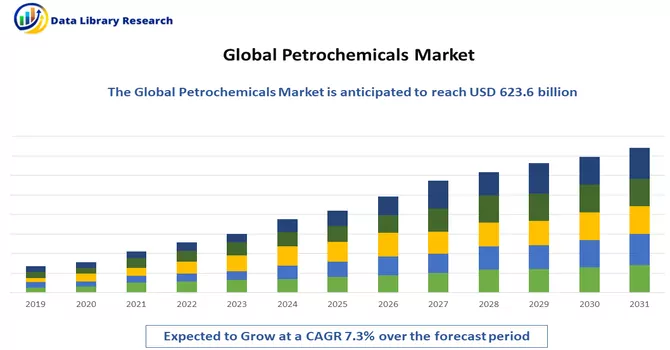

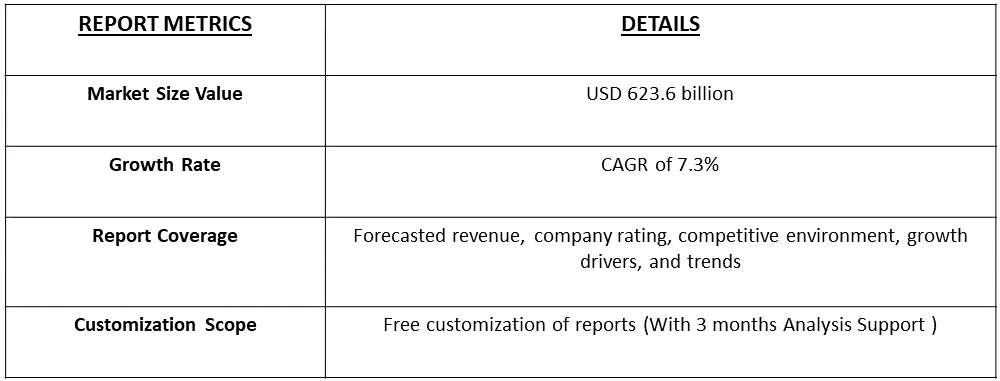

The global petrochemicals market size was valued at USD 623.6 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 7.3% from 2024 to 2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Petroleum, commonly referred to as crude oil, is a naturally occurring, fossil fuel derived from ancient marine organisms buried and subjected to heat and pressure over millions of years. It is a complex mixture of hydrocarbons, primarily consisting of carbon and hydrogen, with varying proportions of other elements such as sulfur, nitrogen, and oxygen. Extracted from underground reservoirs through drilling, petroleum serves as a crucial global energy source, providing the raw material for various products, including gasoline, diesel, jet fuel, and a wide range of petrochemicals essential in the manufacturing of plastics, synthetic materials, and countless industrial goods. The exploration, extraction, refining, and utilization of petroleum play pivotal roles in the global economy, shaping energy policies and impacting environmental concerns.

The petrochemicals market is driven by several key growth factors, including the increasing demand for plastics and synthetic materials in diverse industries such as packaging, automotive, and construction. The growth of emerging economies, urbanization, and a rising global population contribute to heightened consumption of petrochemical products. Additionally, advancements in technology and innovation in the petrochemical sector enhance production efficiency and expand the range of applications. Furthermore, the expanding use of petrochemicals in the production of renewable energy components, medical devices, and consumer goods contributes to sustained market growth. Moreover, the availability of abundant and cost-effective feedstocks, such as shale gas, further propels the petrochemicals industry forward, fostering increased investments and development.

Several key market trends are shaping the petrochemical industry. Firstly, there is a growing emphasis on sustainability, with an increasing demand for bio-based and recycled materials in response to environmental concerns. This shift is driving research and development efforts towards more eco-friendly and circular production processes within the petrochemical sector. Another notable trend is the rising adoption of digital technologies, including artificial intelligence and data analytics, to optimize operations, improve efficiency, and enhance overall supply chain management. Furthermore, geopolitical factors and the global push towards energy transition are influencing the market dynamics, with a focus on diversification of feedstocks and investments in cleaner alternatives. Additionally, the industry is witnessing a surge in demand for specialty chemicals, driven by advancements in end-use applications, such as electronics, healthcare, and agriculture. Overall, the petrochemicals market is experiencing a transformative phase, marked by a convergence of sustainability, technological innovation, and strategic adaptations to meet evolving consumer and regulatory expectations.

