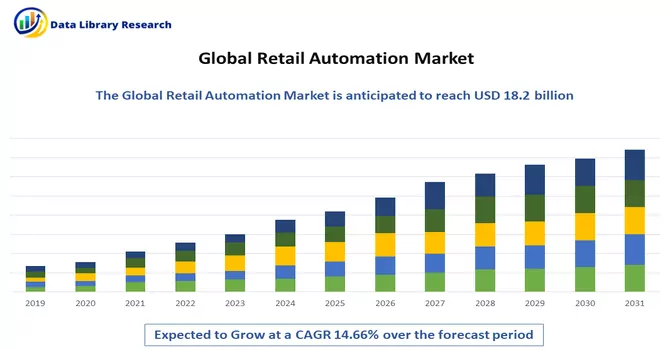

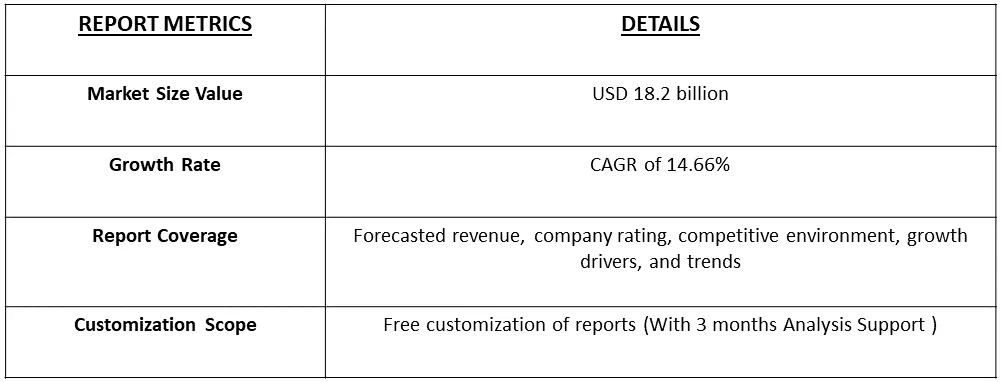

The Retail Automation Market size is estimated at USD 18.2 billion in 2023 and is expected to reach a CAGR of 14.66% during the forecast period (2024-2030).

Get Complete Analysis Of The Report - Download Free Sample PDF

Retail automation refers to the integration of advanced technologies and systems into various aspects of the retail industry to enhance efficiency, accuracy, and overall customer experience. This transformative approach to retail management encompasses a wide range of applications, from inventory management and supply chain optimization to customer service and point-of-sale operations. Automated systems in retail include self-checkout kiosks, inventory tracking using RFID (Radio-Frequency Identification) technology, and sophisticated analytics tools for data-driven decision-making. The adoption of artificial intelligence (AI) and machine learning has further empowered retailers to personalize customer experiences, optimize pricing strategies, and forecast demand more accurately. Retailers are increasingly leveraging automation to streamline routine tasks, allowing employees to focus on more complex and value-added aspects of their roles. Furthermore, innovations like autonomous checkout systems and robotic assistance in warehouses are shaping the future of retail automation, promising a seamless and convenient shopping experience for consumers while improving operational efficiency for businesses. As the retail landscape continues to evolve, the integration of automation technologies is becoming essential for staying competitive in a fast-paced and digitally driven market.

The retail automation market is propelled by multiple driving factors shaping the modern retail landscape. Efficiency and cost savings stand at the forefront, with retailers increasingly adopting automation to streamline operations and reduce expenses. Enhanced customer experiences are realized through self-checkout systems and AI-driven personalized recommendations. Data-driven decision-making benefits from the vast insights generated by automation technologies, enabling retailers to optimize inventory management and tailor marketing strategies. Adaptation to changing consumer preferences is facilitated by online and mobile ordering, automated fulfilment centers, and delivery drones. Additionally, automation ensures accuracy, compliance, and a competitive advantage, as retailers leverage technology to meet evolving demands and differentiate themselves in a dynamic market. Overall, the shift toward retail automation reflects a strategic response to the demands for efficiency, customer-centricity, and innovation in the contemporary retail sector.

