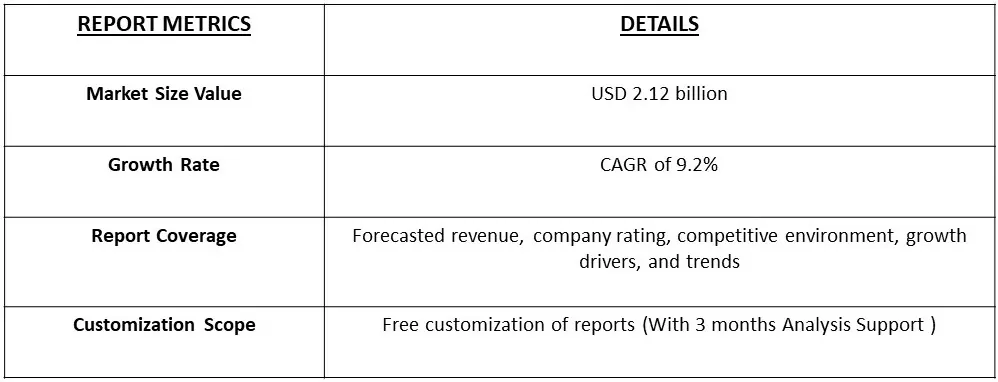

The global vanadium market is expected to experience steady growth, with the market value projected to reach 1.51 billion in 2023 and 2.12 billion by 2031, representing a compound annual growth rate (CAGR) of 9.2% from 2023 to 2031.

Get a Complete Analysis Of The Report - Download a Free Sample PDF

This growth is driven by increasing demand for vanadium-based products, such as steel alloys and catalysts, in various industries including construction, automotive, and energy, as well as growing adoption of vanadium-based batteries and other emerging applications.

The global vanadium market is experiencing steady growth, driven by its critical role in steel production and the rising demand for vanadium-based energy storage solutions. As a key alloying element, vanadium is essential for strengthening steel, making it indispensable in the construction, automotive, and aerospace industries. The growing infrastructure development and urbanization in emerging economies further boost demand for steel manufacturing vanadium.

Additionally, the market is gaining momentum from the increasing interest in vanadium redox flow batteries (VRFBs), which offer long-duration energy storage solutions crucial for supporting renewable energy integration. However, the market faces challenges such as supply volatility, as vanadium production is often concentrated in a few countries, leading to price fluctuations. Overall, the global vanadium market is poised for growth, supported by expanding industrial applications and the emerging energy storage sector, although it remains sensitive to supply chain dynamics and regulatory changes.

The global vanadium market is witnessing several key trends that are shaping its future growth. One of the most notable trends is the increasing demand for vanadium redox flow batteries (VRFBs), driven by the growing need for large-scale, long-duration energy storage solutions in the renewable energy sector. VRFBs are gaining traction due to their ability to store and discharge energy over extended periods, making them ideal for balancing intermittent renewable sources like wind and solar. Additionally, there is a trend towards greater vanadium use in high-strength steel production, particularly in infrastructure and automotive industries, as stricter regulations and performance standards require stronger, lighter materials. The market is also seeing increased investment in vanadium exploration and production to secure supply and reduce dependence on existing sources, particularly in regions like China and Russia, which dominate global production. Furthermore, recycling of vanadium from spent catalysts and industrial by-products is becoming more prevalent, contributing to a more sustainable supply chain. These trends indicate a robust future for vanadium, driven by its expanding applications in energy storage and advanced materials.

Market Segmentation:

The Global Vanadium Market is segmented by type of vanadium (Vanadium Pentoxide (V2O5), Ferrovanadium, Vanadium Trioxide (V2O3), and Vanadium Chloride (VCl3)), Application (Steel Production, Batteries, Chemical Industry, Aerospace and Other Industries), and geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The report offers the market size and forecasts for revenue (USD million) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Rising Demand for Energy Storage Solutions:

The increasing deployment of renewable energy sources, such as wind and solar power, is significantly driving the global vanadium market, primarily through the growing adoption of vanadium redox flow batteries (VRFBs). VRFBs are emerging as a key technology for large-scale energy storage due to their advantages in long-duration, scalable, and efficient energy storage. As renewable energy generation becomes more prevalent, there is a corresponding need for reliable energy storage systems that can manage intermittent energy supply and ensure grid stability. Vanadium's role in these batteries is critical because it allows for high-capacity energy storage and long cycle life, making it ideal for balancing supply and demand over extended periods. The global push towards cleaner energy and the need for sustainable energy storage solutions are driving significant investments and advancements in VRFB technology, thereby boosting demand for vanadium. This trend is expected to continue as countries and companies seek to enhance their renewable energy infrastructure and reduce reliance on fossil fuels.

