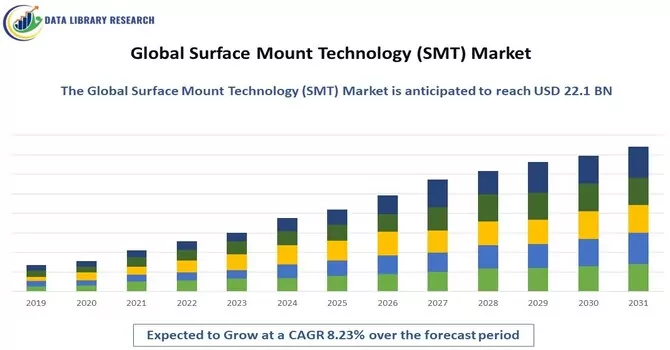

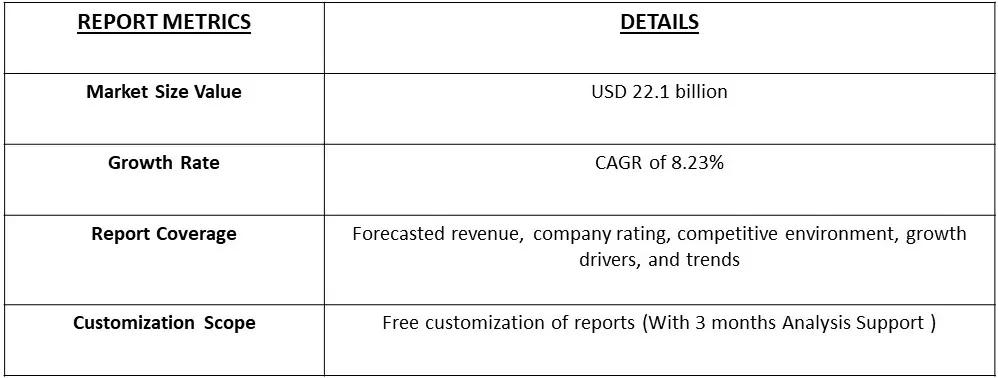

The global Surface Mount Technology (SMT) Market is expected to reach 12.4 billion in 2023 and 22.1 billion by 2031, representing a compound annual growth rate (CAGR) of 8.23% from 2023 to 2031.

Get a Complete Analysis Of The Report - Download Free Sample PDF

The Surface Mount Technology (SMT) market encompasses the sector involved in the design, production, and application of electronic components mounted directly onto the surface of printed circuit boards (PCBs). SMT enables higher circuit density and improved performance in electronic devices by allowing for smaller, more efficient component placement. The market includes various segments such as SMT equipment, materials, and services used in manufacturing and assembly processes. Key drivers include advancements in electronics and telecommunications, increasing demand for miniaturized devices, and the ongoing trend towards automation in manufacturing. The market is characterized by rapid technological innovations and a focus on improving manufacturing efficiency and component reliability.

The Surface Mount Technology (SMT) market is driven by the rising demand for compact, high-performance electronic devices across various industries, including consumer electronics, automotive, and telecommunications. The shift towards miniaturization and increased functionality in electronic products fuels the need for SMT, which allows for higher component density and improved reliability. Technological advancements in SMT equipment and materials, coupled with the growing trend of automation in manufacturing processes, further accelerate market growth. Additionally, the expansion of the Internet of Things (IoT) and the proliferation of smart devices contribute to the increasing adoption of SMT solutions.

The Surface Mount Technology (SMT) market is witnessing key trends that are shaping its future, including the increasing demand for miniaturization and high-density electronic assemblies, driven by advancements in consumer electronics and automotive sectors. The shift towards automation and Industry 4.0 is leading to greater adoption of AI and machine learning in SMT processes, enhancing precision and efficiency. Additionally, the integration of 3D printing with SMT is enabling rapid prototyping and custom PCB designs, while the move towards environmentally friendly manufacturing practices is accelerating the adoption of lead-free soldering and compliance with stringent environmental regulations. These trends collectively point towards a more automated, efficient, and sustainable future for the SMT market.