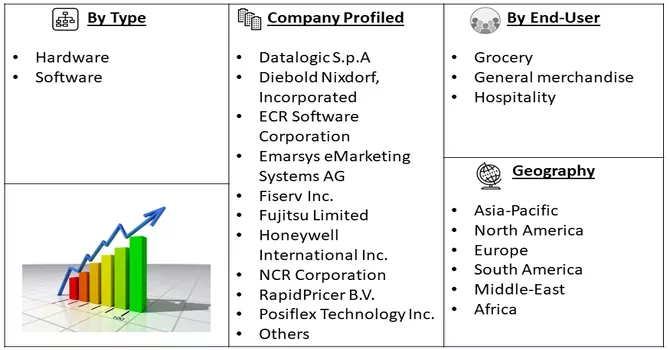

Market Segmentation: The Retail Automation Market Report is segmented by type (hardware and software), end-user (grocery, general merchandise, and hospitality), and geography (Europe, North America, Latin America, Asia-Pacific, and the Middle East and Africa). The market sizes and forecasts are provided in terms of value (USD) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The retail automation market is characterized by dynamic trends that respond to shifting consumer behaviours and technological advancements. The rise of contactless technologies, accelerated by the COVID-19 pandemic, is reshaping the retail landscape, emphasizing touchless payment options and self-checkout systems. Advanced artificial intelligence and machine learning applications are powering personalized customer experiences and predictive analytics for demand forecasting. Smart inventory management, featuring RFID technology and IoT sensors, is optimizing supply chains, while autonomous stores and checkout-free technology are gaining traction. Warehousing and fulfillment operations are witnessing a transformation through the integration of robotics, enhancing efficiency in tasks such as order picking and logistics. The trend towards omnichannel retailing is driving the seamless integration of online and offline experiences, and sustainability initiatives are influencing eco-friendly technologies and packaging solutions. Voice commerce, biometric authentication, and dynamic pricing strategies contribute to enhanced security and competitive pricing. Personalization, augmented reality in retail experiences, and the incorporation of AI-driven virtual assistants are fostering innovation in customer interactions. These trends collectively showcase the continuous evolution of the retail automation market, aiming to deliver efficiency, convenience, and innovative shopping experiences in response to evolving consumer expectations.

Market Drivers:

Rising Demand for Quality and Fast Service

The rising demand for quality and fast service in the retail industry has fueled a significant uptake of retail automation solutions as businesses strive to meet and exceed customer expectations. Automation technologies are playing a pivotal role in expediting service delivery, reducing waiting times, and enhancing overall customer satisfaction. Self-service kiosks and automated checkout systems enable shoppers to complete transactions swiftly, eliminating the need for long queues and expediting the payment process. Additionally, inventory management automation ensures that products are readily available, minimizing stockouts and ensuring a seamless shopping experience. The demand for fast and efficient service is particularly evident in the food and beverage sector, where automated ordering systems, self-service kiosks, and mobile apps enable customers to place orders, customize preferences, and receive their meals promptly. In the realm of e-commerce, automated order fulfilment processes, including robotic picking and packing in distribution centers, contribute to quicker delivery times, meeting the growing expectations for rapid and reliable service. Quality service is also addressed through the personalization capabilities of automation technologies. AI-driven recommendation engines analyze customer preferences, enabling retailers to offer tailored product suggestions and promotions. This personalization not only enhances the overall shopping experience but also contributes to customer loyalty. The symbiosis between the rising demand for quality and fast service and retail automation showcases the industry's commitment to leveraging technology to create a seamless, efficient, and customer-centric retail environment. As consumer expectations continue to evolve, retailers are increasingly turning to automation solutions to deliver the high-quality and swift service that modern shoppers seek.

Growth and Competition among Retail Industry and E-commerce

The retail industry is undergoing significant growth and heightened competition, primarily driven by the rapid ascent of e-commerce. Traditional retailers are adapting to changing consumer habits by investing in digital transformation and retail automation, aiming to enhance operational efficiency and compete with online platforms. E-commerce giants leverage advanced technologies, such as data analytics and machine learning, to offer personalized experiences, while brick-and-mortar retailers focus on creating immersive in-store experiences and omnichannel strategies. The competition revolves around customer-centric approaches, fast delivery services, and innovative marketing strategies. Retailers across the board are embracing emerging technologies like augmented reality, artificial intelligence, and automation to streamline operations and stay ahead in this dynamic and evolving landscape, emphasizing the symbiotic relationship between growth and competition in the retail industry and e-commerce sector.