Growth in High-Strength Steel Production:

The global demand for high-strength, low-alloy (HSLA) steels is another major driver of the vanadium market. Vanadium is used as an alloying element in steel to improve its strength, toughness, and resistance to wear and fatigue. This enhanced performance is critical for applications in the construction, automotive, and aerospace industries, where high-strength materials are required to meet stringent safety and performance standards. As infrastructure projects, automotive production, and advanced manufacturing continue to grow worldwide, the demand for vanadium in steel alloys is increasing. For example, in the construction sector, vanadium-containing steel is used in bridges, high-rise buildings, and pipelines, while in the automotive industry, it contributes to lighter and more durable vehicle components. The trend towards urbanization, infrastructure development, and the need for more resilient materials are driving the growth of high-strength steel production, thereby fueling the demand for vanadium. This trend is expected to persist as industries seek to leverage the benefits of vanadium-enhanced steel for both performance and safety improvements.

Market Restraints:

The global vanadium market faces several key restraints that could impact its growth. One major challenge is the volatility in vanadium prices, which can be influenced by fluctuations in supply and demand, geopolitical factors, and economic conditions. Vanadium production is concentrated in a few countries, such as China and Russia, which can lead to supply disruptions and price instability. Additionally, high production costs associated with vanadium extraction and processing can limit profitability and deter investment, particularly in times of low market prices. The market is also constrained by environmental and regulatory pressures, as vanadium mining and processing can have significant environmental impacts, leading to stricter regulations and higher compliance costs. Moreover, the long development cycles and high capital expenditure required for vanadium-based technologies, such as vanadium redox flow batteries, can slow market adoption and investment. These factors collectively pose challenges to the stable growth of the vanadium market, influencing both supply dynamics and market viability.

The COVID-19 pandemic had a complex impact on the global vanadium market. Initially, the market experienced disruptions due to supply chain interruptions and reduced industrial activity, as lockdowns and travel restrictions affected mining operations and transportation. This led to delays in production and fluctuations in vanadium prices. However, the pandemic also underscored the importance of resilient energy storage solutions, boosting interest in vanadium redox flow batteries (VRFBs) as a technology for large-scale energy storage and grid stability. As governments and industries accelerated their focus on renewable energy and sustainable infrastructure, the demand for VRFBs and, consequently, vanadium, saw renewed growth. Additionally, the pandemic prompted a shift towards remote work and digital technologies, indirectly benefiting sectors that use high-strength steel in infrastructure and automotive applications, further driving vanadium demand. Despite the initial setbacks, the market is recovering as the global economy stabilizes and investment in energy storage and infrastructure continues to grow, positioning vanadium for a strong post-pandemic resurgence.

Segmental Analysis:

Vanadium Pentoxide (V2O5) Segment is Expected to Witness Significant Growth Over the Forecast Period

Vanadium Pentoxide (V2O5): Vanadium Pentoxide is a critical sub-segment of the global vanadium market, primarily utilized in steel production and battery applications. Recent developments include advancements in processing technologies that enhance the purity and efficiency of V2O5, making it a more effective component in high-strength steel alloys and vanadium redox flow batteries. The growing emphasis on sustainable and high-performance materials in construction and renewable energy sectors is driving demand for V2O5. Additionally, increased investment in research to improve the energy storage capabilities of vanadium redox batteries underscores its expanding role in energy solutions. The driving factors for this sub-segment include the need for improved steel durability and the rising adoption of energy storage technologies.

Steel Production Segment is Expected to Witness Significant Growth Over the Forecast Period

The steel production segment remains a cornerstone of the global vanadium market, driven by the essential role vanadium plays in enhancing the strength and toughness of steel. Recent industry trends show a significant rise in construction and infrastructure projects globally, particularly in emerging markets like Asia-Pacific, which drives demand for high-strength, low-alloy steels containing vanadium. Innovations in steel manufacturing, such as the development of new steel grades with improved properties, further boost the need for vanadium. The driving factors for this segment include the robust growth in urbanization and infrastructure development, which continues to increase the consumption of high-quality steel.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

The growth in the region is driven by strong demand from the steel industry, particularly from the United States, where vanadium is used as an alloying element to improve steel's strength and durability. The region's steel industry is expected to continue its growth trajectory, driven by increasing demand for construction materials, automotive parts, and other steel products.

In addition to the steel industry, the North American vanadium market is also expected to benefit from growing adoption of vanadium-based batteries and other emerging applications, such as aerospace and energy storage. The region's automotive industry is also expected to drive demand for vanadium-based catalysts, which are used to reduce emissions and improve fuel efficiency.