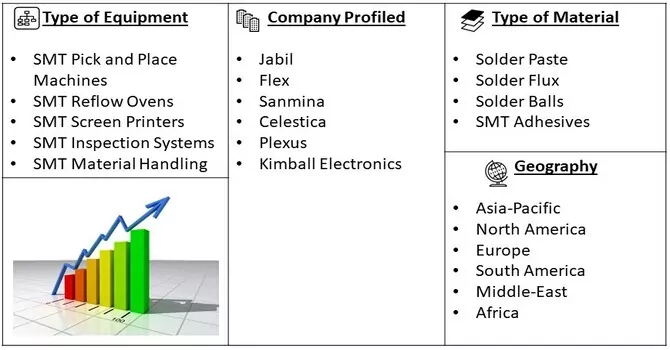

Market Segmentation: The Global Surface Mount Technology (SMT) Market is segmented by Type of Equipment (SMT Pick and Place Machines, SMT Reflow Ovens, SMT Screen Printers, SMT Inspection Systems, and SMT Material Handling), Type of Material (Solder Paste, Solder Flux, Solder Balls and SMT Adhesives), and geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The report offers the market size and forecasts for revenue (USD million) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Demand for Miniaturization and High-Density Electronics:

The increasing consumer demand for smaller, more compact, and multifunctional electronic devices is a significant driver of the Surface Mount Technology (SMT) market. As industries such as consumer electronics, telecommunications, and automotive push towards miniaturization, SMT has become essential for producing high-density electronic assemblies. SMT allows for the placement of small components directly onto the surface of printed circuit boards (PCBs) without the need for wire leads, enabling the creation of compact and lightweight products. This is particularly crucial in the production of smartphones, wearables, IoT devices, and advanced automotive electronics, where space is limited, and efficiency is paramount. The ability of SMT to support high-speed assembly, reduce manufacturing costs, and improve performance by minimizing signal loss and interference further fuels its adoption in these high-demand sectors. ****Growth in Automotive Electronics:

The automotive industry's rapid evolution towards advanced electronic systems and electrification is another key driver for the SMT market. Modern vehicles increasingly rely on sophisticated electronic systems, such as advanced driver-assistance systems (ADAS), infotainment, in-vehicle networking, and electric powertrains. These systems require complex, high-density PCBs, which are best produced using SMT due to its precision, reliability, and ability to handle the assembly of fine-pitch components. Additionally, the shift towards electric vehicles (EVs) has amplified the need for robust electronic components that can withstand harsh environments and provide high performance. As automakers continue to innovate and integrate more electronics into their vehicles, the demand for SMT is expected to grow, making it a critical technology in the future of automotive manufacturing.

Market Restraints:

The Surface Mount Technology (SMT) market faces several restraints that could hinder its growth. One significant challenge is the complexity of SMT assembly processes, particularly as electronic devices become more intricate and require higher precision. This complexity can lead to increased production costs and longer lead times, especially for manufacturers that lack advanced equipment and skilled labor. Additionally, supply chain disruptions, as witnessed during the COVID-19 pandemic, pose a serious risk to the SMT market, given its reliance on a global network for components and raw materials. Another restraint is the stringent environmental regulations, especially in regions like Europe, which impose additional compliance costs on SMT manufacturers. These regulations, particularly those related to the use of hazardous substances and the push for lead-free soldering, can increase production costs and require significant investment in new technologies and materials. Finally, the high initial capital investment required for SMT equipment and technology upgrades can be a barrier for smaller manufacturers, limiting market entry and expansion opportunities.

The COVID-19 pandemic had a mixed impact on the Surface Mount Technology (SMT) market. In the short term, the market experienced significant disruptions due to global supply chain interruptions, factory shutdowns, and reduced workforce availability, which led to delays in production and increased costs. Many electronics manufacturers faced challenges in sourcing critical components, resulting in slowed SMT operations and delayed product launches. However, the pandemic also accelerated the adoption of digital technologies and automation, including SMT, as companies sought to mitigate the impact of labor shortages and improve operational resilience. The surge in demand for electronics, particularly in sectors like remote work, telecommunications, and healthcare, provided a counterbalance to the initial downturn. As a result, while the SMT market faced short-term challenges, it emerged more focused on automation and digital transformation, setting the stage for long-term growth.

Segmental Analysis:

SMT pick and place machines Segment is Expected to Witness Significant Growth Over the Forecast Period

SMT pick and place machines are critical for placing surface mount components onto printed circuit boards (PCBs) with precision. Recent advancements in this sub-segment include the integration of high-speed robotic arms and advanced vision systems that enhance placement accuracy and speed. These machines are now capable of handling a wider range of component sizes and types, which is crucial for meeting the demands of increasingly complex electronic assemblies. The driving factors for this segment include the growing need for miniaturized electronics, rising production volumes, and the push towards higher automation levels in manufacturing processes. As electronic devices become more compact and feature-rich, the demand for efficient and precise pick and place machines continues to grow.

