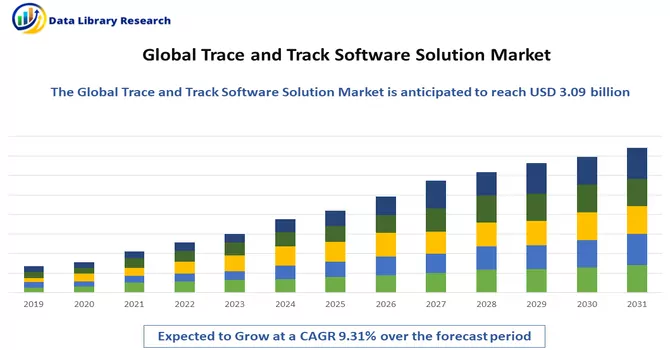

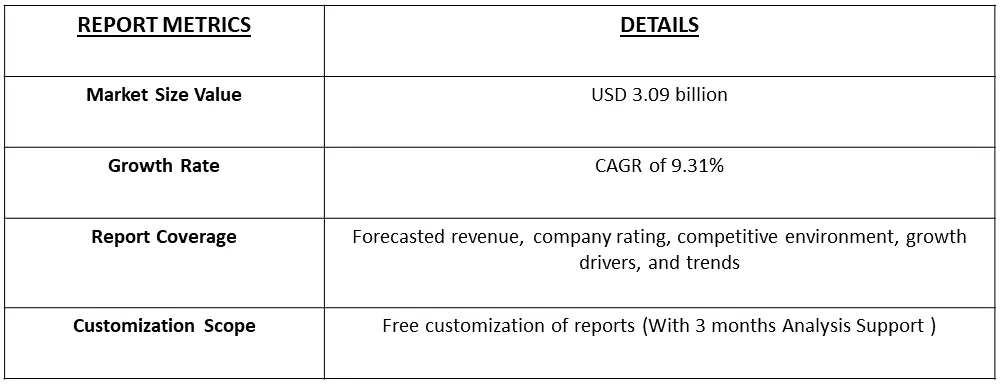

The Track and Trace Solutions Market size is estimated at USD 3.09 billion in 2024 and is expected to reach USD 4.82 billion by 2029, growing at a CAGR of 9.31% during the forecast period (2024-2031).

Get Complete Analysis Of The Report - Download Free Sample PDF

Track and trace solutions refer to a set of technologies and processes implemented to monitor and trace the movement of products, goods, or assets throughout the supply chain. These solutions utilize various technologies such as barcodes, RFID (Radio-Frequency Identification), GPS (Global Positioning System), and advanced software systems to capture, record, and manage data related to the production, distribution, and delivery of items. The primary objective is to provide real-time visibility into the entire lifecycle of a product, enabling businesses to track its journey from manufacturing or origin to the end consumer. Track and trace solutions play a crucial role in enhancing supply chain visibility, improving operational efficiency, ensuring regulatory compliance, and addressing issues such as counterfeiting, theft, or product recalls. These solutions are widely utilized in industries such as pharmaceuticals, food and beverages, logistics, and manufacturing to maintain control and accountability across the supply chain.

The track and trace solutions market is experiencing significant growth, driven by several key factors. The expansion of the medical devices and pharmaceutical industries is a primary contributor, as these sectors increasingly recognize the importance of effective tracking and tracing throughout the supply chain. The implementation of serialization, which involves assigning unique identifiers to each product unit, has witnessed a notable rise, further fueling the demand for track-and-trace solutions. The market is also propelled by an upsurge in packaging-related product recalls, emphasizing the need for robust traceability systems to identify and address potential issues swiftly. Additionally, the escalating incidence of counterfeit drugs has become a critical concern, prompting industries to invest in advanced track-and-trace solutions to authenticate and monitor the movement of pharmaceutical products. These factors collectively underscore the growing importance of track and trace solutions in enhancing supply chain visibility, ensuring product safety, and mitigating risks associated with counterfeiting and recall.

