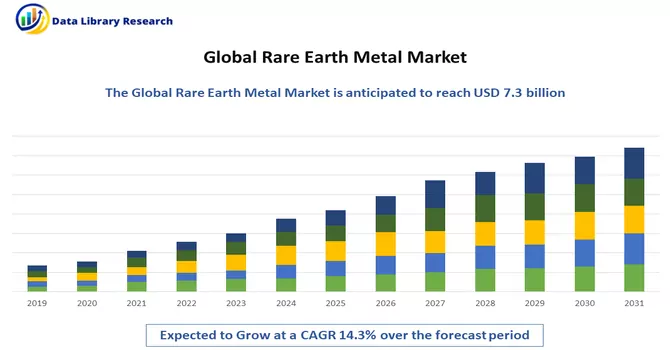

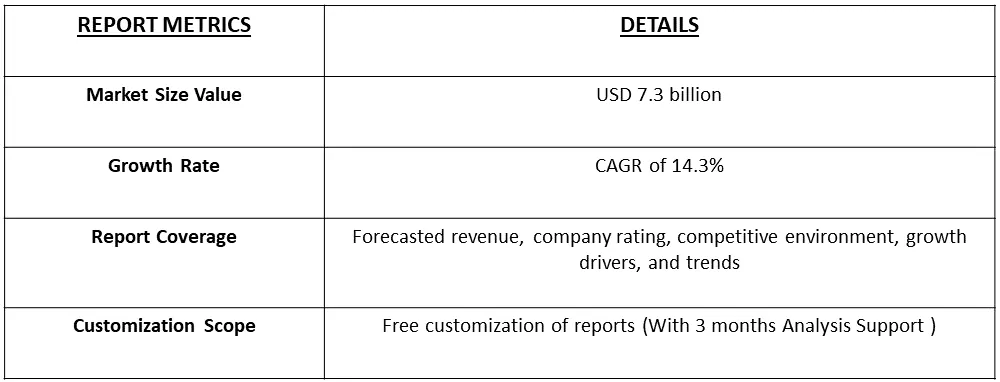

The rare earth metals market was estimated at USD 7.3 billion in 2023 and is projected to reach a CAGR of 14.3% from 2024 to 2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Rare earth metals play a pivotal role in the global market, serving as essential components in the manufacturing of high-tech devices and green technologies. Despite their name, these elements are not actually rare; however, their extraction and processing pose significant challenges. China dominates the rare earth market, accounting for a substantial majority of global production. The strategic importance of rare earth metals lies in their indispensable use in the production of smartphones, electric vehicles, wind turbines, and other advanced technologies. As the demand for clean energy and cutting-edge electronics continues to rise, the market for rare earth metals is expected to grow, prompting efforts by other countries to diversify their sources and reduce dependence on a single supplier.

The evolving dynamics of this market underscore the critical role that rare earth metals play in shaping the future of technological innovation and sustainable development. The rare earth metals market is fueled by several growth-driving factors, prominently led by the increasing demand for clean energy solutions and technological advancements. The expanding production of electric vehicles, wind turbines, and electronic devices relies heavily on rare earth metals, amplifying their significance in a rapidly evolving technological landscape. Additionally, the global push towards sustainability and the development of green technologies underscore the critical role played by rare earth metals in achieving environmental objectives. As countries strive to reduce carbon emissions and transition to renewable energy sources, the demand for these elements is expected to surge, propelling the growth of the rare earth metals market in the foreseeable future.

Market segmentation: The Rare Earth Elements Market is Segmented by Element (Cerium, Neodymium, Lanthanum, Dysprosium, Terbium, Yttrium and Scandium, and Other Elements), Application (Catalysts, Ceramics, Phosphors, Glass and Polishing, Metallurgy, Magnets, and Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Report Offers Market Size and Forecasts for the Rare Earth Elements Market in Volume (ton) for all the Above Segments.