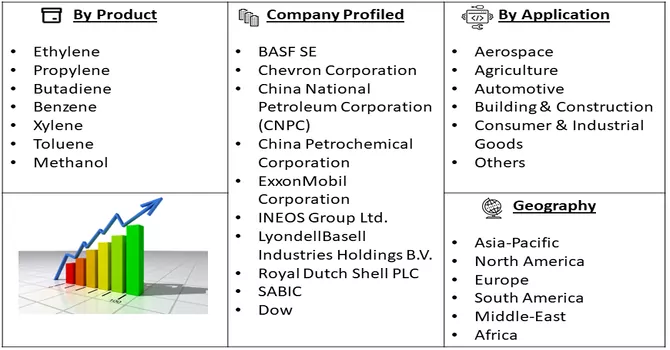

Market Segmentation: The Petrochemicals Market is Segmented by Product (Ethylene, Propylene, Butadiene), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, and South America). The value is provided in (USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Increase in the demand for downstream products from various end-use industries such as construction

The petrochemicals industry is witnessing a notable surge in the demand for downstream products, fueled primarily by diverse end-use sectors, prominently construction. As global economies continue to expand, urbanization and infrastructure development projects are on the rise, propelling the need for a wide array of petrochemical-derived materials. Construction applications, including plastics, adhesives, sealants, and coatings, are experiencing heightened demand due to their versatility, durability, and cost-effectiveness. These petrochemical-based materials play pivotal roles in enhancing the performance, longevity, and sustainability of construction projects. Additionally, the growing population and rising middle-class in emerging economies are driving increased demand for housing, commercial buildings, and infrastructure, further boosting the consumption of downstream petrochemical products. This trend reflects the interdependence between the petrochemicals industry and the construction sector, highlighting the crucial role of petrochemical-derived materials in shaping the modern built environment.

Increase demand for petrochemicals and their derivatives for use in various applications such as tires, pharmaceuticals, high-tech materials, and paints

The petrochemicals industry is experiencing a significant uptick in demand, propelled by diverse applications across sectors such as automotive, pharmaceuticals, high-tech materials, and paints. In the automotive industry, the escalating need for tires with enhanced performance characteristics, including durability, fuel efficiency, and safety, is driving a surge in demand for petrochemical-derived rubber and polymer materials. Likewise, pharmaceuticals increasingly rely on petrochemical derivatives in the manufacturing of drugs, packaging materials, and medical devices, contributing to the industry's growth. In high-tech sectors, such as electronics and telecommunications, petrochemicals play a crucial role in the production of specialty chemicals and materials, including semiconductors and advanced polymers. Additionally, the paints and coatings industry benefits from a diverse range of petrochemical-derived raw materials, ensuring superior quality, durability, and aesthetic properties in the finished products. This multifaceted demand underscores the indispensable role of petrochemicals and their derivatives in driving innovation and meeting the evolving needs of various industries, reinforcing their position as essential components in modern manufacturing and technology.

Market Restraints:

The petrochemical industry faces several market restraints that can impact its growth and operations.

Firstly, environmental concerns and the growing emphasis on sustainability are pressuring the industry to address issues related to carbon emissions, plastic waste, and overall environmental impact. This has led to increased regulatory scrutiny and the need for substantial investments in cleaner technologies. Additionally, geopolitical uncertainties and fluctuations in crude oil prices can significantly affect the cost structure of the petrochemicals industry, impacting profitability and investment decisions. Moreover, the industry is susceptible to market volatility and economic downturns, as demand for petrochemical products is closely tied to broader economic activities. Trade tensions and geopolitical conflicts can disrupt global supply chains, affecting the availability and pricing of raw materials. Another restraint is the increasing competition from alternative materials, such as bio-based and recycled products, as consumers and industries seek more sustainable options. Furthermore, the reliance on fossil fuels as feedstocks raises concerns about resource depletion and the long-term viability of current production methods. Additionally, the petrochemicals industry faces challenges related to technological disruptions and the need for continuous innovation to stay competitive. The shift towards circular economies and the reduction of single-use plastics further add pressure on the industry to adapt and invest in more sustainable practices. Overall, these market restraints necessitate strategic adaptations and investments in research and development to ensure the long-term viability and resilience of the petrochemical sector.

The COVID-19 pandemic has had a profound impact on the petrochemical industry, introducing a combination of short-term disruptions and long-term shifts. The initial wave of the pandemic led to a sudden decline in global demand for petrochemical products as lockdowns, travel restrictions, and economic uncertainties hampered industrial activities and consumer spending. This resulted in reduced production capacities, disrupted supply chains, and a decline in overall revenue for petrochemical companies. The volatility in crude oil prices during the pandemic further exacerbated challenges for the petrochemicals industry, as it heavily relies on oil and gas as feedstocks. Fluctuations in oil prices created uncertainties in production costs and profitability, prompting companies to reassess their strategies and operational efficiency. However, the petrochemicals industry also played a crucial role in addressing the pandemic's challenges. Petrochemical products are vital components in the manufacturing of personal protective equipment (PPE), medical supplies, and pharmaceuticals. The demand for plastics used in packaging for medical supplies, sanitization products, and food packaging witnessed a surge during the pandemic. As the world adapts to the "new normal," the petrochemicals industry is also undergoing transformations. There is an increased focus on sustainability and resilience, with companies reevaluating supply chain strategies and incorporating digital technologies for improved operational efficiency. The pandemic has accelerated trends such as remote work, e-commerce, and a heightened awareness of environmental issues, influencing the demand for specific petrochemical products. In summary, the COVID-19 pandemic has presented both challenges and opportunities for the petrochemical industry. While the immediate impact included disruptions in production and demand, the industry's role in providing essential materials during the crisis and the ongoing shifts in consumer behaviour and industry trends are shaping its trajectory in the post-pandemic era.

