. Additionally, the Canadian Organization for Rare Disorders (CORD) reported that 3.1 million Canadians are impacted by rare diseases as of their 2021 update. Recognizing the substantial prevalence of rare diseases in the region, the government has taken proactive measures to support affected individuals.

To address the challenges posed by the limited availability of FDA-approved treatments for rare diseases, the U.S. government, through the National Institutes of Health (NIH), allocated USD 31 million in grants for rare disease research between 2019 and 2020. This commitment underscores the importance of advancing scientific understanding and treatment options for individuals with rare conditions. Furthermore, the Food and Drug Administration (FDA) in the United States played a pivotal role in advancing research in the field of rare diseases. In October 2020, the FDA executed the Orphan Drug Act, allocating over USD 16 million for six clinical trial research studies. This funding, distributed to both industry and academia, is earmarked for a four-year duration, emphasizing the sustained commitment to advancing orphan drug development. Thus, North America, particularly the United States, remains at the forefront of the orphan drugs market, propelled by regulatory support, a high prevalence of rare diseases, and strategic investments in research and development. The collaborative efforts between government agencies, research institutions, and industry stakeholders underscore the commitment to addressing the unique healthcare needs of individuals affected by rare diseases in the region.

Get Complete Analysis Of The Report - Download Free Sample PDF

The landscape of the orphan drugs market exhibits moderate competitiveness, characterized by a concentration of market share among a select group of major players. While these established entities currently dominate the market, the sector is witnessing the entry of smaller players who are securing a noteworthy share. The escalating prevalence of rare diseases, coupled with a growing number of cases annually, has spurred the participation of emerging companies, contributing to a more diverse and dynamic market environment. This trend underscores the evolving nature of the orphan drugs market, with both established and emerging players playing pivotal roles in addressing the increasing healthcare challenges associated with rare diseases. Some of the market players include:

Recent Developments:

1) In June 2022, the Food and Drug Administration (FDA) bestowed orphan drug designation upon Evorpacept, an advanced CD47 blocker developed by ALX Oncology Holdings Inc. This designation aims to support the treatment of individuals diagnosed with acute myeloid leukaemia (AML).

2) In March 2022, the FDA granted orphan drug designation to a CRISPR-edited T cell receptor (TCR) T-cell therapy, currently under investigation by Intellia Therapeutics. This innovative therapy is being explored for its potential to address acute myeloid leukaemia (AML).

Q1. What was the Orphan Drug Market size in 2022?

As per Data Library Research the global orphan drugs market size accounted for USD 165 billion in 2022.

Q2. At what CAGR is the Orphan Drug Market projected to grow within the forecast period?

Orphan Drug Market is projected to have a notable compound annual growth rate (CAGR) of 16.5% during the forecast period.

Q3. What segments are covered in the Orphan Drug Market Report?

By Drug Type, By Therapy, End-User and Geography these are the segments covered in the Orphan Drug Market Report

Q4. Which Region is expected to hold the highest Market share?

North America region is expected to hold the highest Market share.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model