The global Cardiac Rhythm Management (CRM) market is poised for substantial growth, projected to reach a market value of USD 31.7 billion by 2023 and USD 54.2 billion by 2031, representing a compound annual growth rate (CAGR) of 7.1% from 2023 to 2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Cardiac Rhythm Management (CRM) refers to a specialized area of cardiology focused on diagnosing and treating heart rhythm disorders, such as arrhythmias. It encompasses a range of medical devices and therapeutic procedures designed to monitor, regulate, and restore normal heart rhythms. Key components of CRM include implantable devices like pacemakers and implantable cardioverter-defibrillators (ICDs), which help manage conditions such as bradycardia (slow heart rate) and tachycardia (fast heart rate). Additionally, cardiac resynchronization therapy (CRT) is utilized to improve heart function in patients with heart failure. With advancements in technology, CRM devices are increasingly equipped with remote monitoring capabilities, enabling healthcare providers to track patients' heart health in real time. The overall goal of CRM is to enhance patient outcomes, reduce complications, and improve the quality of life for individuals with cardiac rhythm disorders.

This growth is driven by the increasing prevalence of cardiac arrhythmias, the rising aging population, and advancements in technology that enhance the effectiveness of CRM devices. CRM encompasses a range of medical devices used to monitor and manage heart rhythm disorders, including pacemakers, implantable cardioverter-defibrillators (ICDs), and cardiac resynchronization therapy (CRT) devices. These devices play a critical role in improving the quality of life for patients suffering from heart rhythm abnormalities, significantly reducing mortality rates associated with arrhythmias.

The CRM market is also influenced by increasing awareness and acceptance of advanced cardiac therapies, along with favorable reimbursement policies that facilitate access to these technologies. As healthcare systems globally shift towards value-based care, the focus on effective management of cardiac conditions is heightened. Furthermore, rising investment in research and development to create more sophisticated and user-friendly devices is fostering a competitive environment, propelling market growth. As a result, CRM devices are becoming integral components of comprehensive cardiac care, underscoring the importance of ongoing innovation and education in the field.

Several key trends are shaping the future of the cardiac rhythm management market. One prominent trend is the increasing adoption of remote monitoring and telehealth solutions, which enable healthcare providers to track patient data and heart rhythms in real time, enhancing patient outcomes and reducing hospital readmissions. This shift towards digital health is complemented by advancements in mobile health applications that empower patients to take an active role in managing their conditions. Additionally, the development of next-generation CRM devices equipped with advanced features, such as MRI-conditional technology and leadless pacemakers, is gaining traction, appealing to both patients and healthcare providers.

Moreover, the market is witnessing a surge in minimally invasive procedures, reflecting a broader trend towards less invasive approaches in cardiology. This is fueled by technological advancements in device design and delivery systems, improving patient comfort and recovery times. Increasing collaborations between technology companies and healthcare providers are also driving innovation in the CRM sector, fostering the creation of integrated solutions that enhance the management of cardiac conditions. Collectively, these trends indicate a dynamic evolution in the CRM market, focused on patient-centric approaches, enhanced monitoring capabilities, and continuous advancements in technology.

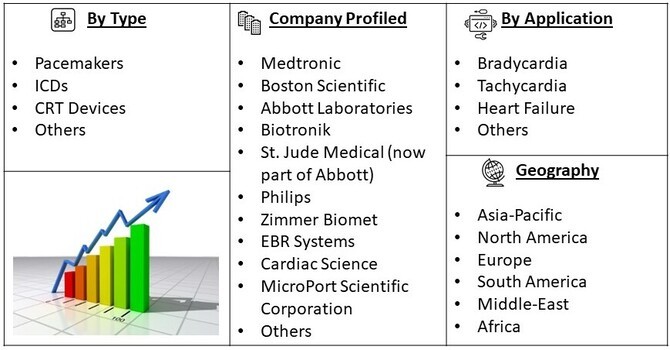

Market Segmentation:

The global cardiac rhythm management market is segmented By Device Type (Pacemakers, ICDs, CRT Devices, And Others), Application (Bradycardia, Tachycardia, Heart Failure, And Others), And Geography (North America, Europe, Asia-Pacific, South America, And The Middle East And Africa). Each segment presents unique opportunities for growth and innovation, driven by varying patient needs and healthcare infrastructures. For instance, the pacemaker segment is expected to capture a significant share of the market, given its widespread use and advancements in technology, including leadless pacemakers that offer enhanced patient comfort and outcomes.