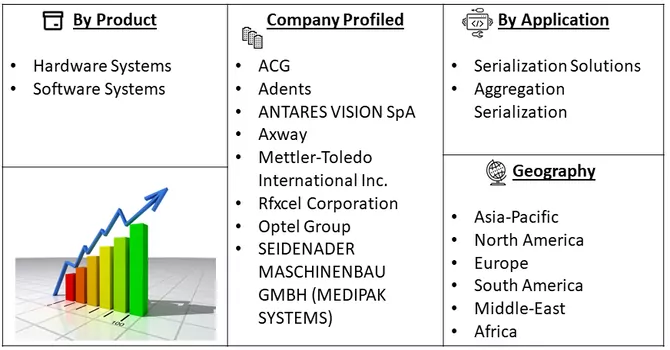

Market Segmentation: Global Track and Trace Solution Market is Segmented by Product (Hardware Systems (Printing and Marking Solutions, Monitoring and Verification Solutions, Labeling Solutions, and Other Hardware Systems) and Software Systems (Plant Manager Software, Line Controller Software, Bundle Tracking Software, and Other Software Solutions), Application (Serialization Solutions (Bottle Serialization, Label Serialization, Carton Serialization, and Data Matrix Serialization), Aggregation Serialization (Bundle Aggregation, Pallet Aggregation, and Case Aggregation), and Geography (North America, Europe, Asia-Pacific, Middle-East and Africa, and South America). The value is provided in (USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The track and trace solutions market is characterized by several prominent trends shaping its evolution. There is a notable surge in the integration of blockchain technology, ensuring secure and transparent recording of transactions. Real-time monitoring and analytics capabilities are gaining prominence, empowering businesses with actionable insights for informed decision-making. Sustainability considerations are influencing the market, driving demand for eco-friendly packaging materials and practices. Mobile track and trace solutions are on the rise, allowing consumers to access real-time information using their smartphones. Global serialization requirements, particularly in the pharmaceutical sector, are driving the adoption of standardized track-and-trace solutions. The integration of IoT devices provides real-time data on product location and condition throughout the supply chain. Artificial Intelligence applications contribute to predictive analytics and automation, enhancing supply chain management. Cross-industry collaboration is fostering the development of standardized solutions and best practices to address common challenges like counterfeiting and regulatory compliance. These trends collectively reflect the dynamic and technology-driven landscape of the track and trace solutions market.

Market Drivers:

Growth in the Medical Devices and Pharmaceutical Industries and Increase in Implementation of Serialization

The growth in the medical devices and pharmaceutical industries, coupled with the increasing implementation of serialization, has emerged as a pivotal driver for advancements in the track and trace solutions market. The medical devices and pharmaceutical sectors are witnessing significant expansion globally, driven by rising healthcare needs, technological innovations, and an ageing population. As these industries strive to ensure the safety and authenticity of their products, there is a growing realization of the importance of robust track and trace solutions. Serialization, involving the unique identification and tracking of individual product units, has gained traction as a crucial measure to enhance traceability and combat issues such as counterfeiting and unauthorized distribution. Regulatory requirements, such as the Drug Supply Chain Security Act (DSCSA) in the U.S., mandate the implementation of serialization, further propelling its adoption. The synergy between the burgeoning medical devices and pharmaceutical industries and the imperative for serialization underscores the integral role played by track-and-trace solutions in ensuring product integrity, regulatory compliance, and overall supply chain transparency in these critical sectors.

Rise in the Number of Packaging-related Product Recalls

The rise in the number of packaging-related product recalls has become a significant catalyst driving the demand for advanced track and trace solutions. In recent times, there has been a noticeable increase in instances where products have been recalled due to issues related to packaging, ranging from labelling errors to contamination concerns. These incidents have far-reaching implications, impacting consumer safety, brand reputation, and regulatory compliance. To address this challenge and mitigate risks, businesses are increasingly turning to track and trace solutions that offer real-time visibility and traceability across the entire supply chain. These solutions enable swift identification of problematic products, facilitate targeted recalls, and enhance overall responsiveness in the face of packaging-related issues. As regulatory scrutiny intensifies and consumer expectations for product safety heighten, the imperative for effective track and trace solutions is underscored by their role in averting potential crises and ensuring the integrity of packaged goods throughout their journey in the supply chain.

Restraints:

High Costs Associated with Serialization and Aggregation

The high costs associated with serialization and aggregation processes stand as potential impediments that could decelerate the growth of the track and trace solution market. Serialization involves assigning unique identifiers to individual products, while aggregation entails grouping these serialized items, both of which contribute to enhanced traceability in the supply chain. However, the implementation of these sophisticated technologies requires substantial financial investments in equipment, software, and training. The financial burden of serialization and aggregation may pose challenges, particularly for smaller enterprises with limited resources. The need for specialized equipment and compliance with regulatory standards further contributes to the elevated costs. Despite the significant benefits in terms of supply chain transparency and consumer safety, the financial barriers associated with serialization and aggregation could potentially slow down the widespread adoption of track-and-trace solutions, necessitating a careful balance between regulatory compliance and cost considerations.

The COVID-19 pandemic has significantly impacted the track and trace solution market, ushering in a heightened awareness of the importance of supply chain visibility and traceability. The disruptions caused by the pandemic, including lockdowns, border closures, and disruptions in manufacturing and logistics, underscored the vulnerabilities in global supply chains. As a result, there has been an increased emphasis on implementing robust track and trace solutions to mitigate risks, ensure continuity in the supply chain, and address challenges such as product shortages and counterfeiting. The pharmaceutical and healthcare sectors, in particular, have witnessed accelerated adoption of track and trace technologies to monitor and secure the distribution of vaccines and essential medical supplies. Additionally, the demand for e-commerce and online retail has surged during the pandemic, further driving the need for efficient track and trace systems to manage the increased volume of shipments. The COVID-19 impact has reinforced the pivotal role of track-and-trace solutions in fostering resilience, transparency, and efficiency across diverse industries.