The growth of the North American vanadium market is expected to be driven by a combination of factors, including increasing demand from end-use industries, advancements in technology, and government initiatives to promote the use of sustainable and environmentally friendly materials. Overall, the North American vanadium market is expected to experience steady growth over the next decade, driven by a range of factors and applications.

Vanadium Market Competitive Landscape:

The competitive landscape of the global vanadium market is marked by significant activity among leading industry players striving to enhance their market positions through strategic initiatives and technological advancements. These companies are at the forefront of vanadium mining, processing, and product innovation, focusing on improving supply chain efficiency, developing high-performance vanadium products, and expanding their global reach. The competitive dynamics are shaped by factors such as advancements in extraction technology, fluctuations in vanadium prices, and growing demand from key industries like steel production and energy storage.

Key competitors include:

Get a Complete Analysis Of The Report - Download a Free Sample PDF

Recent Development:

1. Bushveld Minerals Limited announced the completion of a significant expansion at its Vanchem Vanadium Processing Facility in early 2024. This expansion increases the facility's capacity to produce vanadium pentoxide by 30%, positioning Bushveld as a leading supplier of high-quality vanadium products. The development aligns with the company's strategy to meet the growing global demand for vanadium, driven by its applications in steel production and energy storage solutions. This expansion also enhances Bushveld’s ability to cater to emerging markets and strengthens its competitive edge in the global vanadium market.

2. Largo Resources Ltd. launched a new vanadium redox flow battery project in late 2023, aimed at boosting its presence in the renewable energy storage sector. The project involves the development of an advanced, large-scale vanadium flow battery system designed to improve energy storage efficiency and support grid stability. This initiative underscores Largo's commitment to diversifying its product offerings beyond traditional vanadium applications and capitalizing on the growing demand for energy storage solutions. The successful implementation of this project is expected to reinforce Largo’s market position and drive innovation within the vanadium sector.

Q1. What are the driving factors for the Global Vanadium Market?

The global vanadium market is driven by several key factors, including the increasing demand for high-strength steel in construction and infrastructure projects, which benefits from vanadium's ability to enhance steel strength and durability. The growing interest in energy storage solutions, particularly vanadium redox flow batteries, is also a significant driver due to their efficiency and scalability for renewable energy applications. Additionally, advancements in aerospace technology require vanadium-based alloys for their superior performance characteristics. The rising focus on improving energy efficiency and reducing carbon emissions further supports the market growth for vanadium applications in various industries.

Q2. What are the restraining factors for the Global Vanadium market?

The global vanadium market faces several restraining factors, including price volatility and fluctuations in vanadium supply due to its reliance on mining and extraction processes. High production costs and environmental regulations associated with vanadium extraction can also impact market dynamics. The availability of substitute materials and technologies, such as other metal alloys or energy storage solutions, can limit the demand for vanadium. Additionally, geopolitical tensions and trade barriers affecting key vanadium-producing regions can create supply chain uncertainties and hinder market growth.

Q3. Which segment is projected to hold the largest share in the Global Vanadium market?

The steel production segment is projected to hold the largest share in the global vanadium market. Vanadium is primarily used to produce high-strength steel, which is crucial for construction, infrastructure, and manufacturing applications. The demand for vanadium in steel production is driven by its ability to improve the mechanical properties and durability of steel, making it a preferred choice for various industrial applications. As infrastructure development and construction activities increase globally, the steel production segment will continue to dominate the vanadium market.

Q4. Which region holds the largest share in the Global Vanadium market?

Asia-Pacific holds the largest share in the global vanadium market. This region, particularly China, is a major consumer and producer of vanadium due to its large-scale steel production and significant investments in infrastructure projects. The high demand for high-strength steel in construction and industrial applications, along with growing energy storage needs, drives the market in this region. Additionally, the presence of key vanadium mining and processing companies in Asia-Pacific contributes to its dominant position in the global market.

Q5. Which are the prominent players in the Global Vanadium market?

Prominent players in the global vanadium market include China Vanadium Titano-Magnetite Mining Company Limited, Bushveld Minerals Limited, Fortescue Metals Group, VanadiumCorp Resource Inc., Largo Resources Ltd., TNG Limited, Ascot Resources Ltd., Molybdenum Corp, and Hunan Zhongnan Vanadium and Titanium Co., Ltd. These companies are key contributors to the market due to their extensive mining operations, vanadium processing capabilities, and strategic investments in technology and innovation. Their market presence and competitive positioning are bolstered by their ability to meet global demand and manage supply chain complexities.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model