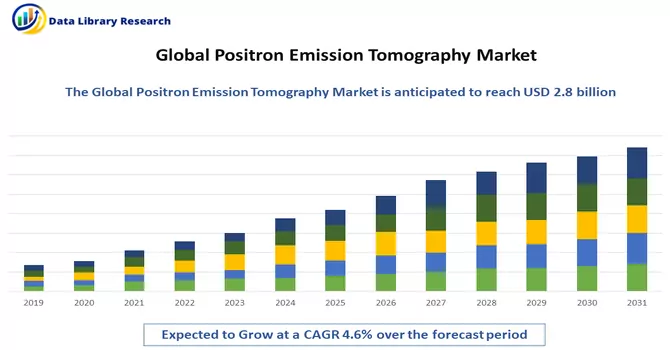

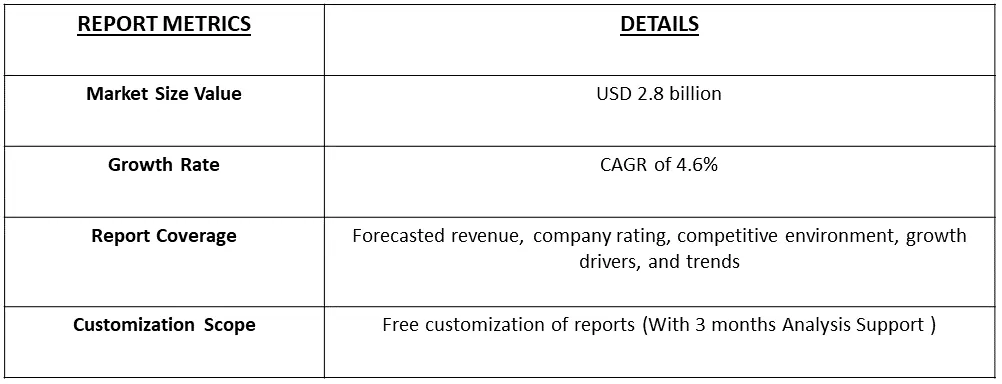

The Positron Emission Tomography Market size is estimated at USD 2.8 billion in 2023 and is expected to register a CAGR of 4.6% during the forecast period (2024-2031).

Get Complete Analysis Of The Report - Download Free Sample PDF

Positron Emission Tomography (PET) is a medical imaging technique that utilizes positron-emitting radioactive tracers to visualize and quantify physiological and biochemical processes in the human body. During a PET scan, a patient is injected with a small amount of a radiotracer, which emits positrons, the antimatter counterparts of electrons. As the positrons interact with electrons in the body, they annihilate, producing two gamma rays that travel in opposite directions. These gamma rays are detected by a ring of sensitive detectors surrounding the patient, enabling the reconstruction of three-dimensional images of the tracer distribution within the body. PET is particularly valuable in oncology for cancer staging, monitoring treatment response, and identifying the precise location of abnormalities. Additionally, it is used to assess brain function and disorders such as Alzheimer's disease. The high sensitivity and ability to provide functional information make PET a powerful tool for non-invasive imaging and quantitative analysis of physiological processes at the molecular level.

Several market driving factors contribute to the growth and expansion of the Positron Emission Tomography (PET) market. Firstly, the increasing prevalence of cancer and neurological disorders has led to a rising demand for accurate diagnostic tools, with PET offering non-invasive and high-resolution imaging capabilities for early detection and effective treatment planning. Additionally, advancements in PET technology, such as the development of hybrid imaging systems like PET-CT and PET-MRI, enhance the diagnostic accuracy by combining anatomical and functional information. The expanding applications of PET beyond oncology, such as in cardiology and neurology, further widen its market reach. Moreover, ongoing research and development activities, as well as collaborations between industry players and research institutions, contribute to continuous innovations in radiotracers and imaging systems, boosting the overall efficiency and reliability of PET scans. Furthermore, the increasing awareness among healthcare professionals and patients about the benefits of early disease detection and personalized medicine fuels the adoption of PET imaging, driving market growth. Overall, these factors collectively contribute to the dynamic expansion of the Positron Emission Tomography market.