For Detailed Market Segmentation - Get a Free Sample PDF

In terms of geography, North America is anticipated to hold a dominant position in the CRM market, supported by advanced healthcare systems, a high prevalence of cardiac diseases, and favorable reimbursement frameworks. Meanwhile, the Asia-Pacific region is projected to witness the fastest growth due to rising awareness of cardiac health, increasing disposable incomes, and expanding access to healthcare services. As each segment evolves, stakeholders are encouraged to focus on patient-specific solutions and innovative technologies to address the growing demand for effective cardiac rhythm management.

Market Drivers:

The rising incidence of cardiac arrhythmias is a significant driver for the Cardiac Rhythm Management (CRM) market. Factors such as sedentary lifestyles, increased stress, and dietary changes have contributed to a growing number of individuals experiencing conditions like atrial fibrillation, bradycardia, and tachycardia. Additionally, the aging population is particularly vulnerable to these disorders, as age-related changes in heart function become more pronounced. As awareness of heart health increases, more patients are seeking diagnostic and therapeutic options to manage their conditions effectively. This surge in demand creates opportunities for healthcare providers and manufacturers to offer advanced CRM solutions tailored to individual patient needs. The emphasis on preventive healthcare and timely interventions further fuels the growth of the market, as early detection and treatment can significantly reduce complications and improve quality of life. Consequently, the increasing prevalence of cardiac arrhythmias is expected to remain a driving force in the CRM landscape.

Continuous technological advancements in Cardiac Rhythm Management devices are revolutionizing the market and driving growth. Innovations such as leadless pacemakers, subcutaneous implantable cardioverter-defibrillators (ICDs), and advanced cardiac resynchronization therapy systems enhance the safety and effectiveness of treatment options. These new devices often feature remote monitoring capabilities, allowing healthcare providers to track patients’ heart rhythms in real-time, thus enabling proactive management of potential issues. Furthermore, improvements in device design have led to reduced complications, shorter recovery times, and greater patient comfort. As healthcare professionals become more familiar with these technologies, their adoption rates are increasing, making advanced CRM solutions more accessible to a broader patient population. The ongoing investment in research and development is expected to yield even more sophisticated devices in the future, further driving demand in the CRM market. Ultimately, these technological advancements are pivotal in meeting the growing need for effective management of cardiac rhythm disorders.

Market Restraints:

Despite its robust growth potential, the cardiac rhythm management market faces several challenges. One significant restraint is the high cost associated with CRM devices and procedures, which can limit accessibility for many patients, particularly in developing regions where healthcare budgets are constrained. Additionally, concerns about device-related complications and the need for regular follow-ups can deter patients from opting for CRM solutions.

Regulatory hurdles and the lengthy approval processes for new devices also pose challenges for manufacturers seeking to enter the market. Moreover, competition from alternative treatments, such as medication and lifestyle changes, can impact the adoption of CRM technologies. Lastly, the lack of awareness and education regarding cardiac rhythm disorders in certain regions can restrict market growth. Addressing these barriers is crucial for stakeholders aiming to maximize the potential of the cardiac rhythm management market.

The COVID-19 pandemic has had a profound impact on the Cardiac Rhythm Management (CRM) market, affecting both the demand for and delivery of cardiac care. Initially, many elective procedures, including the implantation of CRM devices such as pacemakers and ICDs, were postponed or canceled due to healthcare resource allocation toward managing COVID-19 patients. This resulted in a significant decline in procedures, causing delays in diagnosis and treatment for patients with arrhythmias. Moreover, patient apprehension about visiting healthcare facilities during the pandemic contributed to a drop in consultations for cardiac issues. Many individuals avoided seeking care, leading to the potential worsening of their conditions and increased complications. On the other hand, the pandemic accelerated the adoption of telemedicine and remote monitoring technologies, allowing healthcare providers to manage patients' cardiac health from a distance. This shift not only ensured continuity of care but also highlighted the importance of innovative solutions in the CRM space.