Market Restraints:

High Hardware Failure Rates

The high hardware failure rates pose a significant challenge to the growth of the retail automation market. Despite the increasing adoption of automation technologies, the reliability of hardware components, including self-checkout kiosks, point-of-sale terminals, and inventory management systems, is a crucial factor influencing the industry's trajectory. Frequent breakdowns and malfunctions not only lead to operational disruptions for retailers but also result in dissatisfied customer experiences, potentially hindering the broader acceptance of retail automation solutions. The need for consistent uptime and system reliability is paramount in the retail sector, where smooth transactions and efficient operations are critical. Addressing and mitigating hardware failure issues through improved quality control, robust maintenance protocols, and advancements in hardware durability will be essential for sustaining the momentum of growth in the retail automation market. As the industry navigates these challenges, a focus on enhancing the reliability and resilience of hardware components will be instrumental in fostering trust among retailers and driving continued adoption of automation solutions in the retail space.

The COVID-19 pandemic has significantly impacted the retail automation market, prompting shifts in consumer behaviour, operational priorities, and technology adoption within the retail sector. One notable effect has been the acceleration of contactless technologies and automation solutions to address hygiene concerns and adhere to social distancing guidelines. Retailers, driven by the need for safer in-store experiences, have expedited the deployment of self-checkout kiosks, touchless payment systems, and other automated processes to minimize physical contact. The pandemic has also underscored the importance of robust inventory management and supply chain automation. Retailers are increasingly turning to technologies such as RFID, AI-driven demand forecasting, and robotic automation in warehouses to ensure the availability of essential goods, navigate disruptions in the supply chain, and adapt to fluctuating consumer demand. The downside, the economic uncertainties and temporary closures of retail establishments during lockdowns have led to budget constraints, affecting the pace of investment in automation technologies for some businesses. Small and medium-sized retailers, in particular, faced challenges in adopting automation due to financial constraints and the need for rapid adaptation. Additionally, the focus on essential goods and reduced foot traffic in brick-and-mortar stores during lockdowns impacted the immediate demand for certain automation solutions. looking forward, the post-pandemic retail automation landscape is likely to continue evolving. The lessons learned during the pandemic, such as the importance of flexibility, agility, and the need for robust automation, will likely drive continued investments in technologies that enhance operational efficiency, improve customer experiences, and ensure resilience in the face of unforeseen disruptions. The COVID-19 impact on the retail automation market has accelerated digital transformation trends and highlighted the strategic importance of technology in creating a more adaptive and resilient retail ecosystem.

Segmental Analysis:

Software Segment is Expected to Witness Significant Growth Over the Forecast Period

Software plays a pivotal role in driving efficiency, enhancing customer experiences, and optimizing operations within the realm of retail automation. Retailers increasingly rely on sophisticated software solutions to streamline processes, manage inventory, and offer personalized customer interactions. Point-of-sale (POS) systems, powered by advanced software, facilitate smooth and secure transactions, while inventory management software with real-time tracking capabilities minimizes stockouts and overstock situations. Customer relationship management (CRM) software enables retailers to analyze customer data, tailoring promotions and loyalty programs for enhanced engagement. Additionally, software solutions integrate artificial intelligence (AI) and machine learning algorithms to predict consumer trends, optimize pricing strategies, and provide actionable insights for strategic decision-making. E-commerce platforms and mobile applications further extend the reach of retailers, allowing for seamless omnichannel experiences. Moreover, automation software in areas such as robotic process automation (RPA) and warehouse management contributes to operational efficiency, reducing manual errors and enhancing overall productivity. The symbiotic relationship between software innovation and retail automation underscores the industry's commitment to leveraging technology for a competitive edge, improved customer satisfaction, and sustained growth.