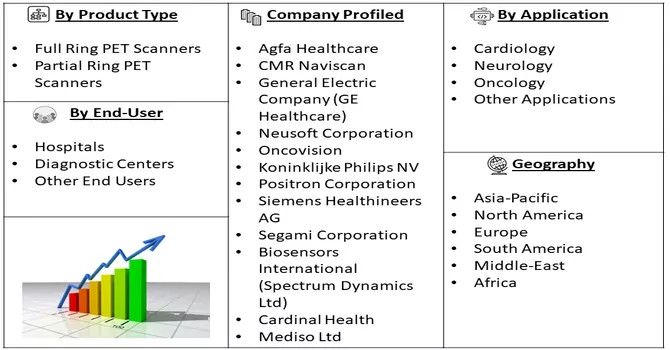

Market Segmentation: The Global Positron Emission Tomography (PET) Scanners Market is Segmented by Product Type (Full Ring PET Scanners and Partial Ring PET Scanners), Application (Cardiology, Neurology, Oncology, and Other Applications), End-User (Hospitals, Diagnostic Centers, and Other End Users), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The market size and forecasts are provided in terms of value (in USD) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Several key market trends are shaping the landscape of the Positron Emission Tomography (PET) market. Firstly, there is a noticeable shift towards the development of novel radiotracers with enhanced specificity, allowing for more precise and targeted imaging. This trend is driven by a growing emphasis on personalized medicine and the need for tailored diagnostic solutions. Additionally, there is a rising integration of artificial intelligence (AI) and machine learning in PET image analysis, facilitating improved image interpretation, faster processing, and enhanced diagnostic accuracy. The market is also witnessing an increased adoption of hybrid imaging technologies, such as PET-CT and PET-MRI, which provide comprehensive anatomical and functional information in a single scan, contributing to more comprehensive patient assessment. Another notable trend is the expanding applications of PET beyond oncology, with a focus on cardiovascular and neurological disorders. Furthermore, efforts to reduce radiation exposure during PET scans and the development of cost-effective imaging solutions are gaining traction. Lastly, collaborations between industry players and research institutions for the advancement of PET technologies and the increasing use of PET in drug development and clinical trials reflect the dynamic and evolving nature of the Positron Emission Tomography market.

Market Drivers:

Increasing Demand for PET Analysis in Radio Pharmaceuticals

The increasing demand for Positron Emission Tomography (PET) analysis in the field of radiopharmaceuticals is a notable trend shaping the landscape of medical imaging and diagnostics. PET, as a molecular imaging technique, offers unique insights into physiological processes at the cellular and molecular levels, making it invaluable in the development and evaluation of radiopharmaceuticals. Radiopharmaceuticals, compounds labelled with short-lived radioisotopes, are crucial for both diagnostic and therapeutic applications. PET allows for the visualization and quantification of these radiopharmaceuticals in the body, enabling precise assessments of organ function, metabolic activity, and disease presence. The use of PET in radiopharmaceutical analysis is particularly evident in drug development and clinical trials.

Researchers and pharmaceutical companies utilize PET to study the pharmacokinetics and biodistribution of new compounds, providing crucial data on their effectiveness and safety. The ability of PET to offer quantitative and real-time information aids in optimizing drug development processes and ensuring that potential therapies are thoroughly evaluated. In clinical practice, PET is widely employed for cancer imaging, neurology, and cardiology. The technique plays a pivotal role in cancer diagnosis, staging, and treatment response assessment, contributing to personalized and targeted therapeutic approaches. In neurology, PET is utilized to study brain function and neurodegenerative disorders, while in cardiology, it provides valuable information on myocardial perfusion, metabolism, and viability. The versatility of PET extends beyond conventional medical applications, with emerging roles in areas such as immunology, inflammation, and infectious diseases. As the understanding of these fields deepens, the demand for PET analysis continues to grow, driven by its ability to offer functional and quantitative information at the molecular level.

Integration of X-ray Tomography (CT) into PET

The integration of X-ray Tomography, or CT (Computed Tomography), into Positron Emission Tomography (PET) represents a transformative advancement in medical imaging, giving rise to the hybrid imaging modality known as PET-CT. This innovative approach combines the functional and metabolic insights of PET with the anatomical details provided by CT in a single imaging session. PET-CT, widely used in oncology, offers a comprehensive view by highlighting areas of abnormal metabolic activity through PET and providing precise anatomical localization through CT. Beyond oncology, the integration of X-ray Tomography into PET has demonstrated significant value in cardiology and neurology, enhancing diagnostic accuracy for various cardiovascular and neurological conditions. This synergy enables clinicians to make more precise diagnoses, formulate personalized treatment plans, and monitor treatment responses, ultimately contributing to improved patient outcomes. As technology evolves, further refinements in the integration of X-ray Tomography into PET are anticipated, promising continuous advancements in diagnostic capabilities and patient care.

