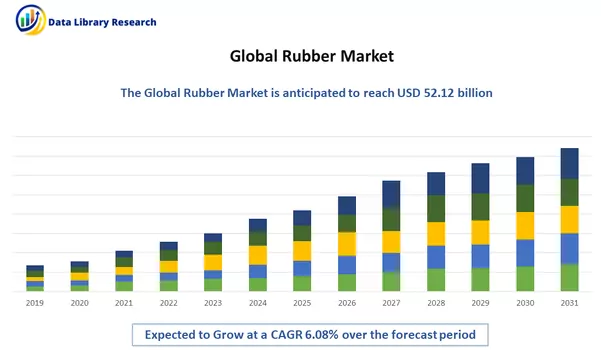

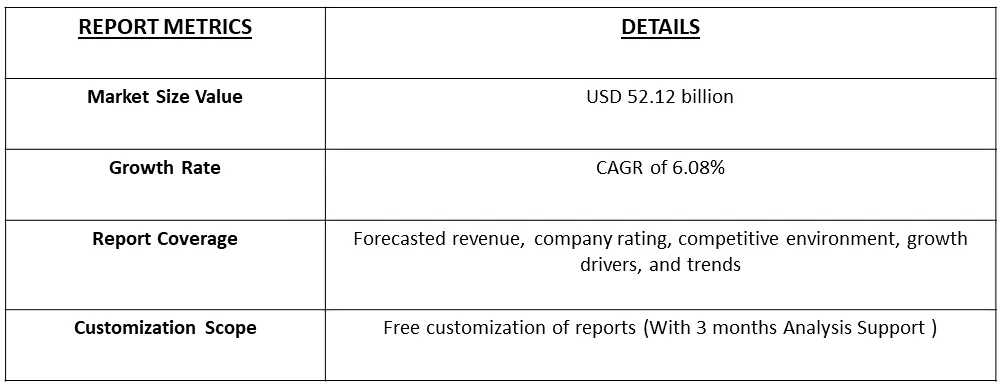

The global rubber market size was valued at USD 52.12 billion in 2023 and is a compound annual growth rate (CAGR) of 6.08% from 2024 to 2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Rubber is a natural or synthetic elastic material characterized by its ability to undergo significant deformation under stress and return to its original shape when the stress is removed. It has various applications due to its unique properties, including elasticity, resilience, insulating capabilities, and water resistance. Derived from the latex sap of certain plants, most notably the rubber tree (Hevea brasiliensis), natural rubber consists mainly of polymers of isoprene. It has been traditionally used for a wide range of products, including tires, footwear, industrial goods, and consumer items.

The automotive sector is a major consumer of rubber, particularly in tire manufacturing. As the global demand for vehicles continues to rise, driven by population growth, urbanization, and increased mobility, the demand for rubber in tire production experiences a corresponding increase. The tire industry is one of the largest consumers of rubber. Growth in the tire market, fueled by increased vehicle production, replacement demand, and advancements in tire technologies, positively influences the rubber market. The growing emphasis on sustainability and environmental considerations has led to the development of eco-friendly rubber products. The demand for sustainable rubber, produced through environmentally responsible practices, is gaining traction.

Market Segmentation: The Global Rubber Market is Segmented by Type (Natural Rubber and Synthetic Rubber), End-Use (Automotive, Construction, Industrial, Healthcare, Consumer goods, Packaging), and geography ( North America, Europe, Asia-Pacific, South America, and Africa. The report offers the market size and forecasts in terms of volume in metric tons and value in USD thousand for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

There is a growing trend toward sustainable and eco-friendly rubber production practices. Companies and consumers are increasingly prioritizing environmentally responsible sourcing, processing, and disposal of rubber products. The market is witnessing a gradual shift toward synthetic rubber due to its consistent quality, performance, and versatility. Advancements in synthetic rubber technologies and formulations are driving this transition. The global rubber market is experiencing some degree of consolidation, with mergers and acquisitions among key players. This trend aims to strengthen market positions, enhance capabilities, and expand geographical reach.

Market Drivers:

Rising Automotive Services

The automotive sector is a major consumer of rubber, particularly in tire manufacturing. As the global demand for vehicles continues to rise, driven by population growth, urbanization, and increased mobility, the demand for rubber in tire production experiences a corresponding increase. The automotive industry stands as a significant consumer of rubber, with a particular emphasis on tire manufacturing. The ever-growing global demand for vehicles, fueled by factors such as population expansion, urbanization trends, and heightened mobility needs, directly contributes to an escalating requirement for rubber in the production of tires. As the automotive sector continues to thrive, the surge in demand for rubber underscores its pivotal role in meeting the requirements of tire production.