Grocery Segment is Expected to Witness Significant Growth Over the Forecast Period

The grocery industry is experiencing a transformative wave with the integration of retail automation technologies, fundamentally reshaping the way consumers shop for and retailers manage grocery products. Automated solutions are addressing key challenges in the grocery sector, enhancing operational efficiency, and elevating the overall shopping experience. Automated checkout systems, including self-checkout kiosks and cashierless stores, reduce wait times and streamline the payment process. RFID technology and smart shelves automate inventory management, ensuring accurate stock levels, reducing errors, and minimizing instances of overstock or stockouts. Additionally, robotic systems in fulfilment centers are optimizing order picking and packing processes, enabling quicker and more precise delivery of online grocery orders. AI-powered recommendation engines and personalized promotions cater to individual preferences, fostering customer loyalty. Online grocery platforms with automated order fulfilment and delivery logistics contribute to the seamless integration of e-commerce and brick-and-mortar operations, creating a comprehensive omnichannel experience for consumers. The evolving intersection of grocery and retail automation exemplifies the industry's commitment to leveraging technology to meet consumer expectations for convenience, speed, and a personalized shopping journey.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North America stands at the forefront of the global retail automation landscape, showcasing a robust adoption of innovative technologies to enhance the retail experience. The region's retail sector is witnessing a surge in automation across various facets, including customer interactions, inventory management, and fulfillment processes. Self-checkout kiosks and cashierless stores are becoming increasingly prevalent, offering customers a convenient and efficient shopping experience. Advanced technologies such as artificial intelligence (AI), machine learning, and data analytics are being harnessed to analyze consumer behaviour, optimize pricing strategies, and personalize marketing efforts. In the realm of supply chain management, the integration of automation is evident in smart inventory systems, RFID technology, and robotic fulfilment centers, driving operational efficiency. The emphasis on omnichannel retailing is driving the seamless integration of online and offline channels, with retailers leveraging automation to offer a cohesive shopping journey. Sustainability initiatives, such as eco-friendly packaging and energy-efficient systems, are gaining traction. North America's retail automation landscape mirrors the region's commitment to technological innovation, efficiency, and delivering an enhanced and adaptive retail experience to a diverse consumer base.

Get Complete Analysis Of The Report - Download Free Sample PDF

The retail automation market is marked by a state of fragmentation, featuring a multitude of solution providers operating on a global scale. The landscape is defined by intense competition, driven by the continuous evolution of automation technology. Established players in the market consistently allocate substantial investments toward research and development efforts, aiming to not only stay ahead of the technological curve but also to create barriers that discourage potential new entrants from challenging their market dominance. Furthermore, these incumbent participants actively pursue expansion strategies, seeking to optimize and broaden their existing market presence. In essence, the competitive dynamics within the retail automation sector underscore a commitment to innovation, market defence, and strategic growth initiatives.

Recent Development:

1) In October 2022, Focal Systems, a prominent retail automation provider, forged a partnership with Piggly Wiggly Midwest locations, initiating a trial of the Focal Operating System (FocalOS) in stores spanning Wisconsin and Illinois. The primary goal of this collaboration is to elevate the customer experience through the utilization of FocalOS, a comprehensive system designed to digitize and automate various facets of retail operations. This includes streamlining processes such as ordering, inventory management, merchandising, and personnel management within the stores.

2) In February 2022, RetailNext Inc., a key player in smart store retail analytics aimed at enhancing the shopping experience, unveiled an expansion of its free traffic system upgrades. This strategic move addresses the increasing challenge faced by retailers in upgrading their outdated hardware to align with the latest industry standards. The initiative by RetailNext Inc. aims to support retailers in staying technologically current without incurring additional costs, ultimately facilitating a smoother and more efficient retail environment.

Q1. What was the Retail Automation Market size in 2023?

As per Data Library Research the Retail Automation Market size is estimated at USD 18.2 billion in 2023.

Q2. At what CAGR is the Retail Automation market projected to grow within the forecast period?

Retail Automation Market is expected to reach a CAGR of 14.66% during the forecast period.

Q3. What are the factors driving the Retail Automation market?

Key factors that are driving the growth include the Rising Demand for Quality and Fast Service and Growth and Competition among Retail Industry and E-commerce

Q4. Who are the key players in Retail Automation market?

Some key players operating in the market include

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model