Market Restraints:

Stringent Regulatory Guidelines

The Positron Emission Tomography (PET) market faces the challenge of stringent regulatory guidelines that have the potential to impede its growth trajectory. As a highly sophisticated medical imaging technology involving the use of radioactive tracers, PET is subject to rigorous regulatory scrutiny to ensure patient safety, radiation protection, and the reliability of diagnostic information. Stringent regulations imposed by health authorities and regulatory bodies necessitate thorough validation, quality control, and compliance with specific standards for PET facilities and radiotracers. Adherence to these guidelines often demands substantial financial investments, time-consuming processes, and intricate documentation, which can pose challenges for market players, especially smaller enterprises. Delays in regulatory approvals, increased compliance costs, and the need for continuous adherence to evolving standards may slow down the pace of innovation and market entry for new technologies and products. However, these stringent regulations are crucial for maintaining high standards of patient care and safety, ensuring accurate diagnoses, and fostering public confidence in the use of PET technology. Industry stakeholders must navigate these regulatory challenges adeptly through collaboration with regulatory bodies, continuous quality improvement initiatives, and proactive compliance strategies to overcome potential obstacles and sustain the growth of the Positron Emission Tomography market.

The Positron Emission Tomography (PET) market underwent significant disruptions in its initial phases due to the widespread impact of the COVID-19 pandemic. The imposition of complete shutdowns on radiological and scan services, implemented to curb the virus's spread, was a major contributing factor. Additionally, the apprehension surrounding the virus prompted individuals to reduce their visits to scanning centers and clinics. Notably, research presented at the Society of Nuclear Medicine and Molecular Imaging (SNMMI) 2021 Annual Meeting highlighted the valuable role of PET in assessing the neurological effects of COVID-19. Patients newly diagnosed with COVID-19, requiring inpatient treatment and undergoing PET brain scans, exhibited deficits in neuronal function and concurrent cognitive impairment. Strikingly, this impairment persisted for up to six months post-diagnosis in some cases. The comprehensive exploration of PET's role during the COVID-19 pandemic not only sheds light on the virus's impact on the brain but also hints at the potential application of PET in addressing future epidemics. This underscores the adaptability and versatility of PET technology in the realm of healthcare crises beyond the immediate context of the COVID-19 pandemic.

Segmental analysis:

Full Ring PET Scanners Segment is Expected to Witness Significant Growth Over the Forecast Period

Full Ring PET Scanners represent a significant advancement in positron emission tomography (PET) technology, featuring a complete circular or ring-shaped detector configuration. This design enhances the efficiency and accuracy of detecting gamma rays emitted by positron-emitting radiotracers, providing improved sensitivity and resolution for three-dimensional image reconstruction. Particularly valuable in oncology, neurology, and cardiology, these scanners offer enhanced diagnostic capabilities for cancer staging, neuroimaging, and cardiac studies. The increased sensitivity enables early disease detection and improved characterization of abnormalities. Technological innovations, including time-of-flight (TOF) information, further enhance their performance by providing precise positron emission event localization. Full-ring PET scanners play a pivotal role in modern healthcare, contributing to personalized medicine and advancing our understanding of various diseases.

Cardiology Segment is Expected to Witness Significant Growth Over the Forecast Period

Positron Emission Tomography (PET) has become a pivotal imaging tool in cardiology, playing a crucial role in the comprehensive evaluation of various cardiovascular conditions. Widely utilized for myocardial perfusion imaging, PET provides high-resolution images that precisely detect blood flow abnormalities, aiding in the diagnosis and prognosis of coronary artery disease (CAD). The assessment of myocardial metabolism, facilitated by radiotracers like Fluorodeoxyglucose (FDG), is instrumental in conditions such as myocarditis and cardiac sarcoidosis. PET also contributes to viability studies, assisting in the differentiation of viable and non-viable myocardial tissue for optimal decision-making in revascularization procedures. Beyond that, PET offers accurate measurements of cardiac function parameters, including ejection fraction and ventricular volumes, providing a comprehensive understanding of heart performance. Additionally, its sensitivity to inflammatory and infectious processes allows early detection and management of conditions like endocarditis. In the realm of cardiovascular research, PET serves as a valuable tool, contributing to advancements in diagnostic and therapeutic strategies. Overall, the integration of PET in cardiology enhances diagnostic precision, guiding effective treatment plans and improving patient outcomes.