In May 2023, The Goodyear Tire & Rubber Company (NASDAQ: GT) introduced a novel tread formulation for its ElectricDrive™ GT tire, designed specifically for electric vehicles in the size 235/40R19. The specialized tread compound, aimed at providing improved all-season traction, will incorporate Monolith carbon black produced through methane pyrolysis. This collaboration between Monolith and Goodyear signifies progress toward achieving zero-emissions carbon black in tire manufacturing. Thus, such developments are expected to provide better solutions to automotive industries, thereby driving the growth of the studied market over the forecast period.

Growing R&D Investments in Green Technologies

Research and development investments in green technologies for rubber production, including bio-based rubber alternatives and sustainable cultivation methods, are driving innovation in the industry. Furthermore, the strategic developments between industries are expected to fuel the growth of the studied market over the forecast period. For instance, in October 2023, U.S. Senator Sherrod Brown (D-OH) disclosed that Akron has been officially recognized as a Regional Technology and Innovation Hub (Tech Hub). This designation is intended to leverage Akron's historical prominence in the rubber industry and propel the region into a leadership role in the production of sustainable polymers – representing the next evolution in rubber and plastics. The Department of Commerce Tech Hubs Program, established by Brown's CHIPS Act, aims to boost regional technology advancement by enhancing a region's capabilities in manufacturing, commercialization, and deployment of critical technologies. Senator Brown actively advocated for the selection of an Ohio-based project by the Commerce Department.

Market Restraints:

Price Volatility and Dependency on Weather Change

The rubber market is susceptible to price fluctuations influenced by factors such as weather conditions, geopolitical events, and global economic trends. These fluctuations can create uncertainty and affect the profitability of businesses operating in the rubber industry. Also, natural rubber production heavily relies on favourable weather conditions. Adverse weather events, such as storms, droughts, or excessive rainfall, can disrupt the cultivation of rubber plants, leading to supply shortages and affecting market dynamics. Thus, these factors are expected to slow down the growth of the studied market.

The COVID-19 pandemic has had a multifaceted impact on the natural rubber market, affecting various aspects of production, supply chains, demand, and overall market dynamics. The global rubber supply chain experienced disruptions due to lockdowns, travel restrictions, and labour shortages imposed to curb the spread of the virus. This impacted the production of natural rubber, leading to delays and supply chain bottlenecks. The automotive industry, a major consumer of natural rubber for tire manufacturing, faced a decline in demand as vehicle production and sales dropped during lockdowns. This reduction in demand from the automotive sector had a direct impact on the natural rubber market. Thus the pandemic underscored the importance of sustainability and resilience in supply chains. This renewed focus may lead to increased efforts to promote sustainable practices within the natural rubber industry.

Segmental Analysis:

Synthetic Rubber Segment is Expected to Witness Significant Growth over the Forecast Period

Synthetic rubber has become a pivotal component in various industries, offering a versatile alternative to natural rubber with tailored properties to meet specific business needs. This man-made elastomer, derived from petroleum-based feedstocks, boasts exceptional durability, resilience, and resistance to heat and chemicals. Industries such as automotive, manufacturing, and construction leverage synthetic rubber for tire production, gaskets, seals, and various moulded goods. Its consistent quality and reliable performance make it a preferred choice for applications requiring stringent specifications. Moreover, the stability of synthetic rubber prices, often less susceptible to natural fluctuations, enhances cost predictability for businesses. As a result, companies across sectors continue to integrate synthetic rubber into their operational processes, ensuring product excellence, operational efficiency, and overall competitiveness in the dynamic global market. Thus, owing to such factors, the segment is expected to witness significant growth over the forecast period.

Automotive Industry Segment is Expected to Witness Significant Growth over the Forecast Period

In the automotive industry, rubber plays a pivotal role as a foundational material, contributing to the durability, safety, and performance of vehicles. The integration of rubber components, such as tires, gaskets, hoses, and seals, is indispensable for ensuring optimal functionality and resilience in various automotive applications. Tires, composed predominantly of rubber compounds, are critical for providing traction, stability, and a smooth ride. Moreover, rubber-based components contribute to noise reduction, vibration isolation, and sealing integrity, enhancing overall driving comfort and safety. In the intricate machinery of an automobile, rubber's versatility shines as it facilitates the effective functioning of complex systems. The demand for specialized rubber formulations tailored to meet stringent automotive standards underscores the industry's emphasis on innovation and performance. As the automotive landscape evolves with advancements like electric and autonomous vehicles, the role of rubber remains pivotal, adapting to new requirements while upholding the industry's commitment to quality, reliability, and sustainability. In essence, the automotive sector's reliance on rubber epitomizes the symbiotic relationship between material science and the pursuit of engineering excellence in modern vehicle manufacturing. Thus, owing to such factors, the segment is expected to witness significant growth over the forecast period.