Segmental Analysis:

Plant Manager Software Segment is Expected to Witness Significant Growth Over the Forecast Period

The integration of plant manager software with track and trace solutions represents a pivotal advancement in manufacturing and supply chain management. Plant manager software plays a crucial role in overseeing and optimizing various aspects of production within manufacturing facilities. When seamlessly integrated with track-and-trace solutions, it enhances the visibility and control of the entire manufacturing process. This integration enables plant managers to monitor the movement of raw materials, work-in-progress, and finished goods in real time. They can track each product's journey through serialization and traceability, ensuring compliance with regulatory standards. Additionally, plant manager software can facilitate predictive maintenance based on data collected from the track and trace system, optimizing equipment efficiency and reducing downtime. The synergy between plant manager software and track and trace solutions exemplifies a holistic approach to manufacturing management, fostering efficiency, quality assurance, and adherence to regulatory requirements throughout the production lifecycle.

Label Serialization Segment is Expected to Witness Significant Growth Over the Forecast Period

Label serialization, when integrated with track and trace solutions, forms a critical component of modern supply chain management, especially in industries like pharmaceuticals and manufacturing. Label serialization involves assigning a unique identifier to each product or item, typically in the form of a barcode or QR code on its label. When seamlessly connected with track-and-trace solutions, this unique identifier becomes a key to tracing the product throughout its entire lifecycle within the supply chain. It allows for real-time monitoring, enabling stakeholders to track the movement, location, and status of each labelled item. This level of traceability is essential for compliance with regulations, especially in sectors with stringent requirements, such as pharmaceuticals, where maintaining the integrity of the supply chain and ensuring authenticity are paramount. The combination of label serialization and track and trace solutions empowers businesses with enhanced transparency, improved operational efficiency, and the ability to swiftly respond to any issues or recalls within the supply chain.

North American Region t is Expected to witness Significant Growth Over the Forecast Period

The track and trace solutions market is currently dominated by North America, with the United States holding the largest market share. The outbreak of COVID-19 has further fueled the demand for these solutions in the region, as exemplified by Moderna, a biotechnology company using SAP Digital Supply Chain solutions for the serialization and distribution of a potential COVID-19 vaccine. The market is expected to experience a positive impact due to the pandemic. One of the key drivers for market growth in North America is the escalating issue of counterfeit drugs. The Food and Drug Administration (FDA) initiated a pilot project in 2019 to develop an electronic, interoperable track-and-trace system under the Drug Supply Chain Security Act (DSCSA). This system aims to reduce incorrect domestic drug distribution and prevent counterfeit drugs from infiltrating the supply chain. The DSCSA pilot program focuses on identifying efficient processes to comply with drug supply chain security and technology requirements, emphasizing the region's commitment to tackling counterfeit medicines.

Get Complete Analysis Of The Report - Download Free Sample PDF

Major market players actively pursue strategies such as expanding their production capabilities, engaging in mergers and acquisitions, and conducting research and development initiatives to maintain a competitive edge in the industry. This involves increasing their capacity for manufacturing, acquiring other companies or merging with them to strengthen their market position, and investing in innovative research and development efforts. These strategic moves are crucial for staying ahead of competitors, enhancing market share, and ensuring sustained growth in the dynamic business environment. The commitment to these initiatives underscores the players' proactive approach in adapting to market trends, meeting evolving customer demands, and securing a prominent position in the competitive landscape.

Recent Development:

1) In February 2021, Antares Vision made a strategic acquisition by adding Adents High Tech International to its portfolio. This move aimed to enhance Antares Vision's suite of software solutions, enabling comprehensive traceability, and tracking throughout the entire supply chain. The acquisition not only bolstered the company's technological capabilities but also played a pivotal role in expanding its global footprint, with a particular emphasis on strengthening its presence in France.

2) In January 2021, OPTEL and Bureau Veritas joined forces to introduce V-TRACE, a holistic and secure traceability solution designed for managing the logistics of the COVID-19 vaccine supply chain. This collaboration represented a significant step in ensuring the transparency and reliability of vaccine distribution, leveraging the expertise of both companies in traceability and quality assurance.

Q1. How big is the Trace and Track Software Solution Market ?

The Track and Trace Solutions Market size is estimated at USD 3.09 billion in 2024 and is expected to reach USD 4.82 billion by 2029.

Q2. At what CAGR is the Track and Trace Solutions market projected to grow within the forecast period?

Track and Trace Solutions Market is expected to reach at a CAGR of 9.31% during the forecast period.

Q3. Which region has the largest share of the Track and Trace Solutions market? What are the largest region's market size and growth rate?

North America has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here.

Q4. What segments are covered in the Track and Trace Solutions market Report?

By Product, Application and Geography these segments are covered in the Track and Trace Solutions market Report.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model