For Detailed Market Segmentation - Download Free Sample PDF

The rare earth metals market is currently witnessing notable trends shaped by the evolving dynamics of global industries. A key trend is the increasing emphasis on supply chain resilience and efforts by various countries to diversify their sources of rare earth elements, reducing dependence on a single supplier, notably China. Moreover, the growing demand for rare earth metals in emerging technologies like electric vehicles, renewable energy systems, and advanced electronics is driving innovation in extraction and processing techniques. Recycling initiatives are gaining traction as an environmentally conscious approach, aligning with the broader sustainability goals of industries. The market is also experiencing heightened scrutiny on environmental and ethical practices in rare earth mining, highlighting a shift towards responsible sourcing. As technological advancements continue to unfold, the rare earth metals market is poised for transformative changes, shaping the future of industries reliant on these crucial elements.

Market Drivers:

The escalating demand for electric vehicles

The demand for electric vehicles (EVs) is experiencing unprecedented growth, driven by a confluence of factors that include environmental consciousness, governmental incentives, and technological advancements. As the world shifts towards a greener and more sustainable future, consumers are increasingly embracing EVs as a viable alternative to traditional internal combustion engine vehicles. Improvements in battery technology expanded charging infrastructure, and a surge in automakers investing in electric vehicle production contribute to the rising popularity of EVs. Additionally, stringent emissions regulations and the commitment of various countries to reduce carbon footprints further fuel the escalating demand for electric vehicles, transforming the automotive landscape and influencing the entire supply chain, including the increased need for crucial components like rare earth metals in the manufacturing of electric motors and batteries.

The rapid growth of the renewable energy sector

The renewable energy sector is undergoing rapid and transformative growth, fueled by a global imperative to transition towards sustainable and clean energy sources. Governments, corporations, and consumers alike are increasingly investing in renewable energy technologies, such as solar and wind power, to mitigate the impacts of climate change and reduce dependence on fossil fuels. Technological advancements, decreasing costs, and favourable government policies are key contributors to this growth. The sector's expansion is not only evident in the increasing capacity of renewable energy installations but also in the diversification of energy storage solutions and smart grid technologies. As the world intensifies its commitment to achieving carbon neutrality, the rapid growth of the renewable energy sector is expected to persist, driving innovation and influencing markets, including the heightened demand for critical elements like rare earth metals used in the production of renewable energy technologies.

Market Restraints:

The rare earth metals market faces notable constraints, including environmental concerns associated with mining and processing activities. The extraction of rare earth elements often involves environmentally impactful methods, leading to soil and water contamination and biodiversity degradation. Additionally, geopolitical tensions and trade disputes, particularly with major producer China, can result in supply chain uncertainties and market volatility. High extraction and processing costs, coupled with the complexity of separating rare earth metals, pose economic challenges for market players. Furthermore, the fluctuating prices of rare earth metals in response to market dynamics and regulatory changes can affect profitability and investment decisions. The limited availability of viable alternatives for certain applications may also pose a restraint, emphasizing the importance of sustainable practices and the development of new technologies in overcoming these challenges in the rare earth metals market.

The COVID-19 pandemic has exerted a multifaceted impact on the rare earth metals market. Disruptions in global supply chains, lockdowns, and reduced economic activities have affected both the production and demand sides of the market. The temporary closure of mines and processing facilities, coupled with logistical challenges, led to a slowdown in rare earth metals' extraction and distribution. On the demand side, the pandemic-induced economic uncertainties influenced various industries, impacting their investments and consumption of products requiring rare earth elements. However, as economies recover and stimulus measures are implemented, the demand for clean energy technologies and electronic devices, reliant on rare earth metals, is expected to rebound. The pandemic has also underscored the importance of diversifying supply chains to enhance resilience, prompting renewed efforts by countries to secure and develop domestic sources of rare earth metals. The post-pandemic landscape is likely to witness renewed growth and strategic shifts in the rare earth metals market.