Asia-Pacific Region is Expected to Witness Significant Growth over the Forecast Period

The Asia-Pacific region stands as a dynamic and pivotal player in the global rubber market, contributing significantly to both production and consumption. Asia-Pacific serves as a primary hub for the production of natural rubber, with countries like Thailand, Indonesia, Vietnam, and Malaysia being key contributors. These nations boast extensive rubber plantations, leveraging their tropical climates to cultivate rubber trees. The region's dominance in natural rubber production significantly influences the global supply chain.

In January 2023, Harrisons Malayalam Limited (HML), a Kerala-based plantation company, is actively exploring opportunities in rubber plantation and fruit cultivation in Nagaland. During a press conference held on Saturday, Biju Panicker, Vice President of the Rubber Business at HML Kochi Kerala Limited, revealed the company's plans to delve into the procurement and trade of various processed rubber grades, including Ribbed Smoked Sheets (RSS) and Indian Standard Natural Rubber (ISNR). Panicker emphasized that HML aims to engage with small farmers, intending to initiate a chain reaction. The objective is to empower farmers to produce high-quality rubber through modern and scientific methods. Additionally, the company envisions creating a streamlined market for farmers, ensuring a consistent and fair income throughout the year. This approach aligns with HML's strategy to source rubber materials directly from local farmers. In an expansion move, HML is also considering entering the fruit business, with a particular focus on exploring fruit cultivation in Nagaland, specifically pineapples. The company's diversification efforts signal a broader commitment to sustainable and inclusive agricultural practices while fostering economic opportunities for local farmers in Nagaland. Thus, such developments are expected to boost the growth of the studied market in the region.

Get Complete Analysis Of The Report - Download Free Sample PDF

Global players encounter fierce competition not only among themselves but also from regional counterparts equipped with robust distribution networks and extensive knowledge of suppliers and regulations. This dynamic competitive landscape underscores the challenges faced by global entities striving to navigate regional nuances and compete effectively in the market. Key Rubber Companies:

Recent Development:

1) In July 2023, Pirelli has inked a deal to purchase 100% of Hevea-Tec, the largest independent processor of natural rubber in Brazil. The transaction is valued at approximately 21 million euros based on Enterprise Value, subject to customary adjustments at closing. The completion is anticipated by the end of 2023, pending approval from Antitrust authorities and meeting other specified conditions. This acquisition aligns with Pirelli's strategic goal to enhance its natural rubber supply in Latin America, ensuring a seamless provision in the region and boosting overall operational efficiency. Future plans include an increase in Hevea-Tec's production volumes.

2) In May 2023, KUMHO Petrochemical Co., Ltd., Idemitsu Kosan Co., Ltd., and Sumitomo Corporation entered into a Memorandum of Understanding (MOU) to establish a lasting collaboration aimed at developing and expanding the Asian market for sustainable polymers and chemicals. Under the agreement, Idemitsu will manufacture bio-SM utilizing the mass balance method, while KUMHO Petrochemical Co., Ltd., will be responsible for producing bio-SSBR (Solution Styrene Butadiene Rubber). The coordination of this collaboration and the facilitation of market development for biomaterials will be overseen by Sumitomo Corporation.

Q1. What was the Rubber Market size in 2023?

As per Data Library Research the global rubber market size was valued at USD 52.12 billion in 2023.

Q2. At what CAGR is the Rubber market projected to grow within the forecast period?

Rubber Market is a compound annual growth rate (CAGR) of 6.08% over the forecast period.

Q3. What are the factors driving the Rubber Market?

Key factors that are driving the growth include the Rising Automotive Services and Growing R&D Investments in Green Technologies.

Q4. What Impact did COVID-19 have on the Rubber Market?

The COVID-19 pandemic has had a multifaceted impact on the natural rubber market, affecting various aspects of production, supply chains, demand, and overall market dynamics. For more insights request a sample here.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model