As restrictions eased and healthcare systems adapted, there was a resurgence in CRM procedures as patients sought to address their delayed treatments. The pandemic underscored the necessity for advanced cardiac care solutions, positioning the CRM market for growth in a post-pandemic landscape. Overall, while the COVID-19 crisis temporarily disrupted the CRM market, it also paved the way for lasting changes that could enhance patient care and management in the future.

Segmental Analysis:

The growth of the pacemaker market is primarily driven by the rising prevalence of cardiac disorders, particularly bradycardia and heart failure, which necessitate effective management solutions. As the global population ages, the incidence of these conditions increases, leading to a higher demand for pacemakers. Technological advancements play a crucial role as well; innovations such as leadless pacemakers and devices with extended battery life enhance patient comfort and outcomes. Increased awareness of heart health, coupled with regular screening initiatives, facilitates early diagnosis and timely intervention, further boosting demand. Additionally, improved access to healthcare services, especially in emerging markets, is making these life-saving devices more available to patients. Favorable regulatory approvals and expanding insurance coverage also contribute to market growth by reducing financial barriers. A shift toward personalized medicine encourages tailored treatment plans, which often incorporate advanced pacemaker technology, appealing to both patients and healthcare providers. Lastly, the integration of remote monitoring features allows for real-time health management, fostering adherence to treatment and improving patient outcomes. Collectively, these factors position the pacemaker market for sustained growth in the coming years.

The Heart Failure and Cardiac Rhythm Management (CRM) market is experiencing significant growth due to the rising prevalence of heart failure globally, driven by factors such as aging populations, increasing rates of obesity, and lifestyle-related conditions like diabetes and hypertension. Heart failure often leads to arrhythmias, creating a dual demand for both heart failure management and effective CRM solutions, such as pacemakers and implantable cardioverter-defibrillators (ICDs). Technological advancements in CRM devices, including more efficient and patient-friendly options, are enhancing treatment outcomes and improving the quality of life for patients. Additionally, increasing awareness and early diagnosis of heart conditions are driving patient engagement and treatment adherence. The growing focus on personalized medicine is also playing a vital role, as healthcare providers aim to tailor therapies to individual patient needs. Furthermore, advancements in remote monitoring technology enable continuous tracking of patients' cardiac health, facilitating timely interventions. As healthcare systems adapt to these challenges, the Heart Failure and CRM market is well-positioned for continued expansion, driven by innovations and a commitment to improving patient outcomes.

Geographic Insights:

North America is anticipated to hold the largest share of the cardiac rhythm management market, driven by a combination of factors including advanced healthcare infrastructure, high prevalence of cardiovascular diseases, and robust reimbursement policies. The region is home to leading manufacturers and a well-established network of specialized healthcare providers, ensuring access to the latest CRM technologies. Additionally, increasing awareness about the benefits of timely cardiac interventions and the presence of numerous clinical trials further bolsters the region's market position.

Meanwhile, the Asia-Pacific region is expected to experience the fastest growth, attributed to rising disposable incomes, improved healthcare access, and increasing awareness of cardiovascular health. Countries like India and China are investing significantly in healthcare infrastructure, leading to better access to CRM devices. As the population ages and lifestyle-related diseases become more prevalent, the demand for effective cardiac rhythm management solutions is set to rise in this region, presenting lucrative opportunities for stakeholders.

To Learn More About This Report - Request a Free Sample Copy

The competitive landscape of the global cardiac rhythm management market features a mix of established players and innovative newcomers, all striving to capture market share through technological advancements and enhanced patient care. Major players include Medtronic, Boston Scientific, and Abbott Laboratories, recognized for their extensive portfolios of CRM devices and commitment to innovation. Other prominent companies include Biotronik, Biotronic, and St. Jude Medical, which focus on developing cutting-edge technologies that improve patient outcomes and expand the scope of cardiac therapies.