Segmental Analysis:

Yttrium and Scandium Segment is Expected to Witness Significant Growth Over the Forecast Period

Yttrium and scandium are rare earth metals that play important roles in various industries, including electronics, aerospace, and renewable energy. The rare earth metals market, including yttrium and scandium, has experienced significant growth in recent years due to their unique properties and diverse applications. Yttrium is used in the production of phosphors for television screens, LEDs, and fluorescent lamps, as well as in the manufacturing of superconductors and various electronic devices. Scandium is primarily used as an alloying element in aluminum to improve its strength, durability, and heat resistance, making it ideal for aerospace and automotive applications. The rare earth metals market is characterized by a high level of demand from industries such as electronics, automotive, and renewable energy. The increasing use of rare earth metals in magnets, batteries, and other high-tech applications has led to a surge in demand, driving up prices and prompting exploration and mining activities worldwide. China currently dominates the rare earth metals market, accounting for a significant portion of global production. However, other countries, including Australia, the United States, and Russia, are ramping up their rare earth mining efforts to reduce reliance on Chinese supply and meet growing demand. As industries continue to innovate and develop new technologies, the demand for rare earth metals such as yttrium and scandium is expected to remain strong. This presents opportunities for companies involved in the exploration, mining, and processing of rare earth metals to capitalize on this growing market and contribute to technological advancements across various industries.

Metallurgy Segment is Expected to Witness Significant Growth Over the Forecast Period

Metallurgy plays a crucial role in the rare earth metal market, as these metals are essential components in the production of various high-tech materials and devices. Rare earth metals, including elements like neodymium, dysprosium, and praseodymium, are prized for their unique magnetic, catalytic, and luminescent properties, making them indispensable in a wide range of applications. One of the key uses of rare earth metals in metallurgy is in the production of high-strength permanent magnets. These magnets are essential components in electric vehicle motors, wind turbines, and many other applications where strong, lightweight magnets are needed. Neodymium, in particular, is a critical component in these magnets, making it a key focus of the rare earth metal market. Rare earth metals are also used in metallurgy to improve the properties of steel and other alloys. For example, adding small amounts of rare earth metals to steel can improve its strength, corrosion resistance, and heat resistance. This makes rare earth metals valuable in the production of high-performance alloys used in aerospace, automotive, and other industries. The rare earth metal market is heavily influenced by factors such as technological advancements, geopolitical issues, and environmental concerns. China is currently the dominant producer of rare earth metals, but other countries are investing in exploration and mining efforts to reduce dependency on Chinese supply. As the demand for rare earth metals continues to grow, driven by the increasing use of high-tech devices and renewable energy technologies, metallurgy will play an increasingly important role in ensuring a stable supply of these critical materials. This presents opportunities for companies involved in metallurgy to innovate and develop new technologies for the extraction, processing, and application of rare earth metals, contributing to the growth and sustainability of the rare earth metal market. Thus, owing to such factors the segment is expected to witness significant growth over the forecast period.

Asia-Pacific Region is Expected to Witness Significant Growth Over the Forecast Period

The Asia-Pacific region is a significant player in the global rare earth metal market, both in terms of production and consumption. Countries in this region, particularly China, dominate the rare earth metal market due to their abundant reserves and strong industrial base. Rare earth metals are essential components in various high-tech industries, including electronics, renewable energy, and automotive, making them critical for the region's economic growth and technological advancement. China is the largest producer of rare earth metals in the world, accounting for a significant portion of global production. The country's vast reserves and relatively low production costs have made it a key player in the rare earth metal market. However, other countries in the Asia-Pacific region, such as Australia, Malaysia, and Vietnam, also have significant rare earth metal reserves and are investing in their extraction and processing capabilities to reduce dependency on Chinese supply. The Asia-Pacific region is also a major consumer of rare earth metals, driven by the region's strong industrial base and growing demand for high-tech products. Rare earth metals are used in a wide range of applications in industries such as electronics, automotive, and renewable energy. The increasing adoption of electric vehicles and renewable energy technologies in the region is expected to further drive demand for rare earth metals in the coming years. The Asia-Pacific region's dominance in the rare earth metal market presents both opportunities and challenges. While the region's abundant reserves and strong industrial base provide a competitive advantage, geopolitical tensions and environmental concerns surrounding rare earth metal production could impact the market. However, with proper management and sustainable practices, the Asia-Pacific region is well-positioned to continue driving growth and innovation in the global rare earth metal market.