Hospitals Segment is Expected to Witness Significant Growth Over the Forecast Period

Hospitals have increasingly incorporated Positron Emission Tomography (PET) into their diagnostic and therapeutic armamentarium, revolutionizing patient care and management. PET imaging, a non-invasive and powerful molecular imaging technique, provides detailed insights into the physiological and metabolic activities within the human body. In the hospital setting, PET is prominently utilized for various medical disciplines, with a notable impact on oncology, neurology, and cardiology. In oncology, PET scans play a crucial role in cancer staging, treatment planning, and monitoring treatment response, contributing to more personalized and effective care strategies. Neurologically, PET assists in the assessment of brain function and the diagnosis of conditions such as Alzheimer's disease. Cardiology benefits from PET by offering comprehensive information on myocardial perfusion, metabolism, and viability, aiding in the diagnosis and management of cardiovascular diseases. The integration of PET technology in hospitals not only enhances diagnostic capabilities but also fosters multidisciplinary collaboration and the development of advanced treatment modalities. As hospitals continue to prioritize precision medicine and patient-centric care, the inclusion of Positron Emission Tomography reflects a commitment to leveraging cutting-edge technology for more accurate and targeted healthcare interventions.

North America Segment is Expected to Witness Significant Growth Over the Forecast Period

The Positron Emission Tomography (PET) market in North America is poised for substantial growth, driven by several key factors. Technological advancements in PET imaging, especially in the domains of oncology and advanced diagnostics, contribute significantly to the anticipated market expansion. The increasing demand for precision diagnostics further propels this growth trajectory. The region is witnessing a surge in cancer cases, particularly in breast, prostate, and colorectal cancers, as indicated by the American Cancer Society's 2022 update. The prevalence of such cases underscores the critical role PET plays in cancer detection, staging, and monitoring. Government initiatives and funding, coupled with the installation of PET scans in hospitals across North America, are additional catalysts for market growth. For example, the investment by the Ontario government in Royal Victoria Regional Health Centre's PET-CT scanner project is indicative of this trend. Market players are adopting strategic initiatives, including product launches, collaborations, and acquisitions, to strengthen their market presence. Notable instances include Prescient Imaging's 510(k) clearance for its BBX-PET machine, Siemens Healthineers' FDA clearance for the Biograph Vision Quadra PET/CT Scanner, and Health Canada's approval of Illuccix for PET imaging of PSMA-positive lesions in prostate cancer patients. These developments contribute to increased product availability and competition in the region, fostering a favourable environment for market growth. In summary, North America is positioned for significant expansion in the Positron Emission Tomography market, driven by technological advancements, increasing cancer prevalence, government support, and strategic efforts by market players.

Get Complete Analysis Of The Report - Download Free Sample PDF

The Positron Emission Tomography (PET) market exhibits a consolidated structure, with companies strategically employing various initiatives to fortify their market positions. Key strategic measures include mergers, new product launches, acquisitions, and partnerships. These actions are undertaken to enhance competitiveness, foster innovation, and broaden market reach. Through mergers and acquisitions, companies aim to integrate complementary capabilities and expand their portfolio offerings. Simultaneously, the introduction of new products allows firms to stay at the forefront of technological advancements and cater to evolving customer needs. Partnerships are also leveraged to tap into synergies, share resources, and collectively address market challenges. This strategic landscape underscores a dynamic industry where collaborative efforts and proactive measures play pivotal roles in sustaining and advancing market leadership. Some of the market players are:

Recent Development:

1) In August 2022, Positron Corporation, a company specializing in nuclear medicine PET imaging devices and clinical services, successfully acquired its inaugural PET-CT system, which is currently in transit from its partner Neusoft Medical Systems in China to its validation partner in the United States. The "Affinity PET-CT" system signifies a significant milestone for Positron as it advances in the field of positron emission tomography (PET).

2) In July 2022, Radialis Inc. obtained regulatory clearance to introduce the Radialis PET Imager, an organ-targeted PET system, to the U.S. market. Distinguished by its advanced sensitivity to radiotracers, the Radialis PET Imager has the capability to generate functional images characterized by high spatial resolution, thereby enhancing the depth of information attainable through molecular imaging techniques.

Q1. What was the Positron Emission Tomography Market size in 2023?

As per Data Library Research the Positron Emission Tomography Market size is estimated at USD 2.8 billion in 2023.

Q2. At what CAGR is the Positron Emission Tomography market projected to grow within the forecast period?

Positron Emission Tomography Market is expected to register a CAGR of 4.6% during the forecast period.

Q3. Who are the key players in Positron Emission Tomography Market?

Some key players operating in the market include

Q4. Which region has the largest share of the Positron Emission Tomography market? What are the largest region's market size and growth rate?

North America has the largest share of the market . For detailed insights on the largest region's market size and growth rate request a sample here.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model