Additionally, companies like Philips, Zimmer Biomet, and EBR Systems are increasingly contributing to the market with innovative solutions tailored to specific patient needs. Emerging players are also making their mark, leveraging advancements in digital health and remote monitoring technologies. The competitive strategies employed by these companies include aggressive research and development initiatives, strategic partnerships, and targeted marketing campaigns aimed at raising awareness about the benefits of CRM solutions. As the market evolves, ongoing innovations and a focus on personalized patient care will be crucial for maintaining a competitive edge.

Here are the major players in the global Cardiac Rhythm Management market

Recent Development:

Q1. What are the driving factors for the Global Cardiac Rhythm Management (CRM) Market?

Driving Factors for the Global Cardiac Rhythm Management (CRM) Market

1. Increasing Prevalence of Cardiac Disorders: The rising incidence of heart diseases, including arrhythmias, heart failure, and other cardiovascular conditions, significantly drives demand for CRM devices. As lifestyles change and populations age, more individuals are experiencing heart-related issues that necessitate effective management solutions.

2. Technological Advancements: Innovations in CRM technologies, such as leadless pacemakers, advanced ICDs, and remote monitoring systems, are enhancing patient outcomes and safety. These advancements attract more healthcare providers and patients to adopt these devices, propelling market growth.

Q2. What are the restraining factors for the Global Cardiac Rhythm Management (CRM) Market?

Restraining Factors for the Global Cardiac Rhythm Management (CRM) Market

1. High Costs of Devices and Procedures: The cost of advanced CRM devices and associated surgical procedures can be prohibitive for many patients, particularly in developing regions. This financial barrier limits access to essential treatments.

2. Risk of Complications: Concerns regarding potential complications, such as infections or device malfunctions, may deter some patients from opting for CRM solutions. This hesitation can impact the overall adoption rates of these technologies.

Q3. Which segment is projected to hold the largest share in the Global Cardiac Rhythm Management (CRM) Market?

The segment focusing on implantable cardioverter-defibrillators (ICDs) is projected to hold the largest share in the global Cardiac Rhythm Management market. ICDs are essential for managing life-threatening arrhythmias and preventing sudden cardiac arrest, making them critical for patients with severe heart conditions. The increasing prevalence of these conditions, coupled with advancements in ICD technology—such as subcutaneous devices and remote monitoring features—enhances their appeal and adoption. As more patients are diagnosed with arrhythmias and heart diseases, the demand for ICDs is expected to continue rising, solidifying their dominant position in the market.

Q4. Which region holds the largest share of the Global Cardiac Rhythm Management (CRM) Market?

North America is expected to hold the largest share of the global Cardiac Rhythm Management market. The region benefits from advanced healthcare infrastructure, a high concentration of skilled cardiologists, and widespread access to innovative medical technologies. The increasing prevalence of cardiovascular diseases and a growing aging population further drive demand for CRM solutions. Additionally, favorable reimbursement policies and a strong emphasis on research and development in the healthcare sector enhance the adoption of advanced CRM devices. The presence of prominent market players and ongoing technological advancements solidify North America's leading position in the CRM market.

Q5. Which are the prominent players in the Global Cardiac Rhythm Management (CRM) Market?

Prominent Players in the Global Cardiac Rhythm Management Market. These three major players accounts for major market share.

1. Medtronic: A global leader in medical technology, Medtronic offers a comprehensive range of CRM devices, including pacemakers, ICDs, and cardiac monitors. The company is known for its innovative solutions that enhance patient care and improve outcomes. Medtronic invests heavily in research and development, continuously advancing its product offerings to meet the evolving needs of healthcare providers and patients.

2. Abbott Laboratories: Abbott is recognized for its advanced CRM solutions, particularly in the areas of implantable cardiac devices and arrhythmia management. The company focuses on innovation, with a strong portfolio that includes the latest technologies in pacemakers and ICDs. Abbott's commitment to improving patient outcomes through research and education solidifies its position as a key player in the CRM market.

3. Boston Scientific: Known for its expertise in cardiovascular devices, Boston Scientific develops a wide range of CRM products, including pacemakers and ICDs. The company emphasizes innovation and patient-centric solutions, making it a leader in the cardiac market. Boston Scientific is dedicated to advancing technologies that improve the quality of life for patients with heart rhythm disorders.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model