Get Complete Analysis Of The Report - Download Free Sample PDF

The analyzed market exhibits a high degree of fragmentation, primarily attributable to the presence of numerous players operating on both a global and regional scale. The competitive landscape is characterized by a diverse array of companies, each contributing to the overall market dynamics. This fragmentation arises from the existence of specialized solution providers, established industry players, and emerging entrants, all vying for market share. The diversity in market participants is underscored by the adoption of various strategies aimed at expanding the company's presence. On a global scale, companies within the studied market are strategically positioning themselves through aggressive expansion initiatives. This often involves entering new geographical regions, targeting untapped markets, and establishing a robust global footprint. The pursuit of global expansion is driven by the recognition of diverse market opportunities and the desire to capitalize on emerging trends and demands across different regions. Simultaneously, at the regional level, companies are tailoring their approaches to align with local market dynamics. Regional players are leveraging their understanding of specific market nuances, regulatory environments, and consumer preferences to gain a competitive edge. This regional focus allows companies to cater to the unique needs of local clientele, fostering stronger market penetration. To navigate the complexities of the fragmented market, companies are implementing a range of strategies. These strategies include investments in research and development to stay at the forefront of technological advancements, mergers and acquisitions to consolidate market share, strategic partnerships for synergies, and innovation to differentiate products and services. The adoption of such multifaceted strategies reflects the competitive nature of the market, with participants continually seeking avenues for growth and sustainability. In essence, the high fragmentation in the studied market not only signifies the diversity of players but also underscores the dynamism and competitiveness that drive ongoing strategic manoeuvres. As companies explore various avenues for expansion, the market continues to evolve, presenting both challenges and opportunities for industry stakeholders.

Recent Development:

1) In August 2022, Lynas Rare Earths Ltd disclosed its strategy to increase production capacity at the Mt Weld mine in Western Australia, known for its deposits of neodymium (Nd) and praseodymium (Pr). The company envisions the initiation of expansion activities by early 2023, with full operational capacity expected by 2024. This expansion aligns with Lynas's commitment to meet the growing global demand for rare earth metals.

2) In a separate development in April 2022, Iluka Resources Ltd declared a substantial investment of USD 1.2 billion for the establishment of the Eneabba Phase 3 rare earth refinery in Western Australia. This refinery is specifically designed for the dedicated production of rare Earth oxides. The investment represents Iluka's strategic initiative to position itself as a key hub for the downstream processing of Australia's rare earth resources. By channelling resources into refining capabilities, Iluka aims to play a pivotal role in enhancing the value chain of rare earth elements within the country.

Q1. What was the Rare Earth Metal Market size in 2023?

As per Data Library Research the rare earth metals market was estimated at USD 7.3 billion in 2023.

Q2. At what CAGR is the Rare Earth Metal market projected to grow within the forecast period?

Rare Earth Metal Market is projected to reach a CAGR of 14.3% over the forecast period.

Q3. What are the factors on which the Rare Earth Metal market research is based on?

By Elements, By Application and Geography are the factors on which the Rare Earth Metal market research is based.

Q4. What are the factors driving the Rare Earth Metal market?

Key factors that are driving the growth include the The escalating demand for electric vehicles and The rapid growth of the renewable energy sector.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model