Solder paste Segment is Expected to Witness Significant Growth Over the Forecast Period

Solder paste is a key material in the SMT process, used to create solder joints that connect electronic components to PCBs. Recent developments in solder paste include innovations in flux formulations and solder powder compositions that improve the reliability and quality of solder joints. New types of solder paste offer better performance in high-temperature and high-frequency applications, catering to advanced electronics and automotive industries. The driving factors for this sub-segment include the need for high-quality soldering to ensure device functionality and durability, as well as the increasing complexity of PCB designs. Advancements in solder paste technology are crucial for addressing the challenges of miniaturization and high-density component placements in modern electronics.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

The Global Surface Mount Technology (SMT) market in North America is driven by several factors, including the growing demand for electronic components in the automotive and aerospace industries, increasing adoption of IoT and AI technologies, and the need for faster and more efficient manufacturing processes. Additionally, the region's strong presence of leading electronics companies, such as Intel and Texas Instruments, is also driving the demand for SMT.

Get a Complete Analysis Of The Report - Download a Free Sample PDF

Surface Mount Technology (SMT) Market Competitive Landscape:

The competitive landscape of the Global Surface Mount Technology (SMT) market is characterized by a mix of established players and new entrants, with a focus on innovation, quality, and customer service. Additionally, new entrants such as Benchmark Electronics and TTM Technologies are also gaining traction in the market, offering innovative solutions and competitive pricing.

The market is dominated by players such as:

Recent Development:

1) Panasonic Corporation unveiled its new NPM-WX Series pick and place machine in early 2024, designed to significantly enhance the speed and accuracy of surface mount assembly. This state-of-the-art machine features advanced robotic arms and a high-resolution vision system capable of handling a wider variety of component sizes and types with increased precision. The introduction of the NPM-WX Series reflects Panasonic's commitment to meeting the growing demands for miniaturization and complexity in electronic devices, while also improving overall production efficiency and reducing downtime. This development is expected to bolster Panasonic's competitive position in the global SMT market by addressing the industry's need for advanced, high-performance manufacturing solutions.

2) Koh Young Technology launched its latest Zenith 3D AOI System in late 2023, which represents a significant advancement in automated optical inspection technology. The Zenith 3D system incorporates advanced machine vision and artificial intelligence to offer high-speed, high-accuracy inspection of solder joints and component placements. This new system improves defect detection capabilities and reduces false positives, enhancing the reliability and quality of surface mount assemblies. Koh Young’s development highlights its focus on innovation and precision, responding to the increasing complexity of electronic products and the need for stringent quality control measures. This advancement positions Koh Young as a leader in the SMT inspection segment, supporting manufacturers in achieving higher production yields and better product quality.

Q1. What are the driving factors for the Global SMT technology market?

The global SMT technology market is driven by the increasing demand for miniaturized and high-performance electronic devices across various industries, including consumer electronics, automotive, and telecommunications. Advancements in technology, such as high-speed placement machines, automated inspection systems, and improved solder materials, are also key drivers. The shift towards automation and the need for efficient, high-quality production processes further propel the market. Additionally, the growing emphasis on smart devices, IoT, and 5G technology requires sophisticated SMT solutions to meet the complexity and performance standards of modern electronics.

Q2. What are the restraining factors for the Global SMT technology market?

The global SMT technology market faces several restraining factors, including the high cost of advanced SMT equipment and technology, which can be a barrier for smaller manufacturers and companies in emerging markets. Additionally, the complexity of SMT processes and the need for skilled labor and ongoing training can pose challenges. Supply chain issues and fluctuations in the prices of raw materials, such as solder paste and electronic components, may also impact market growth. Moreover, technological obsolescence and the rapid pace of innovation can lead to increased costs for companies seeking to stay competitive.

Q3. Which segment is projected to hold the largest share in the Global SMT technology market?

The SMT pick and place machines segment is projected to hold the largest share in the global SMT technology market. These machines are essential for placing surface mount components onto printed circuit boards with precision and speed. Their critical role in achieving high production efficiency and accommodating a wide range of component sizes and types makes them a key component in SMT processes. The increasing demand for faster and more accurate assembly processes in electronics manufacturing drives the growth of this segment.

Q4. Which region holds the largest share in the Global SMT technology market?

Asia-Pacific holds the largest share in the global SMT technology market. This region, particularly countries like China, Japan, and South Korea, is a major hub for electronics manufacturing and assembly. The presence of numerous electronics manufacturers and high adoption rates of advanced SMT technologies contribute to its dominance. Additionally, the region's robust supply chain, skilled labor force, and increasing demand for electronic devices drive market growth.

Q5. Which are the prominent players in the Global SMT technology market?

Prominent players in the global SMT technology market include Panasonic Corporation, Koh Young Technology, Juki Corporation, ASM Assembly Systems, Fuji Machine Manufacturing Co., Ltd., Universal Instruments Corporation, Mycronic AB, SMD (Surface Mount Devices), and Yamaha Motor Co., Ltd. These companies are key contributors to the market, known for their innovative SMT solutions, extensive product portfolios, and significant presence in global electronics manufacturing. Their ongoing investments in research and development and technological advancements help them maintain a competitive edge in the market.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model