Segmental Analysis:

Propylene Segment is Expected to Witness Significant Growth Over the Forecast Period.

Propylene is a crucial building block in the petrochemical industry, serving as a key intermediate for the production of various chemicals and plastics. As one of the primary derivatives of crude oil and natural gas, propylene plays a pivotal role in the synthesis of polypropylene, a widely used thermoplastic with applications ranging from packaging materials to textiles and automotive components. The propylene and petrochemicals market are closely interconnected, with propylene serving as a feedstock for the manufacturing of a diverse array of chemical products. The propylene market is influenced by factors such as supply-demand dynamics, global economic conditions, and technological advancements in production processes. With an increasing demand for polypropylene and other propylene-based products, the petrochemical industry continually explores innovative methods for propylene production, including refining processes and steam cracking. Market trends in propylene and petrochemicals include a growing focus on sustainable practices, prompting research into bio-based propylene and renewable sources. Additionally, market participants are navigating regulatory changes and consumer preferences toward eco-friendly materials, influencing the development and adoption of greener technologies within the propylene and petrochemical sectors. The propylene and petrochemicals market is dynamic, shaped by global industrial activities, technological breakthroughs, and environmental considerations. As industries strive for greater sustainability and efficiency, the evolution of propylene and its derivatives remains integral to the broader landscape of the petrochemical sector.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North America plays a pivotal role in the global petrochemicals market, boasting a significant share in production, consumption, and innovation within the industry. The region's petrochemical sector is closely tied to its abundant and diverse feedstock resources, primarily sourced from the robust shale gas and oil reserves. The United States, in particular, stands out as a major player, with the shale revolution fostering a surge in production capacity and propelling North America into a prominent position as a net exporter of petrochemical products.The petrochemicals market in North America is characterized by a diverse product portfolio, including ethylene, propylene, benzene, and various plastics and specialty chemicals. Key end-user industries such as automotive, construction, and packaging drive the demand for these petrochemical products. The region's strategic investments in downstream facilities and technological advancements contribute to its competitiveness on the global stage. Moreover, sustainability concerns and the demand for greener alternatives are influencing the petrochemical landscape in North America. Industry players are increasingly exploring eco-friendly processes, recycling initiatives, and bio-based feedstocks to align with evolving environmental regulations and consumer preferences. Trade dynamics also play a significant role, with North America serving as a vital exporter of petrochemical products, particularly to Asia. The proximity to emerging markets, coupled with logistical advantages, positions North America as a key player in the global supply chain for petrochemicals. However, the industry faces challenges, including regulatory uncertainties, geopolitical factors, and the volatility of commodity prices. Nevertheless, strategic investments, technological innovations, and a focus on sustainable practices are expected to shape the resilient future of the petrochemicals market in North America. As the region continues to navigate these complexities, collaboration between industry stakeholders and governmental support will be crucial for sustaining growth and competitiveness in the global petrochemical arena.

Get Complete Analysis Of The Report - Download Free Sample PDF

Leading companies in the petrochemicals market, including Saudi Basic Industries Corporation (SABIC), ExxonMobil Corporation, BASF SE, Dow Inc., China Petroleum & Chemical Corporation (Sinopec), Royal Dutch Shell, and Chevron Phillips Chemical Company, collectively dominate the industry and shape global trends. Operating on a global scale, these companies are key players in the production of petrochemicals, plastics, and specialty chemicals. While their specific financials, strategy maps, and product details are proprietary, their influence is evident in their diversified portfolios, innovative approaches, and significant market shares, contributing to the intricate supply network of the petrochemicals sector. For more detailed information, one should refer to the companies' official reports and industry analyses.

Recent Development:

1) In November 2023, Dow unveiled plans to invest $8.9 billion in a groundbreaking net-zero petrochemical plant project situated in Alberta's Industrial Heartland, Canada. This venture aims to yield approximately 3 million tons of low-emission ethylene and polyethylene derivatives. The commencement of construction for the project is scheduled for 2024.

2) In July 2023, SABIC took a significant step towards environmental sustainability by introducing its latest NORYLTM portfolio, utilizing post-consumer recycled materials. This initiative seeks to reduce the carbon footprint in the petrochemical industry, showcasing SABIC's commitment to fostering an environmentally friendly approach in the chemical sector.

Q1. What was the Petrochemicals Market size in 2023?

As per Data Library Research the global petrochemicals market size was valued at USD 623.6 billion in 2023.

Q2. At what CAGR is the Petrochemicals market projected to grow within the forecast period?

Petrochemicals Market is expected to grow at a compound annual growth rate (CAGR) of 7.3% over the forecast period.

Q3. Which Region is expected to hold the highest Petrochemicals Market share?

North America region is expected to hold the highest Petrochemicals Market share.

Q4. Who are the key players in Petrochemicals Market?

Some key players operating in the market include

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model